Surging Nvidia Stock Keeps Drawing In More Believers

The chip company that is cashing in on the market’s artificial-intelligence obsession seems to many investors like an unstoppable force

Nvidia ’s historic run is minting profits for investors big and small . Many are betting the boom is just beginning.

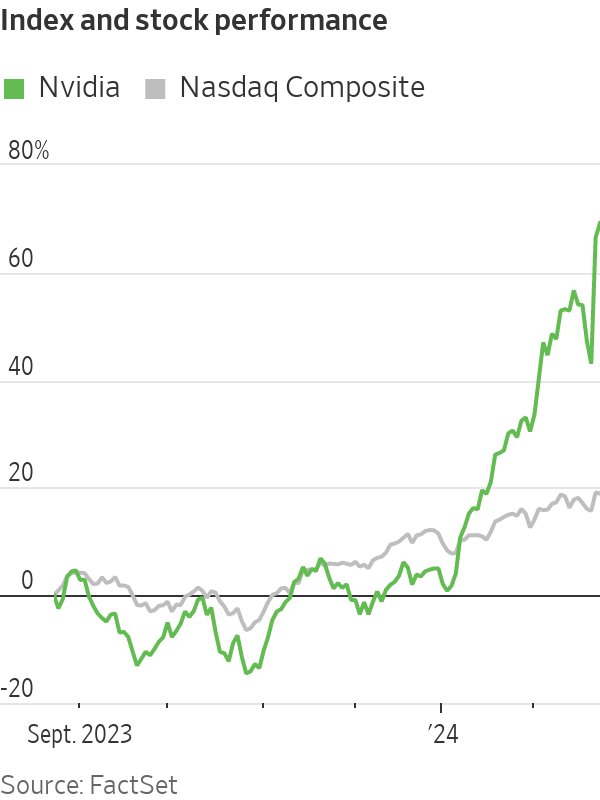

They are piling into trades that the chipmaker’s shares, which have more than tripled over the past year , are headed still higher. Some have turned to the options market to look for ways to turbocharge their bets on artificial intelligence after a blockbuster earnings report sent the stock up 17% over the past two days.

The exuberance reflects hope that the company is the vanguard of wide adoption of artificial intelligence—and an intense fear of missing out among investors who have sat on the sidelines while the company’s valuation has eclipsed $2 trillion .

With the help of Nvidia, stocks have stormed into 2024 . The S&P 500, which has chalked up fresh records in recent weeks, is up 6.7%. That is the index’s second-best performance for this time period over the past 10 years. The gains were only surpassed by an 11% increase in 2019.

Nvidia has contributed to about a quarter of those gains, according to S&P Dow Jones Indices.

The Nasdaq, too, is up 6.6% this year and neared a record Friday. The tech-heavy index has been boosted by Nvidia, which this week tacked on $277 billion in additional market value, along with six other tech titans collectively known as the Magnificent Seven.

The Dow Jones Industrial Average is up 3.8% this year and has hit repeated records in recent weeks.

“You look at these numbers and what this company’s done—it’s almost without precedent,” said Mike Ogborne, founder of San Francisco-based hedge fund Ogborne Capital Management, who counts Nvidia among his top five biggest holdings . “It is nothing short of amazing.”

Ogborne compared AI with the launch of the internet more than two decades ago, which kick-started a technology craze that lasted years.

“It’s exciting,” Ogborne said. “It’s great for America.”

Unfazed by questions about AI

Tamar June in Reno, Nev., is one investor along for Nvidia’s furious stock-market ascent. Since the 1990s, the 61-year-old software-company chief executive has been buying shares of tech firms, including Apple , Microsoft , Cisco, Intel and Oracle . June had been familiar with Nvidia for some time but in recent years kept reading about the chip company in the news. She liked that it was profitable and growing.

June decided to purchase some shares in 2022 at about $260, then watched the stock erase more than half of its value later that year. She held on, knowing that Nvidia’s graphics processing units were in high demand for cloud computing. Then, an AI frenzy hit the stock market in 2023, sending Nvidia’s stock soaring.

Now, Nvidia shares are closing in on $800, and June is looking for opportunities to buy more. She isn’t fazed by worries that the AI boom is bound to come crashing down. June experienced the bursting of the dot-com bubble and the 2008 financial crisis—and watched stocks bounce back to new highs.

“I think it’s still in the beginning stages,” June said of AI developments. “There’s still a lot of headroom for technology because our whole future depends on it.”

$20 billion in options

A herd of investors chased Nvidia while it raced toward its $2 trillion valuation.

At Robinhood Markets , Nvidia was the most purchased stock by customers on a net basis and received the heaviest notional trading volumes over the past month, according to Stephanie Guild, head of investment strategy at the digital brokerage.

