Germany Is Losing Its Mojo. Finding It Again Won’t Be Easy.

Europe’s biggest economy is sliding into stagnation, and a weakening political system is struggling to find an answer

BERLIN—Two decades ago, Germany revived its moribund economy and became a manufacturing powerhouse of an era of globalization.

Times changed. Germany didn’t keep up. Now Europe’s biggest economy has to reinvent itself again. But its fractured political class is struggling to find answers to a dizzying conjunction of long-term headaches and short-term crises, leading to a growing sense of malaise.

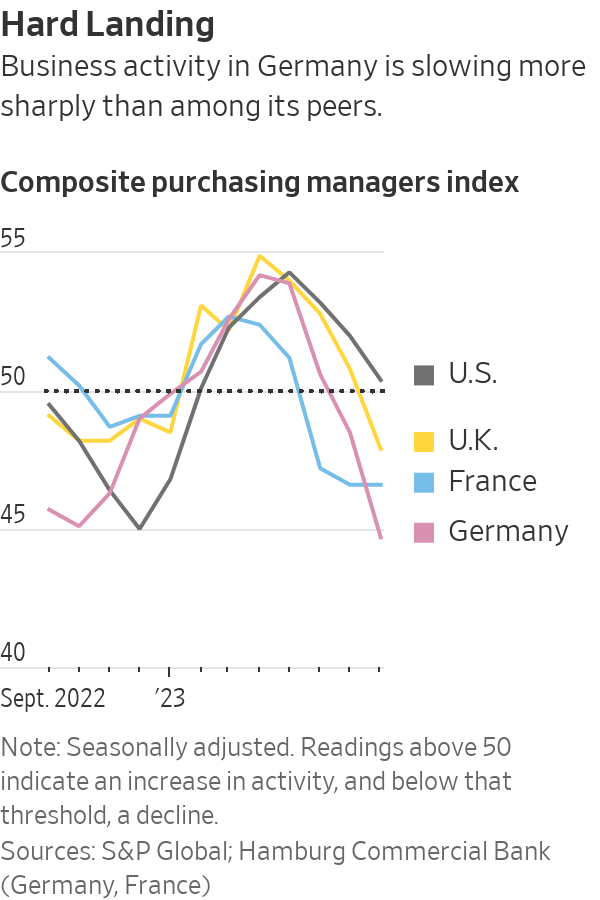

Germany will be the world’s only major economy to contract in 2023, with even sanctioned Russia experiencing growth, according to the International Monetary Fund.

Germany’s reliance on manufacturing and world trade has made it particularly vulnerable to recent global turbulence: supply-chain disruptions during the Covid-19 pandemic, surging energy prices after Russia invaded Ukraine, and the rise in inflation and interest rates that have led to a global slowdown.

At Germany’s biggest carmaker Volkswagen, top executives shared a dire assessment on an internal conference call in July, according to people familiar with the event. Exploding costs, falling demand and new rivals such as Tesla and Chinese electric-car makers are making for a “perfect storm,” a divisional chief told his colleagues, adding: “The roof is on fire.”

The problems aren’t new. Germany’s manufacturing output and its gross domestic product have stagnated since 2018, suggesting that its long-successful model has lost its mojo.

China was for years a major driver of Germany’s export boom. A rapidly industrialising China bought up all the capital goods that Germany could make. But China’s investment-heavy growth model has been approaching its limits for years. Growth and demand for imports have faltered.

Instead of Germany’s best customers, Chinese industries have become aggressive competitors. Upstart Chinese carmakers are competing with German incumbents such as VW that are lagging in the electric-vehicle revolution.

More broadly, the world has become less favourable to the kind of open trade that benefited Germany. The shift was expressed most clearly in then-President Donald Trump imposing tariffs not only on imports from China but also those of U.S. allies in Europe. The U.K.’s 2016 decision to leave the European Union and Russia’s annexation of Crimea in 2014, leading to EU sanctions, also signaled a shift toward a more hostile environment for big exporters.

