How to Play the Property Meltdown in Five Charts

Savvy buyers made a fortune after the 2008 crash, picking up real estate at distressed prices. Investors hoping to spot bargains in the latest slump can watch these trends.

Is the pain over yet for U.S. commercial real estate? The answer might be yes for stocks but no for the assets they own.

A record $205.5 billion of cash is earmarked for investment in U.S. commercial real estate, according to dry-powder data from Preqin. But good deals may not be available for another six to 12 months. Here are some trends investors can watch for signs of when it is the right time to buy.

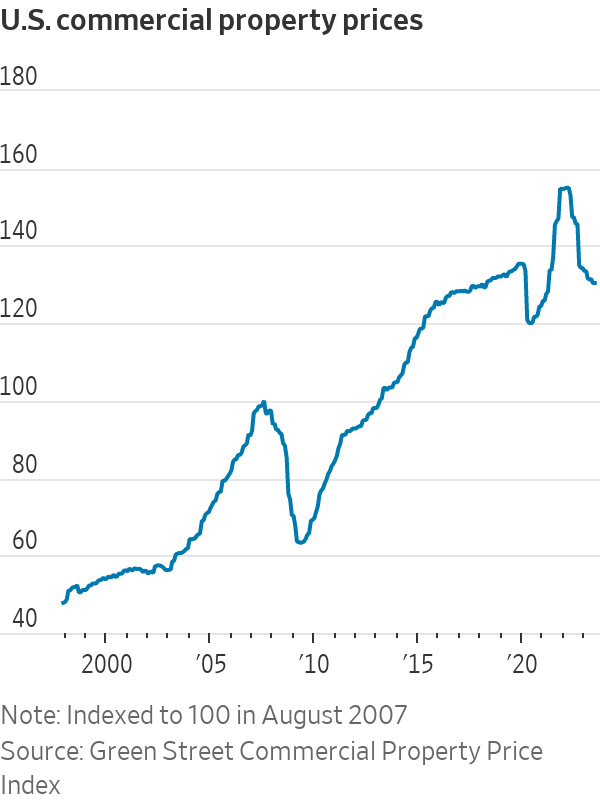

How Much Are Values Down Already?

U.S. commercial property prices have fallen 16% on average since their peaks in March 2022, according to real-estate research firm Green Street. Unlike the 2008 crisis, when a lack of credit hurt the value of all real estate, today’s downturn has hit some types of properties much harder than others.

Unsurprisingly given remote working, offices are the worst performers, having lost 31% of their value since the Fed first began raising interest rates. The discount isn’t as enticing as it sounds, as troubled buildings need heavy investment to bring them up to a standard that will attract tenants, or to be redeveloped for new uses.

Meanwhile, prospects for snapping up America’s e-commerce warehouses at knockdown prices look slim. Warehouse values are down just 8% from peaks to reflect higher financing costs, and top industrial stocks like Prologis don’t look cheap either, trading close to net asset value.

Apartments might be a better bet for those hunting for distressed assets. Prices for multifamily apartment buildings have fallen by a fifth since March 2022. Some owners who paid top dollar for properties during the pandemic using short-term, floating-rate debt may be forced to sell if mortgage repayments become unmanageable when their interest rate hedges expire.

