The Building Boom Is Prolonging Market Pain

Construction employment is higher than ever—undermining bets the Fed will soon pivot

US: The building boom has helped push unemployment to around its lowest level in more than 50 years. That is perplexing investors who want to see the Federal Reserve switch course on interest rates.

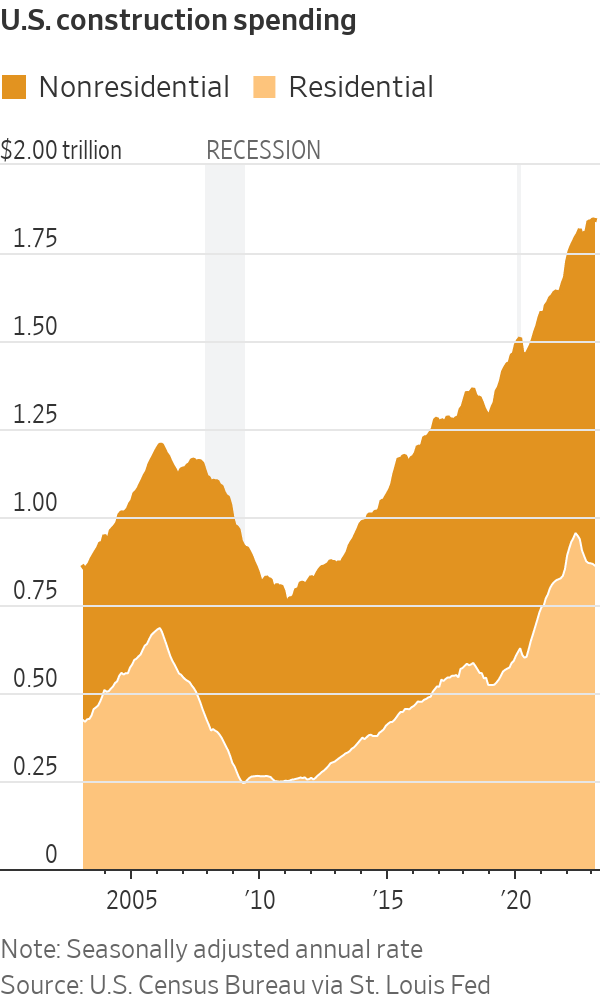

Construction spending and employment have risen to new records this year, boosted by government outlays for infrastructure, a domestic manufacturing renaissance and a wave of apartment building that got off to a slow start during the pandemic when prices for building materials, such as lumber, were sky high.

Construction companies with jobs ranging from airport overhauls to bathroom renovations say they have enough work booked to maintain payrolls—for years in some cases. Even home builders, who slowed down last year when rates began to rise, are ramping up into spring.

The persistent strength in a sector that is usually among the first to suffer job loss when borrowing costs rise is undermining investor hopes that the Fed’s aggressive interest-rate increases would quickly slow inflation and rejuvenate the stock market.

It also threatens to upend bets in the market that recession and lower rates are on the horizon. Investors are trading government bonds as if rate cuts will come within the next year and buying technology stocks, bitcoin and other speculative assets that surged when borrowing costs were near zero.

The issue for investors is that the longer it takes for construction activity and employment to decline, the longer it will be before the central bank can cut rates.

“Through this whole cycle, many have expected a much faster slowdown than has occurred,” said Bob Elliott, co-founder and chief executive of asset manager Unlimited. “Macroeconomic cycles take years to play out.”

