Online Shopping Tools Make DIY Interior Design Magical

Digital tools let you customise a product or ‘drop’ it into a photo of your room.

I AM A RUG addict. The way some people like to test-drive cars, I like to roll out antique Tabrīz carpets to see how their colours and patterns might completely transform the living room…or the family room…or even the kitchen.

This once seemed like a harmless hobby, when we had lots of empty floors and very little furniture. But now it’s attracting unfavourable notice.

“You have a very big rug problem,” said my best friend, Stephanie, an interior designer who absolutely refuses to look at rugs with me, the other day. “You have to stop working poor Richard to death.”

Richard runs the rug store in town, and this past week he delivered two 50-pound rugs. I wanted to try them in the dining room.

Lucky for him, he only had to drop them in the corner of the room. Then my husband had to move the furniture so I could try out these rugs. Which I didn’t want in the end. Because there are so many rugs to try.

Stephanie, who happened to stop by after the rugs were rolled back up and waiting for Richard to retrieve them, observed, “People are not going to put up with this much longer.”

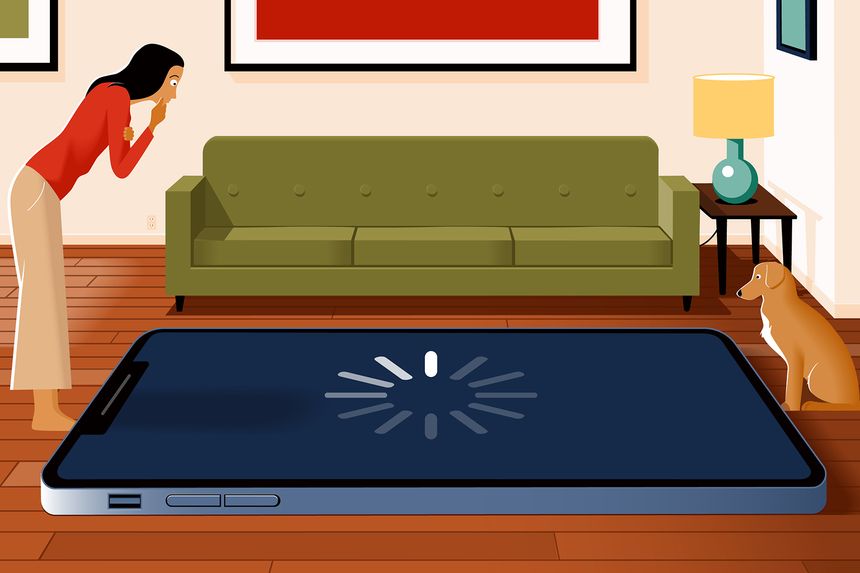

Maybe they won’t have to. I recently discovered a miracle cure for my problem: room previewer tools on retailers’ websites, which let you see exactly how a rug—or sofa or bed—will look in your house without having to move furniture around.

These digital tools are becoming popular on retail websites. Some use augmented reality, some use 3-D rendering technologies and others just seem to be magic.

My favourite kind of tool allows me to upload a photo of my room. Then the tool inserts the rug (or furniture) I’m pondering into the image, perfectly scaled to fit my space.

After I spent the better part of an afternoon trying this out at Rugs Direct, CB2 and A-Street Prints (which sells wallpaper), I had an epiphany: Finally, the internet works!

The days of software that made you wait for minutes for a crude rendering to appear (or crashed your computer before the task was completed) are over. Processing power has gotten so fast, even on our phones, that we have the bandwidth to move photos across the internet in seconds, while a software tool does super-complicated math simultaneously and inserts a product from a retailer’s image library into that image and makes the mash-up appear on-screen.

Or something like that. For technical details, I phoned Pawel Rajszel, CEO of Leap Tools, creator of the Roomvo tool on the Rugs Direct site.

“I’m looking at a photo online of my dining room with a very attractive rug under the table. I’m wondering how this is possible,” I said.

