America’s Hot Labour Market Fuels Job Growth in Unexpected Places

Payroll increase extends to building, home selling and auto making

The U.S. labor market is showing surprising pockets of strength as companies directly in the crosshairs of rising interest rates hold on to or add workers.

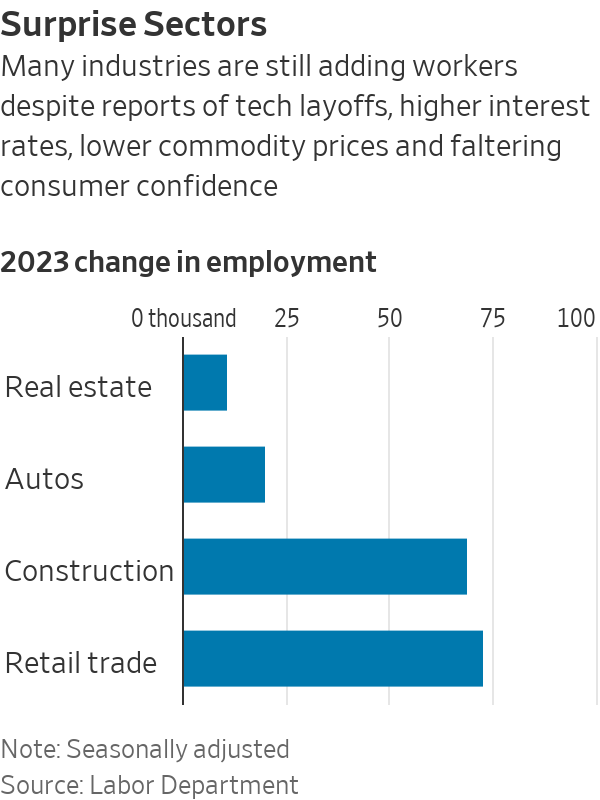

Builders, architects and engineers, real-estate agents, vehicle manufacturers and other businesses typically sensitive to higher borrowing costs have increased employment during the opening months of 2023.

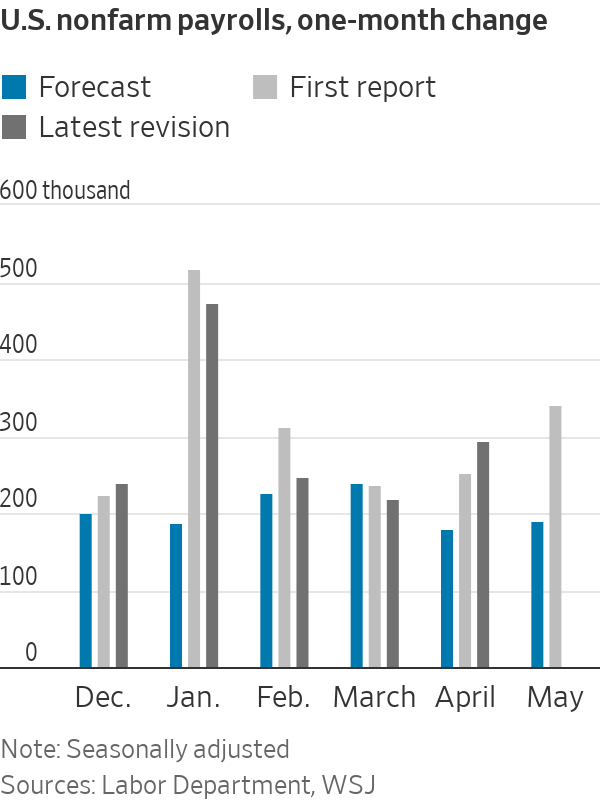

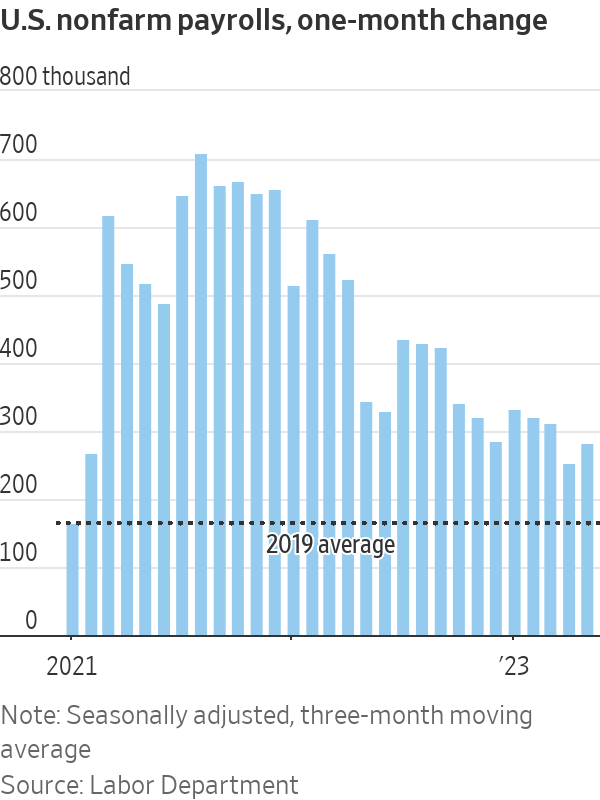

Those job gains, along with much larger increases in industries still trying to claw back workers lost during the pandemic, have added up to almost 1.6 million jobs in the first five months of 2023, outpacing economists’ forecasts.

