Cruise Lines Pursue Greener Journeys Ahead of New Climate Rules

As tourists flock to ships and strain port cities, companies are pushed to invest in cleaner tech

AMSTERDAM—The global cruise industry is trying to go green ahead of a wave of new climate rules. Getting it done involves managing high costs, a dearth of renewable fuel and pressure from regulators and environmental groups.

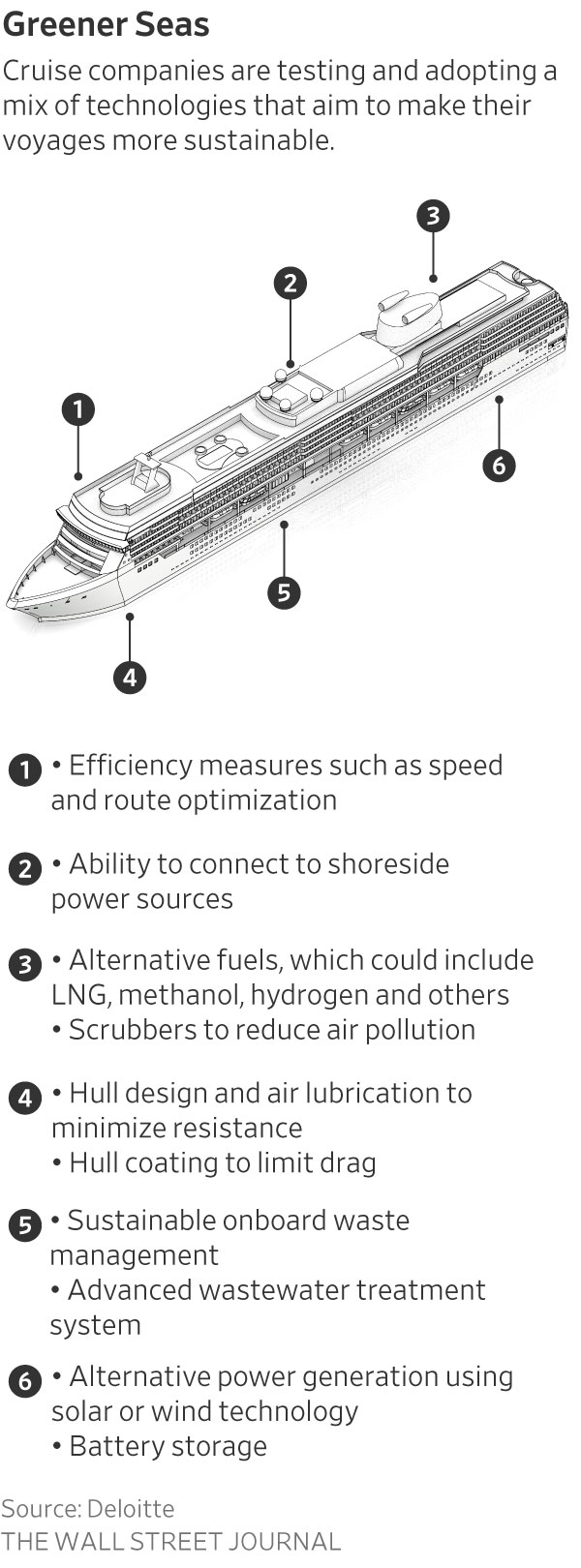

Cruise operators are buying new ships that can run on alternative fuels, redesigning hulls to move more efficiently through the water and adding electricity hookups for when their ships are at port, where they otherwise might pump out toxic exhaust.

Carnival, the world’s biggest cruise company, has equipped more than half of its fleet to plug into local power grids when docked. Royal Caribbean and Norwegian Cruise Line Holdings have ships on order that the companies say will be able to run on methanol. MSC Cruises uses a digital platform to analyse weather, fuel consumption and other data to optimise its ships’ efficiency.

The companies are preparing for new rules that will require them to pay for some of their emissions and meet new targets in transitioning to cleaner fuels. They also expect that global regulations could tighten further. Cruise lines, like other parts of the shipping industry, are pushed to act quickly and thoroughly because ships that are ordered today are likely to be in operation for decades.

“We build ships now that last 40 years,” said Torstein Hagen, chairman of cruise company Viking, which has ships on order that will be equipped to use renewable hydrogen. “We’d better get it right.”

Complicating the industry’s investments is the high cost of building and fuelling eco-friendly ships after some cruise operators racked up billions of dollars in debt during the pandemic. Cleaner renewable fuels are expensive and aren’t yet available or used in large quantities. Just 34 of the world’s ocean-cruise ports—roughly 2%—have electrical hookups, according to industry figures.

The number of passengers taking oceangoing cruises is expected to jump this year to more than 31 million, according to industry group Cruise Lines International Association, up from about 20 million last year and about 6% above 2019 levels, before the pandemic largely shut down the industry.

That revival has put renewed pressure on port cities, as some seek limits on visits by cruise ships, and added to concerns from environmentalists about the industry’s contribution to global greenhouse gas emissions.

Although cruise ships are responsible for a tiny portion of overall human-caused greenhouse-gas emissions, their onboard services contribute to higher emissions on average compared with cargo ships, according to industry estimates.

Cruises are also discretionary—nobody must go on a cruise—a point that environmentalists raise in their calls for fast action from the industry.

