The Building Boom Is Prolonging Market Pain

Construction employment is higher than ever—undermining bets the Fed will soon pivot

US: The building boom has helped push unemployment to around its lowest level in more than 50 years. That is perplexing investors who want to see the Federal Reserve switch course on interest rates.

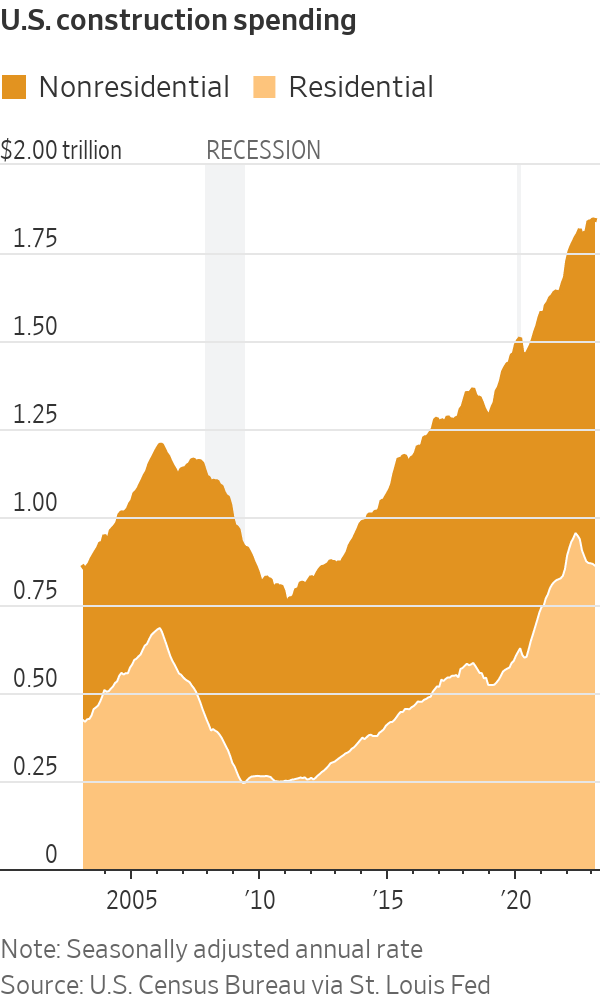

Construction spending and employment have risen to new records this year, boosted by government outlays for infrastructure, a domestic manufacturing renaissance and a wave of apartment building that got off to a slow start during the pandemic when prices for building materials, such as lumber, were sky high.

Construction companies with jobs ranging from airport overhauls to bathroom renovations say they have enough work booked to maintain payrolls—for years in some cases. Even home builders, who slowed down last year when rates began to rise, are ramping up into spring.

The persistent strength in a sector that is usually among the first to suffer job loss when borrowing costs rise is undermining investor hopes that the Fed’s aggressive interest-rate increases would quickly slow inflation and rejuvenate the stock market.

It also threatens to upend bets in the market that recession and lower rates are on the horizon. Investors are trading government bonds as if rate cuts will come within the next year and buying technology stocks, bitcoin and other speculative assets that surged when borrowing costs were near zero.

The issue for investors is that the longer it takes for construction activity and employment to decline, the longer it will be before the central bank can cut rates.

“Through this whole cycle, many have expected a much faster slowdown than has occurred,” said Bob Elliott, co-founder and chief executive of asset manager Unlimited. “Macroeconomic cycles take years to play out.”