The Labor Department will release June jobs figures on Friday.

“The labor market has continually surprised,” said Daniel Zhao, lead economist for the research team at Glassdoor, an online employment site.

Robust hiring defies theFederal Reserve

The strong job gains come despite companies and consumers facing higher borrowing costs.

The Federal Reserve raised interest rates to a 16-year high in 2023. And it is expected to increase them further later this year as part of a campaign to slow the economy, cool the labor market and tamp down inflation that is running too hot.

Some industries are defying the Fed’s efforts.

Construction employment has been one of the biggest surprises in recent months. In the past, builders have been hit especially hard when interest rates rose.

But employment in residential construction has merely levelled off in 2023, while industrial and infrastructure businesses gallop ahead.

Projects related to electric-vehicle batteries and semiconductors are driving much of the growth, spurred in part by the Chips and Science Act of 2022, which set aside $52.7 billion for financial assistance for the construction and expansion of semiconductor manufacturing facilities and other programs.

“Many of these were announced or broke ground before the Chips Act, but that added fuel to the bonfire,” said Kenneth Simonson, chief economist at Associated General Contractors of America.

Architectural and engineering firms have also added workers. The real-estate industry hasn’t shed any jobs this year despite a slowdown in single-family home sales.

American factories also often get caught in the Fed’s crosshairs when costs go up for auto loans and other personal loans. But auto and parts manufacturers have added almost 20,000 workers so far in 2023, helping to offset losses at makers of furniture, plastics and paper products.

According to Commerce Department data, car sales are still below pre pandemic levels, held back by limited supplies and high prices. But figures from the Fed show factories are trying to catch up. Auto and light-truck assemblies were above an annual pace of 11 million in April and May, the first time that number has been topped in back-to-back months since 2018.

Some employers stabilise, others heat up

The story is similar in other corners of the economy. Home-improvement and furniture stores have shed workers, for example, but department stores and warehouse clubs have added them. The final result: Overall retail employment has grown slightly so far this year.

The financial sector has also posted growth despite banking sector turmoil, with gains at insurers, brokers and financial advisers outpacing losses in banking.

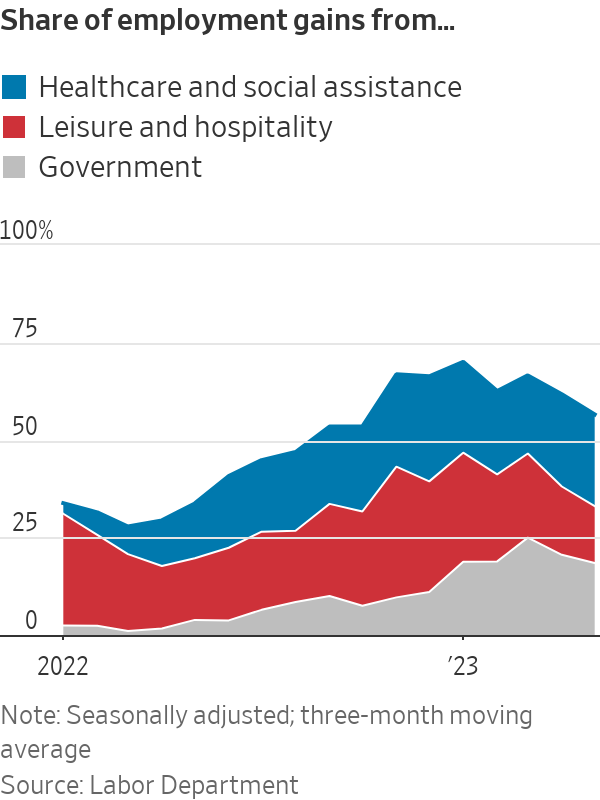

Other sectors aren’t merely holding up—they are rapidly hiring. Government, leisure and hospitality and healthcare account for about 60% of all employment gains so far in 2023. The first two categories are still playing Covid-19 catch-up: Employment at restaurants, hotels, schools and in other municipal services are still below pre pandemic levels.

The picture isn’t entirely rosy.

Tech layoffs are well documented. Some economists worry that residential construction employment could be headed for a fall as a big run-up in apartment projects leads to an oversupply of units and signs of falling rents.

