Stocks Gain for Second Month in a Row

Dow exits bear market after Fed chief’s comments fuel hopes that the pace of interest-rate increases would slow

The S&P 500 notched a second month of gains but remained on track for its worst year since 2008 after rapidly rising interest rates battered stocks.

The broad U.S. stock index is down about 15% this year even after rallying in October and November. The tech-heavy Nasdaq Composite, whose members tend to be especially sensitive to changing rates, has slumped 27% in 2022.

Stocks have pulled back this year as the Federal Reserve lifts rates in an attempt to tame sky-high inflation. Higher rates give investors more options to earn a return outside the stock market and ding the worth of companies’ future earnings in commonly used valuation models.

“It’s been a pretty one-dimensional year,” said Matt Orton, chief market strategist at Raymond James Investment Management. “The persistence of inflation has dominated everything else.”

Major indexes have pared their losses in recent weeks, boosted by a slowdown in inflation and hopes that the Fed will slow its campaign of rate increases starting in December.

That optimism was bolstered Wednesday when Fed Chairman Jerome Powell indicated in a speech that the central bank is on track to raise interest rates by a half percentage point at its December meeting. That would mark a downshift after a series of four 0.75-point rate rises.

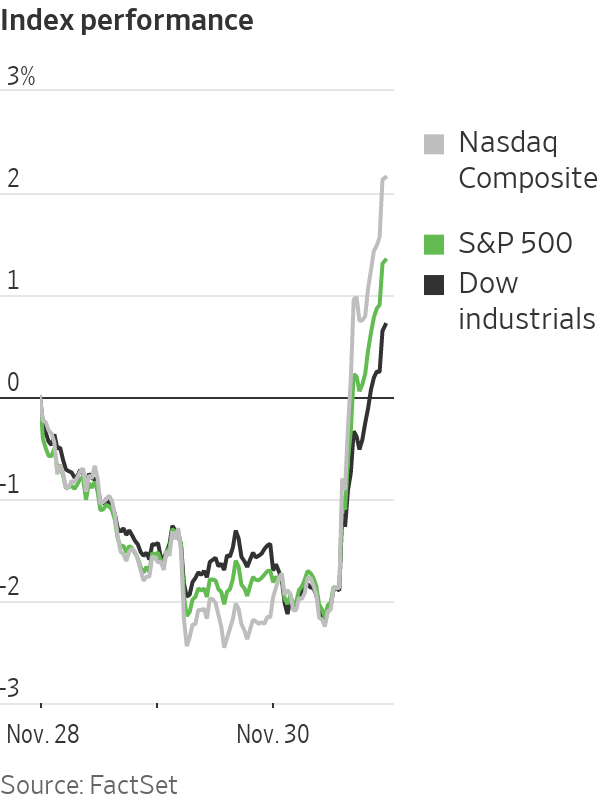

Stocks rallied as Mr. Powell spoke, lifting the S&P 500 3.1% for the day. The Dow Jones Industrial Average rose 2.2%, or about 735 points, in 4 p.m. ET trading, while the Nasdaq Composite jumped 4.4%. The sharp move was enough to put the Dow industrials back in a bull market, defined as a 20% rise from a recent low.

“Today’s speech gives more hope for the possibility of that elusive soft landing,” said Hank Smith, head of investment strategy at Haverford Trust. “From the market’s perspective there’s the chance of a soft landing as opposed to a hard landing that’s a traditional recession.”

Investors will closely watch inflation data due to be published on Dec. 13 for further clues about the path of interest rates.

“Operation catch-up is what this year has been all about and I think it’s over,” said Hani Redha, portfolio manager at PineBridge Investments. “They’ve caught up. They’re in a decent place,” he said of the Fed.

Still, Mr. Redha said Mr. Powell could be seeking to push back at expectations of a looming pivot toward easier monetary policy.

Mr. Redha said stocks are likely to come back under pressure in early 2023. The Fed, he said, will continue to tighten monetary policy through its bondholdings even if it stops raising interest rates, while a recession will hurt earnings.

Money managers also are eying corporate earnings as a potential drag on stocks in the months to come. Analysts are forecasting profits from S&P 500 companies will rise more than 5% next year, according to FactSet. But many investors think those projections are unrealistic.

“Earnings estimates are too high for 2023,” said Niladri Mukherjee, head of CIO portfolio strategy for Merrill and Bank of America Private Bank. “They need to come down.”

Government bond prices have risen since data published Nov. 10 showed inflation slowed in October, sparking hopes the Fed will ease off the brakes.

The yield on 10-year Treasurys declined to 3.699% Wednesday, from 3.746% Tuesday. It is down from more than 4% at the start of the month.

Yields on longer-term U.S. Treasurys have fallen far below those on short-term bonds, a sign investors think the Fed is close to winning its inflation battle—and that the economy is heading toward recession.

Falling yields, coupled with easing fears of a steep European downturn, have pulled the dollar down from multiyear highs. The WSJ Dollar Index fell 4.2% this month through Tuesday, putting it on pace for its largest one-month percentage decline since 2010.