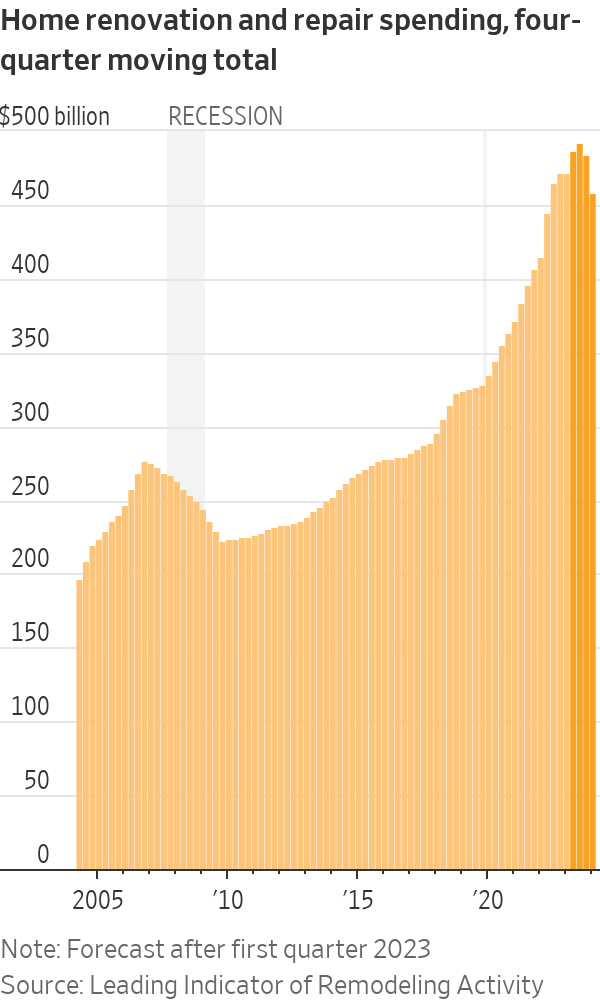

There are signs of slowdown, to be sure. Apartment construction is expected to decline once the latest batch of buildings is finished. Problems at regional banks are drying up financing for some projects. Spending on home improvement and repairs is forecast to decline over the next year, the first contraction since the depths of the foreclosure crisis in 2010, according to a closely watched barometer of the remodelling industry.

“Maybe we’re starting to see the effects of higher cost of capital on interest-rate-sensitive sectors,” said Anirban Basu, chief economist at trade group Associated Builders and Contractors, which said its measure of construction backlog declined in March to the lowest level since August. “The Federal Reserve raises rates until something breaks and something is starting to break.”

Even when construction employment declines, the effects might not be felt immediately in the broader economy. During the relatively fast-crashing 2008 financial crisis, the number of people working in residential construction peaked in April 2006 and had fallen roughly 15% before overall employment began to drop about two years later, Bureau of Labor Statistics data show.

The 2008 crash kicked off a deep recession and a years long home-building slump that left the U.S. severely short of housing.

Meanwhile, millions of homeowners are locked into historically low mortgage rates, which is keeping existing homes off the market and stoking demand for new construction, builders and analysts say. New-home sales climbed 9.6% in March, the Census Bureau said.

PulteGroup Inc., the country’s third-largest home builder, Tuesday reported record first-quarter revenue after selling 6% more houses at a 9% higher average price than a year earlier. Executives said they are adding sales and construction staff and building more spec homes, especially those aimed at first-time buyers.

“They don’t have a home to sell. And so they are not hampered by the low interest rate,” said Chief Executive Ryan Marshall. Pulte’s shares are up 47% this year and among the leaders of the S&P 500 stock index, which has gained 8.6%.

Employment in residential construction has been buoyed by the biggest burst in apartment building since the mid-1980s. Apartment projects were delayed after the Covid lockdown because of the budget-straining expense of building materials, such as lumber, which shot to more than twice the pre pandemic high and added millions of dollars to construction costs.

“People couldn’t build their projects, so they kicked the can down the road,” said Ivan Kaufman, chairman and CEO of Arbor Realty Trust Inc., which lends to landlords.

Though prices for lumber and other materials have come down, developers now face construction financing that is about twice as expensive as it had been and landlords are unlikely to be able to offset greater borrowing costs with rent increases, which should hinder new projects, said Mr. Kaufman.

So far, the roughly $50 billion decline in residential construction spending over the past year has been more than made up for by gains in commercial projects, including highways, hotels and hospitals. A record $108 billion was spent building factories last year, and the amount has risen this year, to a seasonally adjusted annualised rate of about $141 billion in February, according to Census Bureau data.