Germany’s long industrial boom led to complacency about its domestic weaknesses, from an ageing labor force to sclerotic services sectors and mounting bureaucracy. The country was doing better at supporting old industries such as cars, machinery and chemicals than at fostering new ones, such as digital technology. Germany’s only major software company, SAP, was founded in 1975.

Years of skimping on public investment have led to fraying infrastructure, an increasingly mediocre education system and poor high-speed internet and mobile-phone connectivity compared with other advanced economies.

Germany’s once-efficient trains have become a byword for lateness. The public administration’s continued reliance on fax machines became a national joke. Even the national soccer teams are being routinely beaten.

“We’ve kind of slept through a decade or so of challenges,” said Moritz Schularick, president of the Kiel Institute for the World Economy.

In March, one of Germany’s most storied companies, multinational industrial-gas group Linde, delisted from the Frankfurt Stock Exchange in favor of maintaining a sole listing on the New York Stock Exchange. The decision was driven in part by the growing burden of financial regulation in Germany. But also, Linde, whose roots go back to 1879, said it no longer wanted to be perceived just as German—an association that it believed was depressing its appeal to investors.

Germany today is in the midst of another cycle of success, stagnation and pressure for reforms, said Josef Joffe, a longtime newspaper publisher and a fellow at Stanford University.

“Germany will bounce back, but it suffers from two longer-term ailments: above all its failure to transform an old-industry system into a knowledge economy, and an irrational energy policy,” Joffe said.

“I think it’s important to remember that Germany is still a global leader,” German Finance Minister Christian Lindner said in an interview. “We’re the world’s fourth-largest economy. We have the economic know-how and I’m proud of our skilled workforce. But at the moment, we are not as competitive as we could be,” he said.

Germany still has many strengths. Its deep reservoir of technical and engineering know-how and its specialty in capital goods still put it in a position to profit from future growth in many emerging economies. Its labor-market reforms have greatly improved the share of the population that has a job. The national debt is lower than that of most of its peers and financial markets view its bonds as among the world’s safest assets.

The country’s challenges now are less severe than they were in the 1990s, after German reunification, said Holger Schmieding, economist at Berenberg Bank in Hamburg.

Back then, Germany was struggling with the massive costs of integrating the former Communist east. Rising global competition and rigid labor laws were contributing to high unemployment. Spending on social benefits ballooned. Too many people depended on welfare, while too few workers paid for it. German reliance on manufacturing was seen as old-fashioned at a time when other countries were betting on e-commerce and financial services.

After a period of national angst, then-Chancellor Gerhard Schröder pared back welfare entitlements, deregulated parts of the labor market and pressured the unemployed to take available jobs. The controversial reforms split Schröder’s Social Democrats, and he fell from power.

Private-sector changes were as important as government measures. German companies cooperated with employees to make working practices more flexible. Unions agreed to forgo pay raises in return for keeping factories and jobs in Germany.

Germany Inc. grew leaner. Meanwhile, the world was demanding more of what Germans were good at making, including capital goods and luxury cars.

China’s sweeping investments in industrial capacity powered the sales of machine-tool makers in Bavaria and Baden-Württemberg. VW invested heavily in China, tapping newly affluent consumers’ appetite for German cars.

Schröder’s successor, longtime Chancellor Angela Merkel, presided over years of growth with little pressure for further unpopular overhauls. Booming exports to developing countries helped Germany bounce back from the 2008 global financial crisis better than many other Western countries.

Complacency crept in. Service sectors, which made up the bulk of gross domestic product and jobs, were less dynamic than export-oriented manufacturers. Wage restraint sapped consumer demand. German companies saved rather than invested much of their profits.

Successful exporters became reluctant to change. German suppliers of automotive components were so confident of their strength that many dismissed warnings that electric vehicles would soon challenge the internal combustion engine. After failing to invest in batteries and other technology for new-generation cars, many now find themselves overtaken by Chinese upstarts.