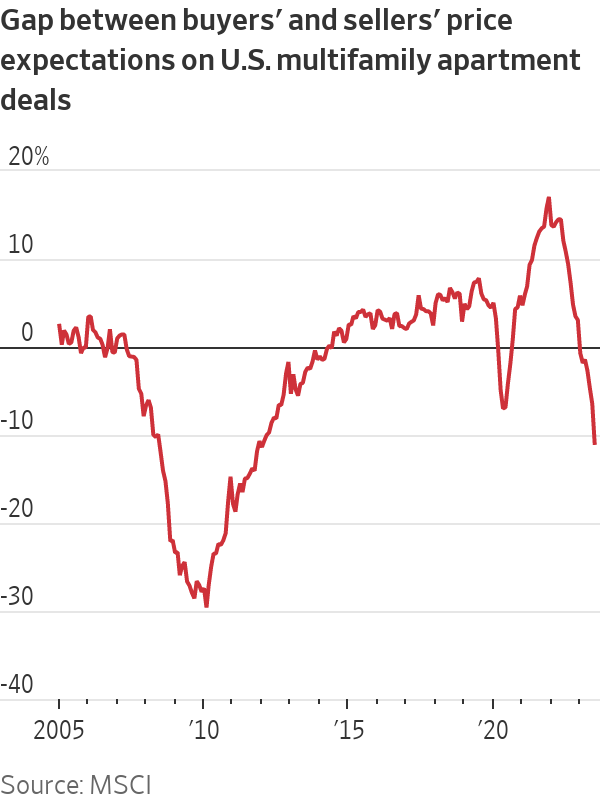

Property Sellers Are Still Demanding Yesterday’s Prices

Sellers are holding out for prices that are no longer realistic. MSCI’s bid-ask spread reflects the difference between what U.S. property owners are asking for and what buyers are willing to pay.

As of July, the gap for multifamily apartments was 11%, the widest it has been since early 2012, when the property market was still recovering from the 2008 crash. The gap for office and retail is a bit narrower at around 8%. Price expectations are closest for industrial warehouses, where sellers want just 2% more than buyers are willing to pay.

The market will be sluggish until one side caves. In the second quarter of 2023, investment in U.S. commercial real estate was down 64% compared with a year earlier, according to data from CBRE.

As the bid-ask gap narrows, it will signal that valuations are approaching more sustainable levels. But this will take some time. It was five years after the 2008 crash before buyers and sellers saw eye to eye on prices on the hardest-hit assets like apartments—although the adjustment should be much faster this time.

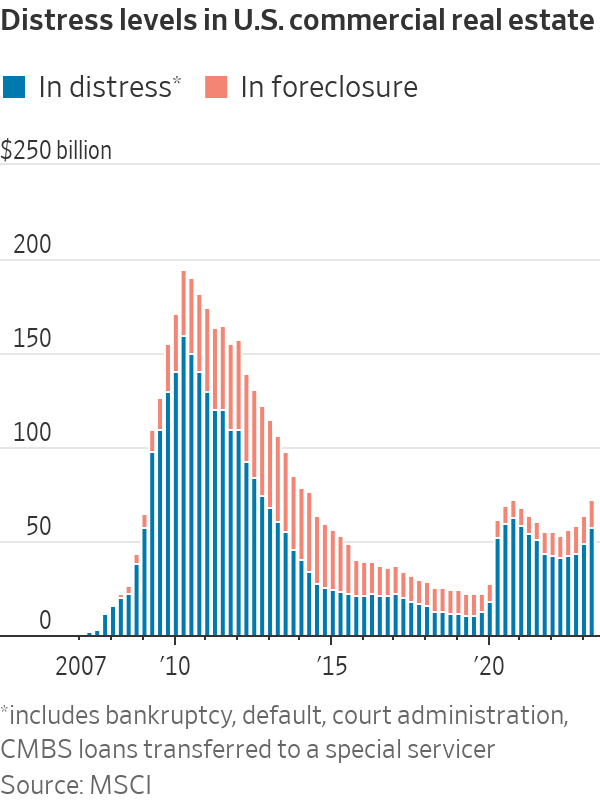

What Could Force Sellers to Slash Prices?

The number of properties that slip into distress will be key for bargain-hunters.

So far, there haven’t been many forced sales. Only 2.8% of all office deals in the U.S. in the second quarter were distressed, according to MSCI.

This may be because loans haven’t matured yet. “Owners don’t want to take a loss but once there are refinancing issues, they will have that come-to-Jesus moment with lenders,” says Jim Costello, chief economist at MSCI Real Assets.

Even if forced sales are still rare, the value of U.S. property in distress—in default or special servicing—is rising. In the second quarter, an additional $8 billion of assets got into distress, bringing the total to $71.8 billion, according to MSCI. Including properties that look at risk, the pool of potentially troubled assets is more than double this amount.

