New MacBook Pro With M1 Pro and M1 Max Chips

Apple’s first MacBook Pro redesign in five years reverses course on some problematic design choices.

Apple in 2016: Laptops don’t need full-size ports or MagSafe chargers, but they do need a Touch Bar!

Apple in 2021: Oh, did we say that? So sorry. We actually think laptops do need full-size ports and MagSafe chargers. And what’s a Touch Bar?

Apple’s newest MacBook Pro, introduced along with new AirPods at an event on Monday, might be better called the MacBook Pro-gress. As in, Apple has finally made significant progress in fixing all of the frustrating design changes. It had already killed off the disastrous butterfly keyboard.

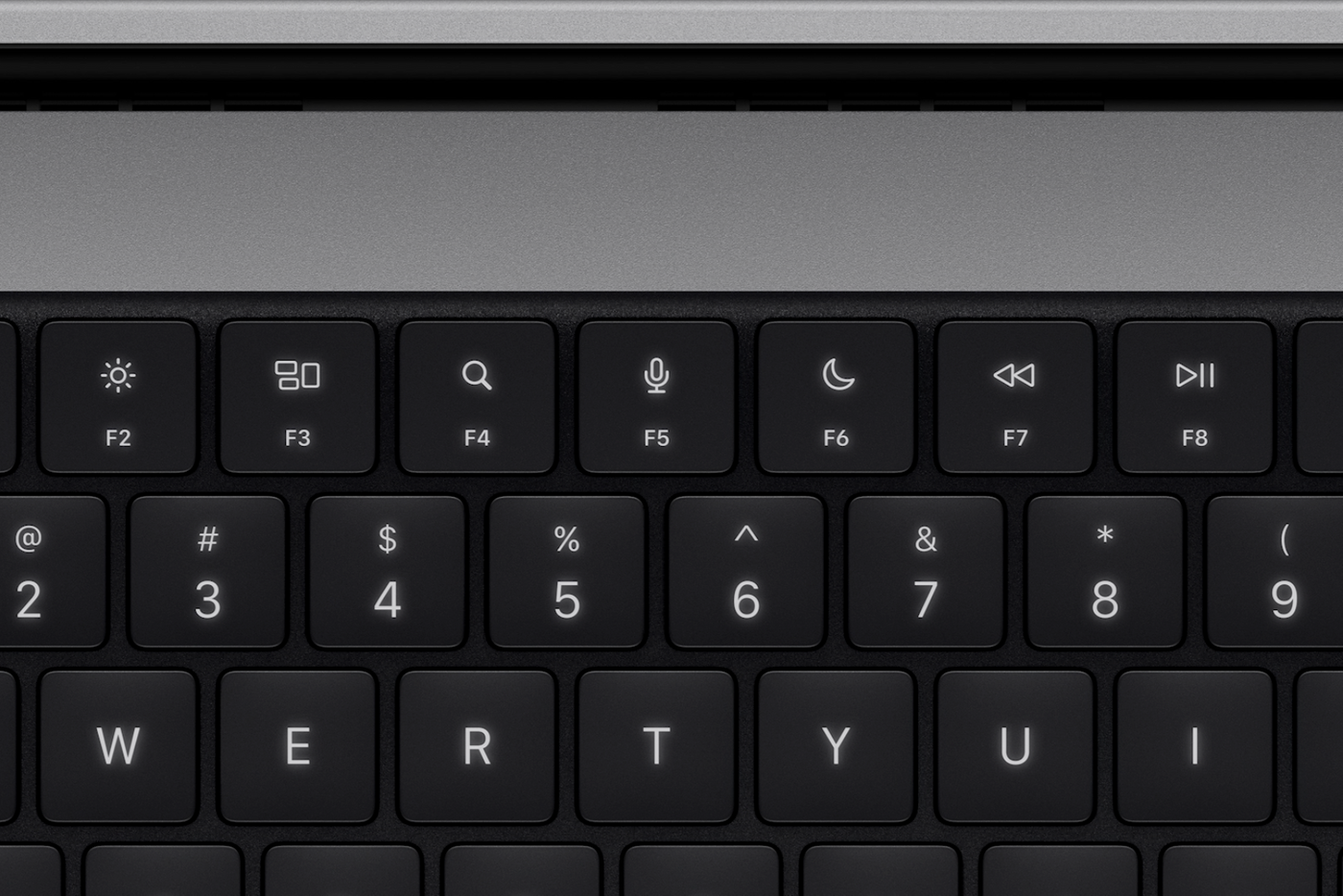

Yes, a full keyboard with real keys. Full-size function keys in place of a Touch Bar. An SD-card slot. An HDMI port. A magnetic MagSafe charging port. They’re all back!

