Buildings Are Empty, Now They Have to Go Green

Rising rates, falling occupancy and new carbon taxes hit building owners

Their buildings echo with empty offices, their borrowing costs have soared, and now owners of buildings in cities across the U.S. are facing a new tax on their carbon emissions.

Cities are toughening their climate standards and are beginning to tax buildings that don’t meet the new requirements. Landlords are left with a difficult choice between paying for expensive upgrades to reduce emissions or paying the tax.

In New York City, which has one of the first and most expensive carbon taxes, landlords of large buildings (including owners of residential buildings) beginning next year will face a $268 fine for every ton of carbon dioxide emitted beyond certain limits.

“If you’re under cash flow pressure due to lack of tenancy, adding a tax on top of that isn’t a good sign,” said Bank of America CMBS Strategist Alan Todd. “It would be potentially pretty painful.”

The Wall Street Journal tallied the potential impact of the taxes on buildings that borrowed funds from Wall Street investors by issuing mortgage-backed bonds. The Journal also looked at properties owned by three of the country’s largest publicly traded landlords. The tax bill for 128 properties analyzed could add up to more than $50 million during the first five-year enforcement period, which begins in 2024, according to the Journal’s analysis of Department of Building data and financial disclosures.

Fines for the same buildings could jump to $214 million if their landlords don’t meet the city’s emissions standards during the period between 2030 and 2034, the Journal’s analysis shows. The Real Estate Board of New York, an industry group, and engineering consulting firm Level Infrastructure said that more than 13,000 properties could face fines totaling about $900 million annually.

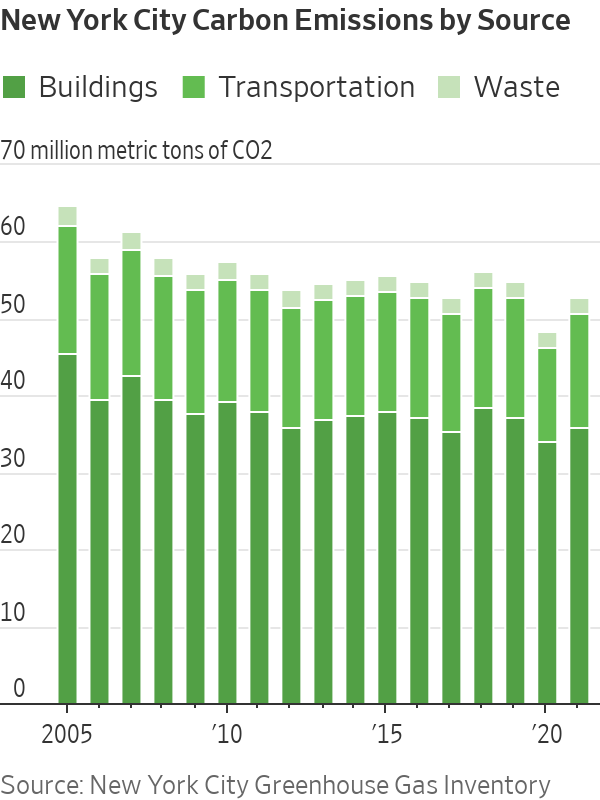

Buildings are by far New York City’s largest source of carbon emissions, which come from the fossil fuels used to heat and to provide air conditioning for them.

More than a dozen local laws regulating buildings’ carbon footprints from Chula Vista, Calif., to Boston have gone into effect since 2021 or will come online by 2030, according to carbon accounting firm nZero. Compliance also begins next year for buildings in Denver, while St. Louis properties face penalties beginning in 2025. Four other laws from Cambridge, Mass., to Reno, Nev., will go into effect in 2026.

The impact of the emissions laws initially will be small but will come on top of other, more costly problems faced by landlords. The law, based on New York’s current projections, would cost the 51-story skyscraper at 277 Park Ave. in Manhattan just $1.3 million in fines in 2024. The revenue of the building, owned by private landlord The Stahl Organization, was $129 million last year.

The building’s vacancy rate has jumped from about 2% in 2014 to 25% currently, according to commercial property data provider Trepp. JP Morgan Chase accounts for about half of the building’s space, but its lease expires in 2026. The bank is constructing a nearby tower that aims to produce net-zero carbon emissions and is scheduled to be completed in 2025. It wouldn’t comment on its leasing plans.

Stahl’s $750 million mortgage on the building is scheduled to mature next August. Stahl is now faced with potentially higher rates if it takes out a new loan, the loss of its biggest tenant and fines for carbon emissions.

