It’s One of America’s Most Expensive Cities, and Home Buyers Can’t Get Enough

A metro area on California’s central coast ranked No. 1 in the latest WSJ/Realtor.com Emerging Housing Markets Index

It’s an area already popular with the likes of Oprah Winfrey, Ellen DeGeneres, Prince Harry and Meghan Markle.

But now the affluent Santa Maria-Santa Barbara metropolitan area on the Central Coast of California nestled between the Santa Ynez Mountains and the Pacific Ocean has ranked as the top housing market in the latest Wall Street Journal/Realtor.com Emerging Housing Markets Index, released Wednesday.

It’s a surprise result for the quarterly index, which has, until now, typically seen more affordable cities rank at the top—Topeka, Kansas, took first place in the prior iteration of the report, released in fall, and Lafayette, Indiana, in the summer ranking.

“Santa Maria-Santa Barbara topping the list serves to highlight the division in today’s housing market,” said Danielle Hale, chief economist at Realtor.com. It’s the one and only West Coast market in the top 20, and, with a median listing price of $1.795 million in December, the highest-priced market by more than $1 million.

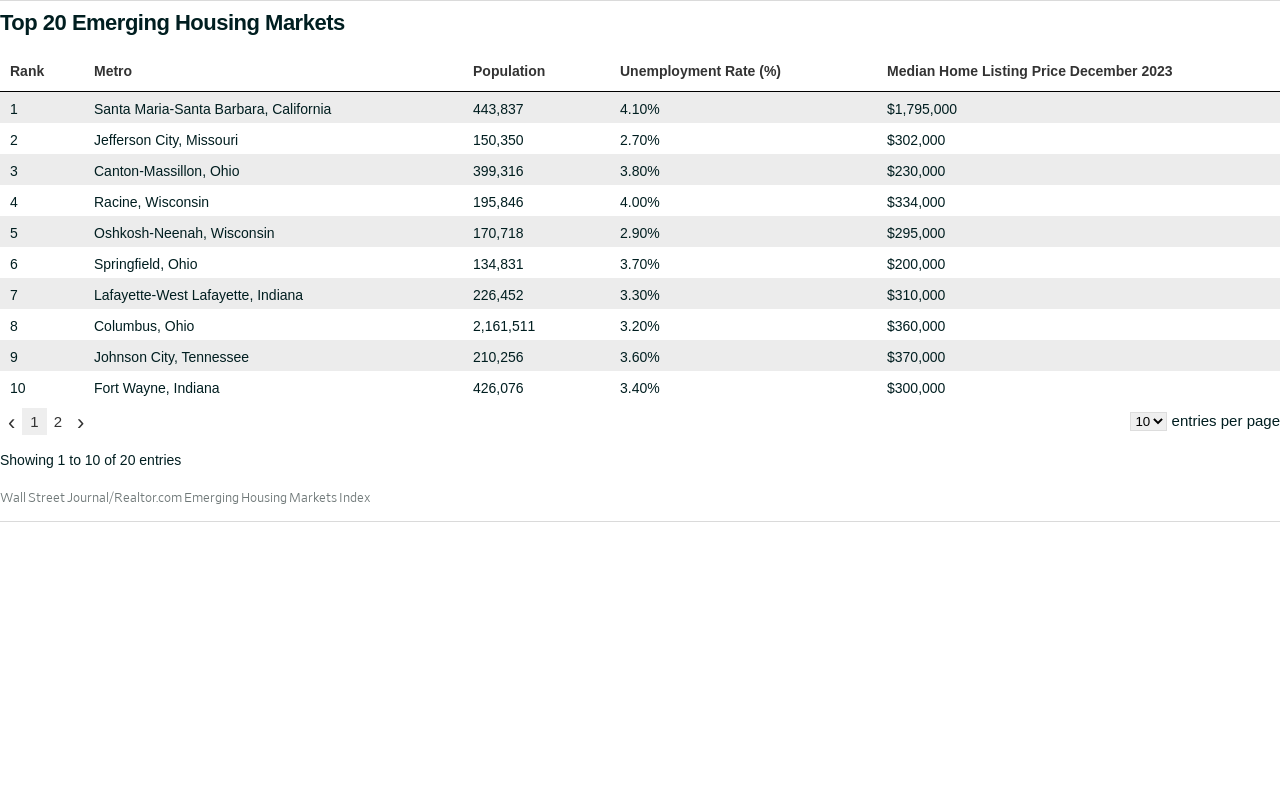

The top five cities in the index were rounded out by Jefferson City, Missouri, where the median listing price was $302,000 in December; the Canton-Massillon metro area in Ohio ($230,000); Racine, Wisconsin ($334,000); and the Oshkosh-Neenah metro area in Wisconsin ($295,000).

“Many housing markets cooled off after the pandemic’s run-up in prices and inventory-depleting demand,” Hale explained. “The markets that have continued to chug along, and even gain steam, are either priced low enough that buyers can compete, or priced high enough that the typical affordability constraints are not of concern to the market’s buyers.”

The latter is the scenario that’s playing out in Santa Barbara.

The index analyses key housing market data, as well as economic vitality and lifestyle metrics for the largest 300 metropolitan areas in the country to highlight emerging housing markets that offer a high quality of life and are expected to see future home price appreciation. It identifies markets that those considering a home purchase should add to their shortlist—whether the goal is to live in it or rent.

Santa Barbara “offers perhaps the finest lifestyle in the U.S.,” said local agent Luke Ebbin of The Ebbin Group at Compass. “Three-hundred days of sunshine and warm weather, a relaxed pace of living, proximity to uncrowded beaches, mountain hikes, fine food and wine, and incredible cultural offerings more often found in major metropolitan areas.”

