Why the U.S. Remains Far From Recession

The pandemic’s after effects fuel economic resilience despite rising interest rates

More than a year after the Federal Reserve began rapidly raising interest rates to tame inflation, the hallmarks of a widely expected recession remain elusive.

Employers are hiring aggressively, consumers are spending freely, the stock market is rebounding and the housing market appears to be stabilising—the most recent evidence that the Fed’s efforts have yet to significantly weaken the economy.

Instead, the lingering effects of the pandemic have left consumers and employers still playing catch-up. That momentum could prove self-sustaining.

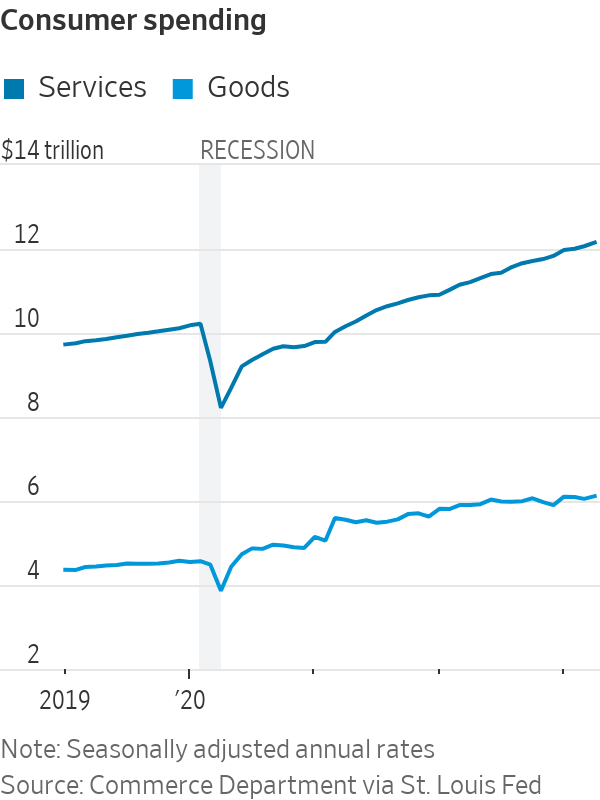

Americans are splurging on the activities they skipped during pandemic lockdowns, such as travel, concerts and dining out. Businesses are staffing up to satisfy the pent-up demand. Government policies in response to the pandemic—low interest rates and trillions of dollars in financial assistance—left consumers and businesses with lots of money and cheap debt. The same inflation that so worries the Fed translates into higher wages and profits, fuelling spending.

Many economists expect the Fed’s rate increases to cool the economy and price pressures over time, triggering a recession later this year. So far, however, the data keep coming in hotter than forecast.

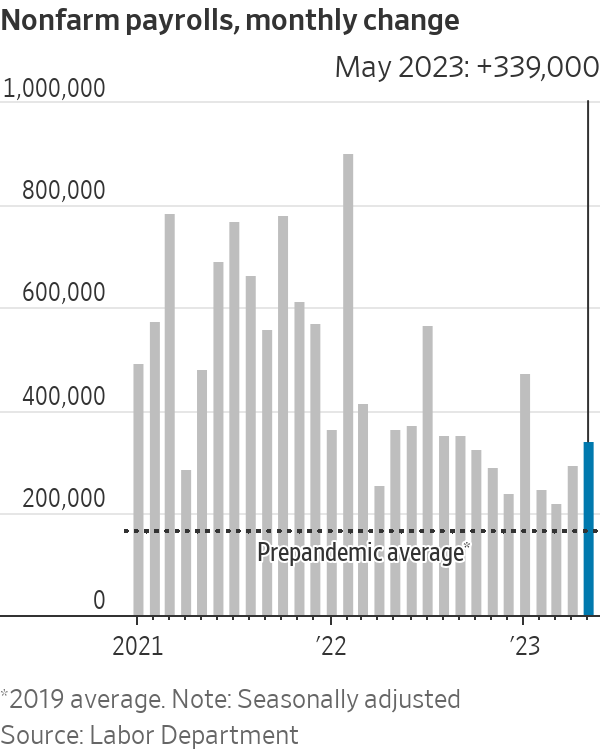

Job gains, in particular, remain robust, pumping more money into Americans’ wallets. Payrolls grew by a surprisingly large 339,000 in May, and the increases for the preceding two months were higher than initially estimated, the Labor Department said Friday.

“I don’t think there’s any chance we’re in a recession,” said Justin Wolfers, professor of public policy and economics at the University of Michigan.

The National Bureau of Economic Research, an academic research group and the official arbiter of U.S. recessions, analyses a slew of economic data to help determine whether the economy is in a recession. Most of those indicators look healthy, Wolfers said.

