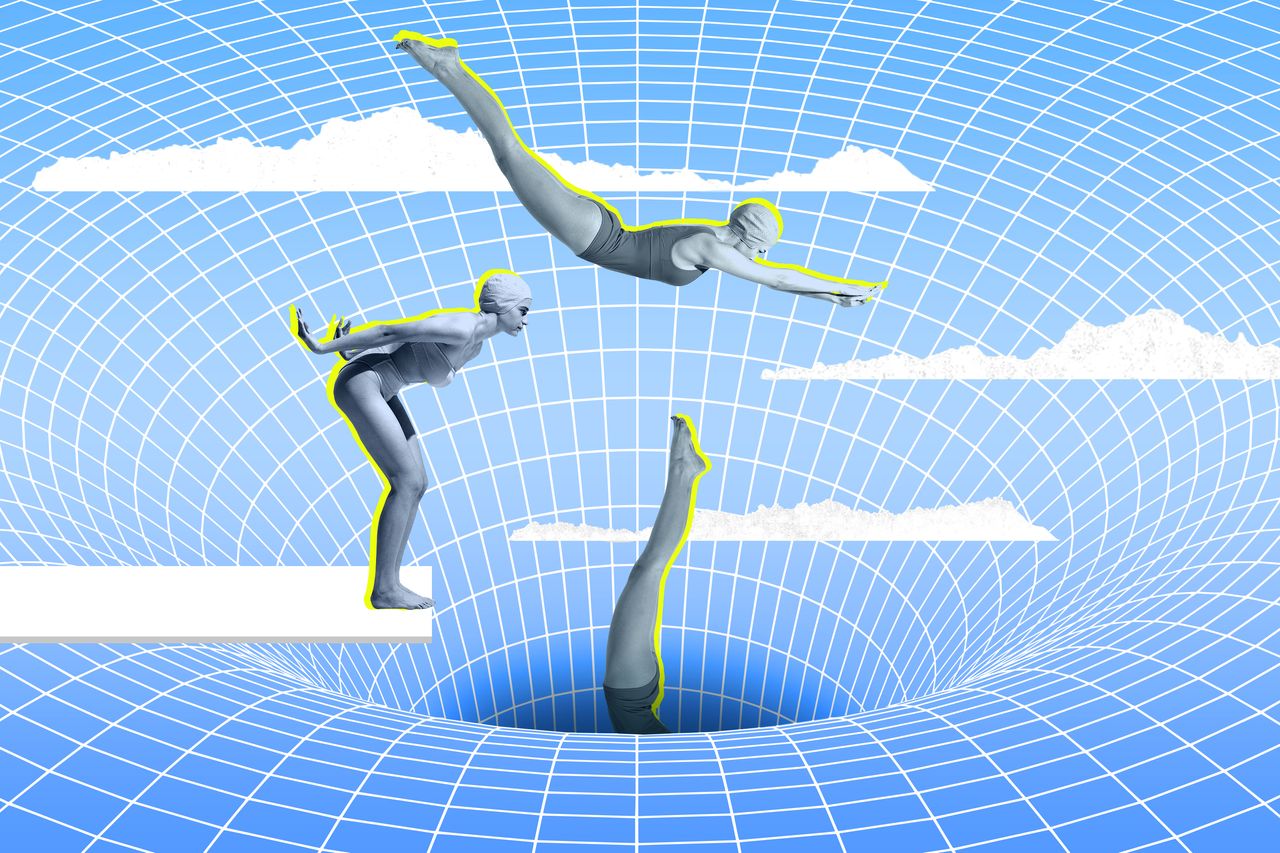

Your Next Big Move Should Scare You

Your gut says no. Here’s why you shouldn’t always listen to it.

Melissa Ben-Ishay was scared when she walked into the first commercial kitchen for baking her cupcakes. She was scared when a publisher proposed she write a cookbook. And she was terrified when the board of Baked by Melissa, the company that bears her name but had long been run by more-experienced executives, offered her the CEO role in 2019.

“It was nauseating and emotional, like in my throat,” she says. She put the “Rocky” theme on her headphones. She considered her blind spots, like her lack of finance knowledge. But she didn’t say no.

“That’s just not an option,” she says. “You have to do the things that are scary.”