“I can’t tell you our secrets, but I can tell you we developed a proprietary technology that tries to adjust for all kinds of factors,” said Mr. Rajszel, who has been refining his room previewer tool since its launch in 2017. “You might notice there’s a shadow on the rug from the light coming into the room,” he said.

“That’s eerie,” I said. What’s next? Visualizing wine spills?

Ben Houston, chief technology officer of Threekit, a Chicago company with a room previewer tool called Virtual Photographer, tells me that in the future, tools may allow a designer and shopper to simultaneously manipulate an uploaded image and add or move multiple pieces of furniture in the photo. “Someone from the store will be able to join you ‘in’ your room and give you shopping advice, like get a bigger rug and move the couch over there.”

For a second, I imagined doing this with Stephanie. If she weren’t so mean.

Threekit’s tool is sort of the opposite of Roomvo’s. You use your phone to grab an image of the furniture you’re considering from a retailer’s website. Then you can place the furniture in any room simply by looking through your viewfinder.

Mr. Houston directed me to Crate & Barrel, which has embedded the Threekit tool on some product pages. I clicked on “View in Room” to see how a full-size Jenny Lind bed would look in my guest room.

“Wow, that’s crazy, it adjusted to the right size in the space,” I told him, “but to be honest, it’s sort of hovering in the air, like the flying bed in ‘Bedknobs and Broomsticks’.”

“We’re working on that,” he said.

Other tools called configurators allow online shoppers to customize products on-screen, changing colour combinations, patterns or shapes.

Retailers who sell high-end custom home furnishing products—like the Rug Company and L’Atelier Paris Haute Design (which sells luxury cooking ranges)—say the configurators have increased sales and cut down on returns.

At L’Atelier Paris, stoves come in 220 colours, and prices range from $13,000 to over $65,000 (“if you add a hood,” said Ricardo Moraes, the company’s CEO) and can be fit with warming drawers, extra burners and other features.

“The days of the professional designer doing everything for the customer are over—people want to configure luxury ranges the way you can go online and configure a car before you buy,” said Mr. Moraes.

At the Rug Company, a configurator let me create custom versions of rugs by Kelly Wearstler, Paul Smith and Diane von Furstenburg. I changed sizes, shapes, patterns and ground color using a palette of 120 colours—which raised a question.

“Computers are notoriously bad at accurately rendering colours. How do I know what my rug will really look like?” I asked James Seuss, the company’s chief executive officer.

“After you create the design, our design team will send you samples of the exact yarns that we will use to make it,” Mr. Seuss said.

I asked him if I could visualize the custom rug in my room. Not yet, he said. For now, there is no room previewer tool on the site.

“If you send our design team a photo, they will insert the rug into it,” he said.

That seemed so primitive—until I looked at my poor husband schlepping actual rugs to the trunk of the car to be returned to Richard.

Reprinted by permission of WSJ. Magazine. Copyright 2021 Dow Jones & Company. Inc. All Rights Reserved Worldwide. Original date of publication: September 21, 2021.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

As Paris makes its final preparations for the Olympic games, its residents are busy with their own—packing their suitcases, confirming their reservations, and getting out of town.

Worried about the hordes of crowds and overall chaos the Olympics could bring, Parisians are fleeing the city in droves and inundating resort cities around the country. Hotels and holiday rentals in some of France’s most popular vacation destinations—from the French Riviera in the south to the beaches of Normandy in the north—say they are expecting massive crowds this year in advance of the Olympics. The games will run from July 26-Aug. 1.

“It’s already a major holiday season for us, and beyond that, we have the Olympics,” says Stéphane Personeni, general manager of the Lily of the Valley hotel in Saint Tropez. “People began booking early this year.”

Personeni’s hotel typically has no issues filling its rooms each summer—by May of each year, the luxury hotel typically finds itself completely booked out for the months of July and August. But this year, the 53-room hotel began filling up for summer reservations in February.

