The Luxury Home Market Posts Its Biggest Decline in a Decade. ‘It’s Like Crickets.’

After a pandemic-induced bull run, the high-end market has finally faltered thanks to inflation, recession fears and rising interest rates

When Nancy Lam upgraded in January to a home closer to her child’s school in the San Francisco Bay Area, she thought she had plenty of time to list her old house, a five-bedroom modern home in the sought-after suburb of Lafayette.

After all, the pandemic had sent the luxury housing market soaring, and homes across the country were seeing aggressive bidding wars and selling for sky-high prices. Ms. Lam, a business professor, and her husband, who works in healthcare and declined to be named, took their time sprucing up the house in a bid to get the best possible price for the home, which they had bought for $1.67 million in 2014.

But after listing it for $3.95 million in May, they realised they may have miscalculated. After weeks on the market, the house hadn’t been scooped up like they expected. There were no reasonable offers, and no bidding wars. Now, four months and two significant price cuts later, the property is still lingering on the market, asking $3.49 million.

“It’s crazy,” she said. “We never expected for this to still be on the market. It really caught us by surprise.”

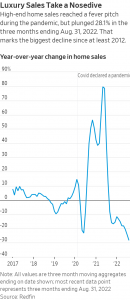

Experts say stories like Ms. Lam’s are becoming increasingly common as the luxury housing market cools following its pandemic-induced bull run. A new report by real-estate brokerage Redfin shows that in the three months ending Aug. 31, sales of luxury U.S. homes dropped 28.1%, from the same period last year. That marks the biggest decline since at least 2012, when Redfin’s records began, and eclipses even the 23.2% decrease recorded during the onslaught of the pandemic in 2020, the report said.

Sales of non luxury homes also fell during the same period, but that drop—19.5%– was smaller than the decline in the luxury market, which is defined as the top 5% of homes based on estimated market value, according to Redfin.

“Six months ago, people were buying homes over-ask and with no appraisal,” said Ms. Lam’s real-estate agent, Herman Chan of Golden Gate Sotheby’s International Realty. “They didn’t even bat an eyelash. Now, it’s like crickets.”

High-end California markets have seen some of the steepest declines in sales volume, Redfin’s data shows. The number of home sales plunged by close to 64% in Oakland, Calif., while San Jose and San Diego also posted decreases of more than 55%. The number of home sales fell 44.3% in Los Angeles, 55.5% in Miami and 11.8% in New York.

Major reasons for the slowdown include recession fears and rising interest rates, which have priced some buyers out of the market and spooked others, according to Redfin Chief Economist Daryl Fairweather. Buyers are getting “sticker shock” when they see the impact of rising rates, which is causing them to re-examine their finances and their buying power, she said. And while super wealthy buyers often aren’t directly impacted by interest rates—many purchase in cash—Ms. Fairweather said they are still paying attention to wider economic indicators.

“We’re dealing with inflation, and inflation cuts into profits,” she said. “Rich people definitely care about how much profits the companies they are invested in are making. That affects stock prices, it affects treasury yields.”

As for purchasing real estate in all cash, Treasurys seem like a better bet than real estate right now, Ms. Fairweather said. “No investor wants to put their money into an asset that is going down in value,” she said.

Mr. Chan said he believes the slowdown in activity is more severe in the luxury market because high-end homeowners have a greater degree of discretion about when to sell and at what price. Often, sellers face no financial pressure to move, he said; they can just wait it out.

Scott Lennard, an agent with Compass in the Seattle, Wash., area, who is listing a $12.5 million estate on Lake Washington, said his client is willing to hold out for the right price and is in no rush to sell, though the property has been on the market for about eight months.

While the volume of luxury sales across the country has dipped dramatically, prices are still holding firm, though their growth has slowed. The median sale price of a U.S. luxury home grew 10.5% to $1.1 million during the three months ending Aug. 31, according to Redfin, compared with a 20.3% increase during the same period of last year. Ms. Fairweather said she expects prices to decline throughout the winter.

Meanwhile, many buyers no longer feel urgency to move quickly, because houses are sitting on the market longer, Mr. Chan said. Some of his clients also dropped their budgets amid stock market volatility this summer, he said. One couple was originally shopping for a home in the $5 million range, but reduced their budget to around $4 million after some of their stocks took a battering and interest rates rose, he said. “They basically lost their down payment buffer zone,” he said.

In Seattle, Mr. Lennard said he sees tech buyers pulling away from the market and taking a “wait and see” approach. The stock prices of Amazon and Microsoft, two major employers in the area, have fallen significantly in the last year, he said.

“That does certainly have an impact on the high-net worth buyers, because so much of their compensation is tied up in stock versus salary,” he said.

Other buyers have left the market during the pandemic frenzy. Frederick Oshay, 62, head of a packaging supplies company, said he planned to buy a home after relocating to the Montecito area from San Francisco’s East Bay last year. He and his agents, Adam McKaig and Melissa Borders of Douglas Elliman, looked at numerous homes priced between about $3.5 million and $7 million, and he even made offers on a few, but was outbid. Now, he said, he is taking a step back until prices start to come down.

“If something was really enticing, I’d probably jump back in,” he said, noting that he’s now seeing more inventory creep onto the market and a slower pace of sales. “But in terms of aggressively pursuing properties in what looks like a bubble, I would say it is time to exercise some buyer prudence.”

