Princess Diana’s Blouse, an Animatronic E.T. Head, and ‘Big Lebowski’ Robe Headline Memorabilia Auction

The blouse Princess Diana wore for her engagement portrait, E.T.’s head, and the robe “The Dude” wore in The Big Lebowski are just some of the wide range of instantly recognisable pop culture artefacts going up for auction next month.

Julien’s Auctions is partnering with Turner Classic Movies for the Dec 14-17 sale, titled Hollywood Legends.

“Associated with phrases such as ‘Danger, Will Robinson,’ ‘E.T. phone home,’ and ‘Avengers, assemble!,’ these iconic collectibles provide a once-in-a-lifetime opportunity for fans, pop culture enthusiasts, and collectors to own a piece of Hollywood history,” Martin Nolan, Julien’s co-founder and executive director, said in a statement announcing the sale Monday.

The sale comprises three components taking place over four days at The Beverly Hilton in Beverly Hills (Dec. 14), Julien’s facility in Gardena, Calif. (Dec. 15-17), and online at JuliensLive.com.

Featuring props, costumes, and models from some of the most iconic science fiction, fantasy, action, and superhero franchises dating back to the 1950s, the first program—billed as Robots, Wizards, Heroes & Aliens—will be held during the sale’s first two days (Dec. 14-15). In celebration of Warner Bros.’ 100th anniversary, an assortment of items from the studio’s biggest film franchises, such as Harry Potter and Batman, will be offered.

Julien’s Auctions

The marquee item is an original mechanical animatronic E.T. head—created by the legendary special effects artist Carlo Rambaldi and as seen throughout Steven Spielberg’s 1982 film E.T. the Extra Terrestrial—that’s estimated to fetch between US$800,000 and US$1 millionThis model comes from Rambaldi’s own collection, as did the animatronic figure of E.T. sold by Julien’s Auctions last November for US$2.56 million.

Also sure to draw heightened interest is one of the most famous robots of all time, the Model B-9 from Lost In Space. One of only two full-scale figures that were made for the pioneering 1960s science fiction series, the still-functional model is expected to sell for between US$300,000 and US$500,000.

