The Home Buyer’s Quandary: Nobody’s Selling

Many are ready to move but don’t want to lose the low-rate mortgages they locked in a few years ago, crimping the supply of homes and keeping prices high

Many Americans who want to move are trapped in their homes—locked in by low interest rates they can’t afford to give up.

These “golden handcuffs” are keeping the supply of homes for sale unusually low and making the market more competitive and pricey than some forecasters expected.

The reluctance of homeowners to sell differentiates the current housing market from past downturns and could keep home prices from falling significantly on a national basis, economists say. This could dull the Federal Reserve’s efforts to slow inflation by cooling the economy.

Emily and Isaac Naatz of Cottage Grove, Minn., a suburb of St. Paul, had a baby last year and want a bigger place. They have lived for more than four years in their two-bedroom townhouse, and they now want a three- or four-bedroom house with a yard and space for a home office. “You get four people in here…and it feels like a large crowd,” Mr. Naatz said.

But they locked in a 30-year fixed mortgage rate of 3.4% in 2021—and don’t want to give that up to take on a new mortgage with a rate about 3 percentage points higher, especially when home prices in their area haven’t come down much.

The type of home they would want to buy would cost them about $1,100 a month more than they currently pay, Mr. Naatz said. “I don’t feel comfortable paying what I still think is an inflated price for a home, and on top of it paying twice the interest rate,” he said.

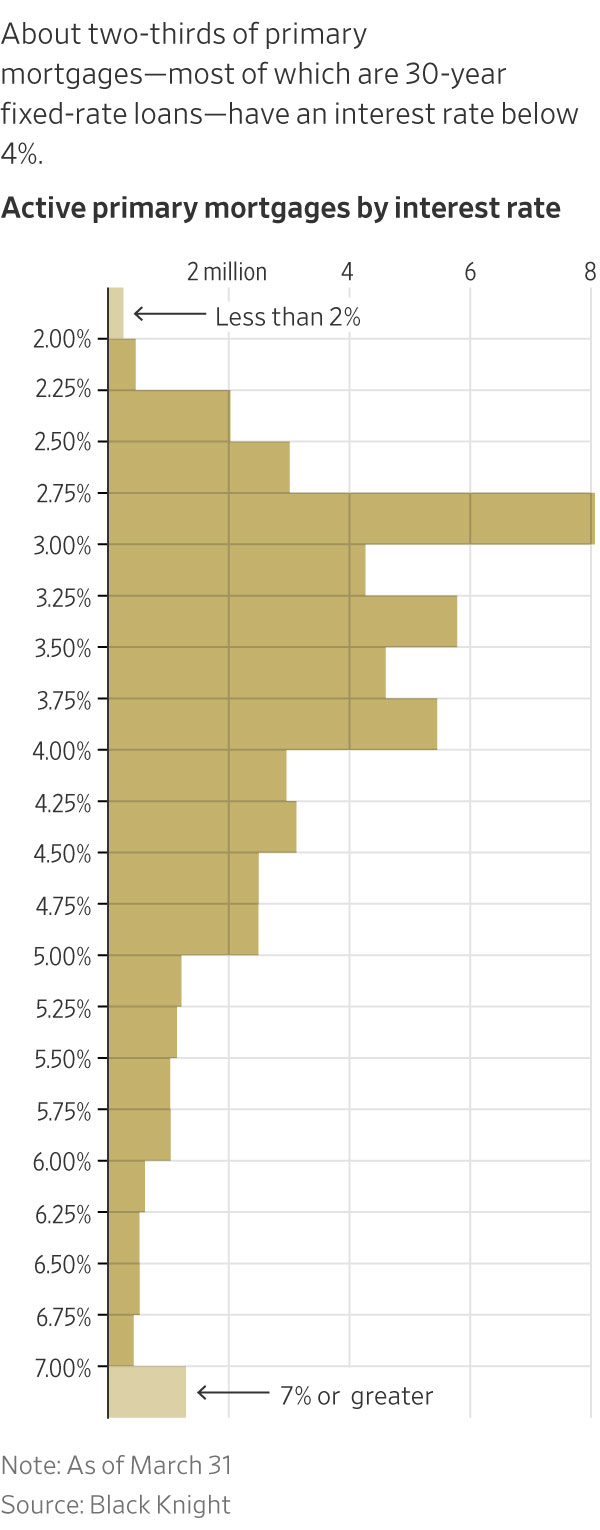

As of March 31, nearly two-thirds of primary mortgages had an interest rate below 4%, according to mortgage-data firm Black Knight. About 73% of primary mortgages have fixed rates for 30 years, Black Knight data show. The average rate for a new 30-year fixed mortgage was 6.39% in the week ended May 4, according to Freddie Mac.

