Europe’s Gas-Guzzling Days Are Fading

In a reality check for natural-gas producers, volatile prices are prompting European homes and factories to go green faster than expected

Last year’s hottest gas market has cooled, and some of the change will stick.

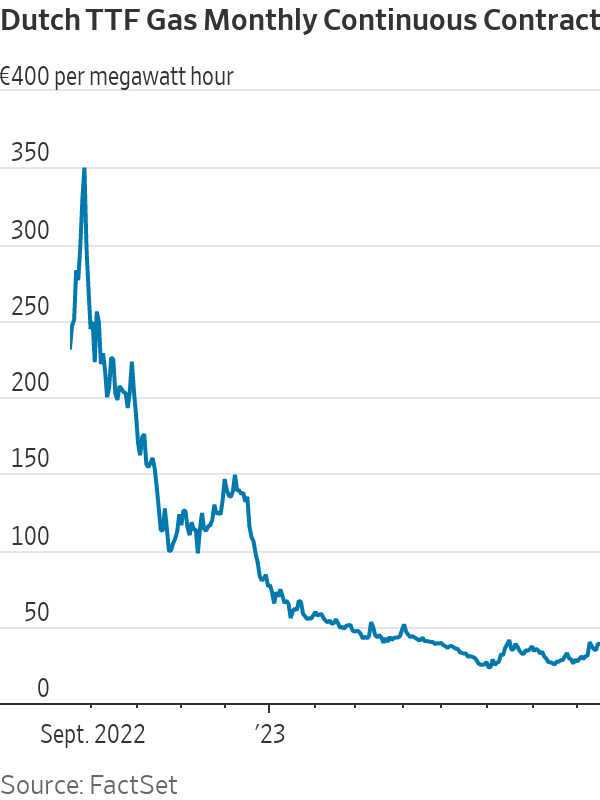

Demand for natural gas in Europe hasn’t bounced back despite lower prices. The region’s TTF benchmark price is down 85% compared with a year ago, when Europe was rushing to fill its gas-storage facilities for winter after Russia cut off supply.

Prices have fallen partly because Europe’s gas storage is already full. It hit a 90% capacity target last week, more than two months ahead of a schedule set last year by the European Union.

But underlying demand is also weak. According to think tank Bruegel’s European natural gas demand tracker, use of gas in the first quarter of this year was 18% lower than the 2019-2021 average, and 19% below in the second quarter. The declines have accelerated from the 12% fall recorded last year.

Weaker economic growth is one reason why gas use hasn’t recovered. Another may be that lower wholesale prices haven’t been passed on to end users yet, according to Ben McWilliams, author of the Bruegel tracker.

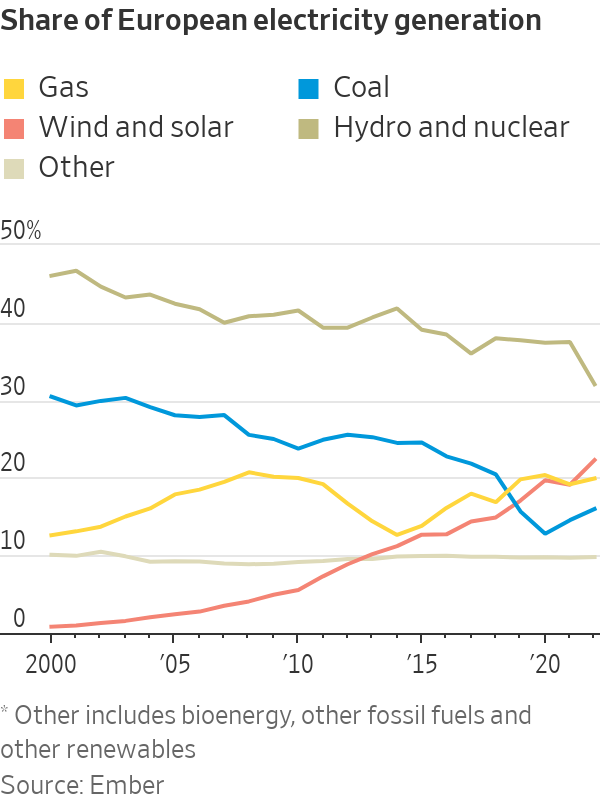

Other factors will be more permanent, notably new technologies. The European Heat Pump Association said sales of heat pumps rose 39% in 2022. They are now installed in 16% of Europe’s residential and commercial buildings, often replacing gas boilers. Heat pumps require electricity, which is often produced using gas, but this too is changing. Installations of new solar capacity rose a record 47% in 2022, and last year was the first time that renewable power generated more of Europe’s electricity than natural gas.

One uncertainty for future gas demand is whether European industries such as chemicals and fertiliser manufacturing will return to normal. The International Energy Agency thinks that up to half of the decline in Europe’s industrial gas demand last year was a result of production shutdowns. Certain companies whose business model traditionally relied on cheap Russian gas moved manufacturing to lower-cost regions such as the U.S., where gas costs roughly a quarter of the European spot price.

European gas prices will be volatile until more global liquefied natural gas supply arrives in 2025. The TTF jumped 5% on Monday because of worries about strikes at an Australian LNG terminal. Companies may be reluctant to restart their European factories until the region’s energy costs are more predictable.

Before the Ukraine war, global demand for natural gas was expected to increase 18% between 2021 and 2030, according to estimates from the Oxford Institute for Energy Studies. This forecast has since been cut to 10%. Lower growth expectations reflect the sharp cutbacks in Europe as well as the U.S. Inflation Reduction Act, which will supercharge America’s shift to renewable energy.