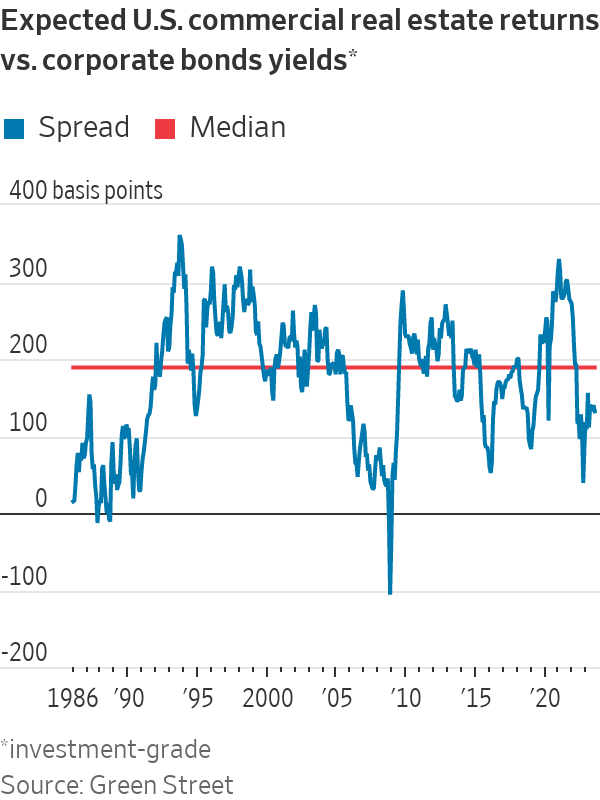

Investment-grade corporate bond yields suggest that property prices have further to fall

Owning commercial property is a bit like owning a corporate bond, only slightly riskier: You bet on the solvency of a tenant, with more uncertainty about the value of the capital you’ll get back. For at least the past 20 years, investors in U.S. real estate have required a return premium of 1.9 percentage points over the yield on investment-grade corporate debt, according to Green Street’s director of research, Cedrik Lachance.

Right now, real estate only offers a 1.3 percentage point premium. For the relationship to return to normal and make property attractive again, U.S. real-estate prices need to fall a further 10% to 15%.

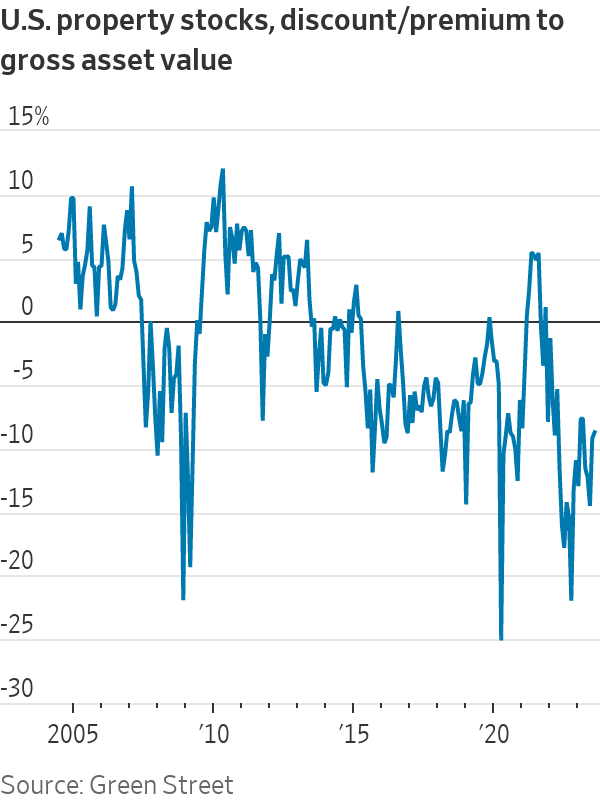

The share prices of listed property companies also point to further falls

Publicly traded real-estate stocks provide a live read of sentiment toward property markets. In the U.S., listed property companies currently trade at a 10% discount to gross asset values, based on Green Street data. This is a good proxy for the size of the price falls that investors still expect in private real-estate values.

Investors can also keep an eye on property stocks for signs of improvement. “Listed real estate is a leading indicator for private in downturns and also recoveries,” says Rich Hill, head of real estate strategy and research at Cohen & Steers, who points out that there are already green shoots. At the end of June, REITs had risen in value for three consecutive quarters and were 13% above their lowest point in the third quarter of last year. Based on how long it usually takes for a recovery to feed through to the private market, property values could hit the bottom within six to 12 months.