The number of hours people are spending on the job is declining, a possible sign that employers have less work for them. Wage growth remains strong but has eased, suggesting that demand for workers is cooling. And job growth has become more concentrated in fewer industries, possibly indicating that the breadth of the economic expansion is also narrowing.

“There are signals on the periphery that the labor market is slowing,” said Brett Ryan, senior U.S. economist at Deutsche Bank.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Records keep falling in 2025 as harbourfront, beachfront and blue-chip estates crowd the top of the market.

A divide has opened in the tech job market between those with artificial-intelligence skills and everyone else.

JPMorgan Chase has a ‘strong bias’ against adding staff, while Walmart is keeping its head count flat. Major employers are in a new, ultra lean era.

It’s the corporate gamble of the moment: Can you run a company, increasing sales and juicing profits, without adding people?

American employers are increasingly making the calculation that they can keep the size of their teams flat—or shrink through layoffs—without harming their businesses.

Part of that thinking is the belief that artificial intelligence will be used to pick up some of the slack and automate more processes. Companies are also hesitant to make any moves in an economy many still describe as uncertain.

JPMorgan Chase’s chief financial officer told investors recently that the bank now has a “very strong bias against having the reflective response” to hire more people for any given need. Aerospace and defense company RTX boasted last week that its sales rose even without adding employees.

Goldman Sachs , meanwhile, sent a memo to staffers this month saying the firm “will constrain head count growth through the end of the year” and reduce roles that could be more efficient with AI. Walmart , the nation’s largest private employer, also said it plans to keep its head count roughly flat over the next three years, even as its sales grow.

“If people are getting more productive, you don’t need to hire more people,” Brian Chesky , Airbnb’s chief executive, said in an interview. “I see a lot of companies pre-emptively holding the line, forecasting and hoping that they can have smaller workforces.”

Airbnb employs around 7,000 people, and Chesky says he doesn’t expect that number to grow much over the next year. With the help of AI, he said he hopes that “the team we already have can get considerably more work done.”

Many companies seem intent on embracing a new, ultralean model of staffing, one where more roles are kept unfilled and hiring is treated as a last resort. At Intuit , every time a job comes open, managers are pushed to justify why they need to backfill it, said Sandeep Aujla , the company’s chief financial officer. The new rigor around hiring helps combat corporate bloat.

“That typical behavior that settles in—and we’re all guilty of it—is, historically, if someone leaves, if Jane Doe leaves, I’ve got to backfill Jane,” Aujla said in an interview. Now, when someone quits, the company asks: “Is there an opportunity for us to rethink how we staff?”

Intuit has chosen not to replace certain roles in its finance, legal and customer-support functions, he said. In its last fiscal year, the company’s revenue rose 16% even as its head count stayed flat, and it is planning only modest hiring in the current year.

The desire to avoid hiring or filling jobs reflects a growing push among executives to see a return on their AI spending. On earnings calls, mentions of ROI and AI investments are increasing, according to an analysis by AlphaSense, reflecting heightened interest from analysts and investors that companies make good on the millions they are pouring into AI.

Many executives hope that software coding assistants and armies of digital agents will keep improving—even if the current results still at times leave something to be desired.

The widespread caution in hiring now is frustrating job seekers and leading many employees within organizations to feel stuck in place, unable to ascend or take on new roles, workers and bosses say.

Inside many large companies, HR chiefs also say it is becoming increasingly difficult to predict just how many employees will be needed as technology takes on more of the work.

Some employers seem to think that fewer employees will actually improve operations.

Meta Platforms this past week said it is cutting 600 jobs in its AI division, a move some leaders hailed as a way to cut down on bureaucracy.

“By reducing the size of our team, fewer conversations will be required to make a decision, and each person will be more load-bearing and have more scope and impact,” Alexandr Wang , Meta’s chief AI officer, wrote in a memo to staff seen by The Wall Street Journal.

Though layoffs haven’t been widespread through the economy, some companies are making cuts. Target on Thursday said it would cut about 1,000 corporate employees, and close another 800 open positions, totaling around 8% of its corporate workforce. Michael Fiddelke , Target’s incoming CEO, said in a memo sent to staff that too “many layers and overlapping work have slowed decisions, making it harder to bring ideas to life.”

A range of other employers, from the electric-truck maker Rivian to cable and broadband provider Charter Communications , have announced their own staff cuts in recent weeks, too.

Operating with fewer people can still pose risks for companies by straining existing staffers or hurting efforts to develop future leaders, executives and economists say. “It’s a bit of a double-edged sword,” said Matthew Martin , senior U.S. economist at Oxford Economics. “You want to keep your head count costs down now—but you also have to have an eye on the future.”

A cluster of century-old warehouses beneath the Harbour Bridge has been transformed into a modern workplace hub, now home to more than 100 businesses.

Once a sleepy surf town, Noosa has become Australia’s prestige property hotspot, where multi-million dollar knockdowns, architectural showpieces and record-setting sales are the new normal.