The Luxury Home Market Confronts Its New Reality: Not Enough Buyers and Sellers

Sales at the high end continue to decline, as homeowners pull back on listing properties and would-be buyers grapple with high interest rates and recession fears

When Joan Dangerfield, wife of the late comedian Rodney Dangerfield, first walked into her Los Angeles home in the early 2000s, she knew immediately that she would buy it. The Art Deco-style estate, perched in the coveted Bird Streets above L.A.’s Sunset Strip, had dramatic views spanning Downtown Los Angeles to the ocean and Catalina Island.

“I stepped 3 feet into the house and I knew it was the place for me,” said Dangerfield, who paid $6.25 million for the property. “It swept me away.”

Roughly two decades later, Dangerfield, 70, is trying to sell the home—and finding that would-be buyers aren’t as eager as she once was. The $17.8 million listing for her property has been active since February and while she has received several full-price offers, they have come with complicated contingencies, such as requiring her to provide seller financing, she said.

“I figured it would sell in a week, but didn’t quite work out that way,” she said of the house, which is comparably priced with other homes in the area. “It was a shock for me to just watch it sit there on the market.”

Luxury sellers across the country are finding themselves in similar circumstances, as the high-end real-estate market faces a perfect storm of rising interest rates, recession fears and population shifts in the wake of the Covid-19 pandemic.

