A Flurry of Bidding Has Started on a Mint Condition Spider-Man Comic

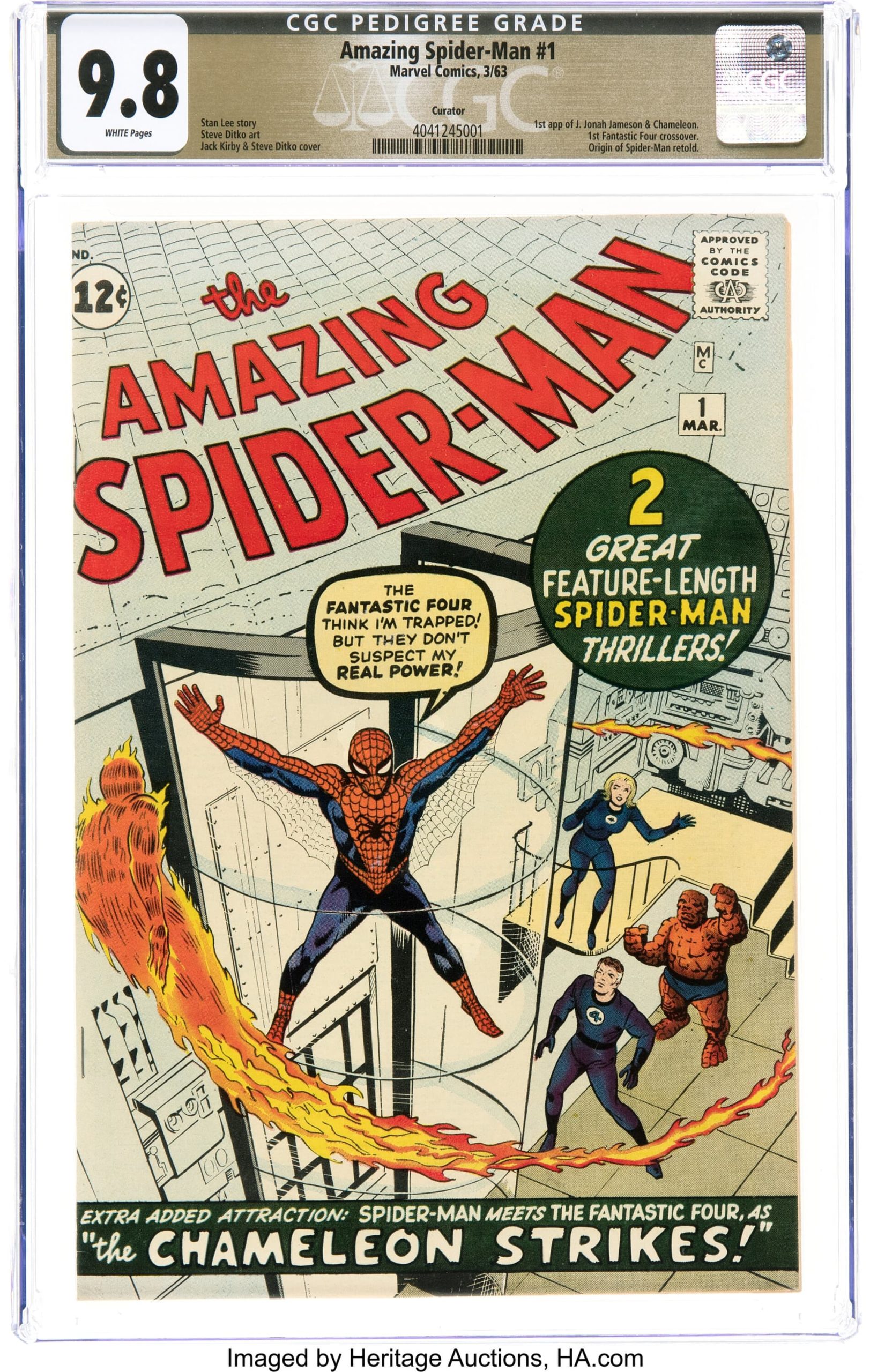

An impressively well-preserved issue of The Amazing Spider-Man No. 1 from 1963 will be sold at auction early next year and bids have already reached six figures.

