‘Envy of the World’—U.S. Economy Expected to Keep Powering Higher

Economists lift their growth forecasts in latest Wall Street Journal survey

It has been two years since forecasters felt this good about the economic outlook.

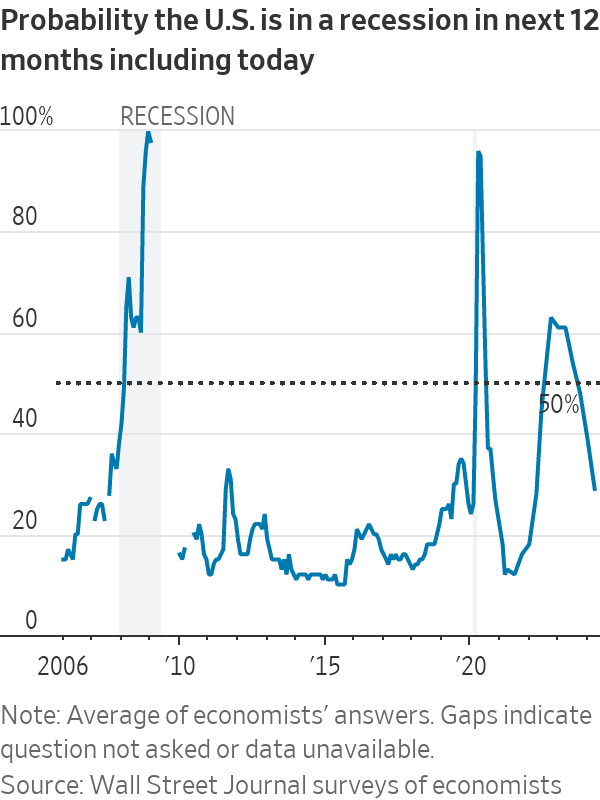

In the latest quarterly survey by The Wall Street Journal, business and academic economists lowered the chances of a recession within the next year to 29% from 39% in the January survey . That was the lowest probability since April 2022, when the chances of a recession were set at 28%.

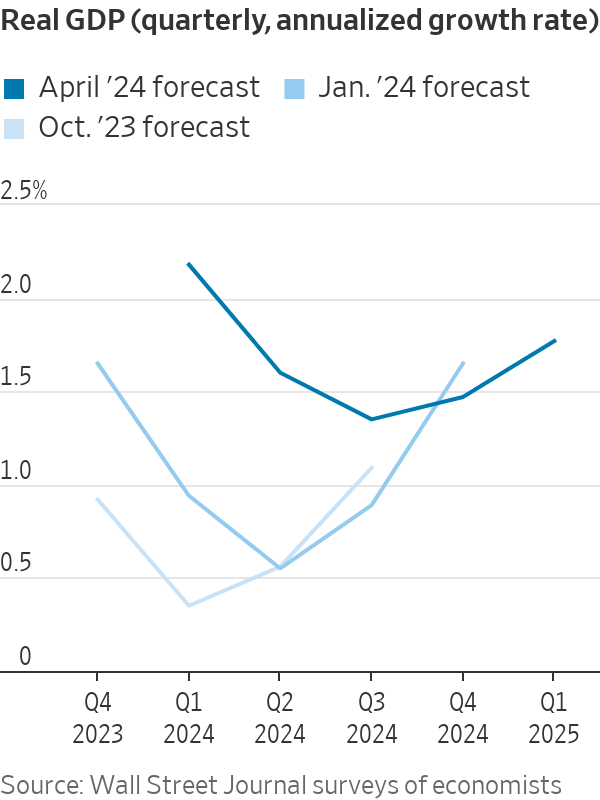

Economists, in fact, don’t think the economy will get even close to a recession. In January, they on average forecast sub-1% growth in each of the first three quarters of this year. Now, they expect growth to bottom out this year at an inflation-adjusted 1.4% in the third quarter.

Just 10% of survey respondents think the economy will experience at least one quarter of negative growth over the next 12 months, down from 33% in January.

The Wall Street Journal survey was conducted from April 5 to 9, just before the release of March consumer-price index data showing inflation running hotter than economists had anticipated.

