American Finance Has Left Europe In the Dust. The Tables Aren’t Turning.

Restoring the competitiveness of European banks and asset managers can’t be achieved by tweaking regulations

After a decade and a half of seeing the U.S. economy pull ahead thanks to its outsize technology sector, European politicians are desperate to fight back in emerging industries such as green energy. One challenge they face is that America also keeps pulling ahead in the business of financing the investments required.

On Thursday, Luxembourg for Finance—a public-private partnership that seeks to promote the financial industry in the low-tax city state—published a report detailing the different ways in which European banks and asset managers might regain an edge relative to U.S. and Asian peers.

This is part of an effort by officials across the European Union to give firms a break. “Old economy” industries such as car manufacturing face rising competition from China and higher energy costs since Russia invaded Ukraine. The U.S. Inflation Reduction Act also has drawn investment across the Atlantic. Last year, the European Commission tasked former Italian prime ministers Mario Draghi and Enrico Letta with drafting a report on European competitiveness.

Luxembourg for Finance Chief Executive Nicolas Mackel echoes a common refrain: “Europe can take the lead in financial services when we eliminate fragmentation.” His report points out that the return on equity of European banks has bounced back in recent years. But it also showcases the gulf that has opened up relative to U.S. financial firms.

European lenders’ return on equity is now around 8%, compared with 12% across the Atlantic and 10% in Asia, in part as a result of stricter regulations following the 2008 banking crisis. Most European banks trade below book value on the stock market, having returned a negative 14% to investors since the April 2009 trough. Large American banks trade above book value and have gained 113%.

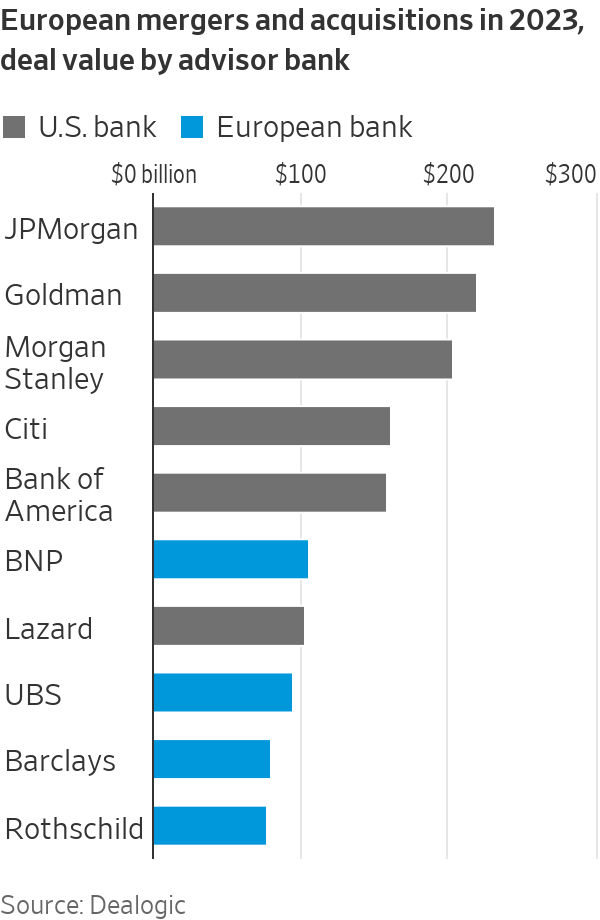

In services particularly exposed to international competition, American banks dominate in Europe too: In 2023, they took the top five positions for mergers and acquisitions deals, Dealogic data shows, with France’s BNP Paribas coming in sixth, and the top six spots for issuing equity.

