Why In-the-Know Men Are Dressing Like Cary Grant in 2024

Stylish guys are now embracing a refined, almost old-timey, style: ‘It projects power and confidence.’

On a recent trip to the new Manhattan flagship for Stòffa, a menswear brand, Colin King made a beeline for the back of the store. The 36-year-old stylist and artistic director had booked a made-to-measure appointment—but not for a suit. Instead, he chose a cotton-silk shirt, relaxed pants in a classy wool, and a drapey, chocolate-brown shirt-jacket, all for his everyday wardrobe. He also snapped up slipperlike suede loafers. “They’re so handsome,” he said.

Lately, the way men like King dress has undergone a subtle shift. Those in the know have been embracing a more refined and considered, if not quite formal, style. “There’s a real move toward relaxed elegance,” said London designer and tailor Charlie Casely-Hayford. “It looks effortless, there’s a nonchalance, but it projects power and confidence.” Stòffa, a newly buzzy, 10-year-old label embodies the look.

Despite a few modern tweaks, we’re talking about the kind of get-ups that Cary Grant might have worn to lounge about—polished yet unstuffy, and with a certain old-timey appeal. The look is linked to the much-talked-about “quiet luxury” movement, but it often has “more personality than quiet luxury,” said David Telfer, creative director at British brand Sunspel. Think flowy, pleated pants, bold polos, souped-up chore jackets and loafers with waferish soles.

Lots of men who now crave easy elegance were stocking up on streetwear a year ago, according to Dag Granath, co-founder of Saman Amel, a Stockholm brand known for its tasteful tailoring. “What we’re seeing is that a 28-to-38-year-old customer is swapping out [streetwear from] high-end fashion labels for a bit of tailoring to anchor the rest of their wardrobe on,” said Granath.

Jon Gorrigan, 43, a fashion photographer in London, used to live in casual streetwear. But he’s “dressing smarter now,” he said, “more like my grandfather, who was a real sharp dresser. He wasn’t a rich man, but he always looked elegant.” He’s swapped sweatshirts for striped polos from London brand King & Tuckfield, and the odd fun piece like a faded Gitman Vintage Hawaiian shirt. Dressing “with more consideration,” as he put it, “makes you feel more grown-up.”

A pair of Saint Laurent loafers were Gorrigan’s entrée into elegance. “They are lower profile, which feels more streamlined, with a subtle monogram,” he said. Indeed, slim-soled shoes, from moccasins to sneakers, help define the modern Cary Grant look. “Men want slimmed-down shoes to go with the new, smarter, classic look,” said Tim Little, creative director and CEO at Grenson, a British shoemaker. The chunky, lug-sole bases that have reigned for years appear to have undertaken a juice cleanse. Current hot, refined styles include leather slippers by Lemaire, Saman Amel’s suede moccasins, and super-lean sneakers like Dries Van Noten’s suede style and Miu Miu’s interpretation of the New Balance 530. A finer shoe “feels a bit more dressy and chic, and won’t dominate the whole outfit in the way a chunky boot would,” said Granath.

Such streamlined kicks go nicely with flowy linen trousers, dark denim and polo shirts—whether preppy buttoned styles or “Johnny collar” polos , a sexier, buttonless take. Sunspel reports that sales of its Riviera polo, a trim design sported by Daniel Craig in “Casino Royale” (2006), have increased by 51% in the U.S. in the last four months, year on year. On the brand’s website, this polo is most often bought with an unstructured linen blazer, noted Telfer.

Those who want a tad less formality than a blazer will appreciate how the humble chore jacket is being reworked in luxe fabrics. The results feel easy yet urbane. See Zegna ’s floppy, silk-linen take, or upcoming fall designs from Scotland’s Johnstons of Elgin made from premium merino and Scottish tweed.

Though elegant dressing reads as expensive, you can score the look at reasonable prices. Accessible labels like Madewell, Percival and Cos sell sophisticated polos and roomy, pleated trousers. Meanwhile, you can find streamlined loafers at OG brand G.H. Bass for $175.

Elegant needn’t be boring, noted Bryan O’Sullivan, 42, a design-studio founder who’s based in both London and New York. His workday uniform consists of high-waist pants and taupe knit polos, “which does feel quite Cary Grant,” he said. But he’ll occasionally add “a splash of flair” with choice items like Bode cream pants embellished with quilted cats.

He said the confidence that this pulled-together, slightly offbeat look projects is good for business. “When you’re trying to convince a client of your creative vision, it does help if you look the part.”

The Wall Street Journal is not compensated by retailers listed in its articles as outlets for products. Listed retailers frequently are not the sole retail outlets.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

The bequests benefit charities, distant relatives and even pets

Charities, distant relatives and even pets are benefiting from surprise inheritances. They can thank people without children.

Not having children is becoming more common, both among millennials and older people. A July Pew Research Center analysis found that 20% of U.S. adults age 50 and older hadn’t had children.

And many of these people don’t have wills. An AARP survey found half of childless people age 50-plus who live alone have a will, compared with 57% of others that age. Those without wills have less control over what happens to their money, which often ends up in the hands of people who don’t expect it.