With the mid-2000s real estate crash in mind, Mr. Oshay said he is wary of buying at the top of the market.

“I know people who bought houses in 2007 and 2008 and then were like, ‘Oh my gosh, I wish I hadn’t bought.’” he said. “That trauma still has a little bit of impact. I don’t want to get crushed.”

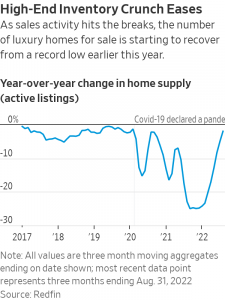

The shortage of luxury inventory that helped drive prices at the start of the pandemic is easing, Redfin’s data shows. The number of luxury homes for sale nationwide is up 39.2% from a record low of roughly 121,000 earlier this year.

Many sellers, however, haven’t adjusted to the new realities of the market, Mr. Chan said. Some of his buyers have made lowball offers on homes, only to be met with significant resistance. “It’s a stalemate,” he said. “Sellers are living in the past, the buyers are living in the future.”

Shannon Hagan of Coldwell Banker Realty said she has also seen buyers starting to retreat from the luxury market in the greater San Diego area. Many are waiting for price cuts that so far haven’t materialised.

“I see a lot of people sitting on the fence, waiting to see who is going to say ‘uncle’ or who’s motivated,” she said. “And most of the people that own those properties are not motivated.”

One of her listings, a $14.95 million oceanfront mansion in Carlsbad, Calif., has been on the market since June. While the seller received one verbal offer, a sale never materialised. Still, she said, her client is wealthy and isn’t desperate to sell. “They don’t have to ever sell—they can carry these properties in perpetuity,” she said.

Ms. Fairweather attributes declines in pricey California markets partly to the popularity of remote work. “People used to live in places like San Francisco because of its great job market,” she said. “But now you can take that job basically anywhere in the country.”

Mr. Chan said he has a number of San Francisco clients who have looked to leave the city in part because of the prevalence of homelessness in some areas.

Ms. Fairweather said she doesn’t see the luxury market improving soon, thanks to persistent inflation and the likelihood of further interest-rate hikes. She said it is likely to remain in “a holding pattern” until the economy starts to improve.

That’s bad news for sellers like Ms. Lam. While she said she’s grateful to have found a new house, she noted that it’s difficult to carry two mortgages and two sets of property taxes and insurance. “We didn’t budget to be carrying two of everything for more than a couple of months,” she said.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

A Sydney site with a questionable past is reborn as a luxe residential environment ideal for indulging in dining out

Long-term Sydney residents always had handful of not-so-glamourous nicknames for the building on the corner of Cleveland and Baptist Streets straddling Redfern and Surry Hills, but after a modern rebirth that’s all changed.

Once known as “Murder Mall” or “Methadone Mall”, the 1960s-built Surry Hills Shopping Centre was a magnet for colourful characters and questionable behaviour. Today, however, a $500 million facelift of the site — alongside a slow and steady gentrification of the two neighbouring suburbs — the prime corner property has been transformed into a luxury apartment complex Surry Hills Village by developer Toga Group.

The crowning feature of the 122-apartment project is the three-bedroom penthouse, fully completed and just released to market with a $7.5 million price guide.

Measuring 211sqm of internal space, with a 136sqm terrace complete with landscaping, the penthouse is the brand new brainchild of Surry Hills local Adam Haddow, director of architecture at award-winning firm SJB.

Victoria Judge, senior associate and co-interior design lead at SJB says Surry Hills Village sets a new residential benchmark for the southern end of Surry Hills.

“The residential offering is well-appointed, confident, luxe and bohemian. Smart enough to know what makes good living, and cool enough to hold its own amongst design-centric Surry Hills.”

Allan Vidor, managing director of Toga Group, adds that the penthouse is the quintessential jewel in the crown of Surry Hills Village.

“Bringing together a distinct design that draws on the beauty and vibrancy of Sydney; grand spaces and the finest finishes across a significant footprint, located only a stone’s throw away from the exciting cultural hub of Crown St and Surry Hills.”

Created to maximise views of the city skyline and parkland, the top floor apartment has a practical layout including a wide private lobby leading to the main living room, a sleek kitchen featuring Pietra Verde marble and a concealed butler’s pantry Sub-Zero Wolf appliances, full-height Aspen elm joinery panels hiding storage throughout, flamed Saville stone flooring, a powder room, and two car spaces with a personal EV.

All three bedrooms have large wardrobes and ensuites with bathrooms fittings such as freestanding baths, artisan penny tiles, emerald marble surfaces and brushed-nickel accents.

Additional features of the entertainer’s home include leather-bound joinery doors opening to a full wet bar with Sub-Zero wine fridge and Sub-Zero Wolf barbecue.

The Surry Hills Village precinct will open in stages until autumn next year and once complete, Wunderlich Lane will be home to a collection of 25 restaurants and bars plus wellness and boutique retail. The EVE Hotel Sydney will open later in 2024, offering guests an immersive experience in the precinct’s art, culture, and culinary offerings.

The Surry Hills Village penthouse on Baptist is now finished and ready to move into with marketing through Toga Group and inquiries to 1800 554 556.

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.