Post pandemic labour market still recovering

Employers hiring last month included those in sectors such as healthcare, leisure and hospitality and government, which saw sharp job losses at the pandemic’s onset in spring 2020. State and local government—which includes public schools—and leisure and hospitality—a category that spans restaurants, hotels, entertainment and spectator sports—have yet to return to their pre pandemic employment levels amid continuing labor shortages.

Across the economy, job openings increased to 10.1 million in April from 9.7 million in March, far exceeding the 5.7 million unemployed Americans that month. The mismatch between job opportunities and job seekers continues to spur wage growth.

Average hourly earnings grew a solid 4.3% in May from a year earlier, similar to annual gains in March and April.

“I certainly did not think the labor market would remain this strong for this long,” said Carl Tannenbaum, chief economist for Northern Trust.

Courtney Wakefield-Smith is among those who have recently benefited from the strong labor market. The 33-year-old said she was promoted last year to an office job at a New Jersey water utility company. In her new role, she makes more than $25 an hour, well above her part-time jobs earlier in the pandemic that paid between $11 and $17 an hour.

Her higher wage and benefits including maternity leave are helping support her newborn son.

“This is my first child,” she said. “I don’t think I would have been able to afford a child before now to be completely honest.”

The job market could stay tight, largely because millions of former workers near retirement age have dropped out of the labor force since the pandemic began. The share of Americans age 16 and older working or seeking a job held steady last month at 62.6%.

Consumers have money to spend

Americans have about $500 billion in so-called excess savings—the amount above what would be expected had pre pandemic trends persisted, according to a May report from the Federal Reserve Bank of San Francisco.

That allows them to shell out for summer travel, concert tickets and cruises despite rising prices—and enabling companies to keep raising them.

Southwest Airlines Chief Executive Bob Jordan said recently the carrier sees strong demand in the next two to three months, the window during which most people book flights. American Airlines raised its projections for unit revenue in the second quarter, citing strong demand.

The number of people passing through U.S. airports during the Memorial Day weekend topped the pre pandemic figure from 2019, according to the Transportation Security Administration.

Brett Keller, CEO of travel site Priceline, a unit of Booking Holdings, said he has been surprised at the strength of travel demand when many consumers are paying more to book an airline ticket or reserve a hotel room.

Keller has seen examples for this summer, with round-trip fares from the East Coast to Boise, Idaho, exceeding $1,000, roughly double $500 a few years ago.

Economy’s resilience complicates Fed rate outlook

Economic activity and inflation haven’t slowed as much as Fed officials anticipated. Since March 2022, they have lifted the benchmark federal-funds rate from near zero to a range between 5% and 5.25%, a 16-year high.

Higher borrowing costs typically are felt first in rate-sensitive parts of the financial markets and economy, such as stocks and housing. The S&P 500, for example, fell about 25% from late December 2021 to last October as the Fed raised rates sharply. The broad index has since rallied about 20%, which wouldn’t typically happen if the economy were falling into recession.

Sales of existing and new homes fell sharply last year but have climbed since January. A shortage of homes for sale has helped drive home prices higher recently. Home builders are feeling more confident as a shortage of existing homes boosts demand for newly built residences. Residential and industrial construction firms added 25,000 jobs last month, up from a monthly average of 17,000 over the prior 12 months.

These signs of resilience suggest the Fed might need to raise interest rates further to push inflation down from its current rate around 5% toward the central bank’s 2% target.

Fed officials last week signalled an inclination to hold rates steady at their meeting this month. But Friday’s jobs report strengthened the likelihood that they would pair any such pause with a stronger preference to raise rates later this year.

“A decision to hold our policy rate constant at a coming meeting should not be interpreted to mean that we have reached the peak rate for this cycle,” Fed governor Philip Jefferson, said Wednesday. “Indeed, skipping a rate hike at a coming meeting would allow the committee to see more data before making decisions about the extent of additional policy firming.”

There are some signs higher rates are having an effect. Businesses slowed investment in the first quarter, cutting back on equipment spending particularly sharply.

The average workweek fell to 34.3 hours last month, the lowest since April 2020 and possibly reflecting that businesses are cutting hours instead of workers. The unemployment rate rose to 3.7% in May from 3.4% in April. The tech-heavy information sector cut 9,000 jobs in May.

Many economists and business executives say it is just a matter of time before interest-rate increases—which work with a lag—significantly sap the economy’s vigour.

Economists surveyed by The Wall Street Journal in April put the probability of a recession at some point in the next 12 months above 50%. But they have said that since October, and the recession appears no closer.

