The Pay Raise People Say They Need to Be Happy

We frequently overestimate just how much happiness money buys

People are often convinced their lives would improve if only they could climb a few rungs on the income ladder.

They are right, to an extent. Many studies have found a link between income and happiness, both in terms of day-to-day mood and longer-term life satisfaction. Having more money would help many people afford necessities, and on average, richer people report being happier.

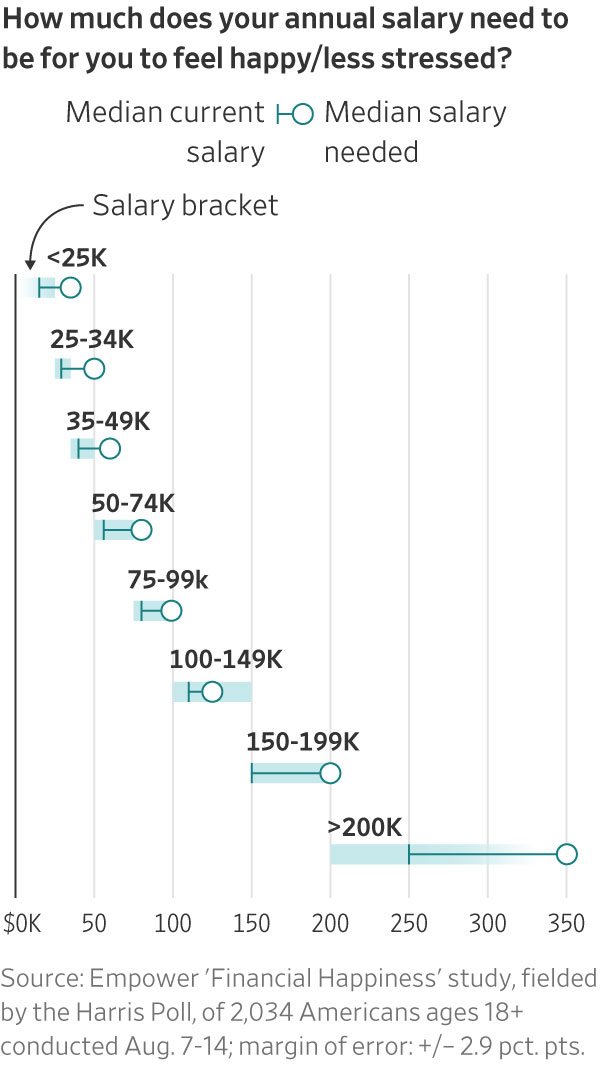

Exactly how much more money do we think we need to be happy? A new survey from the financial-services company Empower put the question to about 2,000 people.

In the survey, most people said it would take a pretty significant pay bump to deliver contentment. The respondents, who had a median salary of $65,000 a year, said a median of $95,000 would make them happy and less stressed. The highest earners, with a median income of $250,000, gave a median response of $350,000.

Employers are planning on an average pay increase of 3.9% in 2024 for nonunion employees, according to a survey from the consulting firm Mercer. In the Empower survey, Americans said that to be happy, they would need almost a 50% raise.

Just how much happier a 3.9% or 50% raise would make any given person is hard to determine, researchers said.

One study, published in the journal Proceedings of the National Academy of Sciences last year, found that people who randomly received $10,000 tended to get a happiness boost that lasted at least six months. (The $2 million given out in the study was provided by a wealthy couple, who the researchers estimated generated 225 times more happiness than if they had kept the money themselves.)

Another, from the Review of Economic Studies in 2020, looked at lottery winners in Sweden whose prizes were mostly between $100,000 and $500,000. They reported higher levels of satisfaction with their lives more than a decade after their windfall, compared with lottery players who won no prize or a small one.

The magnitude of a raise’s effect, though, might not be life-changing.

“The impact of money on happiness isn’t as large as people typically assume,” said Elizabeth Dunn, a psychology professor at the University of British Columbia and a co-author of a book on money and happiness. “Happiness is determined by so many different factors that changing any one thing, it’s hard to have a huge impact.”

Happiness for sale

About seven in 10 respondents in the Empower survey said they strongly or somewhat agreed with the statement: “Having more money would solve most of my problems.” Similar proportions of people in each income bracket felt that way, including those with salaries of $200,000 or more.

Dunn said that many people might be happier if they focus on the best ways to use the money they have, rather than on getting more of it.

“That’s something that we know makes a difference and that people have control over in the immediate term,” she said.

Dunn said many people over emphasise money, relative to other variables, as a path to contentment. Her research indicates that those who give priority to time over money tend to be happier in life.

A little bit more

And as soon as someone does reach a new pay tier, they often start focusing on the next one as their target recalibrates.

“They might imagine that once they get the higher salary, then that’ll be enough,” said Matt Killingsworth, a senior fellow at the University of Pennsylvania’s Wharton School who studies the causes of happiness. “In reality, once they get there, they’ll probably want a little bit more.”

Even very wealthy people think like this. A 2018 study asked millionaires to rate their happiness on a scale from one to 10 and, if they didn’t say 10, predict how much money they would need to move one point higher. Slightly over half of those with a net worth of $10 million or more said their wealth would need to increase by at least 50%.