The U.S. economy has far outperformed expectations over the past year and a half. Instead of stumbling under the weight of the Federal Reserve’s most aggressive interest-rate-raising campaign in four decades, it has continued expanding at a robust clip.

Few think that the economy can do quite as well as last year’s 3.1% growth, as measured by the seasonally adjusted fourth-quarter change from a year earlier. That figure might have been boosted by one-time factors such as federal infrastructure and semiconductor legislation and an uptick in immigration , which also might not last.

Still, economists have had to rethink forecasts for a major slowdown as more time has passed and one still doesn’t seem imminent. Economists on average think the economy grew at a 2.2% rate in the first three months of the year, up from a 0.9% forecast in January.

“The U.S. economy is performing very well,” EconForecaster economist James Smith said in the survey. “We’re truly the envy of the world.”

Much has changed since economists were last this optimistic. Two years ago, the Fed’s benchmark federal-funds rate was set between 0.25% and 0.5%. Inflation was high but economists still generally thought that it could come down without too much help from the Fed. They forecast steady growth and the midpoint of the range for the fed-funds rate topping out at just above 2.5%.

Now, the fed-funds rate is sitting between 5.25% and 5.5%, and economists don’t see a bunch of cuts coming soon. Many analysts trimmed their rate-cut forecasts after last week’s hot inflation report. But even before the report, survey respondents predicted that rates would end the year at 4.67%, implying three cuts. In January, their responses suggested that they thought four or five cuts were likely.

Economists now think the economy can withstand higher rates than they did not long ago.

They expect the 10-year Treasury yield—a key borrowing benchmark that was around 4.4% at the time of the survey—to end 2024 at 3.97%. Looking further into the future, they expect the yield to end 2026 at 3.78%. That is slightly above even their forecast last October, when the yield was higher than it is now.

Many economists have long thought that the economy can handle higher interest rates when it is capable of growing faster, and particularly when worker productivity has increased.

To that end, economists expect the Labor Department’s measure of productivity to rise at an annual rate of 1.9% over the next decade. That matches the annual increase in productivity over the last 40 years. But it is above the 1.2% pace of the 2010s, when the 10-year Treasury yield was typically stuck between 1.5% and 2.5%.

Some economists are now enthusiastic about the economy’s longer-term potential.

“We think that the American economy has entered a virtuous cycle where strong productivity results in growth above the long-term trend, inflation between 2% and 2.5% and an unemployment rate between 3.5% and 4%,” RSM US chief economist Joe Brusuelas said in the survey.

Many aren’t quite as optimistic. One downside of a better growth outlook is that a stronger economy could make it harder for inflation to fall all the way back to the Fed’s 2% target.

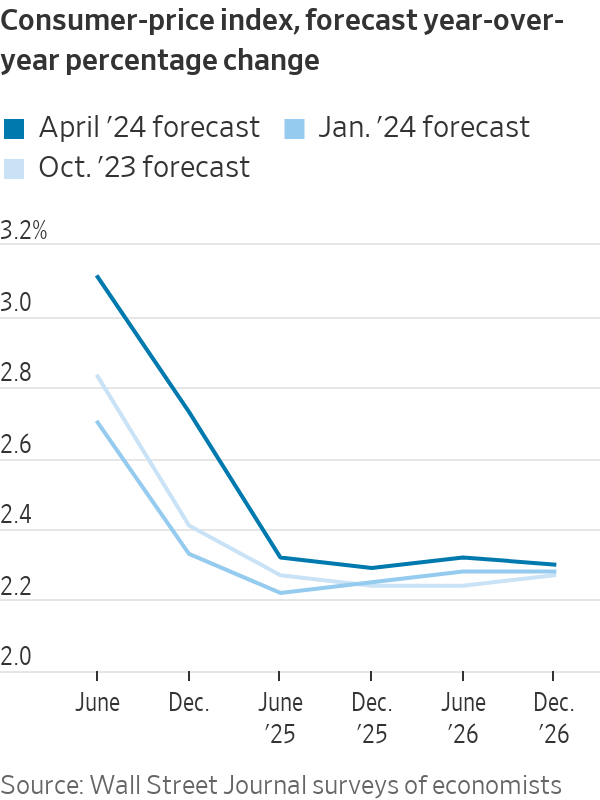

An inflation gauge that is closely watched by the Fed, the core personal-consumption expenditures price index, was 2.8% in February, its most recent reading. Economists now expect it to end the year at 2.5%, after having forecast 2.3% in January.