Big moments and decisions in our lives can make our stomachs drop. Moving somewhere new, getting married, starting a family—if we’re sizing them up realistically, maybe we should be nervous. (Newborns are exhausting; being a manager is hard.) More than half of workers in a recent poll ranked starting a new job as scarier than skydiving or holding a snake.

Just trust your gut, everyone implores when you’re staring down a new opportunity. It takes effort to distinguish between normal jitters and the kind of fear that’s a real warning sign, though. And it’s more work still to convince yourself to just do it, even if you’re doing it scared.

First, take a breath, advises Luana Marques, an associate professor of psychiatry at Harvard Medical School and the author of a coming book about harnessing anxiety. Calm your nerves by meditating, taking a walk or talking to a friend. Then, with clearer eyes, ask yourself: If I said yes, would taking on the discomfort of a new thing get me closer to where I want to be in my career or relationships?

Often, the fear cloaking our big decisions is “an anxiety toward your dream life,” Marques says.

The tough parts

For years, when Jessica Lapp thought about having a baby, she mostly felt freaked out. The wedding photographer, now 29 years old, would scroll through motherhood accounts on Instagram, where new moms lamented having no time to sleep, exercise or shower.

“Why would you sign up for this?” she recalls thinking.

Still, she could envision having a family with her husband. She began to poke at her fear. Was she focusing on the short-term trials of having a baby and losing sight of the long-term joys of having a child?

Fear can even be helpful, she realised, steeling oneself for the tough parts: the colicky baby, the loneliness of those early months.

“It’s the best decision I ever made,” she told me from her home near Charlottesville, Va., while her 1-year-old, Evelyn, napped.

It’s human to overcomplicate the moments that matter, and that’s OK, says Oded Netzer, a Columbia Business School professor who studies the use of data in decision-making. Research from Netzer and co-authors finds that, when faced with a clear but important choice, we start weighing factors that don’t really matter to us, such as the layout of a potential new office or lunch options at the school your kid would attend if you moved. Doing that makes the decision harder for ourselves, but it matches the gravity of the situation.

Spiralling into our fear, he says, ultimately makes us more confident in our call because we’ve done our due diligence instead of blindly trusting our intuition.

Comfortable, miserable

Not choosing is making a choice, too. Many clients who come to Tega Edwin, a St. Louis-based career counsellor, have stayed in bad jobs for years, terrified they’ll fail or be equally miserable elsewhere. And sure, they might.

Avoiding the unknown, Edwin tells them, guarantees a bad outcome: the job you already know you hate.

“I’m going to be in the exact same circumstance and nothing would change,” Danny Thompson, a software engineer in the Dallas area, says he figured when sizing up whether to try martial arts classes.

After gaining pandemic pounds, he was nervous to don the tight shirts required for jiu jitsu, afraid to be out of breath. Yet he knew there was no way his health would improve if he didn’t go.

“Fifteen seconds in, I was exhausted,” he said of the first lesson. Slowly, he got better. He participated in his first competition this winter, still scared, and placed second in his weight class.

Danger ahead

Sometimes you shouldn’t trudge ahead. Anne Mamaghani, a user-experience consultant in San Jose, Calif., felt torn when a recruiter presented a job opportunity that would have brought her near family in Indiana, exposed her to a new industry and boosted her title. The thought of wresting her two children, ages 10 and 13, from their school and community felt awful, though.

The stakes seemed too high to simply forge on, as she’d done in other situations. After all, it was her family members who would pay the price for a wrong call. After a couple of weeks of considering, she told the recruiter no thanks.

Learning to navigate change can be like building a muscle. When Mark Smith moved to Toronto from Salt Lake City a few years ago with his family, panic hit him on the first day of his new job.

“I just started thinking, what have I done?” he says. It took anti anxiety medication, a visit from friends and several months before he felt confident in his new life. That time abroad did bring him closer to his wife and son, he says, and proved his own resilience.

Smith jumped at the chance when the family had an opportunity to move to Italy last year. This time, he says he felt no fear at all.

“A good life,” he says, “requires a few risks.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

As Paris makes its final preparations for the Olympic games, its residents are busy with their own—packing their suitcases, confirming their reservations, and getting out of town.

Worried about the hordes of crowds and overall chaos the Olympics could bring, Parisians are fleeing the city in droves and inundating resort cities around the country. Hotels and holiday rentals in some of France’s most popular vacation destinations—from the French Riviera in the south to the beaches of Normandy in the north—say they are expecting massive crowds this year in advance of the Olympics. The games will run from July 26-Aug. 1.

