The Next Bets for Renewable Energy

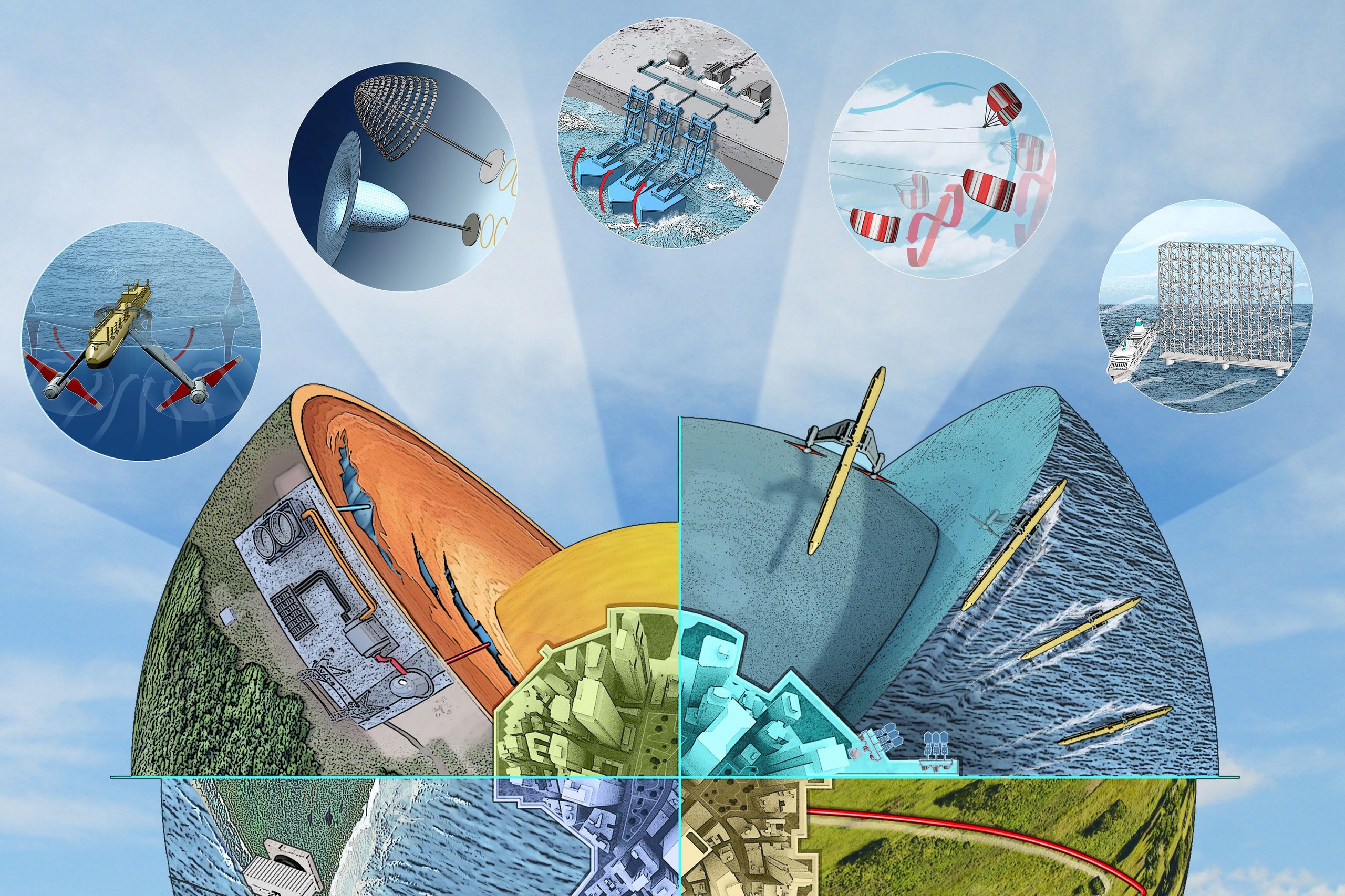

From underwater turbines to high-flying kites, companies look at innovative ways to harness traditional renewables.

