Fed Cuts Rates Again, This Time by a Quarter Point

Powell says he has no intention of leaving Fed before his term expires

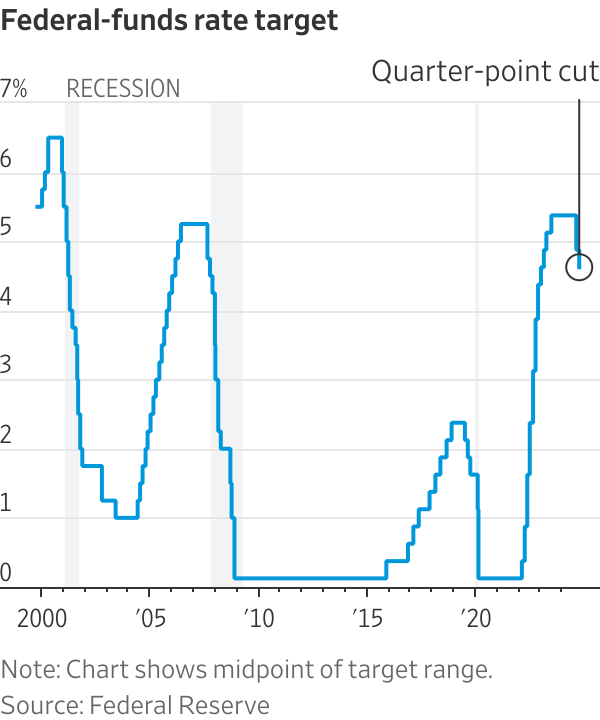

US: The Federal Reserve approved a quarter-point interest-rate cut Thursday, the latest step to prevent large rate increases of the prior 2½ years from weakening the labour market as inflation eases.

The decision, coming the same week as the election of Donald Trump to a second presidential term, followed an initial cut of a half-point in September and will bring the benchmark federal-funds rate to a range between 4.5% and 4.75%. All 12 Fed voters backed the cut.

Officials have said those moves are warranted because they are more confident that inflation will return to the central bank’s target and because they believe rates are still high enough, even with the latest cuts, to dampen economic activity.

The move was expected. Stocks and Treasury yields were steady after the announcement.

“We are committed to maintaining our economy’s strength,” Fed Chair Jerome Powell said at a news conference. He said officials are confident that with an “appropriate recalibration of our policy stance,” inflation can continue heading lower with a solid economy.

Trump’s election victory this week has the potential to reshape the economic outlook, with presumed GOP majorities on both sides of Capitol Hill enabling a broad shift on taxes, spending, immigration and trade. Economists are divided over whether the mix of policies will boost or weaken growth and drive up prices.

The shift in the outlook, in turn, has fuelled questions on Wall Street over whether the Fed will alter its earlier expectation that rates could be steadily dialled lower over the coming year or two.

Powell said it was too soon to say how the next administration’s policies would reshape the economic outlook.

“We don’t guess, we don’t speculate, we don’t assume” what policies will get put into place, Powell said. “In the near term, the election will have no effects on our policy decisions.”

Powell also said he had no intention of leaving the Fed before his four-year term as chair expires in May 2026. “Not permitted under the law,” Powell said when asked if he believed the president could remove him or other Fed personnel from their positions before their term expires.

Since the Fed cut rates in September, longer-dated bond yields have climbed notably, meaning the cost to borrow for a mortgage or car loan has gone up. Yields have increased in large part because better economic data has led investors to reduce their worries about a recession, which could have triggered larger rate cuts.

But some analysts think the bond-market selloff may also reflect concerns by some investors about higher deficits or inflation in a second Trump administration.

Either way, the market has generated an unusual result: Borrowing costs rose after the Fed cut rates. The average 30-year mortgage rate has jumped since mid-September, to 6.8% this week from 6.1%, according to Freddie Mac.

Over a similar time frame, investors in interest-rate futures markets have steadily reduced their expectations over how much the Fed will cut rates over the next year or so. They now see the Fed cutting rates to around 3.6% by 2026, up from an estimated trough of 2.8% in September, according to Citi.

Officials are trying to bring rates back to a more “normal” or “neutral” setting that neither spurs nor slows growth. But they don’t know what constitutes a normal rate. Policies that boost economic activity or prices could also lead officials to conclude that they should maintain a moderately restrictive rate stance. That means they would hold rates somewhat higher than a normal or neutral level.

Before the 2008-09 financial crisis, many thought a neutral rate might be around 4%, but after the crisis and an extremely sluggish recovery, economists and Fed officials concluded the neutral rate might be closer to 2%.

Interest-rate projections that officials submitted in September show most of them expected that if the economy expanded solidly with inflation continuing to cool , they could cut rates to around 3.5% next year.

Inflation based on the Fed’s preferred index was 2.1% in September, from a year earlier. A separate measure of so-called core inflation that strips out volatile food and energy prices was 2.7%. The Fed targets 2% inflation over time.

Because officials don’t have much conviction over where the neutral rate sits, they are likely to be guided by how the economy performs in the months ahead. If inflation keeps slowing and the demand for workers looks soft, officials could conclude it makes sense to continue cutting rates along the path they envisioned in September.

“We’re going to move carefully as this goes on so we can increase the chances that we get it right,” Powell said. “We’re trying to steer between the risk of moving too quicky…or moving too slowly. We’re trying to be on a middle path.”

If inflation progress stalls or ebullient financial markets raise concerns that inflation might get stuck above their target, officials might face more reservations around continuing to cut rates at a steady, meeting-after-meeting clip.

