The Exodus of China’s Wealthy to Japan

Frustrations with China’s autocratic political system and economic slowdown provoke the flight, helping Tokyo’s luxury property market

TOKYO—Last year, China native Tomo Hayashi, the owner of a metals-trading firm, moved to Tokyo. He quickly adopted a Japanese name, spent the equivalent of about $650,000 on a luxury waterfront condo and, in March, brought his family to join him.

The 45-year-old, whose two boys just started in a Japanese elementary school, is one of the many wealthy Chinese driving a boom in high-end Tokyo properties and reshaping the city.

Frustrations with Beijing’s autocratic political system, which flared during abrupt pandemic-era lockdowns and have only grown since then, have helped drive the wave, according to real-estate agents and others watching the exodus. China’s economic slowdown and its struggling stock market are also motivating wealthy people to leave the country, they say.

Hayashi, who like many Chinese buyers avoids discussing politics back home, said the move to Tokyo was a challenge. “But we like Japan—food, culture, education and safety,” he said.

Japan isn’t the only haven for Chinese people seeking a Plan B. The U.S., Canada and Singapore are among the countries drawing Chinese migrants, while Hong Kong residents often head to the U.K.

But Japanese cities that are just a few hours’ flight from China are a leading choice for better-off Chinese people. Japan’s real-estate prices are low for foreigners thanks to the weak yen and it is fairly easy for them to purchase property. And the Japanese writing system uses Chinese characters in part, so new arrivals can more easily find their way around.

A report last June by Henley & Partners that tracks worldwide migration trends estimated that a net total of 13,500 high-net-worth Chinese people would migrate overseas during the year, making China the biggest worldwide loser in that category.

Japan had about 822,000 Chinese residents as of the end of last year, up 60,000 from the previous year in the biggest jump in recent years.

Tokyo real-estate broker Osamu Orihara, a naturalised Japanese citizen who was born in China, said his revenue has tripled or quadrupled compared with 2019 before the pandemic, driven in large part by Chinese buyers.

“What is different from the past is there are more who want to get a long-term visa,” Orihara said.

About one-third of the condos on the floor of the 48-story building where Hayashi lives are owned by individuals with Chinese names or companies whose representatives have Chinese names, according to real-estate records. People in the neighbourhood next to Tokyo Bay, a forest of high-rise condominiums, say the typical building has a quarter or more Chinese residents.

Hayashi said a Chinese friend recommended the building. He described the price for the 650-square-foot, two-bedroom unit as reasonable compared with Hong Kong, where he briefly lived after leaving his hometown of Shenzhen, China, and he said the value has already gone up by some 10% to 15%.

The average price for new apartments in central Tokyo was up nearly 40% last year to the equivalent of about $740,000, according to industry figures. The rise was influenced by a flood of new properties appealing to affluent Chinese buyers who are concerned about a steep slump in their own market, market watchers say.

Brokers said Chinese buyers were also eager to buy resort properties. On the northern island of Hokkaido, a town named Furano that is near ski slopes saw residential land prices rise 28% last year, the fastest rate nationwide. Hideyuki Ishii, a local broker, said wealthy Chinese from the mainland, Hong Kong and Singapore were looking for vacation homes.

“A red tsunami is coming with the Chinese flag in tow,” he said.

Chinese people who want to move to Japan and buy an apartment or house generally face two challenges: getting their money into Japan and getting a visa.

China restricts how much its residents can take out of the country, but many Chinese buyers own companies with international operations or have overseas investments. Orihara, the broker, said his clients usually have a bank account in Hong Kong or Singapore from which they can wire money.

One exception, he said, was a client who bought a $190,000 property and mobilised friends and relatives to carry cash little by little over a few months.

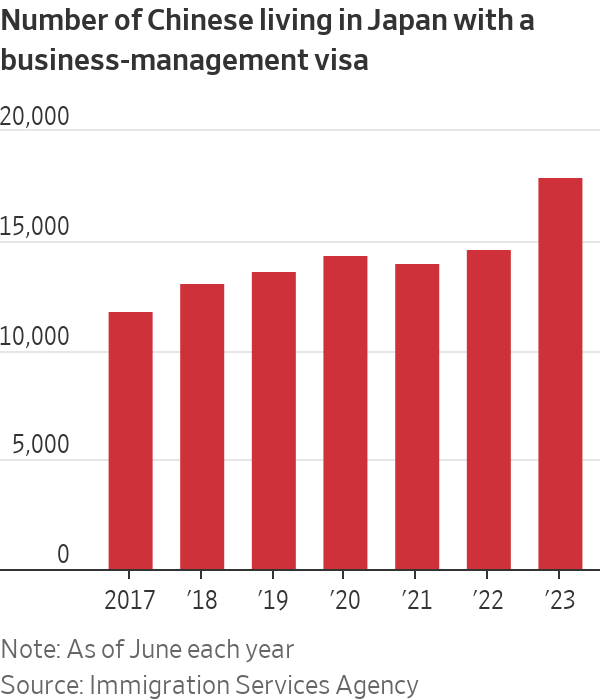

As for the visa, people who invest the equivalent of at least $32,000 in a Japanese business that has a permanent office and two or more employees can get a business-management visa.

Other Chinese obtain a visa for what Japan describes as high-level specialists in business, technology or academia. The number of Chinese with the technology version—software engineers and the like—rose 30% between 2019 and 2023 to more than 10,000. Holders can apply for permanent residency in Japan in as little as one year under a point system that favours those with high salaries and advanced degrees.

Tokyo visa consultant Wang Yun, who is originally from China, said most of his clients were Chinese, often business owners or corporate executives in their late 30s to 50s from big cities such as Shanghai or Beijing.

