World Bank Warns of Lost Decade for Global Economy

Lender sees demographics, war and pandemic aftereffects holding back growth

Over the past year, governments around the world have announced tax breaks, subsidies and new laws in a bid to accelerate investment, combat climate change and expand their workforces.

That might not be enough.

The World Bank is warning of a “lost decade” ahead for global growth, as the war in Ukraine, the Covid-19 pandemic and high inflation compound existing structural challenges.

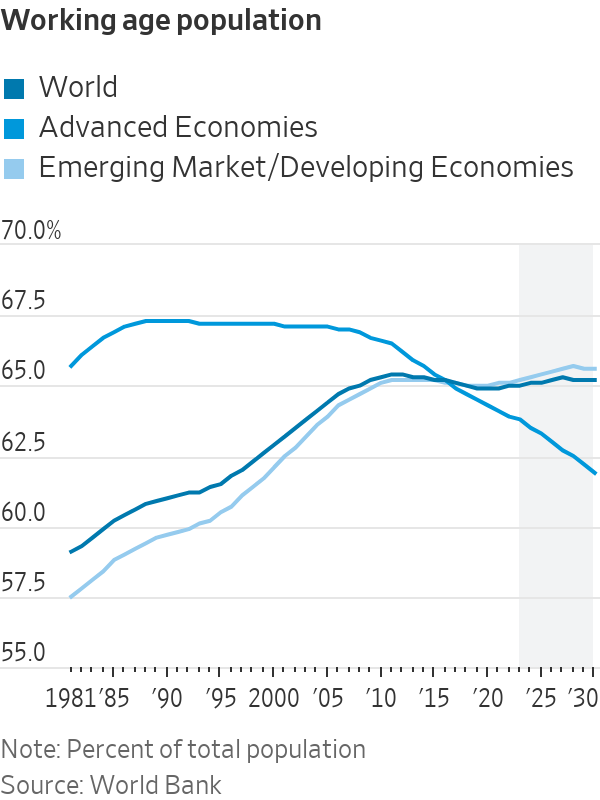

The Washington, D.C.-based international lender says that “it will take a herculean collective policy effort to restore growth in the next decade to the average of the previous one.” Three main factors are behind the reversal in economic progress: an ageing workforce, weakening investment and slowing productivity.

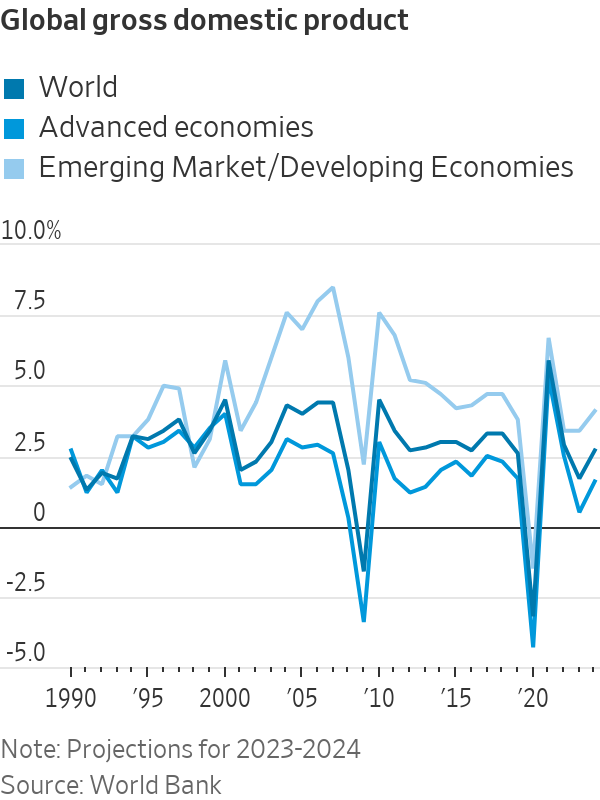

“Across the world, a structural growth slowdown is under way: At current trends, the global potential growth rate—the maximum rate at which an economy can grow without igniting inflation—is expected to fall to a three-decade low over the remainder of the 2020s,” the World Bank said.

Potential growth was 3.5% in the decade from 2000 to 2010. It dropped to 2.6% a year on average from 2011 to 2021, and will shrink further to 2.2% a year from 2022 to 2030, the bank said. About half of the slowdown is attributable to demographic factors.

The latest alarm bells from the World Bank about the global economy come in the wake of the U.S.’s passing the Inflation Reduction Act, which includes hundreds of billions in incentives and funding for clean energy, as well as a law to ratchet up investments in semiconductors. In response, the European Union is relaxing its rules on government tax breaks and other benefits for clean-tech companies.

Meantime, major economies are trying to boost their workforce numbers, often in the face of steep resistance. In France, protesters responded violently to President Emmanuel Macron’s overhaul of the country’s pension system, while China’s shrinking population has prompted local governments there to offer cash rewards and longer maternity leaves to boost births.

These efforts so far might be too little, too late. Weakness in growth could be even more pronounced if financial crises erupt in major economies and trigger a global recession, the World Bank report cautions. The warning comes just weeks after the collapse of Silicon Valley Bank sparked turmoil in the U.S. and European banking sectors.

