Wall Street’s Next Big Play Is Garbage

Landfill firms are investing in trash-gas production and recycling technology

The green push by the U.S. and state governments is turning trash into treasure and boosting the firms that handle America’s garbage.

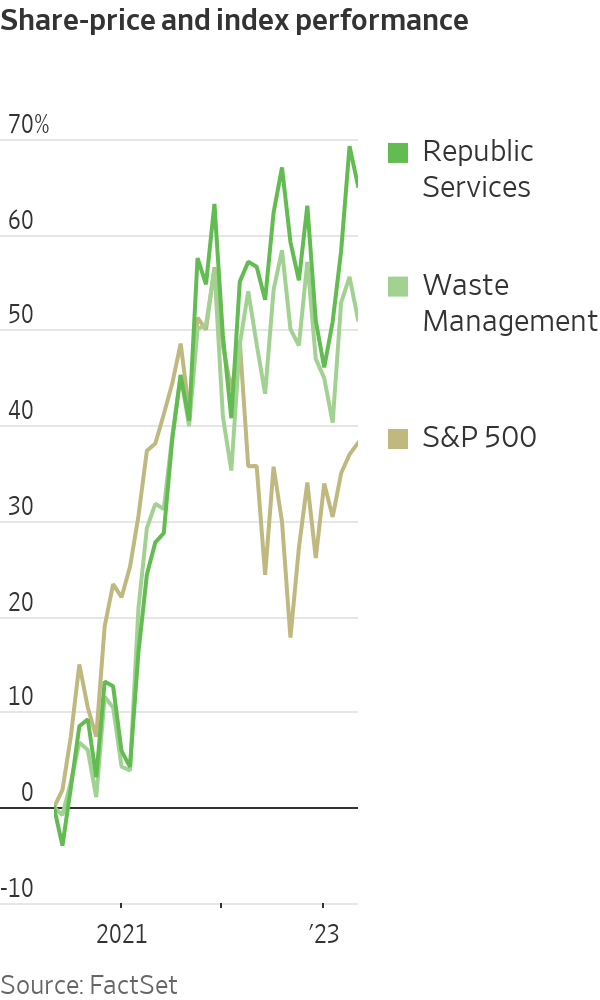

Shares of the biggest players in the U.S. trash business, Waste Management and Republic Services, have traded at record highs since President Biden signed the climate, tax and healthcare bill in August. A recent decline notwithstanding, the stocks are popular picks on Wall Street to ride the sustainability boom higher.

“They’re sitting in this extraordinary position,” said Michael Hoffman, an analyst at investment bank Stifel. “Garbage will be on the forefront.”

Efforts to reduce greenhouse-gas emissions and to reuse materials are making it more profitable to mine landfills for energy and sift through refuse for the hot commodities of the green economy, such as detergent bottles and cardboard boxes.

WM and Republic are building plants to isolate methane from the fumes emitted by rotting garbage and pipe it into the natural-gas grid to be burned in power plants, furnaces and kitchens. They are also equipping recycling facilities with the latest in automation to better sort and process materials for the consumer-goods companies that are under pressure to keep their packaging out of landfills and the ocean.

Landfill owners are forecasting hundreds of millions of dollars in additional profit from rising demand for recycled materials and tax incentives for making energy from emissions that would otherwise seep into the atmosphere.

“We’re blessed to be sitting right in the middle of a megatrend,” Republic Chief Executive Jon Vander Ark said. “We used to think about getting 5% top-line growth a year; now we’re in double-digit top-line growth mode.”

Republic, which has 206 active landfills, has a joint venture with a unit of BP to install gasworks at 43 of its dumps. The Phoenix firm has 65 landfill-gas plants. Some feed utility pipelines. Others generate electricity on site.

Republic is also spending about $275 million to build four polymer-processing facilities that will sort the plastic it collects kerbside and turn it into flakes for new bottles and jugs.