However, with that median listing price of $1.79 million—more than four times the national median—the price tag attached to the idyllic locale is well out of range for many would-be buyers.

“Though Santa Barbara is among the highest-priced large housing markets in the U.S., buyers in the area have seen similar trends to buyers in other more affordable markets,” Hale said. “For-sale inventory fell rapidly during the early days of the pandemic, and has not recovered much as demand waned in the area and homeowners chose not to sell.”

As a result, “buyers hoping to snag a median-priced home are facing more competition, which has driven prices higher,” she said.

In December, 71% of homes on the market in the metro were priced at $1 million or higher, up from the same time in 2019, when the metric stood at 62%.

“Buyers who have been eager to purchase here and have been on the sidelines due to low inventory and high interest rates are entering the market as rates decline and more inventory becomes available,” Ebbin said. That “low inventory and high demand are keeping prices elevated.”

It should come as no surprise then that Santa Barbara boasts an affluent population who “are drawn to the area’s lifestyle, amenities and upscale housing options,” said Santa Barbara-based agent Jason Streatfeild of Douglas Elliman.

Santa Barbara has “long been a popular destination for retirees, especially those seeking a mild climate, beautiful scenery and a relaxed coastal lifestyle,” Streatfeild said, noting that many migrate from colder regions of the country, as well as from other parts of California.

Not only charmed by the balmy wealth, individuals from far and wide are equally wooed to the area by its thriving entrepreneurial community, and Santa Barbara’s “robust job market, including opportunities in technology, healthcare, finance and education, attracts professionals from various parts of the country,” Streatfeild said. “Some may relocate from major metropolitan areas like Los Angeles, San Francisco or New York in search of a more balanced and less crowded lifestyle.”

Indeed, out-of-towners appear to be driving demand in the coastal enclave, according to search data from Realtor.com. More than three-quarters (79.5%) of views to Santa Barbara home listings on the site came from outside of the metro in the fourth quarter, with a notable amount of attention coming from the Los Angeles (32.8%) area, according to the index. House hunters from Silicon Valley, Atlanta and New York City were also shopping in the area, according to Realtor.com data.

Meanwhile, Prince Harry and Megan Markle are prime examples that “Santa Barbara’s appeal extends beyond U.S. borders,” Streatfeild said.

The University of California, Santa Barbara, also attracts a global cohort—along with plenty of domestic new residents—who move to the area to pursue higher education.

The Santa Barbara metro area “attracted a sizeable 3.3% of its listing viewership from shoppers outside of the U.S.,” Hale said in the report. “Suggesting that international demand is applying pressure to already high prices.”

For comparison, “the average international viewership share across the 300 ranked markets was less than half (1.4%) the viewership share in Santa Barbara,” she added.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

A Sydney site with a questionable past is reborn as a luxe residential environment ideal for indulging in dining out

Long-term Sydney residents always had handful of not-so-glamourous nicknames for the building on the corner of Cleveland and Baptist Streets straddling Redfern and Surry Hills, but after a modern rebirth that’s all changed.

Once known as “Murder Mall” or “Methadone Mall”, the 1960s-built Surry Hills Shopping Centre was a magnet for colourful characters and questionable behaviour. Today, however, a $500 million facelift of the site — alongside a slow and steady gentrification of the two neighbouring suburbs — the prime corner property has been transformed into a luxury apartment complex Surry Hills Village by developer Toga Group.

The crowning feature of the 122-apartment project is the three-bedroom penthouse, fully completed and just released to market with a $7.5 million price guide.

Measuring 211sqm of internal space, with a 136sqm terrace complete with landscaping, the penthouse is the brand new brainchild of Surry Hills local Adam Haddow, director of architecture at award-winning firm SJB.

Victoria Judge, senior associate and co-interior design lead at SJB says Surry Hills Village sets a new residential benchmark for the southern end of Surry Hills.

“The residential offering is well-appointed, confident, luxe and bohemian. Smart enough to know what makes good living, and cool enough to hold its own amongst design-centric Surry Hills.”

Allan Vidor, managing director of Toga Group, adds that the penthouse is the quintessential jewel in the crown of Surry Hills Village.

“Bringing together a distinct design that draws on the beauty and vibrancy of Sydney; grand spaces and the finest finishes across a significant footprint, located only a stone’s throw away from the exciting cultural hub of Crown St and Surry Hills.”

Created to maximise views of the city skyline and parkland, the top floor apartment has a practical layout including a wide private lobby leading to the main living room, a sleek kitchen featuring Pietra Verde marble and a concealed butler’s pantry Sub-Zero Wolf appliances, full-height Aspen elm joinery panels hiding storage throughout, flamed Saville stone flooring, a powder room, and two car spaces with a personal EV.

All three bedrooms have large wardrobes and ensuites with bathrooms fittings such as freestanding baths, artisan penny tiles, emerald marble surfaces and brushed-nickel accents.

Additional features of the entertainer’s home include leather-bound joinery doors opening to a full wet bar with Sub-Zero wine fridge and Sub-Zero Wolf barbecue.

The Surry Hills Village precinct will open in stages until autumn next year and once complete, Wunderlich Lane will be home to a collection of 25 restaurants and bars plus wellness and boutique retail. The EVE Hotel Sydney will open later in 2024, offering guests an immersive experience in the precinct’s art, culture, and culinary offerings.

The Surry Hills Village penthouse on Baptist is now finished and ready to move into with marketing through Toga Group and inquiries to 1800 554 556.

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.