Some, such as those in fields that the Biden administration has made national priorities, such as semiconductors and electric vehicles, are supported by government incentives. Others are being built by big companies that can fund projects without borrowing.

Graphic Packaging Holding Co. is building a plant in Waco, Texas, to recycle old cardboard into new paperboard and said it would cover the $1 billion cost with cash over three years of construction. A similar facility that Graphic completed last year in Kalamazoo, Mich., required as many as 1,200 workers from 38 states.

The 2021 infrastructure bill and last years’ climate, tax and healthcare law are pumping money into industrial projects—such as renewable-energy facilities and railroad expansions—that promise to keep workers busy for years.

John Fish, CEO of the Suffolk construction firm, said the Boston-based company is focusing more on government-supported construction, such as airport upgrades. Suffolk employs roughly 2,500 and contracts with another 25,000 or so. It has three or four years of work lined up, including the renovation of Terminal C at Dallas Fort Worth International Airport, which won’t start until next year and isn’t scheduled for completion until 2026.

Home remodeller Jay Cipriani said his staff of 34 has plenty of kitchens and bathrooms to work through this year. But he said he’s getting fewer calls for new jobs and expects a slowing economy could make some prospective clients think twice about nonessential projects: “Maybe we don’t put in that fish pond this year.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

A Sydney site with a questionable past is reborn as a luxe residential environment ideal for indulging in dining out

Long-term Sydney residents always had handful of not-so-glamourous nicknames for the building on the corner of Cleveland and Baptist Streets straddling Redfern and Surry Hills, but after a modern rebirth that’s all changed.

Once known as “Murder Mall” or “Methadone Mall”, the 1960s-built Surry Hills Shopping Centre was a magnet for colourful characters and questionable behaviour. Today, however, a $500 million facelift of the site — alongside a slow and steady gentrification of the two neighbouring suburbs — the prime corner property has been transformed into a luxury apartment complex Surry Hills Village by developer Toga Group.

The crowning feature of the 122-apartment project is the three-bedroom penthouse, fully completed and just released to market with a $7.5 million price guide.

Measuring 211sqm of internal space, with a 136sqm terrace complete with landscaping, the penthouse is the brand new brainchild of Surry Hills local Adam Haddow, director of architecture at award-winning firm SJB.

Victoria Judge, senior associate and co-interior design lead at SJB says Surry Hills Village sets a new residential benchmark for the southern end of Surry Hills.

“The residential offering is well-appointed, confident, luxe and bohemian. Smart enough to know what makes good living, and cool enough to hold its own amongst design-centric Surry Hills.”

Allan Vidor, managing director of Toga Group, adds that the penthouse is the quintessential jewel in the crown of Surry Hills Village.

“Bringing together a distinct design that draws on the beauty and vibrancy of Sydney; grand spaces and the finest finishes across a significant footprint, located only a stone’s throw away from the exciting cultural hub of Crown St and Surry Hills.”

Created to maximise views of the city skyline and parkland, the top floor apartment has a practical layout including a wide private lobby leading to the main living room, a sleek kitchen featuring Pietra Verde marble and a concealed butler’s pantry Sub-Zero Wolf appliances, full-height Aspen elm joinery panels hiding storage throughout, flamed Saville stone flooring, a powder room, and two car spaces with a personal EV.

All three bedrooms have large wardrobes and ensuites with bathrooms fittings such as freestanding baths, artisan penny tiles, emerald marble surfaces and brushed-nickel accents.

Additional features of the entertainer’s home include leather-bound joinery doors opening to a full wet bar with Sub-Zero wine fridge and Sub-Zero Wolf barbecue.

The Surry Hills Village precinct will open in stages until autumn next year and once complete, Wunderlich Lane will be home to a collection of 25 restaurants and bars plus wellness and boutique retail. The EVE Hotel Sydney will open later in 2024, offering guests an immersive experience in the precinct’s art, culture, and culinary offerings.

The Surry Hills Village penthouse on Baptist is now finished and ready to move into with marketing through Toga Group and inquiries to 1800 554 556.

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.