The mortgage-rate factor is leaving some people in houses that aren’t a good fit, whether it’s a growing family without enough bedrooms or ageing homeowners with too much space, or dissuading people from relocating for jobs or other opportunities. Some people that wanted to sell in 2022 or 2023 shelved their plans.

As current homeowners stay put, “the movement up the ladder is sort of grinding to a halt,” said Sam Khater, chief economist at Freddie Mac. “It’s getting much harder for first-time home buyers to jump into the market because of the lack of supply.”

Half the listings

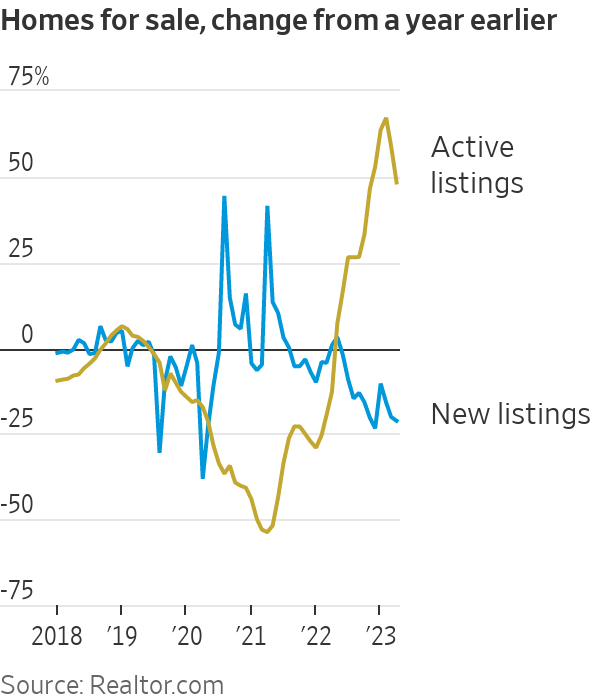

In April, there were about half as many homes for sale as in April 2019, though there were more listings than in April 2022, when they were near record lows, according to Realtor.com.

The number of homes newly listed on the market in April fell about 21% from a year earlier, an indication that sellers are holding back even during the normally busy spring home-buying season.

The constrained inventory is a key reason why home prices haven’t fallen much, even though higher mortgage rates have pushed many buyers to the sidelines.

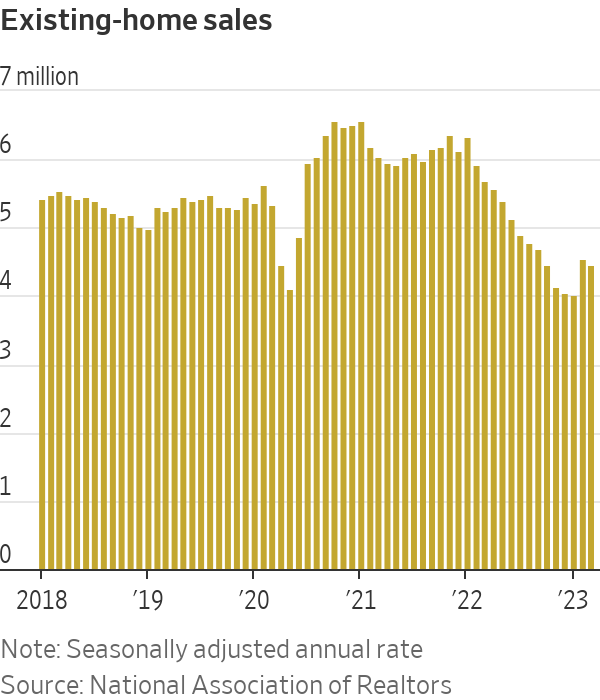

The median existing-home sale price in March slid 0.9% from a year earlier, according to the National Association of Realtors. Existing-home sales, meanwhile, fell 22% in March from a year earlier.

It’s a “unique market condition,” said Lawrence Yun, NAR’s chief economist. “Sales are down and even prices are down in some areas, yet from a buyer’s perspective it’s hard to get that home, because they are competing with other buyers.”

Frenzied bidding wars are still common in parts of the country, especially for moderately priced homes that appeal to first-time home buyers. In Clifton, N.J., a New York City suburb, a two-family house that listed for $449,000 in early April received 120 offers in six days, said Mahmoud Ijbara, the real-estate agent who listed it. The house is under contract for about $150,000 over the asking price, he said.

“The low inventory is what’s driving the prices up,” he said. “A lot of buyers are really panicking right now.”