“It’s already a major holiday season for us, and beyond that, we have the Olympics,” says Stéphane Personeni, general manager of the Lily of the Valley hotel in Saint Tropez. “People began booking early this year.”

Personeni’s hotel typically has no issues filling its rooms each summer—by May of each year, the luxury hotel typically finds itself completely booked out for the months of July and August. But this year, the 53-room hotel began filling up for summer reservations in February.

“We told our regular guests that everything—hotels, apartments, villas—are going to be hard to find this summer,” Personeni says. His neighbours around Saint Tropez say they’re similarly booked up.

As of March, the online marketplace Gens de Confiance (“Trusted People”), saw a 50% increase in reservations from Parisians seeking vacation rentals outside the capital during the Olympics.

Already, August is a popular vacation time for the French. With a minimum of five weeks of vacation mandated by law, many decide to take the entire month off, renting out villas in beachside destinations for longer periods.

But beyond the typical August travel, the Olympics are having a real impact, says Bertille Marchal, a spokesperson for Gens de Confiance.

“We’ve seen nearly three times more reservations for the dates of the Olympics than the following two weeks,” Marchal says. “The increase is definitely linked to the Olympic Games.”

Getty Images

According to the site, the most sought-out vacation destinations are Morbihan and Loire-Atlantique, a seaside region in the northwest; le Var, a coastal area within the southeast of France along the Côte d’Azur; and the island of Corsica in the Mediterranean.

Meanwhile, the Olympics haven’t necessarily been a boon to foreign tourism in the country. Many tourists who might have otherwise come to France are avoiding it this year in favour of other European capitals. In Paris, demand for stays at high-end hotels has collapsed, with bookings down 50% in July compared to last year, according to UMIH Prestige, which represents hotels charging at least €800 ($865) a night for rooms.

Earlier this year, high-end restaurants and concierges said the Olympics might even be an opportunity to score a hard-get-seat at the city’s fine dining.

In the Occitanie region in southwest France, the overall number of reservations this summer hasn’t changed much from last year, says Vincent Gare, president of the regional tourism committee there.

“But looking further at the numbers, we do see an increase in the clientele coming from the Paris region,” Gare told Le Figaro, noting that the increase in reservations has fallen directly on the dates of the Olympic games.

Michel Barré, a retiree living in Paris’s Le Marais neighbourhood, is one of those opting for the beach rather than the opening ceremony. In January, he booked a stay in Normandy for two weeks.

“Even though it’s a major European capital, Paris is still a small city—it’s a massive effort to host all of these events,” Barré says. “The Olympics are going to be a mess.”

More than anything, he just wants some calm after an event-filled summer in Paris, which just before the Olympics experienced the drama of a snap election called by Macron.

“It’s been a hectic summer here,” he says.

AFP via Getty Images

Parisians—Barré included—feel that the city, by over-catering to its tourists, is driving out many residents.

Parts of the Seine—usually one of the most popular summertime hangout spots —have been closed off for weeks as the city installs bleachers and Olympics signage. In certain neighbourhoods, residents will need to scan a QR code with police to access their own apartments. And from the Olympics to Sept. 8, Paris is nearly doubling the price of transit tickets from €2.15 to €4 per ride.

The city’s clear willingness to capitalise on its tourists has motivated some residents to do the same. In March, the number of active Airbnb listings in Paris reached an all-time high as hosts rushed to list their apartments. Listings grew 40% from the same time last year, according to the company.

With their regular clients taking off, Parisian restaurants and merchants are complaining that business is down.

“Are there any Parisians left in Paris?” Alaine Fontaine, president of the restaurant industry association, told the radio station Franceinfo on Sunday. “For the last three weeks, there haven’t been any here.”

Still, for all the talk of those leaving, there are plenty who have decided to stick around.

Jay Swanson, an American expat and YouTuber, can’t imagine leaving during the Olympics—he secured his tickets to see ping pong and volleyball last year. He’s also less concerned about the crowds and road closures than others, having just put together a series of videos explaining how to navigate Paris during the games.

“It’s been 100 years since the Games came to Paris; when else will we get a chance to host the world like this?” Swanson says. “So many Parisians are leaving and tourism is down, so not only will it be quiet but the only people left will be here for a party.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.