All this suggests the best strategy is to buy property stocks but to wait to purchase physical real estate. “If you want to bottom fish in real estate now, do it in the public markets,” says Green Street’s Lachance.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

No trip to Singapore is complete without a meal (or 12) at its hawker centres, where stalls sell multicultural dishes from generations-old recipes. But rising costs and demographic change are threatening the beloved tradition.

In Singapore, it’s not unusual for total strangers to ask, “Have you eaten yet?” A greeting akin to “Good morning,” it invariably leads to follow-up questions. What did you eat? Where did you eat it? Was it good? Greeters reserve the right to judge your responses and offer advice, solicited or otherwise, on where you should eat next.

Locals will often joke that gastronomic opinions can make (and break) relationships and that eating is a national pastime. And why wouldn’t it be? In a nexus of colliding cultures—a place where Malays, Indians, Chinese and Europeans have brushed shoulders and shared meals for centuries—the mix of flavours coming out of kitchens in this country is enough to make you believe in world peace.

While Michelin stars spangle Singapore’s restaurant scene , to truly understand the city’s relationship with food, you have to venture to the hawker centres. A core aspect of daily life, hawker centres sprang up in numbers during the 1970s, built by authorities looking to sanitise and formalise the city’s street-food scene. Today, 121 government-run hawker centres feature food stalls that specialise in dishes from the country’s various ethnic groups. In one of the world’s most expensive cities, hawker dishes are shockingly cheap: A full meal can cost as little as $3.

Over the course of many visits to Singapore, I’ve fallen in love with these places—and with the scavenger hunts to find meals I’ll never forget: delicate bowls of laksa noodle soup, where brisk lashes of heat interrupt addictive swirls of umami; impossibly flaky roti prata dipped in curry; the beautiful simplicity of an immaculately roasted duck leg. In a futuristic and at times sterile city, hawker centres throw back to the past and offer a rare glimpse of something human in scale. To an outsider like me, sitting at a table amid the din of the lunch-hour rush can feel like glimpsing the city’s soul through all the concrete and glitz.

So I’ve been alarmed in recent years to hear about the supposed demise of hawker centres. Would-be hawkers have to bid for stalls from the government, and rents are climbing . An upwardly mobile generation doesn’t want to take over from their parents. On a recent trip to Singapore, I enlisted my brother, who lives there, and as we ate our way across the city, we searched for signs of life—and hopefully a peek into what the future holds.

At Amoy Street Food Centre, near the central business district, 32-year-old Kai Jin Thng has done the math. To turn a profit at his stall, Jin’s Noodle , he says, he has to churn out at least 150 $4 bowls of kolo mee , a Malaysian dish featuring savoury pork over a bed of springy noodles, in 120 minutes of lunch service. With his sister as sous-chef, he slings the bowls with frenetic focus.

Thng dropped out of school as a teenager to work in his father’s stall selling wonton mee , a staple noodle dish, and is quick to say no when I ask if he wants his daughter to take over the stall one day.

“The tradition is fading and I believe that in the next 10 or 15 years, it’s only going to get worse,” Thng said. “The new generation prefers to put on their tie and their white collar—nobody really wants to get their hands dirty.”

In 2020, the National Environment Agency , which oversees hawker centres, put the median age of hawkers at 60. When I did encounter younger people like Thng in the trade, I found they persevered out of stubbornness, a desire to innovate on a deep-seated tradition—or some combination of both.

Later that afternoon, looking for a momentary reprieve from Singapore’s crushing humidity, we ducked into Market Street Hawker Centre and bought juice made from fresh calamansi, a small citrus fruit.

Jamilah Beevi, 29, was working the shop with her father, who, at 64, has been a hawker since he was 12. “I originally stepped in out of filial duty,” she said. “But I find it to be really fulfilling work…I see it as a generational shop, so I don’t want to let that die.” When I asked her father when he’d retire, he confidently said he’d hang up his apron next year. “He’s been saying that for many years,” Beevi said, laughing.