A healthy housing market has between four and six months of supply at current sales rates, economists say. The existing-home market, which makes up most of the housing market, hit a record low 1.6 months’ supply in January 2022 and stood at 2.6 months’ supply in March of this year, according to NAR. The smaller new-home market is more amply supplied, at a seasonally adjusted 7.6 months in March, according to the Commerce Department.

The shortage of supply in the housing market has been a growing issue for years. Following the subprime-mortgage crisis, many builders went out of business and others sharply cut back on spending and new construction.

The problem worsened starting in 2020, when record-low mortgage rates and a pandemic-driven increase in remote work prompted buyers to rush into the market and snap up primary homes, vacation homes and investment properties. Home builders ramped up construction but struggled to meet demand due to volatile material costs, labor shortages and supply-chain issues.

That sales boom, along with a huge wave of homeowners who refinanced their mortgages, locked in millions of homeowners to low-rate, long-term loans. Among people planning to sell their homes and buy new ones in the next 12 months, about 56% plan to wait for rates to decline, according to a Realtor.com survey conducted in February. (News Corp, parent of The Wall Street Journal, operates Realtor.com.)

The Fed has been working to slow inflation. It raised its benchmark federal-funds rate last week for the 10th time since the start of 2022 but signalled it might be done raising rates for now.

Housing is one of the most rate-sensitive economic sectors, and the housing-market slowdown since early 2022 has been one of the main ways that the Fed’s actions have directly affected consumers.

Even some people who can accept higher mortgage rates are staying put because they are struggling to find something to buy. Julie and Aidan Booth expected to live in their three-bedroom home in East Rutherford, N.J., for about five years when they bought it in late 2019. Since then, they’ve had a second child and both switched to fully remote and hybrid working schedules, prompting them to want more space sooner than they expected.

The family started house hunting at the start of the year. They would be able to afford a higher mortgage rate, Mrs. Booth said, but they are stymied by the lack of supply.

“The last three weeks, there has been nothing new in our town” that met their criteria, she said. “There’s just no inventory.”

Opening for builders

The housing scarcity is good news for home builders, who struggled to find customers for much of 2022 with mortgage rates rising but reported stronger-than-expected demand in the first quarter. Newly built homes made up about one-third of total single-family homes for sale in March, up from a historical norm of 10% to 20%.

“If somebody does want a home at [either higher or lower price points], new construction is where they can find it right now,” said Jessica Hansen, vice president of investor relations and communications at D.R. Horton, the biggest home builder by volume, in an April earnings call.

The current market could also be a boon to remodelling companies. Rachael and Aaron Wyley, who have owned their Sacramento, Calif., house for almost 10 years, have considered moving to another house with space for Mrs. Wyley’s mother. But prices were either too high or mortgage rates too steep. Instead, they are saving up to remodel to add an in-law unit.

“We would break down the math of it and look at what we would put down, on top of how much we would get from the house selling,” Mr. Wyley said. “We’d have enough to make the monthly payments but not much else.”

There will always be homeowners who have to move due to life events like death, divorce or job relocations, and others who don’t view current mortgage rates as an obstacle. Many retirees and remote workers opt to move to cheaper housing markets, where lower prices can offset the effect of higher rates. About 38% of owner-occupied housing units have no mortgage, according to Census Bureau data. And about 27% of March existing-home sales were purchased in cash, according to NAR.

Many homeowners who have lived in their houses for years have also built up equity they can use toward down payments on their next homes, reducing the size of their loans. U.S. homeowners had $270,000 more equity on average in the fourth quarter of 2022 than they did at the start of the pandemic, according to CoreLogic.

How long the mortgage rate lock-in effect will last is hard for economists to say. Mortgage rates have never climbed as quickly as they did in 2022.

As the gap widens between homeowners’ existing mortgage rates and the prevailing rate, moving slows down, according to a March working paper by Julia Fonseca at University of Illinois at Urbana-Champaign and Lu Liu at the University of Pennsylvania’s Wharton School. The paper also found homeowners with low locked-in mortgage rates are less likely to relocate for higher-paying jobs.

Ryan and Megan Carrillo bought their first home in Phoenix in 2020 for $320,000, locking in a 2.75% fixed mortgage rate for 30 years.

Last year, after Mr. Carrillo got a higher-paying job, they wanted to upgrade to a nicer house in the $600,000 to $700,000 price range. When they started looking in January 2022, they planned to pay about $3,000 a month for a new house, but they backed out of the market after their expected payments ballooned to more than $4,000 by September.

The Carrillos now plan to stay in their house for about five more years and then turn it into a rental property when they move out of state.

“I’d love to keep it forever and not sell it,” Mr. Carrillo said. His ultra low mortgage rate, he added, is “too good to give up.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

As Paris makes its final preparations for the Olympic games, its residents are busy with their own—packing their suitcases, confirming their reservations, and getting out of town.