Economists, on average, believe that core PCE inflation will fall to 2.1% by the end of next year without a recession. However, their projections might already have ticked higher after last week’s price data, and some continue to worry that the Fed’s efforts to control inflation still present a major threat to the economy.

“The risks are clearly skewed toward more hawkish Fed outcomes, which could drag on our growth forecasts,” Deutsche Bank economists Brett Ryan and Matthew Luzzetti said in the survey.

The Wall Street Journal survey was answered by 69 economists. Not every economist responded to every question.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

The sports-car maker delivered 279,449 cars last year, down from 310,718 in 2024.

Chinese carmaker GAC will expand its Australian electric vehicle line-up with the city-focused AION UT hatchback.

The sports-car maker delivered 279,449 cars last year, down from 310,718 in 2024.

Porsche car deliveries fell 10% in 2025 as demand was hit by a slowdown in luxury spending in China and as it ceased production of its 718 Boxster and 718 Cayman models through the year.

The German luxury sports-car maker said Friday that it delivered 279,449 cars in the year, down from 310,718 in 2024.

The company had a tumultuous year as it contended with a stuttering transition to electric vehicles and a tough Chinese market, while the Trump administration’s automotive tariffs presented a further headwind.

Deliveries in its largest sales region of North America were virtually flat at 86,229, but continued challenges in China meant deliveries in the country dropped 26% to 41,938 vehicles.

Automakers have faced intense competition in China, sparking a prolonged price war as rivals cut prices to win customers, while a lengthy property market slump and economic-growth concerns in the country has also led to buyers pulling back on luxury spending.

“Key reasons for the decline remain the challenging market conditions, particularly in the luxury segment, and the very intense competition in the Chinese market, especially for all-electric models,” the company said.

Other German brands including Audi, BMW and Mercedes-Benz have all recently reported that the challenging Chinese market hit demand last year.

In Europe, Porsche deliveries fell 13% to 66,340 cars excluding its home market of Germany, while German deliveries dropped 16%.

The company cut guidance several times last year as it warned of hits from U.S. import tariffs, investments in new combustion engines and hybrid models amid the slow uptake of EVs, and the competitive situation in China.

Porsche also last year announced plans to scale back its EV ambitions and instead expand its lineup with more gas-powered and plug-in hybrid models than it had originally planned.

However, in its statement Friday, the company said it increased its share of electrified-vehicle deliveries in the year. Around 34% of vehicles delivered worldwide were electrified, an increase of 7.4 percentage points on year, with about 22% all-electric vehicles and 12% plug-in hybrids.

That leaves its global share of fully-electric vehicles at the upper end of its target range of 20% to 22% for 2025.

In Europe, for the first time in 2025, more electrified vehicles than purely combustion engine vehicles were delivered.

The Macan topped the delivery charts in the year, while the 911 reached a record high with 51,583 deliveries worldwide, it said.

Porsche said it is investing in its three-pronged powertrain strategy and will continue to respond to increasing demand for personalization requests from customers.

“We have a clear focus for 2026,” Sales and Marketing Chief Matthias Becker said. “We want to manage supply and demand in accordance with our ‘value over volume’ strategy.

“At the same time, we are realistically planning our volume for 2026 following the end of production of the 718 and Macan with combustion engines.”

Pure Amazon has begun journeys deep into Peru’s Pacaya-Samiria National Reserve, combining contemporary design, Indigenous craftsmanship and intimate wildlife encounters in one of the richest ecosystems on Earth.

ABC Bullion has launched a pioneering investment product that allows Australians to draw regular cashflow from their precious metal holdings.