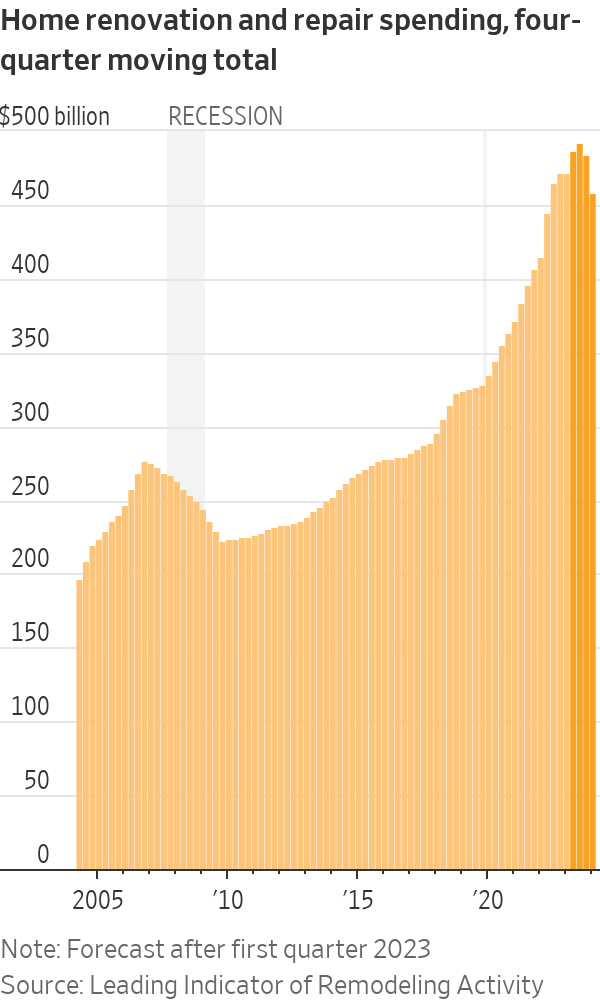

There are signs of slowdown, to be sure. Apartment construction is expected to decline once the latest batch of buildings is finished. Problems at regional banks are drying up financing for some projects. Spending on home improvement and repairs is forecast to decline over the next year, the first contraction since the depths of the foreclosure crisis in 2010, according to a closely watched barometer of the remodelling industry.

“Maybe we’re starting to see the effects of higher cost of capital on interest-rate-sensitive sectors,” said Anirban Basu, chief economist at trade group Associated Builders and Contractors, which said its measure of construction backlog declined in March to the lowest level since August. “The Federal Reserve raises rates until something breaks and something is starting to break.”

Even when construction employment declines, the effects might not be felt immediately in the broader economy. During the relatively fast-crashing 2008 financial crisis, the number of people working in residential construction peaked in April 2006 and had fallen roughly 15% before overall employment began to drop about two years later, Bureau of Labor Statistics data show.

The 2008 crash kicked off a deep recession and a years long home-building slump that left the U.S. severely short of housing.

Meanwhile, millions of homeowners are locked into historically low mortgage rates, which is keeping existing homes off the market and stoking demand for new construction, builders and analysts say. New-home sales climbed 9.6% in March, the Census Bureau said.

PulteGroup Inc., the country’s third-largest home builder, Tuesday reported record first-quarter revenue after selling 6% more houses at a 9% higher average price than a year earlier. Executives said they are adding sales and construction staff and building more spec homes, especially those aimed at first-time buyers.

“They don’t have a home to sell. And so they are not hampered by the low interest rate,” said Chief Executive Ryan Marshall. Pulte’s shares are up 47% this year and among the leaders of the S&P 500 stock index, which has gained 8.6%.

Employment in residential construction has been buoyed by the biggest burst in apartment building since the mid-1980s. Apartment projects were delayed after the Covid lockdown because of the budget-straining expense of building materials, such as lumber, which shot to more than twice the pre pandemic high and added millions of dollars to construction costs.

“People couldn’t build their projects, so they kicked the can down the road,” said Ivan Kaufman, chairman and CEO of Arbor Realty Trust Inc., which lends to landlords.

Though prices for lumber and other materials have come down, developers now face construction financing that is about twice as expensive as it had been and landlords are unlikely to be able to offset greater borrowing costs with rent increases, which should hinder new projects, said Mr. Kaufman.

So far, the roughly $50 billion decline in residential construction spending over the past year has been more than made up for by gains in commercial projects, including highways, hotels and hospitals. A record $108 billion was spent building factories last year, and the amount has risen this year, to a seasonally adjusted annualised rate of about $141 billion in February, according to Census Bureau data.

Some, such as those in fields that the Biden administration has made national priorities, such as semiconductors and electric vehicles, are supported by government incentives. Others are being built by big companies that can fund projects without borrowing.

Graphic Packaging Holding Co. is building a plant in Waco, Texas, to recycle old cardboard into new paperboard and said it would cover the $1 billion cost with cash over three years of construction. A similar facility that Graphic completed last year in Kalamazoo, Mich., required as many as 1,200 workers from 38 states.

The 2021 infrastructure bill and last years’ climate, tax and healthcare law are pumping money into industrial projects—such as renewable-energy facilities and railroad expansions—that promise to keep workers busy for years.