Worried about the hordes of crowds and overall chaos the Olympics could bring, Parisians are fleeing the city in droves and inundating resort cities around the country. Hotels and holiday rentals in some of France’s most popular vacation destinations—from the French Riviera in the south to the beaches of Normandy in the north—say they are expecting massive crowds this year in advance of the Olympics. The games will run from July 26-Aug. 1.

“It’s already a major holiday season for us, and beyond that, we have the Olympics,” says Stéphane Personeni, general manager of the Lily of the Valley hotel in Saint Tropez. “People began booking early this year.”

Personeni’s hotel typically has no issues filling its rooms each summer—by May of each year, the luxury hotel typically finds itself completely booked out for the months of July and August. But this year, the 53-room hotel began filling up for summer reservations in February.

“We told our regular guests that everything—hotels, apartments, villas—are going to be hard to find this summer,” Personeni says. His neighbours around Saint Tropez say they’re similarly booked up.

As of March, the online marketplace Gens de Confiance (“Trusted People”), saw a 50% increase in reservations from Parisians seeking vacation rentals outside the capital during the Olympics.

Already, August is a popular vacation time for the French. With a minimum of five weeks of vacation mandated by law, many decide to take the entire month off, renting out villas in beachside destinations for longer periods.

But beyond the typical August travel, the Olympics are having a real impact, says Bertille Marchal, a spokesperson for Gens de Confiance.

“We’ve seen nearly three times more reservations for the dates of the Olympics than the following two weeks,” Marchal says. “The increase is definitely linked to the Olympic Games.”

Getty Images

According to the site, the most sought-out vacation destinations are Morbihan and Loire-Atlantique, a seaside region in the northwest; le Var, a coastal area within the southeast of France along the Côte d’Azur; and the island of Corsica in the Mediterranean.

Meanwhile, the Olympics haven’t necessarily been a boon to foreign tourism in the country. Many tourists who might have otherwise come to France are avoiding it this year in favour of other European capitals. In Paris, demand for stays at high-end hotels has collapsed, with bookings down 50% in July compared to last year, according to UMIH Prestige, which represents hotels charging at least €800 ($865) a night for rooms.

Earlier this year, high-end restaurants and concierges said the Olympics might even be an opportunity to score a hard-get-seat at the city’s fine dining.

In the Occitanie region in southwest France, the overall number of reservations this summer hasn’t changed much from last year, says Vincent Gare, president of the regional tourism committee there.

“But looking further at the numbers, we do see an increase in the clientele coming from the Paris region,” Gare told Le Figaro, noting that the increase in reservations has fallen directly on the dates of the Olympic games.

Michel Barré, a retiree living in Paris’s Le Marais neighbourhood, is one of those opting for the beach rather than the opening ceremony. In January, he booked a stay in Normandy for two weeks.

“Even though it’s a major European capital, Paris is still a small city—it’s a massive effort to host all of these events,” Barré says. “The Olympics are going to be a mess.”

More than anything, he just wants some calm after an event-filled summer in Paris, which just before the Olympics experienced the drama of a snap election called by Macron.

“It’s been a hectic summer here,” he says.

AFP via Getty Images

Parisians—Barré included—feel that the city, by over-catering to its tourists, is driving out many residents.

Parts of the Seine—usually one of the most popular summertime hangout spots —have been closed off for weeks as the city installs bleachers and Olympics signage. In certain neighbourhoods, residents will need to scan a QR code with police to access their own apartments. And from the Olympics to Sept. 8, Paris is nearly doubling the price of transit tickets from €2.15 to €4 per ride.

The city’s clear willingness to capitalise on its tourists has motivated some residents to do the same. In March, the number of active Airbnb listings in Paris reached an all-time high as hosts rushed to list their apartments. Listings grew 40% from the same time last year, according to the company.

With their regular clients taking off, Parisian restaurants and merchants are complaining that business is down.

“Are there any Parisians left in Paris?” Alaine Fontaine, president of the restaurant industry association, told the radio station Franceinfo on Sunday. “For the last three weeks, there haven’t been any here.”

Still, for all the talk of those leaving, there are plenty who have decided to stick around.

Jay Swanson, an American expat and YouTuber, can’t imagine leaving during the Olympics—he secured his tickets to see ping pong and volleyball last year. He’s also less concerned about the crowds and road closures than others, having just put together a series of videos explaining how to navigate Paris during the games.

“It’s been 100 years since the Games came to Paris; when else will we get a chance to host the world like this?” Swanson says. “So many Parisians are leaving and tourism is down, so not only will it be quiet but the only people left will be here for a party.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.