More than one Singaporean told me that to truly appreciate what’s at stake in the hawker tradition’s threatened collapse, I’d need to leave the neighbourhoods where most tourists spend their time, and venture to the Heartland, the residential communities outside the central business district. There, hawker centres, often combined with markets, are strategically located near dense housing developments, where they cater to the 77% of Singaporeans who live in government-subsidised apartments.

We ate laksa from a stall at Ghim Moh Market and Food Centre, where families enjoyed their Sunday. At Redhill Food Centre, a similar chorus of chattering voices and clattering cutlery filled the space, as diners lined up for prawn noodles and chicken rice. Near our table, a couple hungrily unwrapped a package of durian, a coveted fruit banned from public transportation and some hotels for its strong aroma. It all seemed like business as usual.

Then we went to Blackgoat . Tucked in a corner of the Jalan Batu housing development, Blackgoat doesn’t look like an average hawker operation. An unusually large staff of six swirled around a stall where Fikri Amin Bin Rohaimi, 24, presided over a fiery grill and a seriously ambitious menu. A veteran of the three-Michelin-star Zén , Rohaimi started selling burgers from his apartment kitchen in 2019, before opening a hawker stall last year. We ordered everything on the menu and enjoyed a feast that would astound had it come out of a fully equipped restaurant kitchen; that it was all made in a 130-square-foot space seemed miraculous.

Mussels swam in a mushroom broth, spiked with Thai basil and chives. Huge, tender tiger prawns were grilled to perfection and smothered in toasted garlic and olive oil. Lamb was coated in a whisper of Sichuan peppercorns; Wagyu beef, in a homemade makrut-lime sauce. Then Ethel Yam, Blackgoat’s pastry chef prepared a date pudding with a mushroom semifreddo and a panna cotta drizzled in chamomile syrup. A group of elderly residents from the nearby towers watched, while sipping tiny glasses of Tiger beer.

Since opening his stall, Rohaimi told me, he’s seen his food referred to as “restaurant-level hawker food,” a categorisation he rejects, feeling it discounts what’s possible at a hawker centre. “If you eat hawker food, you know that it can often be much better than anything at a restaurant.”

He wants to open a restaurant eventually—or, leveraging his in-progress biomedical engineering degree, a food lab. But he sees the modern hawker centre not just as a steppingstone, but a place to experiment. “Because you only have to manage so many things, unlike at a restaurant, a hawker stall right now gives us a kind of limitlessness to try new things,” he said.

Using high-grade Australian beef and employing a whole staff, Rohaimi must charge more than typical hawker stalls, though his food, around $12 per 100 grams of steak, still costs far less than high-end restaurant fare. He’s found that people will pay for quality, he says, even if he first has to convince them to try the food.

At Yishun Park Hawker Centre (now temporarily closed for renovations), Nurl Asyraffie, 33, has encountered a similar dynamic since he started Kerabu by Arang , a stall specialising in “modern Malay food.” The day we came, he was selling ayam percik , a grilled chicken leg smothered in a bewitching turmeric-based marinade. As we ate, a hawker from another stall came over to inquire how much we’d paid. When we said around $10 a plate, she looked skeptical: “At least it’s a lot of food.”

Asyraffie, who opened the stall after a spell in private dining and at big-name restaurants in the region, says he’s used to dubious reactions. “I think the way you get people’s trust is you need to deliver,” he said. “Singapore is a melting pot; we’re used to trying new things, and we will pay for food we think is worth it.” He says a lot of the same older “uncles” who gawked at his prices, are now regulars. “New hawkers like me can fill a gap in the market, slightly higher than your chicken rice, but lower than a restaurant.”

But economics is only half the battle for a new generation of hawkers, says Seng Wun Song, a 64-year-old, semiretired economist who delves into the inner workings of Singapore’s food-and-beverage industry as a hobby. He thinks locals and tourists who come to hawker centers to look for “authentic” Singaporean food need to rethink what that amorphous catchall word really means. What people consider “heritage food,” he explains, is a mix of Malay, Chinese, Indian and European dishes that emerged from the country’s founding. “But Singapore is a trading hub where people come and go, and heritage moves and changes. Hawker food isn’t dying; it’s evolving so that it doesn’t die.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.