Plant-Based Plastics Gain Favour as Companies Pursue Sustainability Goals

Bioplastic production is growing at a record clip amid strong demand from fashion and food-packaging companies, in particular

The future is more plastic. Plant-based plastic, that is.

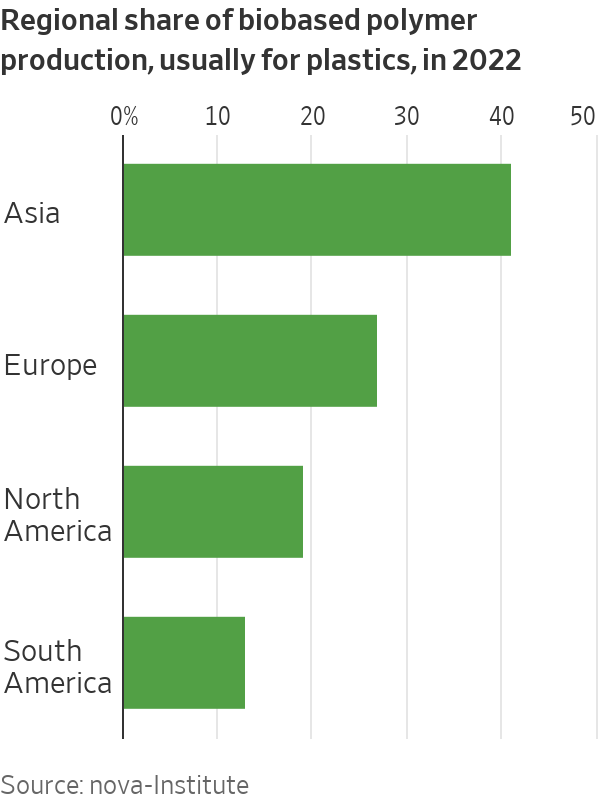

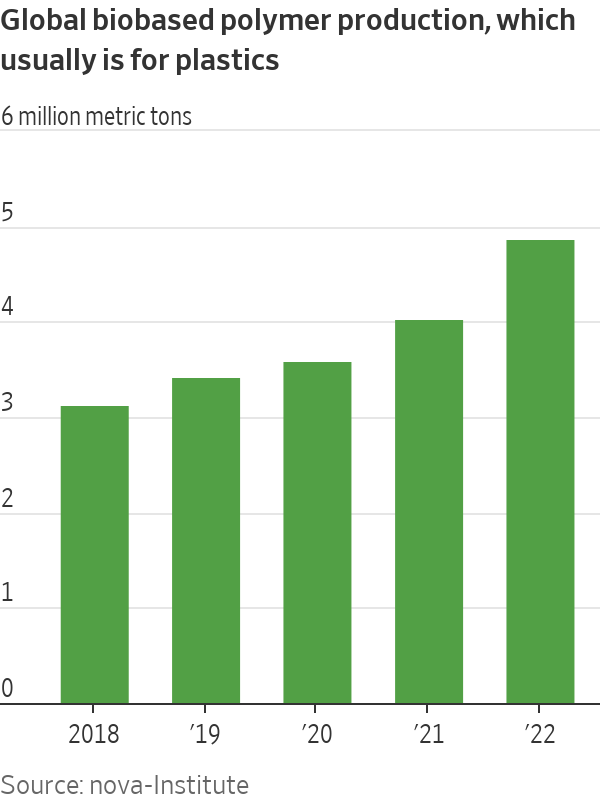

Plant-based plastics, or bioplastics, have accounted for just 1% of the world’s plastic production for well over a decade, according to a review of more than 100 companies by research organisation nova-Institute. Bioplastics haven’t taken off largely because they are typically 50% to 80% more expensive than traditional fossil-fuel-based plastics, but their production is now growing 14% a year, putting them on track to reach up to 3% of the plastics market in the next five years.

Bioplastics are expanding faster than recycled plastic in some cases, such as in Asian countries like China and Japan that are mandating more ecologically friendly materials, nova-Institute founder Michael Carus said. Even if global plastic recycling rates someday reach 70% compared with around 9% today, bioplastics alongside materials made from captured carbon dioxide will have a big role to play asthe world transitions away from fossil-fuel-based materials, he said.

“Not one of them can do it alone,” Carus said, referring to the sustainable materials that will drive the green transition.

Bioplastics’ benefits

Bioplastics are usually derived from plants rich in starch, sugar or pulp, such as corn, wheat, sugar cane, wood and cotton, which makes them costlier than plastics made from fossil fuels because crops need fertiliser and other resources such as water. However, the environmental benefits of plant-based plastics are increasingly appealing to companies promising to use more sustainable materials by the end of the decade.

Plants absorb the atmosphere’s carbon dioxide, which cuts the greenhouse-gas emissions from making bioplastics to at least half that of fossil-fuel-based plastics. Bioplastics can also sometimes cause less pollution when they degrade in the environment.

