EV Trade War Could Spread to Luxury Cars

Investors used to worry about an invasion of Chinese electric vehicles into Europe. Tit-for-tat tariffs would instead hit Porsches heading to China.

Europe’s politicians have no easy options for dealing with Chinese electric vehicles.

Slap a 100% tariff on them, as President Biden did last month , and China can easily retaliate against the more than 300,000 luxury cars it gets annually from the European Union. Let Chinese EVs into the EU with the current 10% tariff, though, and Chinese companies have an open road to take market share, given impressive technology and a roughly 30% cost advantage.

This week, the European Commission is expected to announce the results of a nine-month investigation into Chinese EV subsidies . Its most likely course of action is a cautious middle ground—a 25% to 30% tariff that would make European EVs broadly competitive with lower-cost Chinese imports. This could still trigger retaliation, but the EU’s executive body has to do something to protect an economically and strategically important industry.

This political reality only looms larger after this past weekend’s elections for the European Parliament, which rewarded right-wing populist parties in France and Germany. In the coming months a new European Commission will review the policy response to the EV investigation. Arguments for going easy on cheap Chinese EVs , because they help Europe’s climate goals, will presumably take a back seat to economic protectionism.

Just how much market share Chinese cars might take in Europe, at least in the short term, is debatable. After years of modest gains, they accounted for roughly one in 10 new EVs sold in Western Europe in the third quarter of 2023, according to Schmidt Automotive Research. But their share fell back in the final three months of the year, when France excluded China-made models from its subsidy program. High discounts on Chinese brands also point to stalling progress.

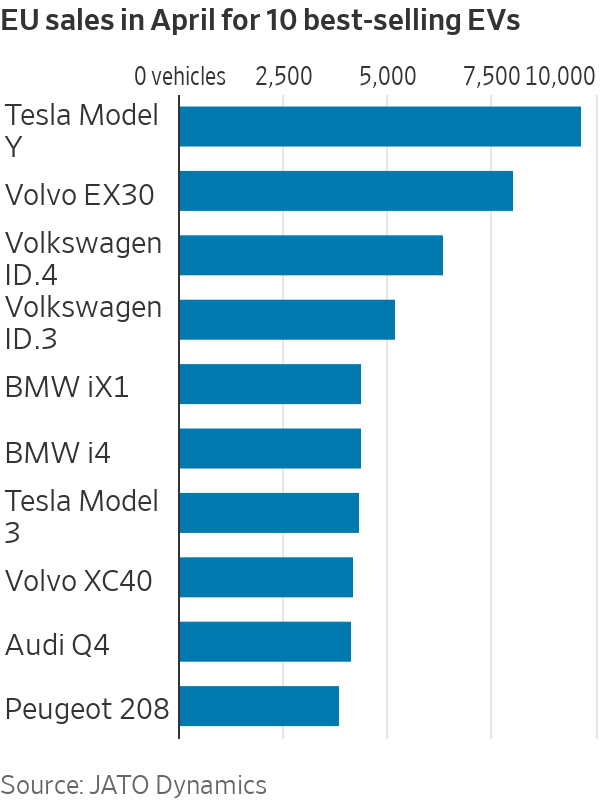

Many European consumers might not be ready for proudly Chinese brands such as BYD. The bestselling “Chinese” brand in Europe by far is MG, which is historically British but now belongs to China’s SAIC. Even it wasn’t one of April’s 10 bestselling EV models in the EU, according to data provider Jato Dynamics.

Many more Europeans would no doubt be converted to Chinese brands by the rock-bottom prices advertised domestically in China, which is in the throes of a vicious price war. But BYD launched its vehicles last year at surprisingly high prices, perhaps mindful of the EU’s investigation as well as the potential to juice its margins to compensate for a tough home market.

Still, the long-term threat posed by Chinese-made EVs in Europe is clear, and the EU won’t take any chances. One consequence of higher tariffs will be more local production. BYD is already building a factory in Hungary, while Volvo Cars will start producing its new EX30 in Belgium next year, rather than shipping it to Europe from China as it currently does. Tesla , which makes its Model 3 for Europe in its factory near Shanghai, will probably need to follow suit.