“It’s part of what makes humans amazing,” said Killingsworth of the impulse to continue advancing. “But it also means we rarely look at an aspect of our life and say, ‘That’s absolutely perfect.’”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Pure Amazon has begun journeys deep into Peru’s Pacaya-Samiria National Reserve, combining contemporary design, Indigenous craftsmanship and intimate wildlife encounters in one of the richest ecosystems on Earth.

Australia’s housing market defies forecasts as prices surge past pandemic-era benchmarks.

Selloff in bitcoin and other digital tokens hits crypto-treasury companies.

The hottest crypto trade has turned cold. Some investors are saying “told you so,” while others are doubling down.

It was the move to make for much of the year: Sell shares or borrow money, then plough the cash into bitcoin, ether and other cryptocurrencies. Investors bid up shares of these “crypto-treasury” companies, seeing them as a way to turbocharge wagers on the volatile crypto market.

Michael Saylor pioneered the move in 2020 when he transformed a tiny software company, then called MicroStrategy , into a bitcoin whale now known as Strategy. But with bitcoin and ether prices now tumbling, so are shares in Strategy and its copycats. Strategy was worth around $128 billion at its peak in July; it is now worth about $70 billion.

The selloff is hitting big-name investors, including Peter Thiel, the famed venture capitalist who has backed multiple crypto-treasury companies, as well as individuals who followed evangelists into these stocks.

Saylor, for his part, has remained characteristically bullish, taking to social media to declare that bitcoin is on sale. Sceptics have been anticipating the pullback, given that crypto treasuries often trade at a premium to the underlying value of the tokens they hold.

“The whole concept makes no sense to me. You are just paying $2 for a one-dollar bill,” said Brent Donnelly, president of Spectra Markets. “Eventually those premiums will compress.”

When they first appeared, crypto-treasury companies also gave institutional investors who previously couldn’t easily access crypto a way to invest. Crypto exchange-traded funds that became available over the past two years now offer the same solution.

BitMine Immersion Technologies , a big ether-treasury company backed by Thiel and run by veteran Wall Street strategist Tom Lee , is down more than 30% over the past month.

ETHZilla , which transformed itself from a biotech company to an ether treasury and counts Thiel as an investor, is down 23% in a month.

Crypto prices rallied for much of the year, driven by the crypto-friendly Trump administration. The frenzy around crypto treasuries further boosted token prices. But the bullish run abruptly ended on Oct. 10, when President Trump’s surprise tariff announcement against China triggered a selloff.

A record-long government shutdown and uncertainty surrounding Federal Reserve monetary policy also have weighed on prices.

Bitcoin prices have fallen 15% in the past month. Strategy is off 26% over that same period, while Matthew Tuttle’s related ETF—MSTU—which aims for a return that is twice that of Strategy, has fallen 50%.

“Digital asset treasury companies are basically leveraged crypto assets, so when crypto falls, they will fall more,” Tuttle said. “Bitcoin has shown that it’s not going anywhere and that you get rewarded for buying the dips.”

At least one big-name investor is adjusting his portfolio after the tumble of these shares. Jim Chanos , who closed his hedge funds in 2023 but still trades his own money and advises clients, had been shorting Strategy and buying bitcoin, arguing that it made little sense for investors to pay up for Saylor’s company when they can buy bitcoin on their own. On Friday, he told clients it was time to unwind that trade.

Crypto-treasury stocks remain overpriced, he said in an interview on Sunday, partly because their shares retain a higher value than the crypto these companies hold, but the levels are no longer exorbitant. “The thesis has largely played out,” he wrote to clients.

Many of the companies that raised cash to buy cryptocurrencies are unlikely to face short-term crises as long as their crypto holdings retain value. Some have raised so much money that they are still sitting on a lot of cash they can use to buy crypto at lower prices or even acquire rivals.

But companies facing losses will find it challenging to sell new shares to buy more cryptocurrencies, analysts say, potentially putting pressure on crypto prices while raising questions about the business models of these companies.

“A lot of them are stuck,” said Matt Cole, the chief executive officer of Strive, a bitcoin-treasury company. Strive raised money earlier this year to buy bitcoin at an average price more than 10% above its current level.

Strive’s shares have tumbled 28% in the past month. He said Strive is well-positioned to “ride out the volatility” because it recently raised money with preferred shares instead of debt.

Cole Grinde, a 29-year-old investor in Seattle, purchased about $100,000 worth of BitMine at about $45 a share when it started stockpiling ether earlier this year. He has lost about $10,000 on the investment so far.

Nonetheless, Grinde, a beverage-industry salesman, says he’s increasing his stake. He sells BitMine options to help offset losses. He attributes his conviction in the company to the growing popularity of the Ethereum blockchain—the network that issues the ether token—and Lee’s influence.

“I think his network and his pizzazz have helped the stock skyrocket since he took over,” he said of Lee, who spent 15 years at JPMorgan Chase, is a managing partner at Fundstrat Global Advisors and a frequent business-television commentator.

From Italy’s $93,000-a-night villas to a $20,000 Bowral château, a new global ranking showcases the priciest Airbnbs available in 2026.

With two waterfronts, bushland surrounds and a $35 million price tag, this Belongil Beach retreat could become Byron’s most expensive home ever.