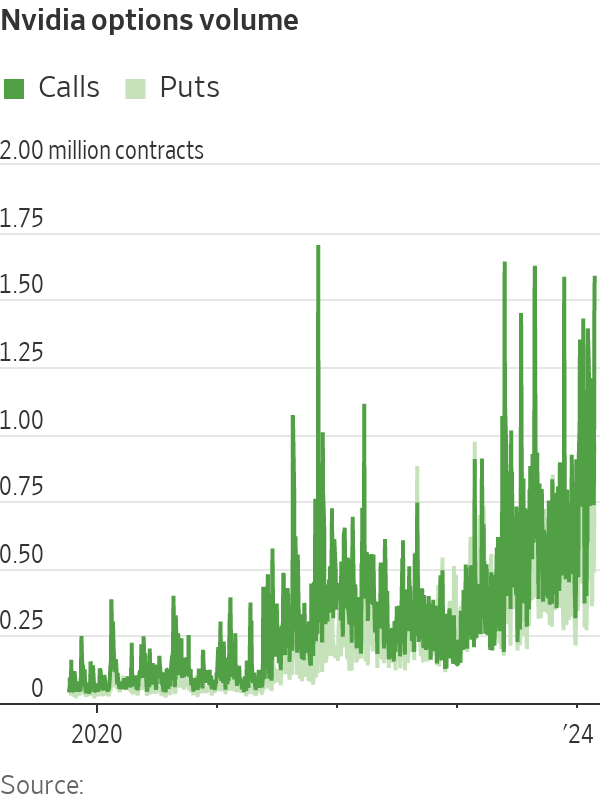

The rise drove many traders to pile into the company’s options, a risky corner of the market notorious for boom-and-bust trades.

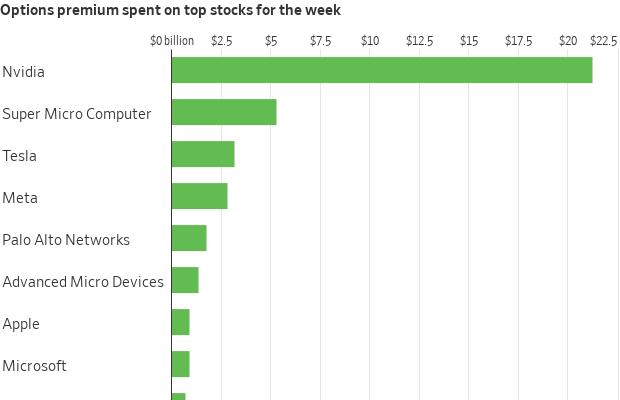

Nvidia has also morphed into one of the most popular trades in this market, with traders placing more than $20 billion in stock-options bets tied to the company over the past week, according to Cboe Global Markets data. That was more than what they spent on Tesla , Meta Platforms , Microsoft, Apple, Amazon and Alphabet combined.

Call options, contracts that confer the right to buy shares at a specific price, were particularly popular. And many of the trades appeared to suggest that investors were fearful of missing out on bigger gains to come. Some of the most active trades Friday were calls pegged to the shares jumping to $800 or $850, up from their closing price of $788.17. Betting against the shares has been a losing game , leading many investors to throw in the towel on bearish wagers.

The values of many of these options bets exploded while Nvidia soared, rewarding those who piled in. The big gains also enticed others to join in the trades while the stock’s rally continued.

“There’s a snowball effect,” said Henry Schwartz, a vice president at exchange-operator Cboe Global Markets, of the options activity surrounding Nvidia.

Ahead of the tech behemoth’s earnings report Wednesday, options pegged to the shares jumping to $1,300 —around double where they were trading at the time—were some of the most popular trades.

And for some investors, the 16% one-day jump in Nvidia’s share price Thursday wasn’t enough. They sought even bigger returns and piled into several niche exchange-traded funds that offer magnified exposure to Nvidia stock.

The GraniteShares 2x Long NVDA Daily ETF has taken in almost half a billion dollars from investors on a net basis since launching late in 2022. The fund’s shares have more than doubled in 2024 and have surged nearly 650% since inception.

There have been few signs of profit-taking so far. Investors added a net $263 million to the fund in the past month. The fund’s cousin, which turbocharges bearish bets against Nvidia, has been much less popular.

The euphoria surrounding Nvidia has spread to other stocks, too. Shares of Super Micro Computer , a much smaller company worth less than $50 billion, popped more than 30% Thursday after Nvidia’s earnings report. Traders spent more than $5 billion on options tied to the company, more than what they spent on Tesla this week. Tesla is worth about 13 times as much as the company.