The inaugural issue, which cost 12 cents when it hit newsstands 60 years ago, is in such good condition that it’s being called the “world’s greatest copy” by Heritage Auctions, which is selling the collectible as part of its Comics & Comic Art SignatureAuction, running from Jan. 11-14.

Considered to be in “near mint/mint” condition, the issue has a grading of 9.8 out of 10 from Certified Guaranty Company (CGC), a third-party grading service for pop-culture collectibles.

The comic is from a collection that was amassed by an employee of a museum who stored the comics in tight packs on the museum’s premises. It’s “considered one of the best Silver Age collections ever discovered,” said Heritage Auctions, referring to the Silver Age of Comic Books, a period that spanned roughly from 1956 to 1970 and saw the creation of some of the most famous superheroes including the X-Men, the Hulk, Iron Man and, of course, Spider-Man.

As of Wednesday afternoon, the current bid for the comic, which marked Spider-Man’s first appearance in his eponymous title, stood at US$220,000.

In July, another first issue of The Amazing Spider-Man, in slightly worse condition, sold for US$520,380.

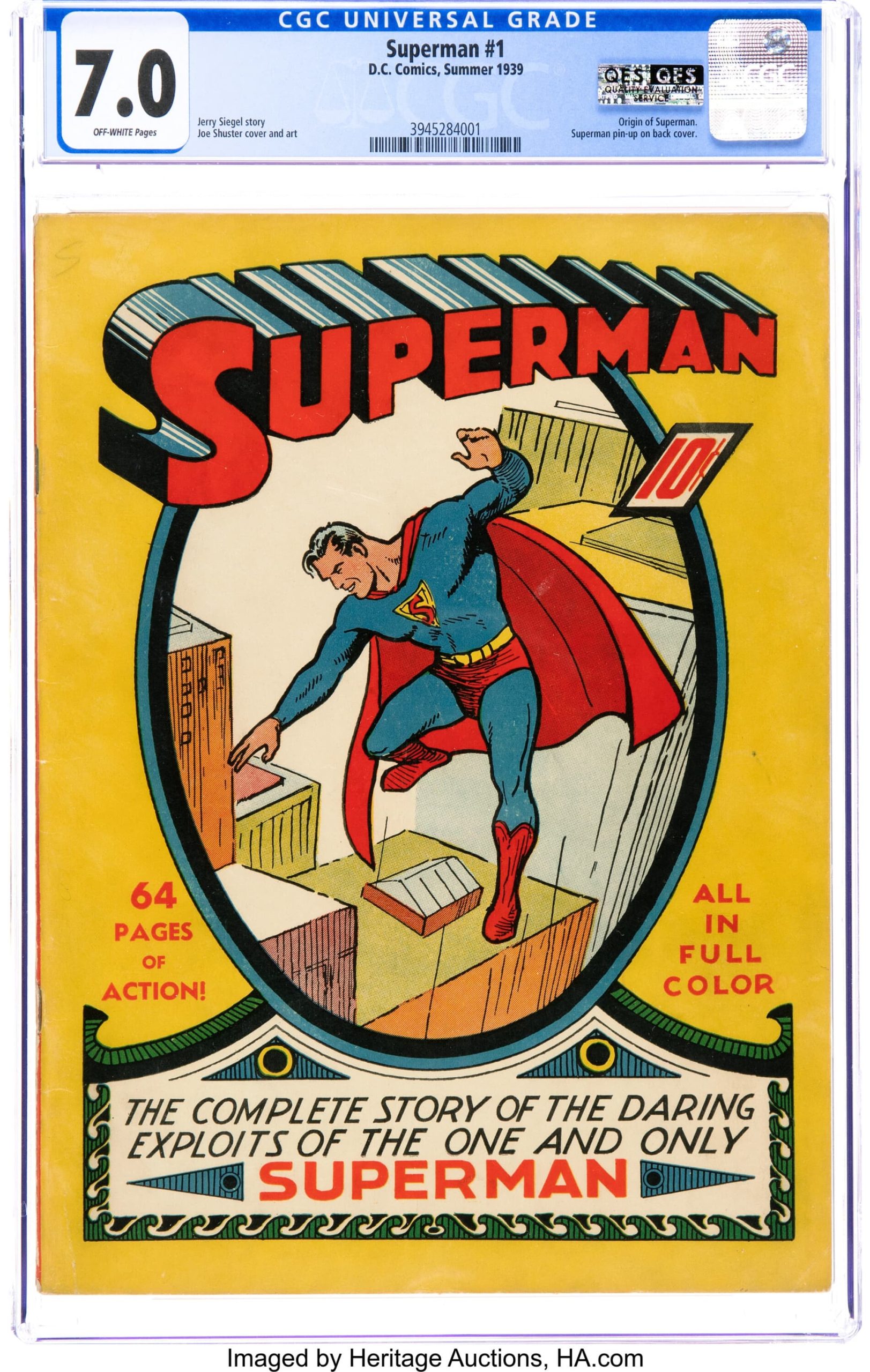

Also selling at the auction is “one of the world’s finest copies” of Superman No. 1 from 1939, according to Heritage. It’s one of only two in the world graded a 7.0 by CGC and considered to be in “fine/very fine” condition.

“This is the finest unrestored copy we’ve ever offered,” the auction house said online.

A Superman No. 1—with a CGC grading of 8.0—sold for US$5.3 million in January 2022, breaking the record for the most expensive comic ever sold.

As of Wednesday afternoon, the highest bid for the issue stands at US$460,000.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Excluding the Covid-19 pandemic period, annual growth was the lowest since 1992

Australia’s commodity-rich economy recorded its weakest growth momentum since the early 1990s in the second quarter, as consumers and businesses continued to feel the impact of high interest rates, with little expectation of a reprieve from the Reserve Bank of Australia in the near term.