—Alison Sider and Chip Cutter contributed to this article.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

As Paris makes its final preparations for the Olympic games, its residents are busy with their own—packing their suitcases, confirming their reservations, and getting out of town.

Worried about the hordes of crowds and overall chaos the Olympics could bring, Parisians are fleeing the city in droves and inundating resort cities around the country. Hotels and holiday rentals in some of France’s most popular vacation destinations—from the French Riviera in the south to the beaches of Normandy in the north—say they are expecting massive crowds this year in advance of the Olympics. The games will run from July 26-Aug. 1.

“It’s already a major holiday season for us, and beyond that, we have the Olympics,” says Stéphane Personeni, general manager of the Lily of the Valley hotel in Saint Tropez. “People began booking early this year.”

Personeni’s hotel typically has no issues filling its rooms each summer—by May of each year, the luxury hotel typically finds itself completely booked out for the months of July and August. But this year, the 53-room hotel began filling up for summer reservations in February.

“We told our regular guests that everything—hotels, apartments, villas—are going to be hard to find this summer,” Personeni says. His neighbours around Saint Tropez say they’re similarly booked up.

As of March, the online marketplace Gens de Confiance (“Trusted People”), saw a 50% increase in reservations from Parisians seeking vacation rentals outside the capital during the Olympics.

Already, August is a popular vacation time for the French. With a minimum of five weeks of vacation mandated by law, many decide to take the entire month off, renting out villas in beachside destinations for longer periods.

But beyond the typical August travel, the Olympics are having a real impact, says Bertille Marchal, a spokesperson for Gens de Confiance.

“We’ve seen nearly three times more reservations for the dates of the Olympics than the following two weeks,” Marchal says. “The increase is definitely linked to the Olympic Games.”

Getty Images

According to the site, the most sought-out vacation destinations are Morbihan and Loire-Atlantique, a seaside region in the northwest; le Var, a coastal area within the southeast of France along the Côte d’Azur; and the island of Corsica in the Mediterranean.

Meanwhile, the Olympics haven’t necessarily been a boon to foreign tourism in the country. Many tourists who might have otherwise come to France are avoiding it this year in favour of other European capitals. In Paris, demand for stays at high-end hotels has collapsed, with bookings down 50% in July compared to last year, according to UMIH Prestige, which represents hotels charging at least €800 ($865) a night for rooms.

Earlier this year, high-end restaurants and concierges said the Olympics might even be an opportunity to score a hard-get-seat at the city’s fine dining.

In the Occitanie region in southwest France, the overall number of reservations this summer hasn’t changed much from last year, says Vincent Gare, president of the regional tourism committee there.

“But looking further at the numbers, we do see an increase in the clientele coming from the Paris region,” Gare told Le Figaro, noting that the increase in reservations has fallen directly on the dates of the Olympic games.

Michel Barré, a retiree living in Paris’s Le Marais neighbourhood, is one of those opting for the beach rather than the opening ceremony. In January, he booked a stay in Normandy for two weeks.

“Even though it’s a major European capital, Paris is still a small city—it’s a massive effort to host all of these events,” Barré says. “The Olympics are going to be a mess.”

More than anything, he just wants some calm after an event-filled summer in Paris, which just before the Olympics experienced the drama of a snap election called by Macron.

“It’s been a hectic summer here,” he says.

AFP via Getty Images

Parisians—Barré included—feel that the city, by over-catering to its tourists, is driving out many residents.

Parts of the Seine—usually one of the most popular summertime hangout spots —have been closed off for weeks as the city installs bleachers and Olympics signage. In certain neighbourhoods, residents will need to scan a QR code with police to access their own apartments. And from the Olympics to Sept. 8, Paris is nearly doubling the price of transit tickets from €2.15 to €4 per ride.

The city’s clear willingness to capitalise on its tourists has motivated some residents to do the same. In March, the number of active Airbnb listings in Paris reached an all-time high as hosts rushed to list their apartments. Listings grew 40% from the same time last year, according to the company.

With their regular clients taking off, Parisian restaurants and merchants are complaining that business is down.

“Are there any Parisians left in Paris?” Alaine Fontaine, president of the restaurant industry association, told the radio station Franceinfo on Sunday. “For the last three weeks, there haven’t been any here.”

Still, for all the talk of those leaving, there are plenty who have decided to stick around.

Jay Swanson, an American expat and YouTuber, can’t imagine leaving during the Olympics—he secured his tickets to see ping pong and volleyball last year. He’s also less concerned about the crowds and road closures than others, having just put together a series of videos explaining how to navigate Paris during the games.

“It’s been 100 years since the Games came to Paris; when else will we get a chance to host the world like this?” Swanson says. “So many Parisians are leaving and tourism is down, so not only will it be quiet but the only people left will be here for a party.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.