Not Even Molten Lava Can Cool This Hot Housing Market

The eastern section of Hawaii’s Big Island continues to attract home buyers searching for a cheap piece of paradise

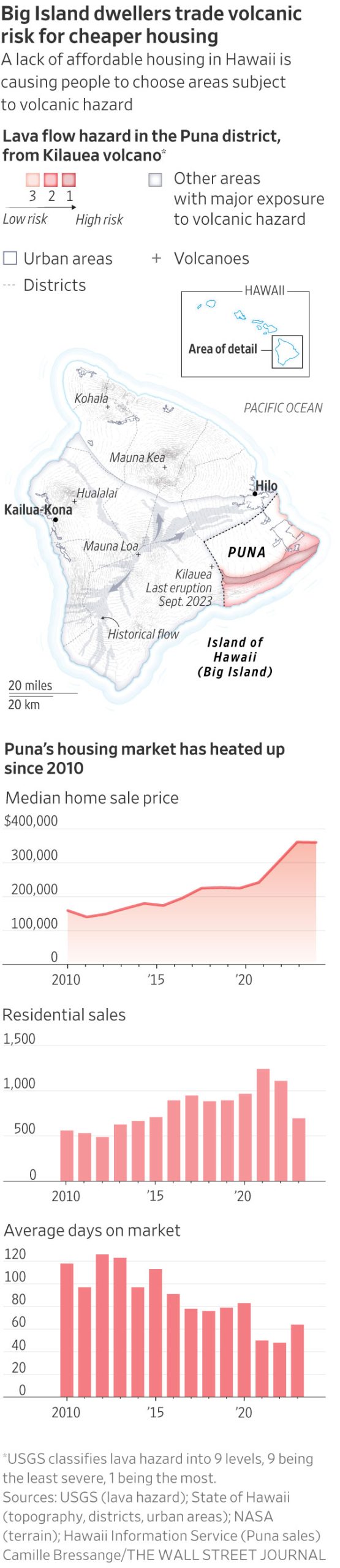

PUNA, Hawaii—In 2018, a large volcanic eruption spewed lava, rock and ash into the middle of a subdivision here, gobbling up more than 700 homes and displacing thousands of residents in a slow-motion disaster. Today, it is Hawaii’s fastest-growing region.

Land in an active lava zone, it turns out, is relatively cheap. Lured by a shot at attainable homeownership in paradise, island dwellers and mainland transplants alike have been flocking to this area in the shadow of Kilauea, driving up prices in the Puna District. Still, the area remains one of the last affordable refuges on the cheapest island in Hawaii, America’s most expensive state.

“In terms of the last bastion of affordability, Puna is it,” said Jared C. Gates, a Realtor who was raised on Oahu and came to the Big Island for college in the 1990s. He purchased his first home in 2005, a modest fixer-upper in Puna, on his salary as a waiter.

Over the past few years, he has been getting more business in Leilani Estates, the neighbourhood where the 2018 eruption began.

None of the homes that were inundated by lava have been rebuilt. Many homeowners have sold their properties to neighbours or the county in a federally funded buyback program, but that land remains vacant for now. The land has been so transformed that it is hard for remaining owners to know even where their property begins and ends.

“It took out roughly a third of the subdivision; totally surreal,” Gates said last fall. “And houses are selling there again.”

Among Gates’s listings that day was a three-bedroom, two-bath home with lush landscaping, two blocks from the mile-wide lava field where heat and steam still radiate from vents in the petrified landscape. “It’s a beaut,” he said. “It will sell.”

Three weeks later it did, for $325,000, cash.

The story of how serene-looking slices of suburbia came to inhabit an active volcanic rift zone is well-known here. In the 1960s, land speculators—aided by a new county government hungry for tax revenue—bought thousands of acres and carved it into lots of an acre or more that were snapped up by investors.

There were virtually no requirements that developers pave roads, place utility lines or build other essential infrastructure. To this day, there is no wastewater treatment plant or hospital. Many of the district’s 51,000 residents rely on filtered rainwater and cesspools to dispose of sewage.

Early buyers included Native Hawaiians looking for an affordable place to call home and mainland hippies intent on off-grid living. As home prices rose in Hawaii and across the nation, however, more working families and mainland retirees went hunting for deals on the Big Island.

County Councilwoman Ashley Kierkiewicz, who represents Puna, said rush-hour traffic on the rural, two-lane highway that connects Puna to Hilo, the county seat roughly 20 miles away, is so bad that she leaves her home 1.5 hours early to get to work.