None of this is ideal for the U.S. LNG players who are currently pouring billions of dollars into new production. Based on projects that have already secured funding, and those in the pipeline, U.S. LNG export capacity could double by the end of this decade, according to Wood Mackenzie estimates.

True, Europe needs plenty of LNG over the next few years to replace the shortfall left by Russian pipeline gas. But the faster the region weans itself off gas, the sooner exporters will need to find a new home for at least some of their cargoes.

The expectation is that countries still using a lot of coal in power generation, such as India and Pakistan, will eventually switch to natural gas to cut their carbon emissions—assuming prices come down enough to make that transition affordable. “The window of opportunity for natural gas is tightening all around the world, although coal-reliant markets in Asia provide growth prospects over the medium-term,” says Gergely Molnar, energy analyst at IEA.

Buyers and sellers of natural gas took very different lessons from last year’s record prices, and the fuel’s reputation as a cheap, reliable form of energy took a hit. The pace of change in Europe’s gas market raises the risk of a glut.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

As Paris makes its final preparations for the Olympic games, its residents are busy with their own—packing their suitcases, confirming their reservations, and getting out of town.

Worried about the hordes of crowds and overall chaos the Olympics could bring, Parisians are fleeing the city in droves and inundating resort cities around the country. Hotels and holiday rentals in some of France’s most popular vacation destinations—from the French Riviera in the south to the beaches of Normandy in the north—say they are expecting massive crowds this year in advance of the Olympics. The games will run from July 26-Aug. 1.

“It’s already a major holiday season for us, and beyond that, we have the Olympics,” says Stéphane Personeni, general manager of the Lily of the Valley hotel in Saint Tropez. “People began booking early this year.”

Personeni’s hotel typically has no issues filling its rooms each summer—by May of each year, the luxury hotel typically finds itself completely booked out for the months of July and August. But this year, the 53-room hotel began filling up for summer reservations in February.

“We told our regular guests that everything—hotels, apartments, villas—are going to be hard to find this summer,” Personeni says. His neighbours around Saint Tropez say they’re similarly booked up.

As of March, the online marketplace Gens de Confiance (“Trusted People”), saw a 50% increase in reservations from Parisians seeking vacation rentals outside the capital during the Olympics.

Already, August is a popular vacation time for the French. With a minimum of five weeks of vacation mandated by law, many decide to take the entire month off, renting out villas in beachside destinations for longer periods.

But beyond the typical August travel, the Olympics are having a real impact, says Bertille Marchal, a spokesperson for Gens de Confiance.

“We’ve seen nearly three times more reservations for the dates of the Olympics than the following two weeks,” Marchal says. “The increase is definitely linked to the Olympic Games.”

Getty Images

According to the site, the most sought-out vacation destinations are Morbihan and Loire-Atlantique, a seaside region in the northwest; le Var, a coastal area within the southeast of France along the Côte d’Azur; and the island of Corsica in the Mediterranean.

Meanwhile, the Olympics haven’t necessarily been a boon to foreign tourism in the country. Many tourists who might have otherwise come to France are avoiding it this year in favour of other European capitals. In Paris, demand for stays at high-end hotels has collapsed, with bookings down 50% in July compared to last year, according to UMIH Prestige, which represents hotels charging at least €800 ($865) a night for rooms.

Earlier this year, high-end restaurants and concierges said the Olympics might even be an opportunity to score a hard-get-seat at the city’s fine dining.

In the Occitanie region in southwest France, the overall number of reservations this summer hasn’t changed much from last year, says Vincent Gare, president of the regional tourism committee there.

“But looking further at the numbers, we do see an increase in the clientele coming from the Paris region,” Gare told Le Figaro, noting that the increase in reservations has fallen directly on the dates of the Olympic games.

Michel Barré, a retiree living in Paris’s Le Marais neighbourhood, is one of those opting for the beach rather than the opening ceremony. In January, he booked a stay in Normandy for two weeks.

“Even though it’s a major European capital, Paris is still a small city—it’s a massive effort to host all of these events,” Barré says. “The Olympics are going to be a mess.”

More than anything, he just wants some calm after an event-filled summer in Paris, which just before the Olympics experienced the drama of a snap election called by Macron.

“It’s been a hectic summer here,” he says.

AFP via Getty Images

Parisians—Barré included—feel that the city, by over-catering to its tourists, is driving out many residents.

Parts of the Seine—usually one of the most popular summertime hangout spots —have been closed off for weeks as the city installs bleachers and Olympics signage. In certain neighbourhoods, residents will need to scan a QR code with police to access their own apartments. And from the Olympics to Sept. 8, Paris is nearly doubling the price of transit tickets from €2.15 to €4 per ride.

The city’s clear willingness to capitalise on its tourists has motivated some residents to do the same. In March, the number of active Airbnb listings in Paris reached an all-time high as hosts rushed to list their apartments. Listings grew 40% from the same time last year, according to the company.

With their regular clients taking off, Parisian restaurants and merchants are complaining that business is down.

“Are there any Parisians left in Paris?” Alaine Fontaine, president of the restaurant industry association, told the radio station Franceinfo on Sunday. “For the last three weeks, there haven’t been any here.”

Still, for all the talk of those leaving, there are plenty who have decided to stick around.

Jay Swanson, an American expat and YouTuber, can’t imagine leaving during the Olympics—he secured his tickets to see ping pong and volleyball last year. He’s also less concerned about the crowds and road closures than others, having just put together a series of videos explaining how to navigate Paris during the games.

“It’s been 100 years since the Games came to Paris; when else will we get a chance to host the world like this?” Swanson says. “So many Parisians are leaving and tourism is down, so not only will it be quiet but the only people left will be here for a party.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.