Where Are Stocks, Bonds and Crypto Headed Next? Five Investors Look Into Crystal Ball

Equities are often seen as expensive after promising start to 2023

A new trading year kicked off just weeks ago. Already it bears little resemblance to the carnage of 2022.

After languishing throughout last year, growth stocks have zoomed higher. Tesla Inc. and Nvidia Corp., for example, have jumped more than 30%. The outlook for bonds is brightening after a historic rout. Even bitcoin has rallied, despite ongoing effects from the collapse of the crypto exchange FTX.

The rebound has been driven by renewed optimism about the global economic outlook. Investors have embraced signs that inflation has peaked in the U.S. and abroad. Many are hoping that next week the Federal Reserve will slow its pace of interest-rate increases yet again. China’s lifting of Covid-19 restrictions pleasantly surprised many traders who have welcomed the move as a sign that more growth is ahead.

Still, risks loom large. Many investors aren’t convinced that the rebound is sustainable. Some are worried about stretched stock valuations, or whether corporate earnings will face more pain down the road. Others are fretting that markets aren’t fully pricing in the possibility of a recession, or what might happen if the Fed continues to fight inflation longer than currently anticipated.

We asked five investors to share how they are positioning for that uncertainty and where they think markets could be headed next. Here is what they said:

‘Animal spirits’ could return

Cliff Asness, founder of AQR Capital Management, acknowledges that he wasn’t expecting the run in speculative stocks and digital currencies that has swept markets to kick off 2023.

Bitcoin prices have jumped around 40%. Some of the stocks that are the most heavily bet against on Wall Street are sitting on double-digit gains. Carvana Co. has soared nearly 64%, while MicroStrategy Inc. has surged more than 80%. Cathie Wood‘s ARK Innovation ETF has gained about 29%.

If the past few years have taught Mr. Asness anything, it is to be prepared for such run-ups to last much longer than expected. His lesson from the euphoria regarding risky trades in 2020 and 2021? Don’t count out the chance that the frenzy will return again, he said.

“It could be that there are still these crazy animal spirits out there,” Mr. Asness said.

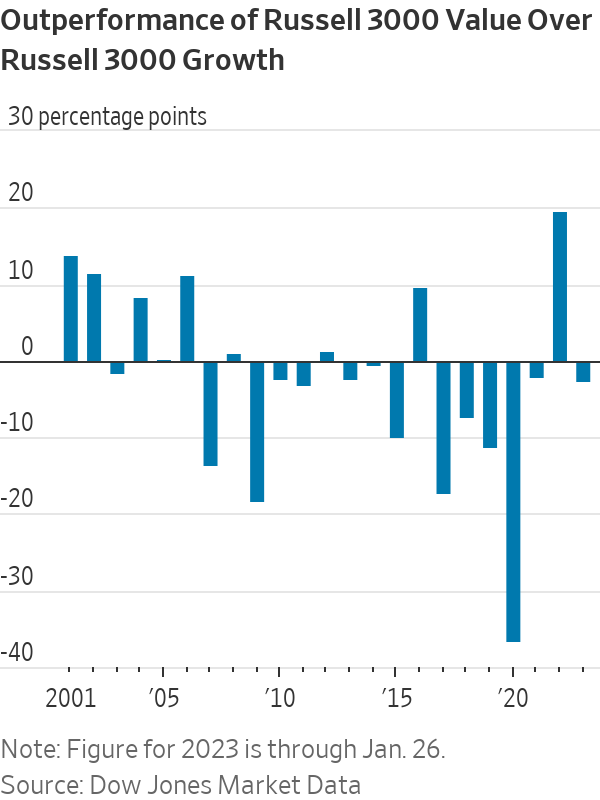

Still, he said that hasn’t changed his conviction that cheaper stocks in the market, known as value stocks, are bound to keep soaring past their peers. There might be short spurts of outperformance for more-expensive slices of the market, as seen in January. But over the long term, he is sticking to his bet that value stocks will beat growth stocks. He is expecting a volatile, but profitable, stretch for the trade.

“I love the value trade,” Mr. Asness said. “We sing about it to our clients.”

—Gunjan Banerji

Keeping dollar’s moves in focus

For Richard Benson, co-chief investment officer of Millennium Global Investments Ltd., no single trade was more important last year than the blistering rise of the U.S. dollar.

Once a relatively placid area of markets following the 2008 financial crisis, currencies have found renewed focus from Wall Street and Main Street. Last year the dollar’s unrelenting rise dented multinational companies’ profits, exacerbated inflation for countries that import American goods and repeatedly surprised some traders who believed the greenback couldn’t keep rallying so fast.