With enormous kites that pull shipping vessels across oceans using wind power, floating devices attached to jetties that generate electricity from the motion of waves hitting the shore and other new technologies, companies are looking to diversify options for harnessing familiar sources of renewable energy in innovative ways. Many of these innovations aim to overcome cost and maintenance issues associated with existing technologies.

As world leaders endorse climate goals like reaching net-zero greenhouse-gas emissions within the next 30 years, these companies are pushing to move their projects from research and development to commercial phases. The net-zero objective—balancing emissions produced and emissions removed from the atmosphere—has spurred growth in the business of sustainable energy, which generates fewer emissions than fossil fuels. Some of these possibilities, like satellites that can wirelessly beam down solar energy from orbit, remain experimental, while others, like underwater turbines that harness tidal movements, have progressed from prototypes to commercial demonstrations. Here are some of the newest developments in generating power from the air, sun, water and Earth.

AIR

Stacked Turbines

Norwegian company Wind Catching Systems is developing a roughly 1,000-foot-tall structure consisting of 126 small turbines stacked and arranged together. The plan is for this “Wind Catching unit” to sit atop a floating platform anchored to the ocean floor about 50 miles offshore. The company says the unit will be able to turn 360 degrees to capture wind from any direction and generate electricity sent via underwater transmission lines back to shore.

The unit can produce up to five times more energy using one-fifth the space of typical offshore wind farms, says CEO and co-founder Ole Heggheim. The company expects to start construction on its first commercial prototype in the North Sea in 2023 and plans to market these wind catchers in the U.K.

Kite Power

SkySails Group, a Germany-based power company, is developing kites that fly a quarter-mile off the ground to produce energy. As the kite rises, it unwinds a tether connected to a winch and generator, which convert the force on the tether into electricity.

“High-altitude wind is the largest untapped energy resource on Earth,” founder and managing director Stephan Wrage says. Its largest kites are nearly 1,940 square feet in size—generating about 200 kilowatts of power, and meant to replace diesel generators in remote, off-grid islands and villages. The company has installed several pilot kites at sites including the Indian Ocean island nation of Mauritius, with plans to connect them to the grid. Starting next year, the company plans to start shifting toward commercial rollout, and eventually hopes to increase its kite size and flying altitude.

A French company, Airseas, has developed an 1003sqm kite called Seawing that attaches to a ship’s bow with a cable and pulls the vessel along using wind power. The company’s aim is to help decarbonize the shipping industry, says CEO and co-founder Vincent Bernatets.

WATER

Turning Tides

When placed underwater, turbines can harness kinetic energy from the natural rise and fall of ocean tides to generate electricity. But turbines placed on the seafloor are expensive to build and maintain. So Scottish company Orbital Marine Power designed a floating tidal turbine named Orbital O2.

The 72-metre-long turbine is anchored offshore near Scotland’s Orkney Islands, where a subsea cable connects it to the local grid. It can power around 2,000 U.K. homes and offset more than 2,400 tons of carbon annually. The company is focused on developing sites around the U.K. coastline and Europe, CEO Andrew Scott says, with an aim to deploy flotillas of tidal turbines. Future turbines will be anchored between about a mile and 3 miles offshore.

Wave Energy

Eco Wave Power Ltd. is working on harnessing water power from the shore. The company has designed 10-foot-long floating devices attached to piers, jetties and existing marine structures. These floaters use the rising and falling movement of waves to generate electricity.

The technology requires less than two feet of water to produce energy, “so we can basically install everywhere and anywhere,” says CEO and co-founder Inna Braverman. If waves get too rough, the devices can lock in an upward position above the water line. The company opened a 100-kilowatt facility connected to the grid in Gibraltar in 2016 that will be refurbished and moved to Los Angeles within the next three months. It expects to connect another power station in Jaffa, Israel, to the local grid by midyear this year. Future projects include possible facilities in New Jersey, California and Portugal.