Broadly, there are two types of bioplastics: Materials that have similar performance to plastic, such as pulp-derived cellulose acetate found in eyeglasses and textiles, and bioplastics that are chemically identical to conventional plastics, such as a polyethylene, polyester and nylon. Around half of today’s bioplastics are biodegradable, according to nova-Institute, meaning they break down more naturally and are less harmful to habitats. Still, many of these bioplastics require industrial composting facilities to degrade and aren’t designed to be thrown away in a home garden.

Some of the earliest adopters of bioplastics are fashion companies, including Lululemon, which has a goal to replace the majority of oil-based nylon with plant-based nylon by 2030. A big selling point for the sportswear company is using plants to make chemically identical nylon that can be easily switched in, but still cuts emissions by nearly half.

The strongest demand for bioplastics is currently from fashion and food-packaging companies, but interest is also rising from companies in cosmetics, electronics and more durable goods such as tools, Eastman Chemical’s Chief Technology Officer Chris Killian said.

Eastman, formerly a division of Kodak, earns more than $1 billion of its $10 billion or so in yearly sales from bioplastics made from cellulose acetate, a material it has produced for more than 70 years. Cellulose acetate, which Eastman makes from cotton linters and wood pulp, was first used in Kodak film in the company’s early days, but it is now expanding into packaging, textiles and other applications. In 2022, Eastman signed an agreement with Warby Parker for the material to be used in eyewear.

“It has a great deal of legs,” he said of the cellulose acetate-derived plastics.

Challenges ahead

Plant-based plastics remain a tough sell because fossil-fuel-based plastics are much cheaper, but prices could fall if companies continue to buy more bioplastics and governments encourage their use. This year, the Biden administration called on the federal government to assess the potential for biomaterials, including for plastics, fuels and medicines. And last year, the U.S. Defense Department said it would invest $1.2 billion in bio manufacturing. The European Union is also considering mandating bioplastics under packaging rules that are being discussed.

In the U.S., there is government support at the state and federal level to convert biological raw materials into fuels such as ethanol, but that level of support doesn’t yet exist for plant-based plastics, said Manav Lahoti, chemical giant Dow’s global sustainability director, olefins, aromatics and alternatives.

“The market is ready to take off on the demand side,” he said. “But to make the economics work, there is some regulatory support that is required.”

Another hurdle to scaling up bioplastics is what happens at their end of life. Only plant-based plastics that are chemically identical to fossil-fuel–based versions can enter the existing and growing recycling infrastructure. The world’s limited amount of feedstock, which often goes to feeding cattle and other livestock, also presents challenges to using more bioplastics.

One answer: turning agricultural waste into recyclable plastics.

This year, Dow struck an agreement with biomass refinery startup New Energy Blue to buy bioethylene made from the stalks and leaves of corn grown in Iowa. Dow will then make conventional and recyclable plastics from the material and sell to companies in transportation, footwear, and packaging.

Dow is already providing bioplastics for Crocs shoes and LVMH Moët Hennessy Louis Vuitton’s perfume packaging, and sees demand outstripping supply, said Haley Lowry, Dow’s global sustainability director for packaging and specialty plastics.

“We are trying to find more sources,” she said. “The demand from our customers is there; it’s really finding the sources of biofeed that makes sense.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Excluding the Covid-19 pandemic period, annual growth was the lowest since 1992

Australia’s commodity-rich economy recorded its weakest growth momentum since the early 1990s in the second quarter, as consumers and businesses continued to feel the impact of high interest rates, with little expectation of a reprieve from the Reserve Bank of Australia in the near term.

The economy grew 0.2% in the second quarter from the first, with annual growth running at 1.0%, the Australian Bureau of Statistics said Wednesday. The results were in line with market expectations.

It was the 11th consecutive quarter of growth, although the economy slowed sharply over the year to June 30, the ABS said.

Excluding the Covid-19 pandemic period, annual growth was the lowest since 1992, the year that included a gradual recovery from a recession in 1991.

The economy remained in a deep per capita recession, with gross domestic product per capita falling 0.4% from the previous quarter, a sixth consecutive quarterly fall, the ABS said.

A big area of weakness in the economy was household spending, which fell 0.2% from the first quarter, detracting 0.1 percentage point from GDP growth.

On a yearly basis, consumption growth came in at just 0.5% in the second quarter, well below the 1.1% figure the RBA had expected, and was broad-based.

The soft growth report comes as the RBA continues to warn that inflation remains stubbornly high, ruling out near-term interest-rate cuts.

RBA Gov. Michele Bullock said last month that near-term rate cuts aren’t being considered.

Money markets have priced in a cut at the end of this year, while most economists expect that the RBA will stand pat until early 2025.

Treasurer Jim Chalmers has warned this week that high interest rates are “smashing the economy.”

Still, with income tax cuts delivered at the start of July, there are some expectations that consumers will be in a better position to spend in the third quarter, reviving the economy to some degree.

“Output has now grown at 0.2% for three consecutive quarters now. That leaves little doubt that the economy is growing well below potential,” said Abhijit Surya, economist at Capital Economics.

“But if activity does continue to disappoint, the RBA could well cut interest rates sooner,” Surya added.

Government spending rose 1.4% over the quarter, due in part to strength in social-benefits programs for health services, the ABS said.

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.