And this isn’t just a return to Square One. The completely redesigned laptops—available next week at a starting price of $2,999, in both 14.2- and 16.2-inch screen sizes—promise big performance and battery-life improvements with new Apple M1 Pro and M1 Max chips. They have new high-contrast, high-resolution displays and an improved 1080p webcam.

I plan to review the new machines soon but in the meantime let’s run down the best new MacBook Pro features:

Ports and MagSafe

Should we forgive Apple for the bank loans we have had to take out to buy various SD-card, HDMI and USB-C dongles for the past few years? Absolutely not. But should we rejoice about the return of the SD-card and HDMI ports? Abso-freakin’-lutely. Many professionals still rely on those and many Windows PCs have kept these ports over the years, even while adding USB-C ports.

The new MacBook Pro models have three USB-C ports (with Thunderbolt 4) for connecting other peripherals. And while you can also continue to charge the laptops via those ports—handy when you’re tethered to an external monitor—chances are you’re going to want to carry the new MagSafe 3 charger that comes in the box. Like the original MacBook MagSafe charger, it clips magnetically to the laptop. If it gets knocked out, your laptop doesn’t go tumbling down, it just detaches. Apple also says the new charger is capable of faster charging, getting up to 50% in 30 minutes.

Keyboard

Apple hoped its Touch Bar—a touch-screen strip above the number row—would be a good substitute for traditional function keys and provide dynamic shortcuts based on whatever app you were in. Instead, it got in the way more than an aeroplane’s middle-seat armrest. No, Siri, you can’t help me! I just want to mute my volume!

On these new MacBook Pro models, the traditional function row is back, and at full size, with the volume, screen brightness and other controls you’re familiar with. A Touch ID fingerprint sensor remains in the upper right hand corner of the keyboard to quickly and securely unlock your machine without a password.

Webcam and Display

When I first saw the iPhone-like display notch at the top, surrounding the webcam, I hoped Apple also added Face ID facial recognition to its high-end laptops. But nope, that area is all for a new 1080p webcam, which Apple says doubles the resolution and improves lowlight performance. I look forward to testing that, because built-in laptop webcams haven’t been good.

The main event really is the laptops’ new Liquid Retina XDR displays, which are brighter and have refresh rates up to 120 hertz, to make everything from scrolling to videos seem smoother. Hertz so good, just like John Mellencamp said.

M1 Pro and M1 Max

Now, to be fair, during the past year I learned to live without the ports—and even coexist with the Touch Bar—because of the M1 chip inside of last year’s 13-inch MacBook Pro. By subbing in its own chip for Intel’s, Apple was able to create snappier, quieter and cooler machines. Plus, the battery lasts at least six to eight hours in my daily use.

With the new MacBook Pros, that performance has been revved up. The two machines are available with faster versions of the M1 chip—the better and faster M1 Pro and then the even better and even faster M1 Max. Apple presented more charts and graphs than a quarterly earnings report at its event, to show the leaps in raw processing and graphical performance. Plus, the M1 Pro chip can support up to 32 gigabytes of memory and the M1 Max can take 64GB. The current M1 chip maxes out at 16GB.

The battery-life claims are impressive, too. The company says the 14-inch model can play video for 17 hours, while the 16-inch model can go 21 hours. Apple says it’s the “longest battery life ever on a Mac notebook.”

Is it everything I’ve wanted for the past few years? Seems like it, but I’ll have to test it out myself, especially those webcam, battery and performance claims. Plus, now my dog can go bury my dongle collection in the backyard. He’ll be so happy.

Reprinted by permission of The Wall Street Journal, Copyright 2021 Dow Jones & Company. Inc. All Rights Reserved Worldwide. Original date of publication: October 18

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

More than one fifth of Australians are cutting back on the number of people they socialise with

Australian social circles are shrinking as more people look for ways to keep a lid on spending, a new survey has found.

New research from Finder found more than one fifth of respondents had dropped a friend or reduced their social circle because they were unable to afford the same levels of social activity. The survey questioned 1,041 people about how increasing concerns about affordability were affecting their social lives. The results showed 6 percent had cut ties with a friend, 16 percent were going out with fewer people and 26 percent were going to fewer events.

Expensive events such as hens’ parties and weddings were among the activities people were looking to avoid, indicating younger people were those most feeling the brunt of cost of living pressures. According to Canstar, the average cost of a wedding in NSW was between $37,108 to $41,245 and marginally lower in Victoria at $36, 358 to $37,430.

But not all age groups are curbing their social circle. While the survey found that 10 percent of Gen Z respondents had cut off a friend, only 2 percent of Baby Boomers had done similar.

Money expert at Finder, Rebecca Pike, said many had no choice but to prioritise necessities like bills over discretionary activities.

“Unfortunately, for some, social activities have become a luxury they can no longer afford,” she said.

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.