County officials say rules tied to federal funding bar local government from building affordable housing in lava zones 1 and 2, which are the riskiest and make up most of lower Puna. State law also prohibits them from spending most local money on private subdivisions, meaning that roads are largely maintained by owner associations.

Hawaii County Mayor Mitch Roth said that while the county has added a new firehouse, police station and park facilities there in recent years, the county has limited funds to make major investments in high-risk areas.

“Are we going to invest public money in a high-risk place…knowing that whatever you build could be taken out by lava at any time?” said Roth.

The lack of some modern conveniences has scarcely slowed the flow of newcomers.

Like many places in the U.S., an influx of remote workers during the pandemic has helped send the housing market here into overdrive.

Among the recent arrivals are David Booth and his partner, Juan Polanco. The former Phoenix residents had been brainstorming tropical locations where they could slash their living expenses and ease into retirement.

“The attraction to the Big Island was affordability,” said Booth, 61, who now works remotely. He and Polanco, 59, paid cash for a 1,500-square-foot home that had been split into three units with separate entrances. “You can’t have this on any other island for this price point.”

The property sits on a 1-acre lot in Hawaiian Paradise Park, a subdivision located in the less-risky lava zone 3. Homes with repeated sales in the neighbourhood have seen a nearly 800% appreciation in price since 2000, according to data from the University of Hawaii Economic Research Organization.

Properties in lava zones 1 and 2—some with sweeping oceanfront views—were far cheaper, Booth said. In the end, the risk of losing their nest egg to a natural disaster, and the difference in insurance rates, were deal breakers.

They are getting used to bringing in their drinking water and dealing with vicious fire ants. The slow-paced lifestyle and prospect of early retirement are worth it, he said.

They have listed the two other units as vacation rentals, and their first guests arrive next week.

“We are overwhelmed with the amount of beauty here and just how much more relaxed we feel,” said Booth. “We’re building a whole new life here.”

Three years ago, Travis Edwards, 48, was driving delivery trucks and living with his mother in Southern California’s Inland Empire.

He was sick of the traffic, wildfires and car thefts, he said. Upon retiring, his mother sold her house and paid cash for a 1-acre lot with two units in Leilani Estates, surrounded by avocado and citrus trees. Lava insurance rates in lava zone 1, the riskiest area that encompasses the entire subdivision, were so high that they simply stopped paying for it, he said.

He mostly shrugs off the dangers, reasoning that they would be reckoning with fires and earthquakes on top of a lower quality of life back in Southern California.

“It’s just paradise,” said Edwards, who now drives limousines part-time. “The rest of the world doesn’t exist when you’re here.”

Rising prices on the east side have left Puna native Chantel Takabayashi feeling stuck. A single mother of three, she works 16 hours a day as a state prison guard in Hilo. She would like to buy a home closer to work and better schools but has been priced out of most neighbourhoods she has considered.

“I make pretty decent money and I work long, endless hours, and I still can’t afford better housing,” she said.

Liz Fusco, who manages more than 100 rental properties for Hilo Bay Realty in Pahoa, said that during the pandemic, she saw three-bedroom homes in parts of Puna that once fetched $1,500 a month rent for as much as $2,300.

Most of the applicants were mainlanders, she said, with stellar rental histories, plenty of income and pristine credit. Units that would typically take more than a month to rent were getting leased in three days.

Tina Garber, who has lived in the Puna area for 21 years, has been displaced twice in the past 18 months after the homes she was renting went up for sale.

Currently, she is paying $750 a month—three-quarters of her monthly income as a housecleaner—for a 400-square-foot studio surrounded on three sides by cooled lava. Her landlord just told her it will be listed for sale in April.

“People that come over here with money, they do not realise that it is so hard to make it here,” Garber said. “They think, ‘Oh, a good deal in Hawaii.’ But it puts a lot of pain and suffering on local folks.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

The remote northern island wants more visitors: ‘It’s the rumbling before the herd is coming,’ one hotel manager says

As European hot spots become overcrowded , travellers are digging deeper to find those less-populated but still brag-worthy locations. Greenland, moving up the list, is bracing for its new popularity.

Aria Varasteh has been to 69 countries, including almost all of Europe. He now wants to visit more remote places and avoid spots swarmed by tourists—starting with Greenland.

“I want a taste of something different,” said the 34-year-old founder of a consulting firm serving clients in the Washington, D.C., area.