Once settled, many Chinese opt to use a Japanese name, including on legal records in Japan. Some turn to Japanese readings of their name’s Chinese characters, while others pick an entirely new name.

In addition to convenience when dealing with Japanese people, using a Japanese name allows people of Chinese origin to keep a lower profile back home, where they typically still have family. That may be helpful because Chinese authorities tend to frown on the trend of people moving out with their assets.

Popular Chinese social-media platforms such as Weibo , Little Red Book and WeChat buzz with talk of purchasing real estate in Japan. There is some censorship: Citing government regulations, Weibo blocks searches using a hashtag that translates as “Chinese investors are flooding into Tokyo to buy houses,” though users can search for that subject without the hashtag symbol.

Satoyoshi Mizugami, another broker in Tokyo with roots in China, said he hoped to triple his staff to 300 people in five years to handle all the new business from Chinese buyers. A new office building is under construction to accommodate them, he said.

One of Mizugami’s clients is a 42-year-old Chinese man who was educated in the U.K. and started a restaurant business in China and the U.S. He had been living in China since the pandemic and, when he decided to leave, chose Japan because he thought the business environment was better than that of the U.S. Last year, he bought an apartment in central Tokyo, using the money from selling his U.S. business.

This buyer said he was opening a food-trading business in Japan and applying for a visa to move to Japan with his Chinese-American wife and their 4-year-old son.

On a recent morning in Tokyo, Hayashi, the buyer of the waterfront condominium, was busy helping his boys, 9 and 7, learn Japanese and English online and watching them play outside. His wife had briefly returned to China to see their 15-year-old daughter, who is staying to finish high school there.

Hayashi said he intended to stick with Japan for the long haul. He said one attraction was the high level of medical care, which he expects would be valuable when he gets older. He was careful to note that he has been paying Japanese taxes since last year. As a holder of a high-level specialist visa, he said “I’d like to get permanent residency in four or five years.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

The Republican nominee says it would help bring down home prices, though these buyers account for a fraction of U.S. home sales

Former President Donald Trump said he would ban undocumented immigrants from obtaining home mortgages, a move he indicated would help ease home prices even though these buyers account for a tiny fraction of U.S. home sales.

Home loans to undocumented people living in the U.S. are legal but they aren’t especially common. Between 5,000 and 6,000 mortgages of this kind were issued last year, according to estimates from researchers at the Urban Institute in Washington.

Overall, lenders issued more than 3.4 million mortgages to all home purchasers in 2023, federal government data show.

Trump, the Republican presidential nominee, made his comments Thursday during a policy speech to the Economic Club of New York in Manhattan.

Housing remains a top economic issue for voters during this presidential election. Rent and home prices grew at historic rates during the pandemic and mortgage rates climbed to levels not seen in more than two decades. A July Wall Street Journal poll showed that voters rank housing as their second-biggest inflation concern after groceries.

Both major candidates for the 2024 presidential election have made appeals to voters on housing during recent campaign stops, though the issue has so far featured more prominently in Vice President Kamala Harris ’s campaign.

Trump has blamed immigrants for many of the nation’s woes, including crime and unemployment. Now, he is pointing to immigrants as a cause of the nation’s housing-affordability crisis. Yet some affordable-housing advocates and real-estate professionals said Trump’s mortgage proposal would fail to bring relief to priced-out home buyers.

“It’s unfortunate that given the significant housing affordability crisis that is widely acknowledged across most partisan lines, we are arguing about a minuscule segment of the market,” said David Dworkin, president of the National Housing Conference, an affordable-housing advocacy group.

Gary Acosta, chief executive of the National Association of Hispanic Real Estate Professionals, a trade organization, said, “It’s just another effort to vilify immigrants and to continue to scapegoat them for any issues that we have here in the United States.”

A Trump campaign spokeswoman didn’t immediately respond to a request for comment.

Undocumented immigrants in the U.S. can obtain an obscure type of mortgage designed for taxpayers without Social Security numbers, most of whom are Hispanic. The passage of the USA Patriot Act of 2001 allowed banks to use identification numbers from the Internal Revenue Service as an alternative to Social Security, extending a number of financial services to people without legal status for the first time.

Mortgage loans for undocumented immigrants are typically higher interest and borrowers include legal residents who have undocumented spouses, Acosta said. Lenders include regional credit unions and community-development financial institutions.

In his speech, Trump said that “the flood” of undocumented immigrants is driving up housing costs. “That’s why my plan will ban mortgages for illegal aliens,” he said.

Trump didn’t elaborate on how he would enact a ban on such loans.

Though mortgages for undocumented people living in the U.S. are relatively rare, residential real-estate purchases by foreign nationals are big business , especially in expensive coastal cities such as New York and Los Angeles. These sales have declined in recent years, however.

Close to half of foreign purchases are made by people residing abroad, while the other half are made by recent immigrants or residents on nonimmigrant visas, according to an annual survey by the National Association of Realtors. Many affluent foreigners buy U.S. homes with cash instead of obtaining mortgage financing.

In his Thursday speech, which focused mostly on other economic matters such as energy and taxation, Trump proposed other measures to bring down housing costs, including cutting regulations for builders and allowing more building on federal land. Similar ideas appeared in the housing policy outline Harris released in August .

The former president has spoken on housing-related issues in speeches at other recent campaign stops, including in Michigan last month, where he touted his administration’s 2020 overturn of a policy that had encouraged cities to reduce racial segregation .

“I keep the suburbs safe,” Trump said. “I stopped low-income towers from rising right alongside of their house. And I’m keeping the illegal aliens away from the suburbs.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.