Vander Ark said consumer-product companies face minimum post-consumer-content mandates in California, Washington and other states, as well as their own sustainability goals. Republic’s first plastics plant is scheduled to open later this year in Las Vegas. Customers lined up.

“There’s fighting among customers about who gets what,” Vander Ark said.

Analysts say one risk is that adding exposure to volatile markets for commodities and renewable-fuel credits might spook investors interested in the steady and predictable profits involved in dumping garbage into landfills. Executives say the sustainability businesses are supplementary and moneymakers even when commodity prices are low, like now.

“Yes, there’s a year-over-year impact, but recycling is still profitable,” said Tara Hemmer, WM’s chief sustainability officer. “It still is one of our highest return-on-capital investments.”

WM, which operates more than 250 landfills, is in the second year of a four-year plan to spend $1.2 billion adding 20 trash-gas plants as well as $1 billion expanding and automating its recycling business.

The Houston company expects new and upgraded facilities to increase its recovery of reusable materials 25% by 2025. Having machines do the dirty work also cuts labor costs, executives say.

A lot of hard-to-fill jobs will be replaced by optical sorters, which use infrared cameras to spot valuable materials in the jumble and blow the desirable bits into separate bins with pinpoint puffs of air, Hemmer said.

“In the past we might have had mixed-paper bales that had cardboard embedded in them,” she said. “Now we’re able to pull more of that cardboard out, it goes in the cardboard bale, and the price point on cardboard is much higher than mixed paper.”

WM says the blended commodity value from its automated material recovery facilities is about 15% higher per ton. Not only do the machines amass more of the valuable stuff, the company says the material emerges cleaner and can fetch more than messy bales.

The recycling investments will add $240 million to its bottom line over the next four years, WM says. It has higher expectations for its gas business.

WM says it will boost landfill-gas output eightfold and generate more than $500 million in additional earnings before interest, taxes, depreciation and amortisation through 2026.

That profit forecast assumes two prices associated with every million British thermal units of gas. WM is counting on the actual fuel selling for $2.50, which is lately about the price of gas from geologic wells. Another $23.50 is anticipated from renewable-fuel credits, which is in line with recent trading, according to energy-information firm Platts.

The outlook doesn’t count the $250 million or more of tax credits WM expects for building new gas plants.

Last year’s climate bill sweetened the economics of trash gas. A federal proposal to offer additional credits for biogas projects that produce power for electric vehicles could make the incentives even stronger.

Waste-company executives and analysts say that many are worth building anyway and that the incentives make it economical to install gasworks at smaller, less-gassy landfills.

“Landfill gas is essentially the only scalable biofuel that doesn’t have a food-for-fuel trade-off,” said Goldman Sachs analyst Jerry Revich. “These projects don’t need any subsidies, but they will take the free money.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

We’re thinking about productivity at work all wrong, Cal Newport says. But how do we tell the boss that?

You’re oh so busy. You’re on Slack and email and back-to-back Zoom calls , sometimes all at once . Are you actually getting real work done?

Cal Newport doesn’t think so.

“It’s like, wait a second, none of this mattered,” says the Georgetown University computer science professor and crusader for focus in a distracted age.

Newport, 41, says we can accomplish more by shedding the overload. He calls his solution “slow productivity”—and has a book by the same name —a way for high achievers to say yes to fewer things, do them better and even slack off in strategic doses. Top-notch quality is the goal, and frenetic activity the enemy.

This, he told me, is the thing that can save our jobs from AI and layoffs, and even make shareholders happy.

I had questions. Can we really be less is more at work, or have we grown addicted to constantly crossing endless tasks off our to-do lists? What will our bosses think?

After all, so many of us yearn for a burnout cure-all that will preserve our high-achiever status, and this isn’t the first you-can-have-it-all proposition we’ve heard. Champions of the four-day workweek promise we can ditch an entire workday just by working smarter. Remote-work die-hards swear it’s a win for employers and employees. Few dreams are more seductive than bidding goodbye to hustle culture, while still reaping the benefits of said hustle.