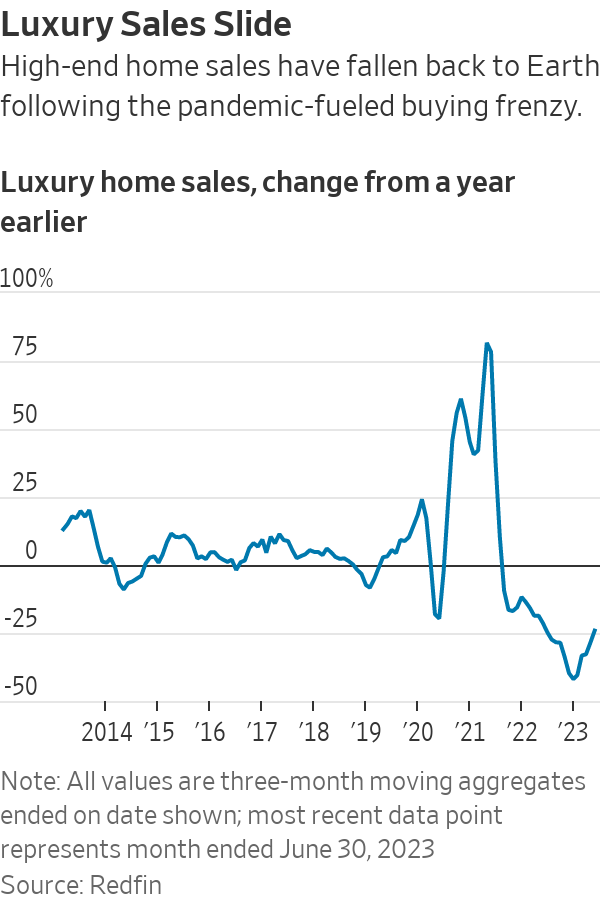

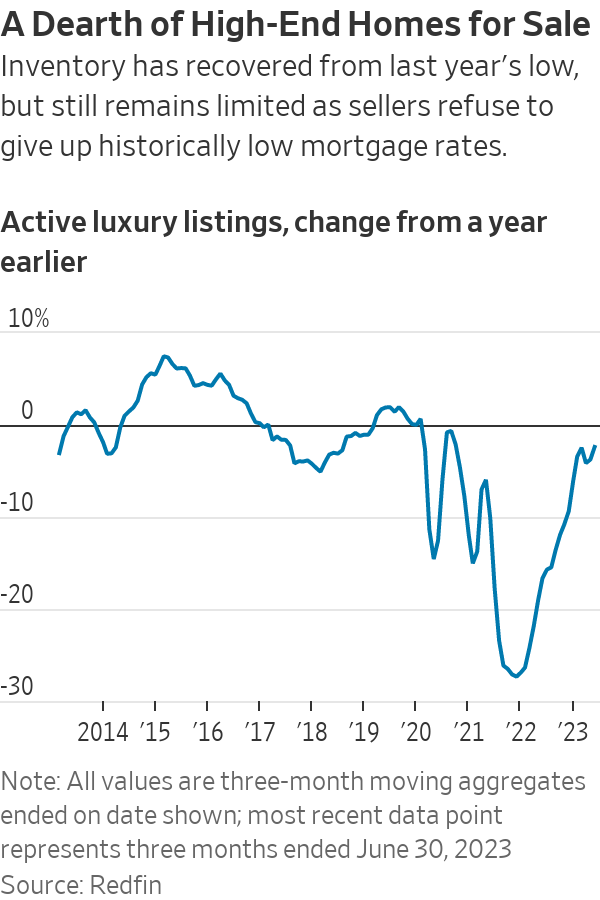

Sales of luxury homes nationwide, defined as the top 5% of homes based on estimated market value, declined by 24.13% in the three months ended June 30, compared with the same period last year, according to a new report by brokerage Redfin. Inventory of luxury homes was down 2.39% during that same period, while the median sales price for a luxury home was up by 4.55%. In many metros, homeowners appear to have pulled back on listing homes in light of the market shift. New luxury listings were down by 17.08% year-over-year in the three months ended June 30, Redfin’s data shows.

Sales of non luxury homes also fell during the same period, but that drop—19.42%—was smaller than the decline in the luxury market, according to Redfin.

“The luxury market is definitely hurting in terms of transactions,” said Daryl Fairweather, Redfin’s chief economist. “Even when you compare it to the rest of the market, it’s looking like luxury has really cooled off.”

The report marks the continuation of a market slide that began in earnest last spring, following an unprecedented deal-making frenzy during the pandemic. Redfin’s data shows that sales began to plummet significantly as early as June 2022, as buyers began to grapple with inflation and a volatile stock market. In the first quarter of 2023, luxury sales volume was down by 33.3% year-over-year.

Some of the biggest drops in sales volume over the three months ended June 30 were in markets that seemed unstoppable during the pandemic. The Miami metro area saw the largest drop in activity, for instance, with a 40.14% year-over-year reduction in luxury transaction volume for the three months ended June 30, according to Redfin.

Other metro areas with large drops included Nassau County on New York’s Long Island, where luxury sales volume dropped 39.34% year-over-year, followed by New York City, down 35.98%, Los Angeles, down 36.17%, and Chicago, which was down 34.13%.

Real-estate agents and industry experts said the luxury market’s performance has been uneven. That often comes down to pricing: In areas where sellers have capitulated to the declining market and dropped prices, transaction activity is holding relatively steady. But in markets where sellers are clinging to pandemic-era prices, activity has taken a nosedive.

In the San Francisco area, for instance, where median sales prices for luxury homes were down by 12.73%, there was only a 4.04% drop in transaction volume. “Because the prices have fallen, it’s opened up the opportunity for people who say, ‘I might finally be able to buy,’ ” Fairweather said.

In contrast, in markets like New York, Chicago and Los Angeles, prices have remained consistent or even risen slightly from last year, but transaction activity is way down. “There’s less demand, but it’s not enough of a pullback in demand to draw down prices,” Fairweather said.

In Miami, industry insiders say it is lack of supply, not lack of demand, that has caused the drop in activity. That’s thanks in large part to the mass migration to Miami and buying frenzy during Covid. “People who are going to sell have already sold,” Fairweather said, noting that new luxury listings in the Miami area were down by 33.1% year-over-year in the three months ended June 30. “There are definitely people who are moving to Miami who want to buy homes, but there are not necessarily homes for sale.”

Heigo Paartalu is among those buyers frustrated by a lack of inventory properties.

Paartalu, a Cigarette boat dealer and CEO of YachtWay, a digital boat show company, said he and his wife purchased a modern, five-bedroom house on Hibiscus Island, a gated island in Miami Beach, for $6 million in late 2021. The home value shot up 25% after about a year, so they cashed out and sold the house for $7.5 million in early 2023. Now, with a budget of around $10 million, they are looking for a waterfront property in the area without luck. “The inventory is very low and we’re not seeing the prices come down, which is what we were hoping for,” he said. The couple is currently renting in Miami’s Edgewater neighbourhood for $24,000 a month.

Jeff Miller of ONE Sotheby’s International Realty, Paartalu’s broker, said some homeowners aren’t selling because prices have gotten so high they won’t be able to buy something else in the area. Others don’t want to walk away from low mortgage rates. “It’s creating a huge shortage in our supply of available inventory and homes,” he said.

Even with a limited supply of inventory in Miami, Dina Goldentayer of Douglas Elliman said buyers have more leverage than they did last year for things like home inspections and closing credits. “I’m no longer taking the position of, ‘Take it or leave it,’ ” she said. “There are clear shifts that are making it seem like a normal market.”

In Los Angeles, the issues in the luxury market go far beyond an inventory crunch. Real-estate agent Juliette Hohnen of Douglas Elliman estimated that her business is down roughly 50% in that market from this time last year. At the height of the pandemic-fuelled market, she said, she had signed as many as 10 deals in a month. This July, she has only one so far. She chalked up the drop to rising interest rates, an outward migration from Los Angeles to lower-tax states, the introduction of a new mansion tax and more recently, the strike by both the actors’ and writers’ unions. She said she was slated to show an Oscar-winning writer around L.A. homes this month, but he called off his search in favour of renting amid the strikes.