This phenomenon of a surprise inheritance is common enough that it has a name: the laughing heir .

“All they do is get the money and go, ‘Ah ha ha, look at that,’ ” said Michael Ettinger , an estate lawyer in New York.

Kelley Gilpin McKeig, a 64-year-old healthcare-industry consultant in Ridgefield, Wash., received a phone call several years ago saying her cousin Nick Caldwell left behind money in a savings account. They hadn’t been in touch for 20 years.

“I thought it was a scam,” she said. “Nobody else in our family had heard that he had passed.”

She hunted down his death certificate and a news article and learned he had died about a year and a half before in a workplace accident.

Caldwell, who was in his 50s, had died without a will. His estate was split among cousins and an uncle. It took about two years for the money to be distributed because of the paperwork and court approval involved. Gilpin McKeig’s share was $2,300.

Afterward, she updated her will to make sure what she has doesn’t go to “just anybody down the line, or cousins I don’t care about.”

Who inherits

There are trillions of dollars at stake as baby boomers age.

Most people leave their money to spouses and children when they die. A 2021 analysis of Federal Reserve survey data found that 82% of heirs’ inheritances came from parents.

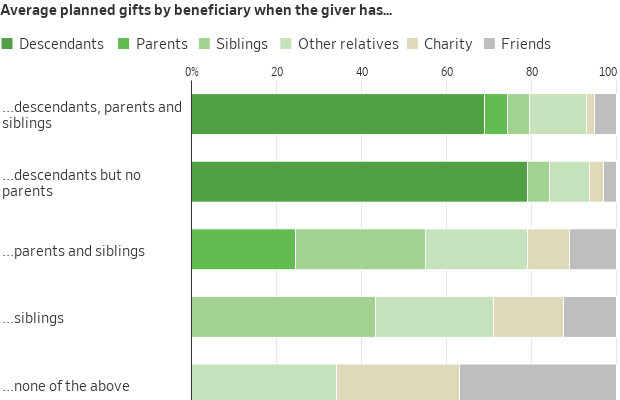

People with no children say they want to leave a greater share of their estates to charity, friends and extended family , according to research by two Yale law professors that surveyed 9,000 U.S. adults.

Rebecca Fornwalt, a 33-year-old writer, created a trust after landing a book deal. While her heirs are her parents, her backup heirs include her sister and about a half-dozen close friends. She set aside $15,000 for the care of each of her two dogs.

Susan Lassiter-Lyons , a financial coach in Florence, Ariz., said one childless client is leaving equal interests in her home to her two nephews. Another is leaving her home to a man she has been friends with for a long time.

“She broke his heart years ago and she feels guilted into leaving him property,” Lassiter-Lyons said.

A client who is a former escort estranged from her family is leaving her estate to two friends and to charity.

Lassiter-Lyons, who doesn’t have children, set up a trust for her two dogs should she and her wife die. The pet guardian, her wife’s sister, would live in their house while taking care of the dogs. When the dogs die, she inherits the house.

In the Yale study, people without descendants—children or grandchildren—intended to give 10% of their estates to charity, on average, more than triple the intended amount of those with descendants.

The Jewish Community Foundation of Los Angeles, which manages $1.3 billion of assets, a few years ago added an “heirless donors” section to its website that profiles donors and talks about building a legacy.

“Fifteen years ago, we never talked about child-free donors at all,” said Lew Groner , the foundation’s vice president for marketing.

In the absence of a will, heirs are determined by state law . Assets can wind up in the state’s hands. In New York, for example, $240 million in unclaimed funds over the past 10 years has arrived from estates of the deceased, not including real estate, according to the state comptroller’s office. In California, it is $54.3 million.

Hard questions

Financial advisers say a far bigger concern than who gets what is making sure there is enough money and support for a comfortable old age, because clients without children can’t call on them for help.

“I hope there is something left to leave,” said Stephanie Maxfield, a 43-year-old therapist in southern Colorado. “But if there isn’t, I think that’s OK, too.”

She said she would like to leave something to her partner’s nieces and nephews, as well as animal shelters and domestic-violence shelters. Her best friend is a beneficiary.

Choosing an estate executor and who would handle money and health decisions on your behalf can be difficult when you don’t have children, financial advisers say. Using a promised inheritance as a reward for taking care of you when you are older isn’t a good solution, said Jay Zigmont , an investment adviser focused on childless people.

“Unfortunately, it is relatively common to see family members who are in the will decide to opt for cheaper medical care (or similar decisions) in order to protect what they will be inheriting,” he said in an email.

Kirsten Tompkins, who is from Birmingham, U.K., and works in consulting, along with her husband divided their estate among their dozen nieces and nephews.

Choosing heirs was the easy part. What is hard is figuring out whom to ask for help as she and her husband get older, she said.

“A lot of us are at an age where we are playing that role for our parents,” the 50-year-old said, referring to tasks such as providing tech support and taking parents to medical appointments. “Who is going to do that for us?”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.