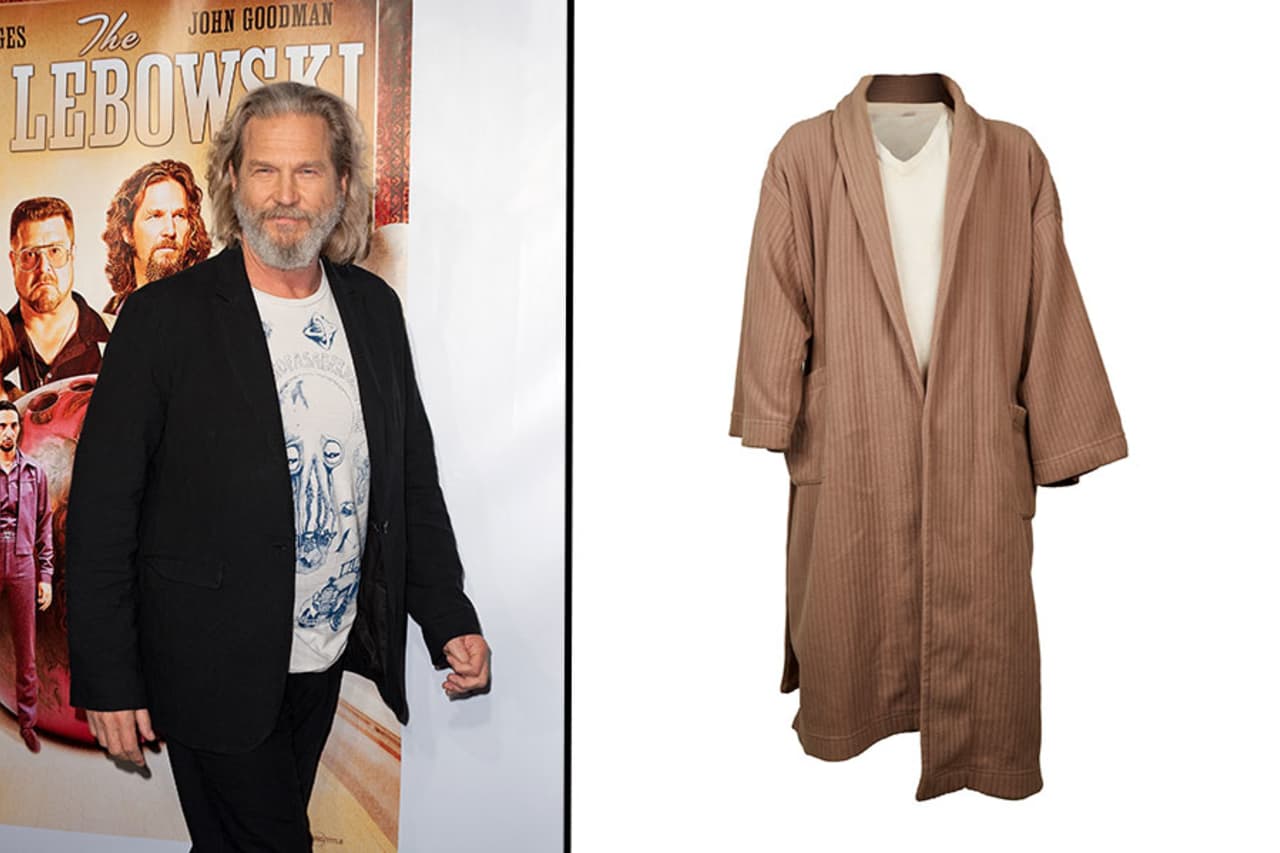

Fans of the Coen Brothers’ 1998 classic film The Big Lebowski will focus on day three (Dec. 16) of the sale, which will celebrate the film’s 25th anniversary. More than 250 items, including storyboards and costumes, will go under the hammer, with a portion of the proceeds going to Share Our Strength’s No Kid Hungry campaign.

Expected to draw the highest bids are a pair of lots featuring items worn by Jeff Bridges in the title role. Estimated to go for between US$30,000 and US$50,000, The Dude ensemble—which appears throughout the film, including in the memorable opening scene—consists of a light-brown knitted fleece bathrobe and an off-white cotton Jockey T-shirt. An original pair of sunglasses featuring nylon frames with amber-colored polycarbonate lenses is expected to sell in the neighbourhood of US$20,000 to US$30,000.

Glamour, Grace and Greatness, the third component of the auction, will close out the sale’s final day (Dec. 17) with items created by revered designers and worn by some of the greatest style icons of all time.

Headliner status goes to a piece from one of the most iconic images ever taken of Princess Diana: the blush pink chiffon blouse worn in her 1981 engagement portrait—famously captured by the world-renowned photographer Lord Snowden for the February 1981 issue of Vogue—is estimated to fetch between US$80,000 and $100,000. With its ruff-like collar and loose pleats to the front, the garment was created by designers David and Elizabeth Emanuel, who would later design Princess Diana’s wedding gown. The blouse, which Elizabeth Emanuel sold from her archives in 2010, was admired by millions when it was previously on display at London’s Kensington Palace as part of the exhibition “Diana: Her Fashion Story” that ran from 2017 to 2019.

Julien’s Auctions

Another famous piece sure to draw intense bidding is a ballerina-length evening dress from the Moroccan-British fashion designer Jacques Azagury that was worn by Princess Diana in Florence, Italy on April 23, 1985. Featuring a black velvet bodice with embroidered stars in metallic thread, and a two-tier royal blue organza skirt with sash and bow, the dress is estimated to sell for between US$100,000 and US$200,000.

Other highlights include Givenchy-designed garments worn by Audrey Hepburn in one of her most memorable roles as Regina “Reggie” Lampert in the 1963 film Charade. A marigold wool coat is expected to sell for between US$20,000 and US$40,000, while a cream wool dress is estimated to earn between US$30,000 and US$50,000.

Fans of timeless classics can bid on iconic pieces such as the dramatic black satin sleeveless gown worn by Gloria Swanson as Norma Desmond in the 1950 film Sunset Boulevard and the blue and white cotton gingham pinafore worn by Margaret O’Brien as Tootie Smith in the 1944 musical comedy Meet Me in St. Louis.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

The remote northern island wants more visitors: ‘It’s the rumbling before the herd is coming,’ one hotel manager says

As European hot spots become overcrowded , travellers are digging deeper to find those less-populated but still brag-worthy locations. Greenland, moving up the list, is bracing for its new popularity.

Aria Varasteh has been to 69 countries, including almost all of Europe. He now wants to visit more remote places and avoid spots swarmed by tourists—starting with Greenland.

“I want a taste of something different,” said the 34-year-old founder of a consulting firm serving clients in the Washington, D.C., area.