The economy grew 0.2% in the second quarter from the first, with annual growth running at 1.0%, the Australian Bureau of Statistics said Wednesday. The results were in line with market expectations.

It was the 11th consecutive quarter of growth, although the economy slowed sharply over the year to June 30, the ABS said.

Excluding the Covid-19 pandemic period, annual growth was the lowest since 1992, the year that included a gradual recovery from a recession in 1991.

The economy remained in a deep per capita recession, with gross domestic product per capita falling 0.4% from the previous quarter, a sixth consecutive quarterly fall, the ABS said.

A big area of weakness in the economy was household spending, which fell 0.2% from the first quarter, detracting 0.1 percentage point from GDP growth.

On a yearly basis, consumption growth came in at just 0.5% in the second quarter, well below the 1.1% figure the RBA had expected, and was broad-based.

The soft growth report comes as the RBA continues to warn that inflation remains stubbornly high, ruling out near-term interest-rate cuts.

RBA Gov. Michele Bullock said last month that near-term rate cuts aren’t being considered.

Money markets have priced in a cut at the end of this year, while most economists expect that the RBA will stand pat until early 2025.

Treasurer Jim Chalmers has warned this week that high interest rates are “smashing the economy.”

Still, with income tax cuts delivered at the start of July, there are some expectations that consumers will be in a better position to spend in the third quarter, reviving the economy to some degree.

“Output has now grown at 0.2% for three consecutive quarters now. That leaves little doubt that the economy is growing well below potential,” said Abhijit Surya, economist at Capital Economics.

“But if activity does continue to disappoint, the RBA could well cut interest rates sooner,” Surya added.

Government spending rose 1.4% over the quarter, due in part to strength in social-benefits programs for health services, the ABS said.

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.