The rising interest rates are keeping inventory low and stymying sales activity, Hohnen said. “Anyone who bought in the last few years has got these crazy low interest rates, usually between two and three percent,” she said. If those buyers sell now, they’ll be incurring rates that are almost double and potentially taking a loss on the sale.

Hohnen said she bought a $2.525 million home in 2021 in the Sag Harbor area of the Hamptons, securing an interest rate of just 1.875% for an adjustable-rate mortgage. Normally, she would buy, renovate and flip, but not this time, she said. “I’m never going to sell that house. I could never afford it if I was buying now. The monthly expenses on a new house would be too high.”

Dangerfield said she didn’t foresee how detrimental the mansion tax would be for her home’s prospects. The new measure, which was implemented April 1, requires sellers to pay 4% on sales of homes priced between $5 million and $10 million, and 5.5% on sales of properties at $10 million or above. “We were flooded with shoppers in March. Then, things just came to a screeching halt. It was such a change in the amount of people coming to view the home that it felt like it wasn’t even on the market,” she said.

One of Dangerfield’s agents, Marcy Roth of the Eklund Gomes team at Douglas Elliman, said the ULA tax “tainted buyer sentiment,” especially when combined with other issues like rising interest rates. “Everything is muddy and offers are complicated,” she said. “There aren’t a lot of quick, clean deals.”

In Chicago, real-estate agent Katherine Malkin of Compass said the city’s downtown area and so-called Gold Coast have been most affected by the slowdown. She said quality of life concerns like crime and an outward migration of some of the city’s businesses has put a damper on sales. Citadel, for instance, the hedge fund headed by billionaire Ken Griffin, recently left the city and moved to Miami. Other businesses that recently relocated their headquarters from Chicago include Boeing.

“You have businesses that are leaving because of the taxes,” Malkin said, noting that some prominent Chicago philanthropists and entrepreneurs have also left the city in the past few years. “They went to Florida, they went to Texas, they went to states that had a much lower tax circumstance. That’s been a difficult thing for people to grasp.”

Some sellers, Malkin said, have been reluctant to lower prices significantly—median luxury sales prices were actually up by more than 6.82% in Chicago in the three months ended June 30—which has been a further drag on sales. “No person of means wants to give their property away when they feel that they’ve invested in it,” she said.

When sellers have capitulated to the market, it has led to activity, Malkin said. She said one of her clients, who public records identify as private-equity executive John Weaver “Jay” Jordan II, recently lowered the price of a roughly 20,000-square-foot townhome in the Gold Coast neighbourhood to $15.75 million from the $18.75 million it listed for in 2020. While the home hasn’t yet sold, the price cut resulted in a new wave of interest, Malkin said. Jordan, who paid $1.8 million for the house in 1996 and remodelled it extensively, didn’t respond to a request for comment.

Although luxury median sale prices in the New York metro area are up by 7.69% for the three months ended June 30 compared with the year-earlier period, the slower pace of sales has allowed some opportunistic buyers to ink great deals. Vanessa Lucin of the Corcoran Group recently worked with buyers who paid $6 million for an Upper West Side apartment that was first listed for $7.495 million in June 2022. The roughly 3,383-square-foot apartment has two private balconies and is currently configured as a four bedroom, according to StreetEasy. Lucin said the couple is relocating to New York from California and began searching in January, when the market had slowed from its Covid peak. “There was another offer on the table but it wasn’t going anywhere,” she said.

Daniel Parker, co-head of Compass New Development Marketing Group, said some recent condo closings reflect deals struck during the more robust market in 2021 and 2022. In pockets of the city, such as Billionaires’ Row and Hudson Yards, developers have offered significant discounts. “They are embracing the market we have rather than the market they wish we had,” he said.

However, there are signs of life. Agents in New York reported a recent pickup in big-ticket deals this summer; in particular, large downtown condos have been the “golden sweet spot” of the market, said luxury real-estate agent Donna Olshan. A string of mega deals downtown over the past few weeks include the $52 million off-market sale of a penthouse at 150 Charles Street, the $50 million off-market sale of penthouse at 151 Wooster Street, and a signed contract for a penthouse asking $52 million at One High Line in Chelsea.

Sylvia Hughes, Lucin’s client, said she and her husband, John Hughes, saw several apartments before making an offer on their new four-bedroom on the Upper West Side. “I think the seller was motivated. This apartment had languished,” she said. By the time they saw it, the original $7.495 million asking price had been reduced to $6.195 million and their offer of $6 million was accepted. “I was beginning to wonder if we should have offered less.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

As Paris makes its final preparations for the Olympic games, its residents are busy with their own—packing their suitcases, confirming their reservations, and getting out of town.