EARTH

Geothermal Energy

Heat left over from when Earth formed and from radioactive elements decaying inside the planet’s molten core permeates toward the crust, creating accessible wells of steam or hot water. Some geothermal power plants pipe that steam or water—between 300 and 700 degrees Fahrenheit—to the surface for use as direct heat. Other plants can also convert that heat into electricity. The hydrothermal resources are injected back into the ground after cooling.

More than 60 geothermal plants operate in the U.S. today, providing nearly 4 gigawatts of electricity, which can power more than one million homes. But the plants tend to be concentrated in areas like California and Nevada with geothermal hot spots like geysers or volcanoes, or where tectonic plates grind past each other and Earth’s heat can move more easily through the crust. The key to making geothermal competitive with other renewables, is “going into regions where nature hasn’t been so generous, and figuring out a way to engineer the system,” says Cornell University professor Jefferson Tester. He is chief scientist for a pilot project at Cornell that aims to directly heat the 30,000-person campus with geothermal resources by 2035.

One solution, Dr. Tester says, is injecting “hot, dry rock”—which lacks the naturally occurring hydrothermal resources needed to generate electricity—with high-pressure water from the surface. That process can crack the rock, allowing a power plant to then collect the injected water after it is heated. The U.S. bipartisan infrastructure bill passed last year devoted $84 million to innovations like this, known as enhanced geothermal systems. These systems may enable engineers to expand the geographic range of where geothermal plants can be built.

SUN

Space-Based Solar

The sun’s power can only intermittently be harnessed from the ground due to weather, changing seasons and nighttime hours. But some scientists and engineers say within the next decade solar energy could come consistently from much closer to the source—wirelessly beamed down as microwaves or laser beams from orbiting satellites to receiving stations on Earth connected to the electrical grid.

“The basics are to put a large, very large platform in space, harvest sunlight, where the sun shines, essentially 99.95% of the time, and send it to markets on the ground, where, on average, the sun is shining only about 15% of the time,” says former NASA scientist John Mankins, president of Mankins Space Technology, a company working on developing a 1.6-km wide solar power satellite prototype that will use microwave beaming.

Wirelessly transferring energy across distances using microwave transmission has already been tested: The U.S. Naval Research Laboratory sent 1.6 kilowatts over a distance of 0.6 mile last year. Engineers at the Japan Aerospace Agency have sent about the same amount of energy the length of a football field.

Other groups are also working on the experimental technology: The California Institute of Technology plans on testing prototypes, which can transfer solar power in space via a steerable microwave beam, by the end of 2022. Engineers in Japan, China, Australia and Russia have all either made strides or expressed interest in developing space-based solar power.

The U.K. has integrated space-based solar energy into the country’s plan to reach net-zero emissions. Its Space Energy Initiative is spearheading a plan to send a 500-megawatt prototype that uses microwave beaming into orbit within the next decade, and aims to connect a satellite four times more powerful to the grid by 2035.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

As Paris makes its final preparations for the Olympic games, its residents are busy with their own—packing their suitcases, confirming their reservations, and getting out of town.

Worried about the hordes of crowds and overall chaos the Olympics could bring, Parisians are fleeing the city in droves and inundating resort cities around the country. Hotels and holiday rentals in some of France’s most popular vacation destinations—from the French Riviera in the south to the beaches of Normandy in the north—say they are expecting massive crowds this year in advance of the Olympics. The games will run from July 26-Aug. 1.

“It’s already a major holiday season for us, and beyond that, we have the Olympics,” says Stéphane Personeni, general manager of the Lily of the Valley hotel in Saint Tropez. “People began booking early this year.”

Personeni’s hotel typically has no issues filling its rooms each summer—by May of each year, the luxury hotel typically finds itself completely booked out for the months of July and August. But this year, the 53-room hotel began filling up for summer reservations in February.