Faig Abbasov, director for shipping at environmental group Transport & Environment, said some cruise companies are investing in technology that can sharply reduce their emissions once it is in use—such as hydrogen fuel cells or engines that can run on green methanol—but the overall industry isn’t moving quickly enough.

New environmental rules are set to take effect over the coming years.

Shipping companies whose vessels start or end voyages in Europe, including those that run large cruise ships, will have to start paying for a portion of their emissions beginning next year through the EU’s emissions-trading system. A separate EU law will compel shipping companies to progressively increase their use of lower-emission fuels beginning in 2025, and ports in the bloc that are used frequently by cruise and containerships will need to provide onshore electricity connections by 2030.

California already has state-level rules that require cruise ships to plug into shore power or otherwise sharply curb their emissions while at high-traffic ports including Los Angeles and Long Beach.

And the International Maritime Organization, a United Nations organisation, in July committed to new greenhouse-gas emission reduction targets. The IMO also has rules for energy efficiency and carbon intensity in the shipping industry.

Regulations are “the only way that you can seriously drive this kind of massive step change in what we’re doing as an industry,” said Linden Coppell, MSC Cruises’ vice president for sustainability. Incoming rules will affect the kinds of ships the company orders in the future, how it transitions to alternative fuels and efforts to improve the vessels’ efficiency, she said.

Cruise companies are moving ahead with green investments despite the debt that some of them racked up during the pandemic.

Carnival said it has fewer new ships on order than at any point in recent decades. However, the company said it hasn’t significantly reduced capital expenditures, which include investments in sustainability-related technologies. Royal Caribbean said its sustainability commitments remained steadfast during the pandemic.

Norwegian has indicated in earnings reports that compliance with environmental rules and its own climate commitments will be costly. The company announced plans for two new methanol-ready ships earlier this year.

The biggest cruise companies “have tremendous access to capital and continue to invest in sustainable technologies,” said Ivan Feinseth, director of research and analyst at Tigress Financial Partners.

Not every move to alternative technology is winning fans. LNG emits less carbon dioxide and significantly fewer air pollutants than the heavy fuel oil used in many ships. But environmental groups say any climate benefits are overshadowed by the escape of unburned methane, a potent contributor to global warming, into the atmosphere.

“LNG is the best thing out there today,” said William Burke, Carnival’s chief maritime officer and a retired vice admiral with the U.S. Navy. He said ships that are built to use LNG will also be capable of running on bio or synthetic forms of the fuel in the future.

Carnival is working with manufacturers to reduce the release of methane and will have more efficient engines in newer ships, he said.

Green methanol, which can be produced from biomass or by using renewable electricity, is gaining ground as a viable alternative fuel for the shipping industry, in part because it can be stored at room temperature.

Norwegian expects to take delivery of two methanol-ready ships in 2027 and 2028. Mark Kempa, the company’s chief financial officer, acknowledged on an earnings call earlier this year that the ships would cost more, but added, “going green is not free.”

Privately owned cruise company Viking, which has a fleet of 10 ocean vessels, says it sees renewable hydrogen as the best future fuel. The company ordered ships that can run on both hydrogen and traditional marine fuels, and its Viking Neptune vessel has hydrogen fuel cells on board to test out the technology. But supplies of the fuel are still limited.

“We can’t solve the world’s hydrogen supply problem,” Hagen said. He said the company plans to increase its use of the fuel as it becomes more available. “When that happens, then we are prepared.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Excluding the Covid-19 pandemic period, annual growth was the lowest since 1992

Australia’s commodity-rich economy recorded its weakest growth momentum since the early 1990s in the second quarter, as consumers and businesses continued to feel the impact of high interest rates, with little expectation of a reprieve from the Reserve Bank of Australia in the near term.

The economy grew 0.2% in the second quarter from the first, with annual growth running at 1.0%, the Australian Bureau of Statistics said Wednesday. The results were in line with market expectations.

It was the 11th consecutive quarter of growth, although the economy slowed sharply over the year to June 30, the ABS said.

Excluding the Covid-19 pandemic period, annual growth was the lowest since 1992, the year that included a gradual recovery from a recession in 1991.

The economy remained in a deep per capita recession, with gross domestic product per capita falling 0.4% from the previous quarter, a sixth consecutive quarterly fall, the ABS said.

A big area of weakness in the economy was household spending, which fell 0.2% from the first quarter, detracting 0.1 percentage point from GDP growth.

On a yearly basis, consumption growth came in at just 0.5% in the second quarter, well below the 1.1% figure the RBA had expected, and was broad-based.

The soft growth report comes as the RBA continues to warn that inflation remains stubbornly high, ruling out near-term interest-rate cuts.

RBA Gov. Michele Bullock said last month that near-term rate cuts aren’t being considered.

Money markets have priced in a cut at the end of this year, while most economists expect that the RBA will stand pat until early 2025.

Treasurer Jim Chalmers has warned this week that high interest rates are “smashing the economy.”

Still, with income tax cuts delivered at the start of July, there are some expectations that consumers will be in a better position to spend in the third quarter, reviving the economy to some degree.

“Output has now grown at 0.2% for three consecutive quarters now. That leaves little doubt that the economy is growing well below potential,” said Abhijit Surya, economist at Capital Economics.

“But if activity does continue to disappoint, the RBA could well cut interest rates sooner,” Surya added.

Government spending rose 1.4% over the quarter, due in part to strength in social-benefits programs for health services, the ABS said.

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.