Other consequences will depend on China’s response. The China Chamber of Commerce to the EU said last month that Beijing was considering a 25% tax on imported cars with large engines. China’s current tariff on vehicle imports from the EU is 15%. This move would hit Porsche in particular as it makes about a quarter of its revenue in China and produces all its cars in Germany.

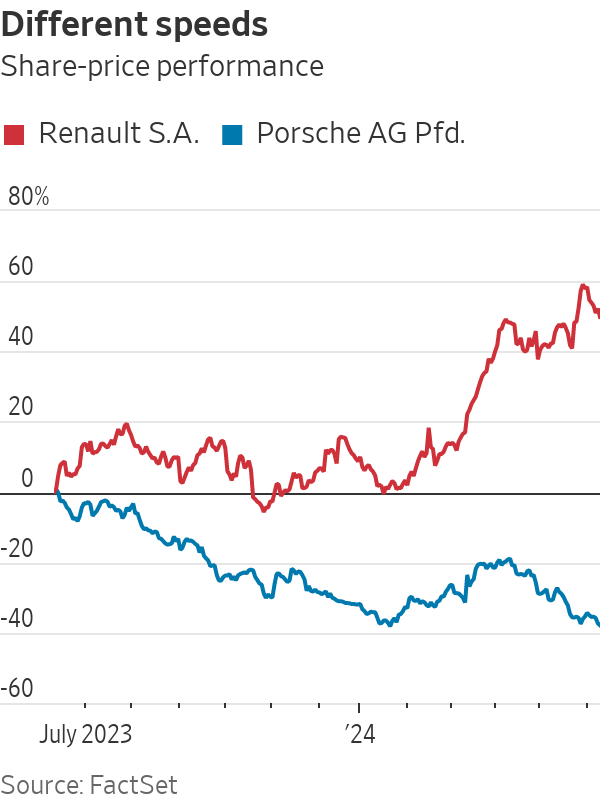

The irony is that investors previously assumed luxury cars were relatively insulated from the threat of Chinese EV imports. Last year, the market was instead worried about the competitive challenge to mass-market manufacturers such as France’s Renault . As politicians in Paris and Brussels responded, concerns shifted, contributing to a gaping divide in stock-market performance: Porsche’s stock is down 37% over one year while Renault’s is up 55%.

In the end, some kind of truce that keeps trade flowing is likely. The EU is more dependent on exports to China than the U.S., ruling out the kind of isolationism Washington is moving toward. That might be a reason to worry more about Renault again, though the French company appears to be making progress in cutting EV costs.

This points to the only sustainable European response to Chinese EVs: matching their technology and cost structure, at least as far as local differences allow. Higher tariffs can only buy a little time.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

More than one fifth of Australians are cutting back on the number of people they socialise with

Australian social circles are shrinking as more people look for ways to keep a lid on spending, a new survey has found.

New research from Finder found more than one fifth of respondents had dropped a friend or reduced their social circle because they were unable to afford the same levels of social activity. The survey questioned 1,041 people about how increasing concerns about affordability were affecting their social lives. The results showed 6 percent had cut ties with a friend, 16 percent were going out with fewer people and 26 percent were going to fewer events.

Expensive events such as hens’ parties and weddings were among the activities people were looking to avoid, indicating younger people were those most feeling the brunt of cost of living pressures. According to Canstar, the average cost of a wedding in NSW was between $37,108 to $41,245 and marginally lower in Victoria at $36, 358 to $37,430.

But not all age groups are curbing their social circle. While the survey found that 10 percent of Gen Z respondents had cut off a friend, only 2 percent of Baby Boomers had done similar.

Money expert at Finder, Rebecca Pike, said many had no choice but to prioritise necessities like bills over discretionary activities.

“Unfortunately, for some, social activities have become a luxury they can no longer afford,” she said.

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.