“We told our regular guests that everything—hotels, apartments, villas—are going to be hard to find this summer,” Personeni says. His neighbours around Saint Tropez say they’re similarly booked up.

As of March, the online marketplace Gens de Confiance (“Trusted People”), saw a 50% increase in reservations from Parisians seeking vacation rentals outside the capital during the Olympics.

Already, August is a popular vacation time for the French. With a minimum of five weeks of vacation mandated by law, many decide to take the entire month off, renting out villas in beachside destinations for longer periods.

But beyond the typical August travel, the Olympics are having a real impact, says Bertille Marchal, a spokesperson for Gens de Confiance.

“We’ve seen nearly three times more reservations for the dates of the Olympics than the following two weeks,” Marchal says. “The increase is definitely linked to the Olympic Games.”

Getty Images

According to the site, the most sought-out vacation destinations are Morbihan and Loire-Atlantique, a seaside region in the northwest; le Var, a coastal area within the southeast of France along the Côte d’Azur; and the island of Corsica in the Mediterranean.

Meanwhile, the Olympics haven’t necessarily been a boon to foreign tourism in the country. Many tourists who might have otherwise come to France are avoiding it this year in favour of other European capitals. In Paris, demand for stays at high-end hotels has collapsed, with bookings down 50% in July compared to last year, according to UMIH Prestige, which represents hotels charging at least €800 ($865) a night for rooms.

Earlier this year, high-end restaurants and concierges said the Olympics might even be an opportunity to score a hard-get-seat at the city’s fine dining.

In the Occitanie region in southwest France, the overall number of reservations this summer hasn’t changed much from last year, says Vincent Gare, president of the regional tourism committee there.

“But looking further at the numbers, we do see an increase in the clientele coming from the Paris region,” Gare told Le Figaro, noting that the increase in reservations has fallen directly on the dates of the Olympic games.

Michel Barré, a retiree living in Paris’s Le Marais neighbourhood, is one of those opting for the beach rather than the opening ceremony. In January, he booked a stay in Normandy for two weeks.

“Even though it’s a major European capital, Paris is still a small city—it’s a massive effort to host all of these events,” Barré says. “The Olympics are going to be a mess.”

More than anything, he just wants some calm after an event-filled summer in Paris, which just before the Olympics experienced the drama of a snap election called by Macron.

“It’s been a hectic summer here,” he says.

AFP via Getty Images

Parisians—Barré included—feel that the city, by over-catering to its tourists, is driving out many residents.

Parts of the Seine—usually one of the most popular summertime hangout spots —have been closed off for weeks as the city installs bleachers and Olympics signage. In certain neighbourhoods, residents will need to scan a QR code with police to access their own apartments. And from the Olympics to Sept. 8, Paris is nearly doubling the price of transit tickets from €2.15 to €4 per ride.

The city’s clear willingness to capitalise on its tourists has motivated some residents to do the same. In March, the number of active Airbnb listings in Paris reached an all-time high as hosts rushed to list their apartments. Listings grew 40% from the same time last year, according to the company.

With their regular clients taking off, Parisian restaurants and merchants are complaining that business is down.

“Are there any Parisians left in Paris?” Alaine Fontaine, president of the restaurant industry association, told the radio station Franceinfo on Sunday. “For the last three weeks, there haven’t been any here.”

Still, for all the talk of those leaving, there are plenty who have decided to stick around.

Jay Swanson, an American expat and YouTuber, can’t imagine leaving during the Olympics—he secured his tickets to see ping pong and volleyball last year. He’s also less concerned about the crowds and road closures than others, having just put together a series of videos explaining how to navigate Paris during the games.

“It’s been 100 years since the Games came to Paris; when else will we get a chance to host the world like this?” Swanson says. “So many Parisians are leaving and tourism is down, so not only will it be quiet but the only people left will be here for a party.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.