A recent study by PwC found that German auto suppliers, partly through reluctance to change, have suffered a loss of global market share since 2019 as big as their gains in the previous two decades.

More German businesses are complaining of the growing density of red tape.

BioNTech, a lauded biotech firm that developed the Covid-19 vaccine produced in partnership with Pfizer, recently decided to move some research and clinical-trial activities to the U.K. because of Germany’s restrictive rules on data protection.

German privacy laws made it impossible to run key studies for cancer cures, BioNTech’s co-founder Ugur Sahin said recently. German approvals processes for new treatments, which were accelerated during the pandemic, have reverted to their sluggish pace, he said.

Germany ought to be among the nations winning from advances in medical science, said Hans Georg Näder, chairman of Ottobock, a leading maker of high-tech artificial limbs. Instead, operating in Germany is getting evermore difficult thanks to new regulations, he said.

One recent law required all German manufacturers to vouch for the environment, legal and ethical credentials of every component’s supplier, requiring even smaller companies to perform due diligence on many foreign firms, often based overseas, such as in China.

Näder said his company must now scrutinise thousands of business partners, from software developers to makers of tiny metal screws, to comply with regulation. Ottobock decided to open its latest factory in Bulgaria instead of Germany.

Energy costs are posing an existential challenge to sectors such as chemicals. Russia’s war on Ukraine has exposed Germany’s costly bet on Russian gas to help fill a gap left by the decision to shut down nuclear power plants.

German politicians dismissed warnings that Russian President Vladimir Putin used gas for geopolitical leverage, saying Moscow had always been a reliable supplier. After Putin invaded Ukraine, he throttled gas deliveries to Germany in an attempt to deter European support for Kyiv.

Energy prices in Europe have declined from last year’s peak as EU countries scrambled to replace Russian gas, but German industry still faces higher costs than competitors in the U.S. and Asia.

German executives’ other complaints include a lack of skilled workers, complex immigration rules that make it hard to bring qualified workers from abroad and spotty telecommunications and digital infrastructure.

“Our home market fills us with more and more concern,” Martin Brudermüller, chief executive of chemicals giant BASF, said at his annual shareholders’ meeting in April. “Profitability is no longer anywhere near where it should be,” he said.

One problem Germany can’t fix quickly is demographics. A shrinking labor force has left an estimated two million jobs unfilled. Some 43% of German businesses are struggling to find workers, with the average time for hiring someone approaching six months.

Germany’s fragmented political landscape makes it harder to enact far-reaching changes like the country did 20 years ago. In common with much of Europe, established centre-right and centre-left parties have lost their electoral dominance. The number of parties in Germany’s parliament has risen steadily.

Chancellor Olaf Scholz and his Social Democrats lead an unwieldy governing coalition whose members often have diametrically opposed views on the way forward. The Free Democrats want to cut taxes, while the Greens would like to raise them. Left-leaning ministers want to greatly raise public investment spending, financed by borrowing if needed, but finance chief Lindner rejects that. “We need fiscal prudence,” Lindner said.

Senior government members accept the need to cut red tape, as well as for an overhaul of Germany’s energy supply and infrastructure. But party differences often hold up even modest changes. This month the Greens lifted a veto of Lindner’s proposal to reduce business taxes only after they extracted consent for more welfare spending. As part of the deal, the government agreed to pass another law drafted by one of Lindner’s allies, Justice Minister Marco Buschmann, to trim regulation for businesses.

Scholz recently rejected gloomy predictions about Germany. Changes are needed but not a fundamental overhaul of the export-led model that has served Germany well throughout the post-World War II era, he said in an interview on national TV recently.

He cited the inflow of foreign investment into the microchips sector by companies such as Intel, helped by generous government subsidies. Scholz said planned changes to immigration rules, including making it easier to qualify for German citizenship, would help attract more skilled workers.

