As Americans Work From Home, Europeans and Asians Head Back to the Office

Return-to-office rates in Paris and Tokyo have climbed to over 75%, while U.S. often sits around half

While U.S. offices are half empty three years into the Covid-19 pandemic, workplaces in Europe and Asia are bustling again.

Americans have embraced remote work and turned their backs on offices with greater regularity than their counterparts overseas. U.S. office occupancy stands at 40% to 60% of prepandemic levels, varying within that range by month and by city. That compares with a 70%-to-90% rate in Europe and the Middle East, according to JLL, a property-services firm that manages 4.6 billion square feet of real estate globally.

Return to office was even more common in Asia, JLL said, where rates ranged from 80% to 110%—meaning that in some cities more people are in the office nowadays than before the pandemic.

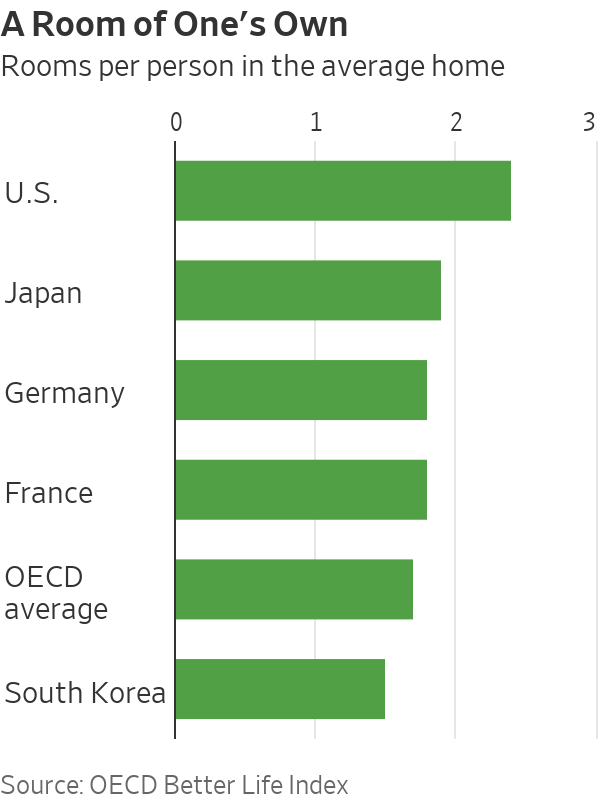

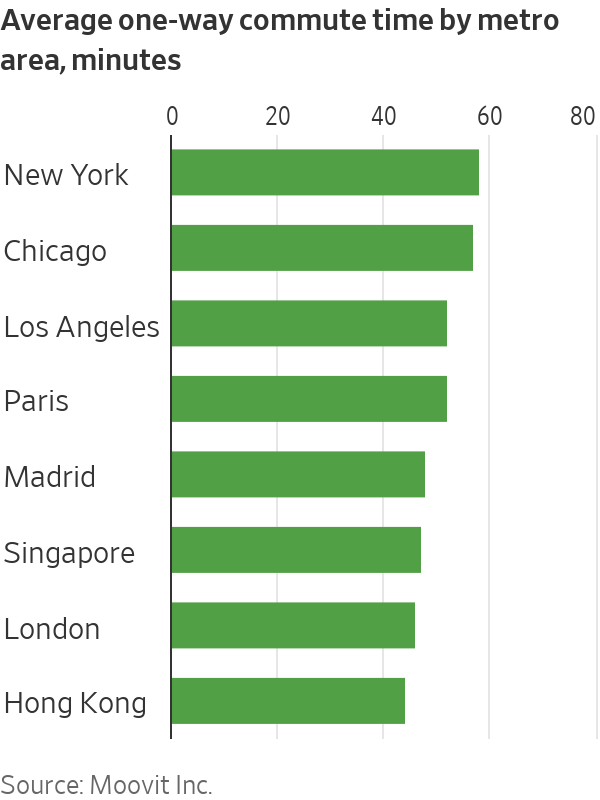

Bigger homes, longer commutes and a tighter labor market help explain why Americans spend less time in the office than Europeans and Asians, workplace consultants say.

This divergence in return-to-office habits not only benefits overseas landlords more than their U.S. peers. It has a direct impact on how quickly metro areas rebound from the pandemic’s economic shock. Cities in Europe and Asia have bounced back relatively well. But empty office buildings and missing commuters have undermined recoveries in U.S. cities such as New York and San Francisco, where local restaurants, shops and other businesses that rely on office workers as their primary customers have suffered.

The number of unemployed in New York City increased by 83,500 between early 2020 and the third quarter of 2022 as the city’s unemployment rate surged far above the national average, according to a report by the New School Center for New York City Affairs. Many of those who lost their jobs worked in Manhattan in face-to-face industries such as retail, accommodation and food services.