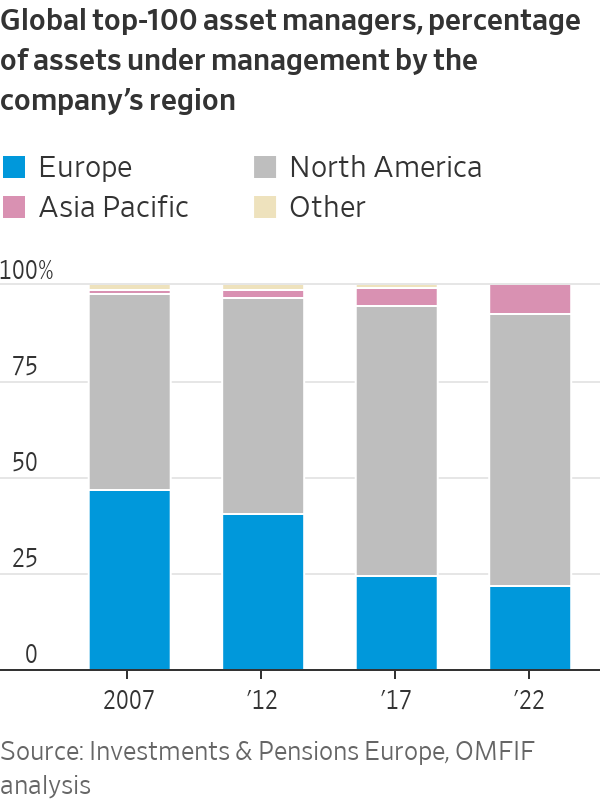

And this isn’t just about banks. In 2007, top European and U.S. asset managers roughly split the global market between them. By 2022, European fund managers had just 22% of total assets under supervision, with only France’s Amundi playing in the big leagues. This reflects their failure to jump on the train of low-fee passive investment as effectively as U.S. giants such as Vanguard and BlackRock. Ironically, the latter’s dominance in exchange-traded funds resulted from its acquisition of iShares from Britain’s Barclays in 2009.

European officials are taking some useful steps. They admitted in 2022 that a directive aimed at harmonising securities markets, known as Mifid 2, has done more harm than good, and have agreed to amend it. New EU-wide savings products give pensioners greater choice, and might help address the lack of sophistication that characterises European individual investors relative to Americans used to managing 401(k)s. Stringent constraints on what asset managers can offer are being relaxed, and the rules governing sustainable finance—where Europe has an edge—are being clarified.

Meanwhile, the fallout from last year’s Silicon Valley Bank debacle will bring U.S. regulation closer to Europe’s.

Such rule changes might narrow the gap, as investors have recognised: The stock-market discount at which European lenders trade compared with American ones has shrunk over the past three years. But it is hard to see the tables fundamentally turning. In the digital era, economies of scale are even more powerful. The European Union comprises many countries with different languages, whose firms and investors have local financial relationships and strong home biases. The obstacles to eliminating fragmentation are huge.

If Europe can’t compete with America’s private financial muscle, it is doubly problematic that its efforts to mobilize industrial investment through the public sector have been meek compared with the U.S. Inflation Reduction Act. Promoting more sustainability-minded funds isn’t an adequate fix.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

The sports-car maker delivered 279,449 cars last year, down from 310,718 in 2024.

Chinese carmaker GAC will expand its Australian electric vehicle line-up with the city-focused AION UT hatchback.

The sports-car maker delivered 279,449 cars last year, down from 310,718 in 2024.

Porsche car deliveries fell 10% in 2025 as demand was hit by a slowdown in luxury spending in China and as it ceased production of its 718 Boxster and 718 Cayman models through the year.

The German luxury sports-car maker said Friday that it delivered 279,449 cars in the year, down from 310,718 in 2024.

The company had a tumultuous year as it contended with a stuttering transition to electric vehicles and a tough Chinese market, while the Trump administration’s automotive tariffs presented a further headwind.

Deliveries in its largest sales region of North America were virtually flat at 86,229, but continued challenges in China meant deliveries in the country dropped 26% to 41,938 vehicles.

Automakers have faced intense competition in China, sparking a prolonged price war as rivals cut prices to win customers, while a lengthy property market slump and economic-growth concerns in the country has also led to buyers pulling back on luxury spending.

“Key reasons for the decline remain the challenging market conditions, particularly in the luxury segment, and the very intense competition in the Chinese market, especially for all-electric models,” the company said.

Other German brands including Audi, BMW and Mercedes-Benz have all recently reported that the challenging Chinese market hit demand last year.

In Europe, Porsche deliveries fell 13% to 66,340 cars excluding its home market of Germany, while German deliveries dropped 16%.

The company cut guidance several times last year as it warned of hits from U.S. import tariffs, investments in new combustion engines and hybrid models amid the slow uptake of EVs, and the competitive situation in China.

Porsche also last year announced plans to scale back its EV ambitions and instead expand its lineup with more gas-powered and plug-in hybrid models than it had originally planned.

However, in its statement Friday, the company said it increased its share of electrified-vehicle deliveries in the year. Around 34% of vehicles delivered worldwide were electrified, an increase of 7.4 percentage points on year, with about 22% all-electric vehicles and 12% plug-in hybrids.

That leaves its global share of fully-electric vehicles at the upper end of its target range of 20% to 22% for 2025.

In Europe, for the first time in 2025, more electrified vehicles than purely combustion engine vehicles were delivered.

The Macan topped the delivery charts in the year, while the 911 reached a record high with 51,583 deliveries worldwide, it said.

Porsche said it is investing in its three-pronged powertrain strategy and will continue to respond to increasing demand for personalization requests from customers.

“We have a clear focus for 2026,” Sales and Marketing Chief Matthias Becker said. “We want to manage supply and demand in accordance with our ‘value over volume’ strategy.

“At the same time, we are realistically planning our volume for 2026 following the end of production of the 718 and Macan with combustion engines.”

From gorilla encounters in Uganda to a reimagined Okavango retreat, Abercrombie & Kent elevates its African journeys with two spectacular lodge transformations.

The era of the gorgeous golden retriever is over. Today’s most coveted pooches have frightful faces bred to tug at our hearts.