He originally planned to go to Nuuk, the island’s capital, this fall via out-of-the-way connections, given there wasn’t a nonstop flight from the U.S. But this month United Airlines announced a nonstop, four-hour flight from Newark Liberty International Airport in New Jersey to Nuuk. The route, beginning next summer, is a first for a U.S. airline, according to Greenland tourism officials.

It marks a significant milestone in the territory’s push for more international visitors. Airlines ran flights with a combined 55,000 seats to Greenland from April to August of this year, says Jens Lauridsen, chief executive officer of Greenland Airports. That figure will nearly double next year in the same period, he says, to about 105,000 seats.

The possible coming surge of travellers also presents a challenge for a vast island of 56,000 people as nearby destinations from Iceland to Spain grapple with the consequences of over tourism.

Greenlandic officials say they have watched closely and made deliberate efforts to slowly scale up their plans for visitors. An investment north of $700 million will yield three new airports, the first of which will open next month in Nuuk.

“It’s the rumbling before the herd is coming,” says Mads Mitchell, general manager of Hotel Nordbo, a 67-room property in Nuuk. The owner of his property is considering adding 50 more rooms to meet demand in the coming years.

Mitchell has recently met with travel agents from Brooklyn, N.Y., South Korea and China. He says he welcomes new tourists, but fears tourism will grow too quickly.

“Like in Barcelona, you get tired of tourists, because it’s too much and it pushes out the locals, that is my concern,” he says. “So it’s finding this balance of like showing the love for Greenland and showing the amazing possibilities, but not getting too much too fast.”

Greenland’s buildup

Greenland is an autonomous territory of Denmark more than three times the size of Texas. Tourists travel by boat or small aircraft when venturing to different regions—virtually no roads connect towns or settlements.

Greenland decided to invest in airport infrastructure in 2018 as part of an effort to expand tourism and its role in the economy, which is largely dependent on fishing and subsidies from Denmark. In the coming years, airports in Ilulissat and Qaqortoq, areas known for their scenic fjords, will open.

One narrow-body flight, like what United plans, will generate $200,000 in spending, including hotels, tours and other purchases, Lauridsen says. He calls it a “very significant economic impact.”

In 2023, foreign tourism brought a total of over $270 million to Greenland’s economy, according to Visit Greenland, the tourism and marketing arm owned by the government. Expedition cruises visit the territory, as well as adventure tours.

United will fly twice weekly to Nuuk on its 737 MAX 8, which will seat 166 passengers, starting in June .

“We look for new destinations, we look for hot destinations and destinations, most importantly, we can make money in,” Andrew Nocella , United’s chief commercial officer, said in the company’s earnings call earlier in October.

On the runway

Greenland has looked to nearby Iceland to learn from its experiences with tourism, says Air Greenland Group CEO Jacob Nitter Sørensen. Tiny Iceland still has about seven times the population of its western neighbour.

Nuuk’s new airport will become the new trans-Atlantic hub for Air Greenland, the national carrier. It flies to 14 airports and 46 heliports across the territory.

“Of course, there are discussions about avoiding mass tourism. But right now, I think there is a natural limit in terms of the receiving capacity,” Nitter says.

Air Greenland doesn’t fly nonstop from the U.S. because there isn’t currently enough space to accommodate all travellers in hotels, Nitter says. Air Greenland is building a new hotel in Ilulissat to increase capacity when the airport opens.

Nuuk has just over 550 hotel rooms, according to government documents. A tourism analysis published by Visit Greenland predicts there could be a shortage in rooms beginning in 2027. Most U.S. visitors will stay four to 10 nights, according to traveler sentiment data from Visit Greenland.

As travel picks up, visitors should expect more changes. Officials expect to pass new legislation that would further regulate tourism in time for the 2025 season. Rules on zoning would give local communities the power to limit tourism when needed, says Naaja H. Nathanielsen, minister for business, trade, raw materials, justice and gender equality.

Areas in a so-called red zone would ban tour operators. In northern Greenland, traditional hunting takes place at certain times of year and requires silence, which doesn’t work with cruise ships coming in, Nathanielsen says.

Part of the proposal would require tour operators to be locally based to ensure they pay taxes in Greenland and so that tourists receive local knowledge of the culture. Nathanielsen also plans to introduce a proposal to govern cruise tourism to ensure more travelers stay and eat locally, rather than just walk around for a few hours and grab a cup of coffee, she says.

Public sentiment has remained in favour of tourism as visitor arrivals have increased, Nathanielsen says.

—Roshan Fernandez contributed to this article.

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.