Worried about the hordes of crowds and overall chaos the Olympics could bring, Parisians are fleeing the city in droves and inundating resort cities around the country. Hotels and holiday rentals in some of France’s most popular vacation destinations—from the French Riviera in the south to the beaches of Normandy in the north—say they are expecting massive crowds this year in advance of the Olympics. The games will run from July 26-Aug. 1.

“It’s already a major holiday season for us, and beyond that, we have the Olympics,” says Stéphane Personeni, general manager of the Lily of the Valley hotel in Saint Tropez. “People began booking early this year.”

Personeni’s hotel typically has no issues filling its rooms each summer—by May of each year, the luxury hotel typically finds itself completely booked out for the months of July and August. But this year, the 53-room hotel began filling up for summer reservations in February.

“We told our regular guests that everything—hotels, apartments, villas—are going to be hard to find this summer,” Personeni says. His neighbours around Saint Tropez say they’re similarly booked up.

As of March, the online marketplace Gens de Confiance (“Trusted People”), saw a 50% increase in reservations from Parisians seeking vacation rentals outside the capital during the Olympics.

Already, August is a popular vacation time for the French. With a minimum of five weeks of vacation mandated by law, many decide to take the entire month off, renting out villas in beachside destinations for longer periods.

But beyond the typical August travel, the Olympics are having a real impact, says Bertille Marchal, a spokesperson for Gens de Confiance.

“We’ve seen nearly three times more reservations for the dates of the Olympics than the following two weeks,” Marchal says. “The increase is definitely linked to the Olympic Games.”

Getty Images

According to the site, the most sought-out vacation destinations are Morbihan and Loire-Atlantique, a seaside region in the northwest; le Var, a coastal area within the southeast of France along the Côte d’Azur; and the island of Corsica in the Mediterranean.

Meanwhile, the Olympics haven’t necessarily been a boon to foreign tourism in the country. Many tourists who might have otherwise come to France are avoiding it this year in favour of other European capitals. In Paris, demand for stays at high-end hotels has collapsed, with bookings down 50% in July compared to last year, according to UMIH Prestige, which represents hotels charging at least €800 ($865) a night for rooms.

Earlier this year, high-end restaurants and concierges said the Olympics might even be an opportunity to score a hard-get-seat at the city’s fine dining.

In the Occitanie region in southwest France, the overall number of reservations this summer hasn’t changed much from last year, says Vincent Gare, president of the regional tourism committee there.

“But looking further at the numbers, we do see an increase in the clientele coming from the Paris region,” Gare told Le Figaro, noting that the increase in reservations has fallen directly on the dates of the Olympic games.

Michel Barré, a retiree living in Paris’s Le Marais neighbourhood, is one of those opting for the beach rather than the opening ceremony. In January, he booked a stay in Normandy for two weeks.

“Even though it’s a major European capital, Paris is still a small city—it’s a massive effort to host all of these events,” Barré says. “The Olympics are going to be a mess.”

More than anything, he just wants some calm after an event-filled summer in Paris, which just before the Olympics experienced the drama of a snap election called by Macron.

“It’s been a hectic summer here,” he says.

AFP via Getty Images

Parisians—Barré included—feel that the city, by over-catering to its tourists, is driving out many residents.

Parts of the Seine—usually one of the most popular summertime hangout spots —have been closed off for weeks as the city installs bleachers and Olympics signage. In certain neighbourhoods, residents will need to scan a QR code with police to access their own apartments. And from the Olympics to Sept. 8, Paris is nearly doubling the price of transit tickets from €2.15 to €4 per ride.

The city’s clear willingness to capitalise on its tourists has motivated some residents to do the same. In March, the number of active Airbnb listings in Paris reached an all-time high as hosts rushed to list their apartments. Listings grew 40% from the same time last year, according to the company.

With their regular clients taking off, Parisian restaurants and merchants are complaining that business is down.

“Are there any Parisians left in Paris?” Alaine Fontaine, president of the restaurant industry association, told the radio station Franceinfo on Sunday. “For the last three weeks, there haven’t been any here.”

Still, for all the talk of those leaving, there are plenty who have decided to stick around.

Jay Swanson, an American expat and YouTuber, can’t imagine leaving during the Olympics—he secured his tickets to see ping pong and volleyball last year. He’s also less concerned about the crowds and road closures than others, having just put together a series of videos explaining how to navigate Paris during the games.

“It’s been 100 years since the Games came to Paris; when else will we get a chance to host the world like this?” Swanson says. “So many Parisians are leaving and tourism is down, so not only will it be quiet but the only people left will be here for a party.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.