Stahl declined to comment.

Shares of the three big landlords whose properties were analysed by the Journal are trading at near historic lows. Shares of Vornado Realty Trust and SL Green, each of which has about 30 New York City office buildings, are down by roughly two-thirds since before the pandemic. Boston Properties Inc., one of the country’s largest office building owners, shares are down more than 50% from before the pandemic.

SL Green faces a potential carbon-tax liability of up to $6.6 million by 2030, according to the Journal’s analysis. The company declined to comment. More than 80 other properties financed using mortgage-backed bonds reviewed by the Journal could have a nearly $27 million carbon-tax bill by 2030.

The costly upgrades needed to comply with the law will hit some properties when they are on the block or when they are trying to attract tenants, who know they will effectively be paying for any improvements. “Tenants are looking to be in a building that is greener,” said Brendan Schmitt, partner in law firm Herrick’s Real Estate Department.

The new laws coincide with big government spending on climate. Landlords can get generous subsidies for projects that reduce emissions.

Ironically, landlords are also benefiting from emptier buildings, which burn less fossil fuel. New York City says about 11% of buildings covered under the law are projected to face penalties using the latest energy data, down from 20% using earlier data.

The city’s law was passed in 2019 and included a $268 fine for every ton of CO emitted by buildings over 25,000 square feet exceeding limits. Landlords will be required to report emissions to city officials starting in 2025 with penalties based on 2024 energy use.

Some big landlords are facing fines in multiple jurisdictions including Boston Properties, which will likely get hit on properties it owns in Boston, New York and Washington, D.C. The company’s eight New York City offices could face a $2.3 million dollar tax bill by 2030, according to city data.

Ben Myers, senior vice president of sustainability at Boston Properties, said complying with local building standards is important. “We have made energy efficiency a priority,” he said.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

A divide has opened in the tech job market between those with artificial-intelligence skills and everyone else.

A 30-metre masterpiece unveiled in Monaco brings Lamborghini’s supercar drama to the high seas, powered by 7,600 horsepower and unmistakable Italian design.

The house, with a pool, a wine cellar and cinema, is in Estoril’s gated Quinto Patino community.

If you’re looking to run into Cristiano Ronaldo, this six-bedroom villa near the coastal Portuguese town of Cascais, where the footballer lives, might up your chances.

The detached home, which came to market earlier this month asking €10 million (US$11.79 million), is within the gated Quinta Patino community in the town’s Estoril suburb, and comes with a private green-tiled pool, its own wine cellar and cinema, as well as a moody six-car show garage.

The eclectic house comes with a little French flair, including a grey mansard roof, as well as arched windows and a cream-stucco facade.

The interiors showcase a mix of modern floor-to-ceiling windows as well as more old-school elegance, including black-and-white checkered flooring, extensive crown moldings, a wood-paneled library and classic columns in between arched windows.

There are six bedrooms across 7,000 square feet, as well as a wine cellar, game room, a pergola and easy transitions between the indoors and outdoors.

“This residence was created for the way people truly want to live, with light-filled spaces that flow naturally from the kitchen and dining areas out to the garden and pool,” said listing agent Yared Hagos of Nest Seekers International via email.

Cascais is located in the Portuguese Riviera, roughly 30 minutes from Lisbon, and features sandy beaches, resorts and other visitor attractions.

“This property represents the best of both worlds, complete privacy in one of Portugal’s most prestigious gated communities, and yet you’re just minutes from the beach, the golf courses, and Lisbon’s cultural scene,” Hagos wrote.

Cascais is also one of many Portuguese cities to have benefited from the popularity of the country’s real estate among foreign investors, particularly its high-end homes , according to Hagos. Mansion Global could not determine the identity of the seller.

“With six consecutive months of rising buyer demand and price growth now exceeding 15% annually, prime areas like Lisbon, Cascais and the Algarve are seeing international buyers compete for an increasingly scarce supply of high-end homes,” he said.

The Portuguese Riviera also has seen an influx of celebrities in recent years, including most notably, soccer legend Cristiano Ronaldo, Mansion Global previously reported.

Once a sleepy surf town, Noosa has become Australia’s prestige property hotspot, where multi-million dollar knockdowns, architectural showpieces and record-setting sales are the new normal.

In the remote waters of Indonesia’s Anambas Islands, Bawah Reserve is redefining what it means to blend barefoot luxury with environmental stewardship.