The factors that spurred the dollar’s rise are now contributing to its fall. Ebbing inflation and expectations of slower interest-rate increases from the Fed have sent the dollar down 1.7% this year, as measured by the WSJ Dollar Index.

Mr. Benson is betting more pain for the dollar is ahead and sees the greenback weakening between 3% and 5% over the next three to six months.

“When the biggest central bank in the world is on the move, look at everything through their lens and don’t get distracted,” said Mr. Benson of the London-based currency fund manager, regarding the Fed.

This year Mr. Benson expects the dollar’s fall to ripple similarly far and wide across global economies and markets.

“I don’t see many people complaining about a weaker dollar” over the next few months, he said. “If the dollar is falling, that economic setup should also mean that tech stocks should do quite well.”

Mr. Benson said he expects the dollar’s fall to brighten the outlook for some emerging- market assets, and he is betting on China’s offshore yuan as the country’s economy reopens. He sees the euro strengthening versus the dollar if the eurozone’s economy continues to fare better than expected.

—Caitlin McCabe

Stocks still appear overvalued

Even after the S&P 500 fell 15% from its record high reached in January 2022, U.S. stocks still look expensive, said Rupal Bhansali, chief investment officer of Ariel Investments, who oversees $6.7 billion in assets.

Of course, the market doesn’t appear as frothy as it did for much of 2020 and 2021, but she said she expects a steeper correction in prices ahead.

The broad stock-market gauge recently traded at 17.9 times its projected earnings over the next 12 months, according to FactSet. That is below the high of around 24 hit in late 2020, but above the historical average over the past 20 years of 15.7, FactSet data show.

“The old habit was buy the dip,” Ms. Bhansali said. “The new habit should be sell the rip.”

One reason Ms. Bhansali said the selloff might not be over yet? The market is still underestimating the Fed.

Investors repeatedly mispriced how fast the Fed would move in 2022, wrongly expecting the central bank to ease up on its rate increases. They were caught off guard by Fed Chair Jerome Powell‘s aggressive messages on interest rates. It stoked steep selloffs in the stock market, leading to the most turbulent year since the 2008 financial crisis. Now investors are making the same mistake again, Ms. Bhansali said.

Current stock valuations don’t reflect the big shift coming in central-bank policy, which she thinks will have to be more aggressive than many expect. Though broader measures of inflation have been falling, some slices, such as services inflation, have proved stickier. Ms. Bhansali is positioning for such areas as healthcare, which she thinks would be more insulated from a recession than the rest of the market, to outperform.

“The Fed is determined to win the war since they lost the battle,” Ms. Bhansali said.

—Gunjan Banerji

A better year for bonds seen

Gone are the days when tumbling bond yields left investors with few alternatives to stocks. Finally, bonds are back, according to Niall O’Sullivan of Neuberger Berman, an investment manager overseeing about $427 billion in client assets at the end of 2022.

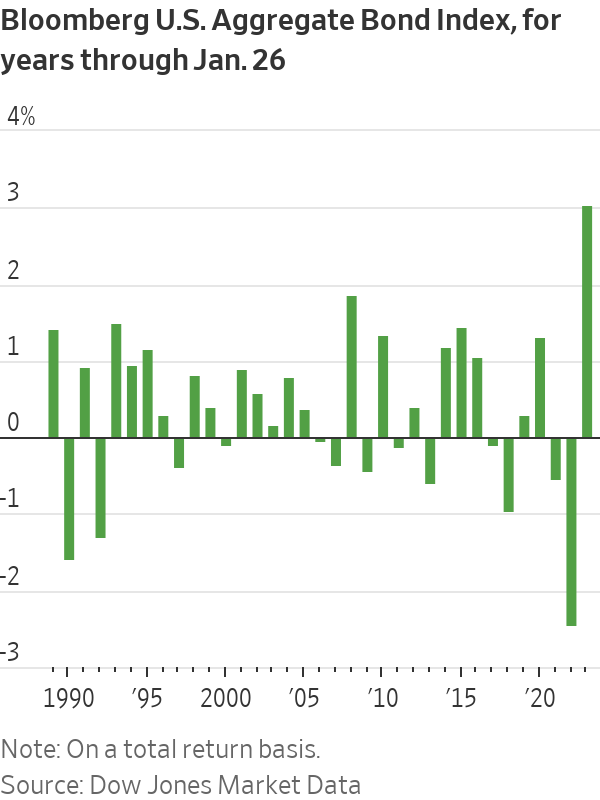

After a turbulent year for the fixed-income market in 2022, bonds have kicked off the new year on a more promising note. The Bloomberg U.S. Aggregate Bond Index—composed largely of U.S. Treasurys, highly rated corporate bonds and mortgage-backed securities—climbed 3% so far this year on a total return basis through Thursday’s close. That is the index’s best start to a year since it began in 1989, according to Dow Jones Market Data.