“We told our regular guests that everything—hotels, apartments, villas—are going to be hard to find this summer,” Personeni says. His neighbours around Saint Tropez say they’re similarly booked up.

As of March, the online marketplace Gens de Confiance (“Trusted People”), saw a 50% increase in reservations from Parisians seeking vacation rentals outside the capital during the Olympics.

Already, August is a popular vacation time for the French. With a minimum of five weeks of vacation mandated by law, many decide to take the entire month off, renting out villas in beachside destinations for longer periods.

But beyond the typical August travel, the Olympics are having a real impact, says Bertille Marchal, a spokesperson for Gens de Confiance.

“We’ve seen nearly three times more reservations for the dates of the Olympics than the following two weeks,” Marchal says. “The increase is definitely linked to the Olympic Games.”

Getty Images

According to the site, the most sought-out vacation destinations are Morbihan and Loire-Atlantique, a seaside region in the northwest; le Var, a coastal area within the southeast of France along the Côte d’Azur; and the island of Corsica in the Mediterranean.

Meanwhile, the Olympics haven’t necessarily been a boon to foreign tourism in the country. Many tourists who might have otherwise come to France are avoiding it this year in favour of other European capitals. In Paris, demand for stays at high-end hotels has collapsed, with bookings down 50% in July compared to last year, according to UMIH Prestige, which represents hotels charging at least €800 ($865) a night for rooms.

Earlier this year, high-end restaurants and concierges said the Olympics might even be an opportunity to score a hard-get-seat at the city’s fine dining.

In the Occitanie region in southwest France, the overall number of reservations this summer hasn’t changed much from last year, says Vincent Gare, president of the regional tourism committee there.

“But looking further at the numbers, we do see an increase in the clientele coming from the Paris region,” Gare told Le Figaro, noting that the increase in reservations has fallen directly on the dates of the Olympic games.

Michel Barré, a retiree living in Paris’s Le Marais neighbourhood, is one of those opting for the beach rather than the opening ceremony. In January, he booked a stay in Normandy for two weeks.

“Even though it’s a major European capital, Paris is still a small city—it’s a massive effort to host all of these events,” Barré says. “The Olympics are going to be a mess.”

More than anything, he just wants some calm after an event-filled summer in Paris, which just before the Olympics experienced the drama of a snap election called by Macron.

“It’s been a hectic summer here,” he says.

AFP via Getty Images

Parisians—Barré included—feel that the city, by over-catering to its tourists, is driving out many residents.

Parts of the Seine—usually one of the most popular summertime hangout spots —have been closed off for weeks as the city installs bleachers and Olympics signage. In certain neighbourhoods, residents will need to scan a QR code with police to access their own apartments. And from the Olympics to Sept. 8, Paris is nearly doubling the price of transit tickets from €2.15 to €4 per ride.

The city’s clear willingness to capitalise on its tourists has motivated some residents to do the same. In March, the number of active Airbnb listings in Paris reached an all-time high as hosts rushed to list their apartments. Listings grew 40% from the same time last year, according to the company.

With their regular clients taking off, Parisian restaurants and merchants are complaining that business is down.

“Are there any Parisians left in Paris?” Alaine Fontaine, president of the restaurant industry association, told the radio station Franceinfo on Sunday. “For the last three weeks, there haven’t been any here.”

Still, for all the talk of those leaving, there are plenty who have decided to stick around.

Jay Swanson, an American expat and YouTuber, can’t imagine leaving during the Olympics—he secured his tickets to see ping pong and volleyball last year. He’s also less concerned about the crowds and road closures than others, having just put together a series of videos explaining how to navigate Paris during the games.

“It’s been 100 years since the Games came to Paris; when else will we get a chance to host the world like this?” Swanson says. “So many Parisians are leaving and tourism is down, so not only will it be quiet but the only people left will be here for a party.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.