Global markets broadly rose Wednesday. Travel, leisure and auto stocks helped push the Stoxx Europe 600 up 0.6%. China’s Shanghai Composite Index added about 0.1%. The Hang Seng rose 2.2%, closing out the biggest one-month advance for the Hong Kong benchmark since 1998.

Oil benchmark Brent crude rose 2.9% to $85.43 a barrel. Traders are awaiting details of the price cap that the U.S. and its allies are due to impose on Russian oil next week. The level of the cap is still under negotiation in the European Union.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

As Paris makes its final preparations for the Olympic games, its residents are busy with their own—packing their suitcases, confirming their reservations, and getting out of town.

Worried about the hordes of crowds and overall chaos the Olympics could bring, Parisians are fleeing the city in droves and inundating resort cities around the country. Hotels and holiday rentals in some of France’s most popular vacation destinations—from the French Riviera in the south to the beaches of Normandy in the north—say they are expecting massive crowds this year in advance of the Olympics. The games will run from July 26-Aug. 1.

“It’s already a major holiday season for us, and beyond that, we have the Olympics,” says Stéphane Personeni, general manager of the Lily of the Valley hotel in Saint Tropez. “People began booking early this year.”

Personeni’s hotel typically has no issues filling its rooms each summer—by May of each year, the luxury hotel typically finds itself completely booked out for the months of July and August. But this year, the 53-room hotel began filling up for summer reservations in February.

“We told our regular guests that everything—hotels, apartments, villas—are going to be hard to find this summer,” Personeni says. His neighbours around Saint Tropez say they’re similarly booked up.

As of March, the online marketplace Gens de Confiance (“Trusted People”), saw a 50% increase in reservations from Parisians seeking vacation rentals outside the capital during the Olympics.

Already, August is a popular vacation time for the French. With a minimum of five weeks of vacation mandated by law, many decide to take the entire month off, renting out villas in beachside destinations for longer periods.

But beyond the typical August travel, the Olympics are having a real impact, says Bertille Marchal, a spokesperson for Gens de Confiance.

“We’ve seen nearly three times more reservations for the dates of the Olympics than the following two weeks,” Marchal says. “The increase is definitely linked to the Olympic Games.”

Getty Images

According to the site, the most sought-out vacation destinations are Morbihan and Loire-Atlantique, a seaside region in the northwest; le Var, a coastal area within the southeast of France along the Côte d’Azur; and the island of Corsica in the Mediterranean.

Meanwhile, the Olympics haven’t necessarily been a boon to foreign tourism in the country. Many tourists who might have otherwise come to France are avoiding it this year in favour of other European capitals. In Paris, demand for stays at high-end hotels has collapsed, with bookings down 50% in July compared to last year, according to UMIH Prestige, which represents hotels charging at least €800 ($865) a night for rooms.

Earlier this year, high-end restaurants and concierges said the Olympics might even be an opportunity to score a hard-get-seat at the city’s fine dining.

In the Occitanie region in southwest France, the overall number of reservations this summer hasn’t changed much from last year, says Vincent Gare, president of the regional tourism committee there.

“But looking further at the numbers, we do see an increase in the clientele coming from the Paris region,” Gare told Le Figaro, noting that the increase in reservations has fallen directly on the dates of the Olympic games.

Michel Barré, a retiree living in Paris’s Le Marais neighbourhood, is one of those opting for the beach rather than the opening ceremony. In January, he booked a stay in Normandy for two weeks.

“Even though it’s a major European capital, Paris is still a small city—it’s a massive effort to host all of these events,” Barré says. “The Olympics are going to be a mess.”

More than anything, he just wants some calm after an event-filled summer in Paris, which just before the Olympics experienced the drama of a snap election called by Macron.

“It’s been a hectic summer here,” he says.

AFP via Getty Images

Parisians—Barré included—feel that the city, by over-catering to its tourists, is driving out many residents.

Parts of the Seine—usually one of the most popular summertime hangout spots —have been closed off for weeks as the city installs bleachers and Olympics signage. In certain neighbourhoods, residents will need to scan a QR code with police to access their own apartments. And from the Olympics to Sept. 8, Paris is nearly doubling the price of transit tickets from €2.15 to €4 per ride.

The city’s clear willingness to capitalise on its tourists has motivated some residents to do the same. In March, the number of active Airbnb listings in Paris reached an all-time high as hosts rushed to list their apartments. Listings grew 40% from the same time last year, according to the company.

With their regular clients taking off, Parisian restaurants and merchants are complaining that business is down.

“Are there any Parisians left in Paris?” Alaine Fontaine, president of the restaurant industry association, told the radio station Franceinfo on Sunday. “For the last three weeks, there haven’t been any here.”

Still, for all the talk of those leaving, there are plenty who have decided to stick around.

Jay Swanson, an American expat and YouTuber, can’t imagine leaving during the Olympics—he secured his tickets to see ping pong and volleyball last year. He’s also less concerned about the crowds and road closures than others, having just put together a series of videos explaining how to navigate Paris during the games.

“It’s been 100 years since the Games came to Paris; when else will we get a chance to host the world like this?” Swanson says. “So many Parisians are leaving and tourism is down, so not only will it be quiet but the only people left will be here for a party.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.