Mr. O’Sullivan, the chief investment officer of multi asset strategies for Europe, the Middle East and Africa at Neuberger Berman, said the single biggest conversation he is currently having with clients is how to increase fixed-income exposure.

“Strategically, the facts have changed. When you look at fixed income as an asset class…they’re now all providing yield, and possibly even more importantly, actual cash coupons of a meaningful size,” he said. “That is a very different world to the one we’ve been in for quite a long time.”

Mr. O’Sullivan said it is important to reconsider how much of an advantage stocks now hold over bonds, given what he believes are looming risks for the stock market. He predicts that inflation will be harder to wrangle than investors currently anticipate and that the Fed will hold its peak interest rate steady for longer than is currently expected. Even more worrying, he said, it will be harder for companies to continue passing on price increases to consumers, which means earnings could see bigger hits in the future.

“That is why we are wary on the equity side,” he said.

Among the products that Mr. O’Sullivan said he favours in the fixed-income space are higher-quality and shorter-term bonds. Still, he added, it is important for investors to find portfolio diversity outside bonds this year. For that, he said he views commodities as attractive, specifically metals such as copper, which could continue to benefit from China’s reopening.

—Caitlin McCabe

Find the fear, and find the value

Ramona Persaud, a portfolio manager at Fidelity Investments, said she can still identify bargains in a pricey market by looking in less-sanguine places. Find the fear, and find the value, she said.

“When fear really rises, you can buy some very well-run businesses,” she said.

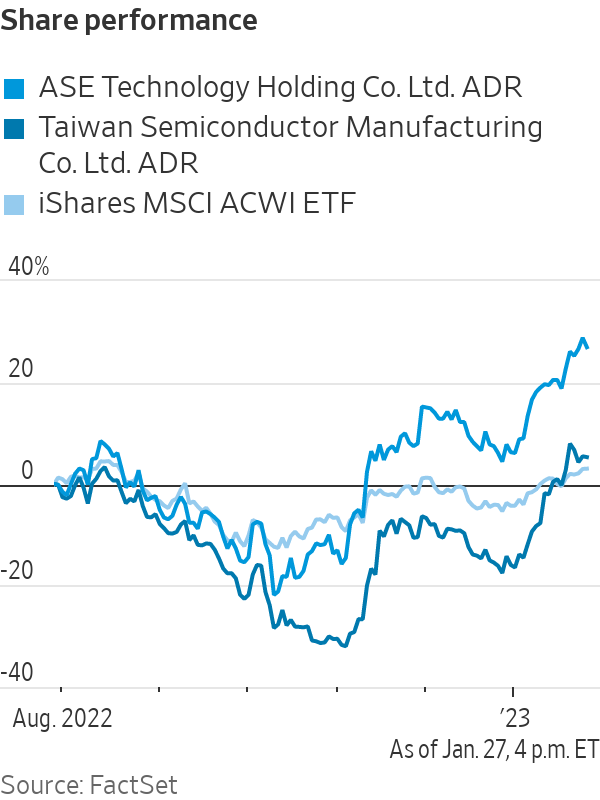

Take Taiwan’s semiconductor companies. Concern over global trade and tensions with China have weighed on the shares of chip makers based on the island. But those fears have led many investors to overlook the competitive advantages those companies hold over rivals, she said.

“That is a good setup,” said Ms. Persaud, who considers herself a conservative value investor and manages more than $20 billion across several U.S. and Canadian funds.

The S&P 500 is trading above fair value, she said, which means “there just isn’t widespread opportunity,” and investors might be underestimating some of the risks that lie in waiting.

“That tells me the market is optimistic,” said Ms. Persaud. “That would be OK if the risks were not exogenous.”

Those challenges, whether rising interest rates and Fed policy or Russia’s war in Ukraine and concern over energy-security concerns in Europe, are complicated, and in many cases, interrelated.

It isn’t all bad news, she said. China ended its zero-Covid restrictions. A milder winter in Europe has blunted the effects of the war in Ukraine on energy prices and helped the continent sidestep recession, and inflation is slowing.

“These are reasons the market is so happy,” she said.

—Justin Baer

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

As Paris makes its final preparations for the Olympic games, its residents are busy with their own—packing their suitcases, confirming their reservations, and getting out of town.

