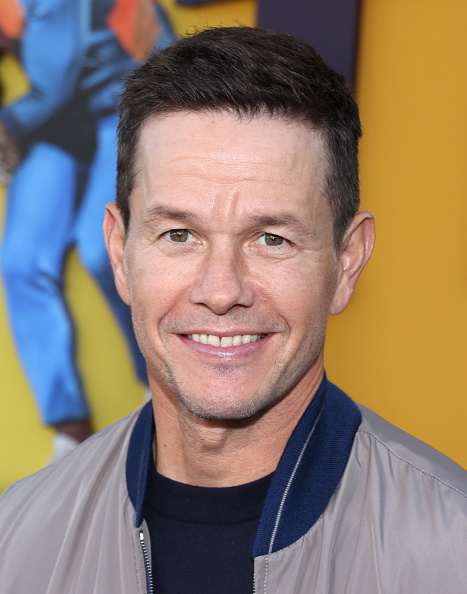

A Beverly Hills Home Once Owned by Mark Wahlberg Asks $28.5 Million

The actor sold the 9,000-square-foot house, which he remodeled, for $10.3 million in 2013

The former home of actor Mark Wahlberg in Beverly Hills, Calif., is hitting the market for $28.5 million.

The seller is Don Rufus Hankey, founder of the real-estate development company Knight Development Group and son of the auto-services mogul Don Hankey. The younger Mr. Hankey said he bought the house in 2018 for $12.4 million.

Mr. Wahlberg bought the property through a trust in 2001 for nearly $5 million and remodelled it. The “Departed” actor sold it in 2013 for $10.3 million, according to public records.

The main house on the roughly 1.7-acre property was built around 1984. It measures approximately 9,000 square feet with five bedrooms. The property also contains a two-bedroom guesthouse, an outdoor sports court, a putting green, an outdoor kitchen, and a pool with a grotto and waterslide. A roughly 2,900-square-foot, detached gym with a boxing ring dates back to Mr. Wahlberg’s time.

“It had a lot of land, it was a nice house, and it had some special amenities you don’t see in many houses,” Mr. Hankey said. His wife, Skye Hankey, a real-estate agent with Premier Realty Services, is the listing agent on the property along with Myles Lewis of Compass.

The Hankeys spent about four years renovating the property, they said. To enhance the main home’s canyon views, they knocked down walls and installed more windows. They also redid the floors and ceilings, updated the appliances and added smart home technology.

Outside, they redid stone work and landscaping and repaved the driveway and sports court. They also knocked down an old pool house, and added an outdoor kitchen and a pool bathroom, Ms. Hankey said.

Mr. Hankey said he and his wife considered moving into the home but instead decided to list it after renovations were completed this year. Their primary home is in Florida, they said.

The home is located in a gated community called Oak Pass Road in the wealthy ZIP Code 90210. According to Redfin, the average sale price in 90210 was $7.15 million last month, up 21.7% from the same time last year.

Mr. Wahlberg, who stars in HBO’s “Wahl Street,” now lives outside Las Vegas.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Savvy high net worth players from Australia and Asia are getting on board as the residential landscape shifts

Build-to-rent (BTR) residential property has emerged as one of the key sectors of interest among institutional and private high-net-worth investors across the Asia-Pacific region, according to a new report from CBRE. In a survey of 500 investors, BTR recorded the strongest uptick in interest, particularly among investors targeting value-added strategies to achieve double-digit returns.

CBRE said the residential investment sector is set to attract more capital this year, with investors in Japan, Australia and mainland China the primary markets of focus for BTR development. BTR is different from regular apartment developments because the developer or investor–owner retains the entire building for long-term rental income. Knight Frank forecasts that by 2030, about 55,000 dedicated BTR apartments will have been completed in Australia.

Knight Frank says BTR is a proven model in overseas markets and Australia is now following suit.

“Investors are gravitating toward the residential sector because of the perception that it offers the ability to adjust rental income streams more quickly than other sectors in response to high inflation,” Knight Frank explained in a BTR report published in September 2023.

The report shows Melbourne has the most BTR apartments under construction, followed by Sydney. Most of them are one and two-bedroom apartments. The BTR sector is also growing in Canberra and Perth where land costs less and apartment rental yields are among the highest in the country at 5.1 percent and 6.1 percent, respectively, according to the latest CoreLogic data.

In BTR developments, there is typically a strong lifestyle emphasis to encourage renters to stay as long as possible. Developments often have proactive maintenance programs, concierges, add-on cleaning services for tenants, and amenities such as a gym, pool, yoga room, cinema, communal working spaces and outdoor barbecue and dining areas.

Some blocks allow tenants to switch apartments as their space needs change, many are pet-friendly and some even run social events for residents. However, such amenities and services can result in BTR properties being expensive to rent. Some developers and investors have been given subsidies to reserve a portion of BTR apartments as ‘affordable homes’ for local essential services workers.

Ray White chief economist Nerida Conisbee says Australian BTR is a long way behind the United States, where five percent of the country’s rental supply is owned by large companies. She says BTR is Australia’s “best bet” to raise rental supply amid today’s chronic shortage that has seen vacancy rates drop below 1% nationwide and rents skyrocket 40% over the past four years.

Ms Conisbee says 84 percent of Australian rental homes are owned by private landlords, typically mum and dad investors, and nine percent are owned by governments. “With Australia currently in the midst of a rental crisis, the question of who provides rental properties needs to be considered,” Ms Conisbee said. “We have relied heavily on private landlords for almost all our rental properties but we may not be able to so readily in the future.” She points out that large companies can access and manage debt more easily than private landlords when interest rates are high.

The CBRE report shows that Asia-Pacific investors are also interested in other types of residential properties. These include student accommodation, particularly in high migration markets like Australia, and retirement communities in markets with ageing populations, such as Japan and Korea. Most Asia Pacific investors said they intended to increase or keep their real estate allocations the same this year, with more than 50 percent of Australian respondents intending to invest more.

This stylish family home combines a classic palette and finishes with a flexible floorplan

Consumers are going to gravitate toward applications powered by the buzzy new technology, analyst Michael Wolf predicts