He originally planned to go to Nuuk, the island’s capital, this fall via out-of-the-way connections, given there wasn’t a nonstop flight from the U.S. But this month United Airlines announced a nonstop, four-hour flight from Newark Liberty International Airport in New Jersey to Nuuk. The route, beginning next summer, is a first for a U.S. airline, according to Greenland tourism officials.

It marks a significant milestone in the territory’s push for more international visitors. Airlines ran flights with a combined 55,000 seats to Greenland from April to August of this year, says Jens Lauridsen, chief executive officer of Greenland Airports. That figure will nearly double next year in the same period, he says, to about 105,000 seats.

The possible coming surge of travellers also presents a challenge for a vast island of 56,000 people as nearby destinations from Iceland to Spain grapple with the consequences of over tourism.

Greenlandic officials say they have watched closely and made deliberate efforts to slowly scale up their plans for visitors. An investment north of $700 million will yield three new airports, the first of which will open next month in Nuuk.

“It’s the rumbling before the herd is coming,” says Mads Mitchell, general manager of Hotel Nordbo, a 67-room property in Nuuk. The owner of his property is considering adding 50 more rooms to meet demand in the coming years.

Mitchell has recently met with travel agents from Brooklyn, N.Y., South Korea and China. He says he welcomes new tourists, but fears tourism will grow too quickly.

“Like in Barcelona, you get tired of tourists, because it’s too much and it pushes out the locals, that is my concern,” he says. “So it’s finding this balance of like showing the love for Greenland and showing the amazing possibilities, but not getting too much too fast.”

Greenland’s buildup

Greenland is an autonomous territory of Denmark more than three times the size of Texas. Tourists travel by boat or small aircraft when venturing to different regions—virtually no roads connect towns or settlements.

Greenland decided to invest in airport infrastructure in 2018 as part of an effort to expand tourism and its role in the economy, which is largely dependent on fishing and subsidies from Denmark. In the coming years, airports in Ilulissat and Qaqortoq, areas known for their scenic fjords, will open.

One narrow-body flight, like what United plans, will generate $200,000 in spending, including hotels, tours and other purchases, Lauridsen says. He calls it a “very significant economic impact.”

In 2023, foreign tourism brought a total of over $270 million to Greenland’s economy, according to Visit Greenland, the tourism and marketing arm owned by the government. Expedition cruises visit the territory, as well as adventure tours.

United will fly twice weekly to Nuuk on its 737 MAX 8, which will seat 166 passengers, starting in June .

“We look for new destinations, we look for hot destinations and destinations, most importantly, we can make money in,” Andrew Nocella , United’s chief commercial officer, said in the company’s earnings call earlier in October.

On the runway

Greenland has looked to nearby Iceland to learn from its experiences with tourism, says Air Greenland Group CEO Jacob Nitter Sørensen. Tiny Iceland still has about seven times the population of its western neighbour.

Nuuk’s new airport will become the new trans-Atlantic hub for Air Greenland, the national carrier. It flies to 14 airports and 46 heliports across the territory.

“Of course, there are discussions about avoiding mass tourism. But right now, I think there is a natural limit in terms of the receiving capacity,” Nitter says.

Air Greenland doesn’t fly nonstop from the U.S. because there isn’t currently enough space to accommodate all travellers in hotels, Nitter says. Air Greenland is building a new hotel in Ilulissat to increase capacity when the airport opens.

Nuuk has just over 550 hotel rooms, according to government documents. A tourism analysis published by Visit Greenland predicts there could be a shortage in rooms beginning in 2027. Most U.S. visitors will stay four to 10 nights, according to traveler sentiment data from Visit Greenland.

As travel picks up, visitors should expect more changes. Officials expect to pass new legislation that would further regulate tourism in time for the 2025 season. Rules on zoning would give local communities the power to limit tourism when needed, says Naaja H. Nathanielsen, minister for business, trade, raw materials, justice and gender equality.

Areas in a so-called red zone would ban tour operators. In northern Greenland, traditional hunting takes place at certain times of year and requires silence, which doesn’t work with cruise ships coming in, Nathanielsen says.

Part of the proposal would require tour operators to be locally based to ensure they pay taxes in Greenland and so that tourists receive local knowledge of the culture. Nathanielsen also plans to introduce a proposal to govern cruise tourism to ensure more travelers stay and eat locally, rather than just walk around for a few hours and grab a cup of coffee, she says.

Public sentiment has remained in favour of tourism as visitor arrivals have increased, Nathanielsen says.

—Roshan Fernandez contributed to this article.

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.