But Scholz has struggled to stop the infighting in his coalition. The government’s approval ratings have tanked, and the far-right populist Alternative for Germany party has overtaken Scholz’s Social Democrats in opinion polls.

“The country is being led by a bunch of Keystone Kops, a motley coalition that can’t get its act together,” Joffe said.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

From warmer neutrals to tactile finishes, Australian homes are moving away from stark minimalism and towards spaces that feel more human.

French luxury-goods giant’s results are a sign that shoppers weren’t splurging on its collections of high-end garments in the run-up to the holiday season.

French luxury-goods giant’s results are a sign that shoppers weren’t splurging on its collections of high-end garments in the run-up to the holiday season.

LVMH Moët Hennessy Louis Vuitton wrapped up last year’s final quarter with sluggish sales growth, a sign that shoppers weren’t splurging on its collections of high-end garments and handbags in the run-up to the holiday season.

The French luxury-goods giant posted fourth-quarter sales of 22.72 billion euros ($27 billion), up 1% organically. Analysts had forecast €22.59 billion in sales and an organic decline of 0.3%, according to Visible Alpha.

LVMH’s fashion and leather goods division, which houses brands like Louis Vuitton and Dior, contributed €10.16 billion in sales, down 3% organically.

Sales at perfumes and cosmetics declined 1%, while the wines and spirits division reported a 9% contraction in sales. Selective retailing, the unit behind Sephora, fared better, with a 7% increase in sales, while watches and jewelry logged 8% growth.

For LVMH and the wider luxury-goods sector, the final quarter represents a key test of customers’ willingness to indulge on nonessential items in the run-up to Black Friday, Thanksgiving and Christmas.

Earlier this month, British trench-coat maker Burberry Group , Italian luxury-fashion house Brunello Cucinelli and Cartier owner Cie. Financière Richemont all reported higher sales for the quarter, raising the bar for industry bellwether LVMH.

Weak sales growth shows that LVMH’s collections aren’t appealing to clients and that the group is still contending with a slowdown in spending for luxury goods that has plagued the industry for years.

Demand weakened considerably after a postpandemic boom, especially among less affluent shoppers. The downturn has been particularly acute in China—a key market for LVMH and its rivals—as shoppers there have been holding back spending.

Last year brought a dose of uncertainty for LVMH and the sector as it took several months for the European Union to reach a trade deal with the U.S. after President Trump announced his Liberation Day tariffs.

Luxury goods are particularly sensitive to trans-Atlantic trade frictions and the specter of tariffs has never fully disappeared despite that trade deal.

Last week, LVMH and other luxury stocks slumped after Trump threatened 10% levies on various European countries he said were opposed to a U.S. takeover of Greenland. He subsequently called off those tariffs.

LVMH closed 2025 with €80.81 billion in annual sales, down 1% organically. Analysts had forecast €80.65 billion in 2025 sales with a 1.8% organic decline, according to Visible Alpha.

The group said revenue declined in Europe in the second half of the year, while the U.S. benefited from solid demand.

Sales in Japan were down from 2024, but the company said it had seen a noticeable improvement in trends in the rest of Asia, citing a return to growth in the second half of the year.

In an earnings call, executives expressed confidence for 2026 despite an uncertain geopolitical and macroeconomic environment, saying the positive trends they started to see in the second half were still there.

Net profit slid 13% on year to €10.88 billion, while profit from recurring operations fell 9% to nearly €17.76 billion. Analysts had forecast net profit of 10.55 billion euros and profit from recurring operations of €17.15 billion, according to Visible Alpha.

The group said it would propose a dividend of €13 a share at its shareholders’ meeting on April 23, the same as the previous year.

Once a sleepy surf town, Noosa has become Australia’s prestige property hotspot, where multi-million dollar knockdowns, architectural showpieces and record-setting sales are the new normal.

In the remote waters of Indonesia’s Anambas Islands, Bawah Reserve is redefining what it means to blend barefoot luxury with environmental stewardship.