Questions surrounding global growth prospects will be in the air in Washington, D.C., alongside the blooming cherry blossoms at the spring meetings of the International Monetary Fund and World Bank from April 10 to 16.

Policy makers and central-bank officials will join economists from around the world to discuss topics including inflation, supply chains, global trade fragmentation, artificial intelligence and human capital.

Earlier this year, the World Bank sharply lowered its short-term growth forecast for the global economy, citing persistently high inflation that has elevated the risk for a worldwide recession. It expects global growth to slow to 1.7% in 2023. Other organisations, such as the International Monetary Fund and the Peterson Institute for International Economics, a Washington-based think tank, expect global GDP growth to expand a more robust 2.9% in 2023.

This isn’t the first time the World Bank has warned of a lost decade. In 2021, the lender said the Covid-19 pandemic raised the prospect owing to lower trade and investment caused by uncertainty over the pandemic. It issued similar warnings after the 2008 financial crisis. Global growth from 2009 to 2018 averaged 2.8% a year, compared with 3.5% in the prior decade.

The World Bank identifies a number of challenges conspiring to push down global growth: weak investment, slow productivity growth, restrictive trade measures such as tariffs and the continuing negative effects—such as learning losses from school closures—because of the pandemic.

It said pro-growth policies would help. Measures to boost labor-force participation among discouraged workers and women can help reverse the negative trend in labor force growth from an older population and lower birthrates, according to the World Bank.

Some view the World Bank’s projection for a lost decade as too pessimistic. Harvard University economist Karen Dynan said that ageing populations in nearly every part of the world will be a drag on global growth, but she was more optimistic on raising productivity—output per worker.

“I expect, outside the demographic effects, output per person to look a lot like it did before the pandemic,” she said.

“The World Bank is right to draw concern to the possibility of a lost decade in sub-Saharan Africa, in Central America, in South Asia—an awful lot of human beings are at risk or are facing very grim situations,” said Adam Posen, president of the Peterson Institute for International Economics.

“But from a global GDP outlook, or even a global population outlook, most of the major emerging markets along with most of the Group of 20 essentially are doing pretty well,” Mr. Posen said. He pointed to economic resilience in Europe and emerging markets in recent years, even as the Federal Reserve has sharply raised interest rates.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

The sports-car maker delivered 279,449 cars last year, down from 310,718 in 2024.

Chinese carmaker GAC will expand its Australian electric vehicle line-up with the city-focused AION UT hatchback.

The sports-car maker delivered 279,449 cars last year, down from 310,718 in 2024.

Porsche car deliveries fell 10% in 2025 as demand was hit by a slowdown in luxury spending in China and as it ceased production of its 718 Boxster and 718 Cayman models through the year.

The German luxury sports-car maker said Friday that it delivered 279,449 cars in the year, down from 310,718 in 2024.

The company had a tumultuous year as it contended with a stuttering transition to electric vehicles and a tough Chinese market, while the Trump administration’s automotive tariffs presented a further headwind.

Deliveries in its largest sales region of North America were virtually flat at 86,229, but continued challenges in China meant deliveries in the country dropped 26% to 41,938 vehicles.

Automakers have faced intense competition in China, sparking a prolonged price war as rivals cut prices to win customers, while a lengthy property market slump and economic-growth concerns in the country has also led to buyers pulling back on luxury spending.

“Key reasons for the decline remain the challenging market conditions, particularly in the luxury segment, and the very intense competition in the Chinese market, especially for all-electric models,” the company said.

Other German brands including Audi, BMW and Mercedes-Benz have all recently reported that the challenging Chinese market hit demand last year.

In Europe, Porsche deliveries fell 13% to 66,340 cars excluding its home market of Germany, while German deliveries dropped 16%.

The company cut guidance several times last year as it warned of hits from U.S. import tariffs, investments in new combustion engines and hybrid models amid the slow uptake of EVs, and the competitive situation in China.

Porsche also last year announced plans to scale back its EV ambitions and instead expand its lineup with more gas-powered and plug-in hybrid models than it had originally planned.

However, in its statement Friday, the company said it increased its share of electrified-vehicle deliveries in the year. Around 34% of vehicles delivered worldwide were electrified, an increase of 7.4 percentage points on year, with about 22% all-electric vehicles and 12% plug-in hybrids.

That leaves its global share of fully-electric vehicles at the upper end of its target range of 20% to 22% for 2025.

In Europe, for the first time in 2025, more electrified vehicles than purely combustion engine vehicles were delivered.

The Macan topped the delivery charts in the year, while the 911 reached a record high with 51,583 deliveries worldwide, it said.

Porsche said it is investing in its three-pronged powertrain strategy and will continue to respond to increasing demand for personalization requests from customers.

“We have a clear focus for 2026,” Sales and Marketing Chief Matthias Becker said. “We want to manage supply and demand in accordance with our ‘value over volume’ strategy.

“At the same time, we are realistically planning our volume for 2026 following the end of production of the 718 and Macan with combustion engines.”

In the remote waters of Indonesia’s Anambas Islands, Bawah Reserve is redefining what it means to blend barefoot luxury with environmental stewardship.

The megamansion was built for Tony Pritzker, heir to the Hyatt Hotel fortune and brother of Illinois Gov. JB Pritzker.