The most immediate focus is whether the Fed will cut again at its upcoming meeting in December. In September, 19 participants were about evenly divided over whether to cut rates one or two more times this year. Nine of them penciled in no more than one cut in either November or December, while 10 penciled in two cuts.

“There’s a lot to learn between now and the December meeting,” said Diane Swonk, chief U.S. economist at KPMG. “They can’t leave the door wide open, but they can’t close the door either.”

Powell said Thursday it was too soon to rule anything “out or in” at that meeting. Slowing down the pace of rate cuts is “something we’re just beginning to think about,” he said. “We’re on a path to a more neutral stance. That has not changed at all since September. We’re just going to have to see where the data lead us.”

Even before the election result, recent data suggested that cutting again would be a finely balanced decision because inflation looks like it might end the year slightly above officials’ projection, while the unemployment rate has edged lower recently, said Matthew Luzzetti, chief U.S. economist at Deutsche Bank.

The election result— which sent stock markets to new highs while raising the prospect of stronger growth, higher inflation and better labour-market outcomes—boosted the odds that the Fed forgoes a cut next month, he said.

“Those could present a strong case from a risk-management perspective to potentially skip that meeting,” said Luzzetti.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Records keep falling in 2025 as harbourfront, beachfront and blue-chip estates crowd the top of the market.

A divide has opened in the tech job market between those with artificial-intelligence skills and everyone else.

JPMorgan Chase has a ‘strong bias’ against adding staff, while Walmart is keeping its head count flat. Major employers are in a new, ultra lean era.

It’s the corporate gamble of the moment: Can you run a company, increasing sales and juicing profits, without adding people?

American employers are increasingly making the calculation that they can keep the size of their teams flat—or shrink through layoffs—without harming their businesses.

Part of that thinking is the belief that artificial intelligence will be used to pick up some of the slack and automate more processes. Companies are also hesitant to make any moves in an economy many still describe as uncertain.

JPMorgan Chase’s chief financial officer told investors recently that the bank now has a “very strong bias against having the reflective response” to hire more people for any given need. Aerospace and defense company RTX boasted last week that its sales rose even without adding employees.

Goldman Sachs , meanwhile, sent a memo to staffers this month saying the firm “will constrain head count growth through the end of the year” and reduce roles that could be more efficient with AI. Walmart , the nation’s largest private employer, also said it plans to keep its head count roughly flat over the next three years, even as its sales grow.

“If people are getting more productive, you don’t need to hire more people,” Brian Chesky , Airbnb’s chief executive, said in an interview. “I see a lot of companies pre-emptively holding the line, forecasting and hoping that they can have smaller workforces.”

Airbnb employs around 7,000 people, and Chesky says he doesn’t expect that number to grow much over the next year. With the help of AI, he said he hopes that “the team we already have can get considerably more work done.”

Many companies seem intent on embracing a new, ultralean model of staffing, one where more roles are kept unfilled and hiring is treated as a last resort. At Intuit , every time a job comes open, managers are pushed to justify why they need to backfill it, said Sandeep Aujla , the company’s chief financial officer. The new rigor around hiring helps combat corporate bloat.

“That typical behavior that settles in—and we’re all guilty of it—is, historically, if someone leaves, if Jane Doe leaves, I’ve got to backfill Jane,” Aujla said in an interview. Now, when someone quits, the company asks: “Is there an opportunity for us to rethink how we staff?”

Intuit has chosen not to replace certain roles in its finance, legal and customer-support functions, he said. In its last fiscal year, the company’s revenue rose 16% even as its head count stayed flat, and it is planning only modest hiring in the current year.

The desire to avoid hiring or filling jobs reflects a growing push among executives to see a return on their AI spending. On earnings calls, mentions of ROI and AI investments are increasing, according to an analysis by AlphaSense, reflecting heightened interest from analysts and investors that companies make good on the millions they are pouring into AI.

Many executives hope that software coding assistants and armies of digital agents will keep improving—even if the current results still at times leave something to be desired.

The widespread caution in hiring now is frustrating job seekers and leading many employees within organizations to feel stuck in place, unable to ascend or take on new roles, workers and bosses say.

Inside many large companies, HR chiefs also say it is becoming increasingly difficult to predict just how many employees will be needed as technology takes on more of the work.

Some employers seem to think that fewer employees will actually improve operations.

Meta Platforms this past week said it is cutting 600 jobs in its AI division, a move some leaders hailed as a way to cut down on bureaucracy.

“By reducing the size of our team, fewer conversations will be required to make a decision, and each person will be more load-bearing and have more scope and impact,” Alexandr Wang , Meta’s chief AI officer, wrote in a memo to staff seen by The Wall Street Journal.

Though layoffs haven’t been widespread through the economy, some companies are making cuts. Target on Thursday said it would cut about 1,000 corporate employees, and close another 800 open positions, totaling around 8% of its corporate workforce. Michael Fiddelke , Target’s incoming CEO, said in a memo sent to staff that too “many layers and overlapping work have slowed decisions, making it harder to bring ideas to life.”

A range of other employers, from the electric-truck maker Rivian to cable and broadband provider Charter Communications , have announced their own staff cuts in recent weeks, too.

Operating with fewer people can still pose risks for companies by straining existing staffers or hurting efforts to develop future leaders, executives and economists say. “It’s a bit of a double-edged sword,” said Matthew Martin , senior U.S. economist at Oxford Economics. “You want to keep your head count costs down now—but you also have to have an eye on the future.”

A luxury lifestyle might cost more than it used to, but how does it compare with cities around the world?

When the Writers Festival was called off and the skies refused to clear, one weekend away turned into a rare lesson in slowing down, ice baths included.