Software that is eating the world

Nvidia’s continued, rapid ascent has stunned even early bulls on semiconductors and generative AI.

Atreides Management founder Gavin Baker, who started covering Nvidia as an analyst at Fidelity in 2000, reminded investors in his Boston hedge fund in an early 2021 letter of Marc Andreessen ’s adage that software was eating the world. “Today, AI is replacing software,” he wrote.

Atreides started buying Nvidia shares in the fourth quarter of 2022, according to regulatory filings.

The wager proved profitable. But as Nvidia shares kept soaring, Baker started selling. Atreides was out of Nvidia by the end of the second quarter of 2023. “This has been a painful mistake,” Baker wrote in a June 2023 letter to his clients, when Nvidia was trading north of $420 a share.

Atreides’s stake in competitor Advanced Micro Devices has helped alleviate the pain from missing out on larger gains. The firm made nearly a quarter billion last year alone on AMD, which it continues to hold along with several other related bets.

Michael Hannosh, a 20-year-old college student in Chicago, said he first purchased shares of Nvidia in August 2022, when the stock traded below $180. Nvidia was one of his first-ever stock purchases. He had built a custom computer for videogaming and used a lot of Nvidia parts.

Hannosh said he kept the shares until last March, then sold them for a roughly 30% profit. He later bought a few more shares at about $230 and sold them over the course of the next several days at a profit.

The shares have tripled since.

“It’s blown my f—ing mind to bits. It’s insane,” said Hannosh. “I really wish I held it, obviously.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

A long-standing cultural cruise and a new expedition-style offering will soon operate side by side in French Polynesia.

The pandemic-fuelled love affair with casual footwear is fading, with Bank of America warning the downturn shows no sign of easing.

The pandemic-fuelled love affair with casual footwear is fading, with Bank of America warning the downturn shows no sign of easing.

The boom in casual footware ushered in by the pandemic has ended, a potential problem for companies such as Adidas that benefited from the shift to less formal clothing, Bank of America says.

The casual footwear business has been on the ropes since mid-2023 as people began returning to office.

Analyst Thierry Cota wrote that while most downcycles have lasted one to two years over the past two decades or so, the current one is different.

It “shows no sign of abating” and there is “no turning point in sight,” he said.

Adidas and Nike alone account for almost 60% of revenue in the casual footwear industry, Cota estimated, so the sector’s slower growth could be especially painful for them as opposed to brands that have a stronger performance-shoe segment. Adidas may just have it worse than Nike.

Cota downgraded Adidas stock to Underperform from Buy on Tuesday and slashed his target for the stock price to €160 (about $187) from €213. He doesn’t have a rating for Nike stock.

Shares of Adidas listed on the German stock exchange fell 4.5% Tuesday to €162.25. Nike stock was down 1.2%.

Adidas didn’t immediately respond to a request for comment.

Cota sees trouble for Adidas both in the short and long term.

Adidas’ lifestyle segment, which includes the Gazelles and Sambas brands, has been one of the company’s fastest-growing business, but there are signs growth is waning.

Lifestyle sales increased at a 10% annual pace in Adidas’ third quarter, down from 13% in the second quarter.

The analyst now predicts Adidas’ organic sales will grow by a 5% annual rate starting in 2027, down from his prior forecast of 7.5%.

The slower revenue growth will likewise weigh on profitability, Cota said, predicting that margins on earnings before interest and taxes will decline back toward the company’s long-term average after several quarters of outperforming. That could result in a cut to earnings per share.

Adidas stock had a rough 2025. Shares shed 33% in the past 12 months, weighed down by investor concerns over how tariffs, slowing demand, and increased competition would affect revenue growth.

Nike stock fell 9% throughout the period, reflecting both the company’s struggles with demand and optimism over a turnaround plan CEO Elliott Hill rolled out in late 2024.

Investors’ confidence has faded following Nike’s December earnings report, which suggested that a sustained recovery is still several quarters away. Just how many remains anyone’s guess.

But if Adidas’ challenges continue, as Cota believes they will, it could open up some space for Nike to claw back any market share it lost to its rival.

Investors should keep in mind, however, that the field has grown increasingly crowded in the past five years. Upstarts such as On Holding and Hoka also present a formidable challenge to the sector’s legacy brands.

Shares of On and Deckers Outdoor , Hoka’s parent company, fell 11% and 48%, respectively, in 2025, but analysts are upbeat about both companies’ fundamentals as the new year begins.

The battle of the sneakers is just getting started.

ABC Bullion has launched a pioneering investment product that allows Australians to draw regular cashflow from their precious metal holdings.

The PG rating has become the king of the box office. The entertainment business now relies on kids dragging their parents to theatres.