John Fish, CEO of the Suffolk construction firm, said the Boston-based company is focusing more on government-supported construction, such as airport upgrades. Suffolk employs roughly 2,500 and contracts with another 25,000 or so. It has three or four years of work lined up, including the renovation of Terminal C at Dallas Fort Worth International Airport, which won’t start until next year and isn’t scheduled for completion until 2026.

Home remodeller Jay Cipriani said his staff of 34 has plenty of kitchens and bathrooms to work through this year. But he said he’s getting fewer calls for new jobs and expects a slowing economy could make some prospective clients think twice about nonessential projects: “Maybe we don’t put in that fish pond this year.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

The Republican nominee says it would help bring down home prices, though these buyers account for a fraction of U.S. home sales

Former President Donald Trump said he would ban undocumented immigrants from obtaining home mortgages, a move he indicated would help ease home prices even though these buyers account for a tiny fraction of U.S. home sales.

Home loans to undocumented people living in the U.S. are legal but they aren’t especially common. Between 5,000 and 6,000 mortgages of this kind were issued last year, according to estimates from researchers at the Urban Institute in Washington.

Overall, lenders issued more than 3.4 million mortgages to all home purchasers in 2023, federal government data show.

Trump, the Republican presidential nominee, made his comments Thursday during a policy speech to the Economic Club of New York in Manhattan.

Housing remains a top economic issue for voters during this presidential election. Rent and home prices grew at historic rates during the pandemic and mortgage rates climbed to levels not seen in more than two decades. A July Wall Street Journal poll showed that voters rank housing as their second-biggest inflation concern after groceries.

Both major candidates for the 2024 presidential election have made appeals to voters on housing during recent campaign stops, though the issue has so far featured more prominently in Vice President Kamala Harris ’s campaign.

Trump has blamed immigrants for many of the nation’s woes, including crime and unemployment. Now, he is pointing to immigrants as a cause of the nation’s housing-affordability crisis. Yet some affordable-housing advocates and real-estate professionals said Trump’s mortgage proposal would fail to bring relief to priced-out home buyers.

“It’s unfortunate that given the significant housing affordability crisis that is widely acknowledged across most partisan lines, we are arguing about a minuscule segment of the market,” said David Dworkin, president of the National Housing Conference, an affordable-housing advocacy group.

Gary Acosta, chief executive of the National Association of Hispanic Real Estate Professionals, a trade organization, said, “It’s just another effort to vilify immigrants and to continue to scapegoat them for any issues that we have here in the United States.”

A Trump campaign spokeswoman didn’t immediately respond to a request for comment.

Undocumented immigrants in the U.S. can obtain an obscure type of mortgage designed for taxpayers without Social Security numbers, most of whom are Hispanic. The passage of the USA Patriot Act of 2001 allowed banks to use identification numbers from the Internal Revenue Service as an alternative to Social Security, extending a number of financial services to people without legal status for the first time.

Mortgage loans for undocumented immigrants are typically higher interest and borrowers include legal residents who have undocumented spouses, Acosta said. Lenders include regional credit unions and community-development financial institutions.

In his speech, Trump said that “the flood” of undocumented immigrants is driving up housing costs. “That’s why my plan will ban mortgages for illegal aliens,” he said.

Trump didn’t elaborate on how he would enact a ban on such loans.

Though mortgages for undocumented people living in the U.S. are relatively rare, residential real-estate purchases by foreign nationals are big business , especially in expensive coastal cities such as New York and Los Angeles. These sales have declined in recent years, however.

Close to half of foreign purchases are made by people residing abroad, while the other half are made by recent immigrants or residents on nonimmigrant visas, according to an annual survey by the National Association of Realtors. Many affluent foreigners buy U.S. homes with cash instead of obtaining mortgage financing.

In his Thursday speech, which focused mostly on other economic matters such as energy and taxation, Trump proposed other measures to bring down housing costs, including cutting regulations for builders and allowing more building on federal land. Similar ideas appeared in the housing policy outline Harris released in August .

The former president has spoken on housing-related issues in speeches at other recent campaign stops, including in Michigan last month, where he touted his administration’s 2020 overturn of a policy that had encouraged cities to reduce racial segregation .

“I keep the suburbs safe,” Trump said. “I stopped low-income towers from rising right alongside of their house. And I’m keeping the illegal aliens away from the suburbs.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.