Newport acknowledges that saying no to preserve our productivity can be a delicate act. He knows that entrepreneurs have more flexibility, but says those of us who answer to managers can carve this out too. We might even find we have more power and value to our employers.

“You should take that value out for a little bit of a spin,” he suggests. He offers some pointers.

Less is more

The way we work now is a “serious economic drag,” Newport says. Knowledge workers have devolved into a form of productivity that’s more about the vibes—stressed!—than actually making money for the company. Data from Microsoft finds that lots of us spend the equivalent of two workdays a week on meetings and email alone.

One mistake we make, Newport says, is taking on too many projects, then getting bogged down in the administrative overload—talking about the work, coordinating with others—that each requires. Work becomes a string of planning meetings, waiting on someone from another department to give us a go-ahead.

Newport recommends giving priority to a couple projects, then bumping the others to a waiting list in order of importance. Make that list public, say, in a Google doc you share with bosses and colleagues.

“When workloads are obfuscated behind black boxes, it’s just people throwing stuff at each other, it’s very dangerous to say no,” Newport says.

If someone comes to you with more work, have them consider where it should go on your list, Newport says.

When you do say yes, double the estimated timelines you set to complete a project. That’s how long it’ll take to do it well, he says. And try what he calls a “one for you, one for me strategy.” Every time you book an hour-long meeting, block an hour for independent work on your calendar.

Be the one to trust

It’s a foreign and bracing approach for those of us who reflexively say yes to work requests. Newport’s philosophy requires transparency and confidence. Instead of “let me see how fast I can turn that around!”, try, “This request will take six hours. I’ll have that time in three weeks.”

This could be heresy at some companies. The trick is in the delivery, he says. Never make it seem like work tasks are a burden you shouldn’t have to face. Instead, stress that you’re trying to be as effective as you can for the team and the company. Be positive, and deliver on the timelines you promise. You’ll be seen as someone who’s organised and on top of your game.

We think bosses want someone who’s always accessible—fast to respond, fast to jump into action, Newport says. But what bosses really want is to know that a project they hand you will get done.

Bite-size shirking

Quiet quitting permanently is a bad idea, Newport says, but a little bit is good.

Don’t feel guilty, he adds. You’re working under a new, better system. We weren’t meant to work all out , every day, without seasonal shifts and pauses.

Pick a time—say, the month of July—to slow down. Don’t volunteer for extra work. Don’t offer Mondays as a possibility for meetings. Take on an easier project for cover.

He also recommends taking yourself out to a monthly movie during the workday. Say it’s a personal appointment, and enjoy the sense of control and creativity it brings.

You don’t have to nail a manifesto to the wall, he adds, or try to change the whole company culture. Instead, quietly carve out change for yourself.

Coming into your power

The catch: You have to be really good at the part of your job that matters. And you have to get big stuff done. Remember, this is about being a happier high performer, not slacking.

“There’s no hiding,” Newport says.

I suspect this terrifies a lot of people. They’ve gotten good at being always on and typing up yet another meeting agenda. Tackling a major project or goal is often harder, and comes without a guarantee that you’re going to nail it.

Scary or not, real work is becoming imperative. AI is coming for the rote parts of our jobs. Leaders are sussing out the “nonsense” projects and roles in their ranks as they cut jobs, Newport says. No boss wants to be left with a team of people who are aces at responding to emails.

Mastering a valuable skill puts you in control. Newport writes of people who leave corporate America behind and move where they want , working remotely as contractors, charging wild fees for fewer hours of work. The more you shed the work that doesn’t matter, and spend that time getting better at the stuff that does, the more leeway you’ll get.

“The marketplace doesn’t care about your personal interest in slowing down,” Newport writes. “If you want more control over your schedule, you need something to offer in return.”

Figure that puzzle out, and you might just be able to have it all—high achievement, and your sanity.

Consumers are going to gravitate toward applications powered by the buzzy new technology, analyst Michael Wolf predicts

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.