Worried about the hordes of crowds and overall chaos the Olympics could bring, Parisians are fleeing the city in droves and inundating resort cities around the country. Hotels and holiday rentals in some of France’s most popular vacation destinations—from the French Riviera in the south to the beaches of Normandy in the north—say they are expecting massive crowds this year in advance of the Olympics. The games will run from July 26-Aug. 1.

“It’s already a major holiday season for us, and beyond that, we have the Olympics,” says Stéphane Personeni, general manager of the Lily of the Valley hotel in Saint Tropez. “People began booking early this year.”

Personeni’s hotel typically has no issues filling its rooms each summer—by May of each year, the luxury hotel typically finds itself completely booked out for the months of July and August. But this year, the 53-room hotel began filling up for summer reservations in February.

“We told our regular guests that everything—hotels, apartments, villas—are going to be hard to find this summer,” Personeni says. His neighbours around Saint Tropez say they’re similarly booked up.

As of March, the online marketplace Gens de Confiance (“Trusted People”), saw a 50% increase in reservations from Parisians seeking vacation rentals outside the capital during the Olympics.

Already, August is a popular vacation time for the French. With a minimum of five weeks of vacation mandated by law, many decide to take the entire month off, renting out villas in beachside destinations for longer periods.

But beyond the typical August travel, the Olympics are having a real impact, says Bertille Marchal, a spokesperson for Gens de Confiance.

“We’ve seen nearly three times more reservations for the dates of the Olympics than the following two weeks,” Marchal says. “The increase is definitely linked to the Olympic Games.”

Getty Images

According to the site, the most sought-out vacation destinations are Morbihan and Loire-Atlantique, a seaside region in the northwest; le Var, a coastal area within the southeast of France along the Côte d’Azur; and the island of Corsica in the Mediterranean.

Meanwhile, the Olympics haven’t necessarily been a boon to foreign tourism in the country. Many tourists who might have otherwise come to France are avoiding it this year in favour of other European capitals. In Paris, demand for stays at high-end hotels has collapsed, with bookings down 50% in July compared to last year, according to UMIH Prestige, which represents hotels charging at least €800 ($865) a night for rooms.

Earlier this year, high-end restaurants and concierges said the Olympics might even be an opportunity to score a hard-get-seat at the city’s fine dining.

In the Occitanie region in southwest France, the overall number of reservations this summer hasn’t changed much from last year, says Vincent Gare, president of the regional tourism committee there.

“But looking further at the numbers, we do see an increase in the clientele coming from the Paris region,” Gare told Le Figaro, noting that the increase in reservations has fallen directly on the dates of the Olympic games.

Michel Barré, a retiree living in Paris’s Le Marais neighbourhood, is one of those opting for the beach rather than the opening ceremony. In January, he booked a stay in Normandy for two weeks.

“Even though it’s a major European capital, Paris is still a small city—it’s a massive effort to host all of these events,” Barré says. “The Olympics are going to be a mess.”

More than anything, he just wants some calm after an event-filled summer in Paris, which just before the Olympics experienced the drama of a snap election called by Macron.

“It’s been a hectic summer here,” he says.

AFP via Getty Images

Parisians—Barré included—feel that the city, by over-catering to its tourists, is driving out many residents.

Parts of the Seine—usually one of the most popular summertime hangout spots —have been closed off for weeks as the city installs bleachers and Olympics signage. In certain neighbourhoods, residents will need to scan a QR code with police to access their own apartments. And from the Olympics to Sept. 8, Paris is nearly doubling the price of transit tickets from €2.15 to €4 per ride.

The city’s clear willingness to capitalise on its tourists has motivated some residents to do the same. In March, the number of active Airbnb listings in Paris reached an all-time high as hosts rushed to list their apartments. Listings grew 40% from the same time last year, according to the company.

With their regular clients taking off, Parisian restaurants and merchants are complaining that business is down.

“Are there any Parisians left in Paris?” Alaine Fontaine, president of the restaurant industry association, told the radio station Franceinfo on Sunday. “For the last three weeks, there haven’t been any here.”

Still, for all the talk of those leaving, there are plenty who have decided to stick around.

Jay Swanson, an American expat and YouTuber, can’t imagine leaving during the Olympics—he secured his tickets to see ping pong and volleyball last year. He’s also less concerned about the crowds and road closures than others, having just put together a series of videos explaining how to navigate Paris during the games.

“It’s been 100 years since the Games came to Paris; when else will we get a chance to host the world like this?” Swanson says. “So many Parisians are leaving and tourism is down, so not only will it be quiet but the only people left will be here for a party.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.