While Manhattan has been particularly hard hit because of its dependence on office commuters, other U.S. central business districts are also struggling. Falling office values are threatening to hit city budgets that depend on property taxes. Lower transit ridership is weighing on the finances of public-transportation authorities. Adding more apartments can help revitalise central business districts, but that will take time.

Several overseas capitals experienced periods where more than 75% of their workers were back at their desks in 2021 and 2022, JLL said. That includes Tokyo, Seoul and Singapore in Asia. Paris regularly topped the list of workers back in the office in Europe. Stockholm wasn’t far behind with several months at a more-than-75% return-to-office rate.

No major U.S. city tracked by JLL achieved that high a return rate during the period.

“The U.S. has borne the brunt of this,” said Phil Ryan, director of city futures at JLL.

Living arrangements are one reason for the difference in work habits. Americans are more likely to live in spacious suburban houses. That makes it easier to set up a home office away from distractions. Hong Kong’s small apartments, for example, often house multiple generations, making working from home less appealing.

Suburban sprawl means many Americans have longer, more tedious commutes plagued by worsening traffic jams—another reason to stay home. While a number of European cities also have long average commutes, New York and Chicago are unmatched, according to mobility-services company Moovit Inc. Public-transit systems in Europe and Asia are often more reliable and less prone to delays, making it easier to get to work.

“We have high-density cities with effective public-transport systems,” said Caroline Pontifex, London-based director of workplace experience at consulting firm KKS Savills. “That makes a difference.”

Another explanation for America’s office exceptionalism is its labor market. At 3.4%, the U.S. unemployment rate is barely more than half the European Union’s unemployment rate of 6.1%. While Europe is also facing labor shortages, U.S. companies have been particularly hard hit, said JLL’s Mr. Ryan.

That has forced them to look farther afield for employees and hire remotely. Tech firms, which account for a particularly high share of employment in some big U.S. cities, have long been more tolerant of remote work.

Co-working companies are also reporting lower occupancy in some U.S. cities. WeWork Inc. said 72% of its desks in New York were leased as of the fourth quarter of 2022, compared with 80% in Paris, 81% in London and 82% in Singapore.

Workplace consultants say they expect the office-use gap between the U.S. and the rest of the world to persist.

It doesn’t help that U.S. offices were emptier long before the pandemic. A construction glut led to high vacancy rates, and even within leased offices companies tended to put fewer people on each floor than their European and Asian peers.

All that empty space is now creating a negative reinforcing cycle, said Phil Kirschner, an associate partner at business consulting company McKinsey & Co. Americans sitting in big, mostly empty offices find the experience depressing, making them more likely to stay at home in the first place. “It feels less energetic,” he said.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Excluding the Covid-19 pandemic period, annual growth was the lowest since 1992

Australia’s commodity-rich economy recorded its weakest growth momentum since the early 1990s in the second quarter, as consumers and businesses continued to feel the impact of high interest rates, with little expectation of a reprieve from the Reserve Bank of Australia in the near term.

The economy grew 0.2% in the second quarter from the first, with annual growth running at 1.0%, the Australian Bureau of Statistics said Wednesday. The results were in line with market expectations.

It was the 11th consecutive quarter of growth, although the economy slowed sharply over the year to June 30, the ABS said.

Excluding the Covid-19 pandemic period, annual growth was the lowest since 1992, the year that included a gradual recovery from a recession in 1991.

The economy remained in a deep per capita recession, with gross domestic product per capita falling 0.4% from the previous quarter, a sixth consecutive quarterly fall, the ABS said.

A big area of weakness in the economy was household spending, which fell 0.2% from the first quarter, detracting 0.1 percentage point from GDP growth.

On a yearly basis, consumption growth came in at just 0.5% in the second quarter, well below the 1.1% figure the RBA had expected, and was broad-based.

The soft growth report comes as the RBA continues to warn that inflation remains stubbornly high, ruling out near-term interest-rate cuts.

RBA Gov. Michele Bullock said last month that near-term rate cuts aren’t being considered.

Money markets have priced in a cut at the end of this year, while most economists expect that the RBA will stand pat until early 2025.

Treasurer Jim Chalmers has warned this week that high interest rates are “smashing the economy.”

Still, with income tax cuts delivered at the start of July, there are some expectations that consumers will be in a better position to spend in the third quarter, reviving the economy to some degree.

“Output has now grown at 0.2% for three consecutive quarters now. That leaves little doubt that the economy is growing well below potential,” said Abhijit Surya, economist at Capital Economics.

“But if activity does continue to disappoint, the RBA could well cut interest rates sooner,” Surya added.

Government spending rose 1.4% over the quarter, due in part to strength in social-benefits programs for health services, the ABS said.

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.