Ten Global Consumer Trends For 2021

Spurred by the Covid-19 pandemic, outdoor pursuits, digital convenience and safety obsession are seen having a lasting impact.

Many of the new habits consumers formed during the coronavirus pandemic are here to stay, market researcher Euromonitor International predicts.

In 2021 consumers will be demanding, anxious, and creative in dealing with change, Euromonitor forecasts in its annual trend report. People will expect increased activism from brands they use, new options for digital services in their daily lives, and more help in achieving mental and physical wellness.

Though some of this year’s trends are directly related to Covid-19—like heightened safety concerns and demand for more open-air spaces—these shifts will continue after the pandemic wanes, says Alison Angus, Euromonitor’s head of lifestyle research. “These changes happened so quickly and have quickly manifested for the long term,” she says.

Euromonitor, a global market-research firm based in London, has released its forecasts since 2010. Last year, just three months after publishing its January 2020 predictions, it revised its expectations to reflect dramatic shifts in consumer behaviour spurred by the pandemic, flagging new trends like the home’s transformation into a multifunctional refuge used for work, school, leisure and exercise. It also noted the pause of other trends like previously rising privacy concerns.

Its forecasts haven’t always come true, at least so far: Euromonitor’s 2018 prediction that DNA-informed personalized nutrition and skin-care products would quickly accelerate didn’t come to pass because such regimens remain too onerous, Ms Angus says. Last year’s expected boom in demand for reusable products also didn’t materialize amid consumers’ sanitary concerns during the pandemic. “Sustainability really took a hit last year,” Ms Angus says. “But I think consumers are reverting back to it.”

Here are some of Euromonitor’s predictions for this year’s big global consumer trends:

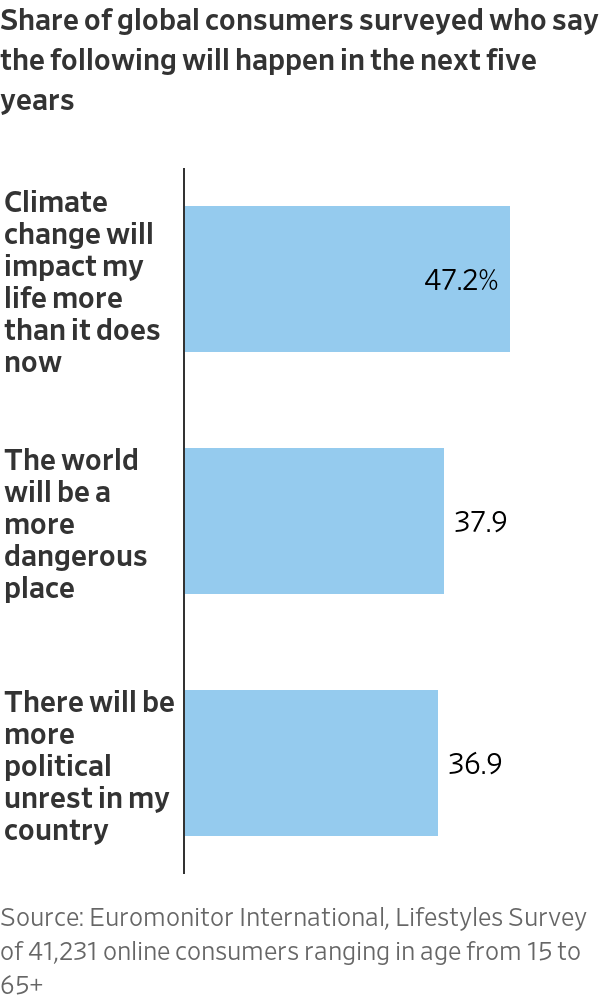

More Brand Activism

Consumers paid closer attention to companies’ actions during the covid-19-fueled lockdowns and will take social and environmental issues more seriously after the pandemic ends, Euromonitor says. People will increasingly demand that companies protect the health and well-being of their workforce, help local communities, and promote ambitious sustainability goals. During the pandemic, “all of a sudden the air cleared, wildlife came out to play and everything was so much nicer,” says Ms Angus. “It’s made consumers realise that actually we want this greener, cleaner climate.”

Spontaneity and Convenience

People miss the spontaneous activities and impulse purchases of their pre-pandemic life—running errands, attending social events, dining out—and they want digital commerce to offer a similar experience, the market researcher says. (It also noted that younger consumers prefer digital interactions while 68% of consumers over the age of 60 prefer speaking with human customer-service representatives.) “We really want that on-the-go coffee, that walk and stop for lunch somewhere, that flexibility and ease,” says Ms Angus. “Companies have to find alternative ways to enable that spontaneity in some form.”

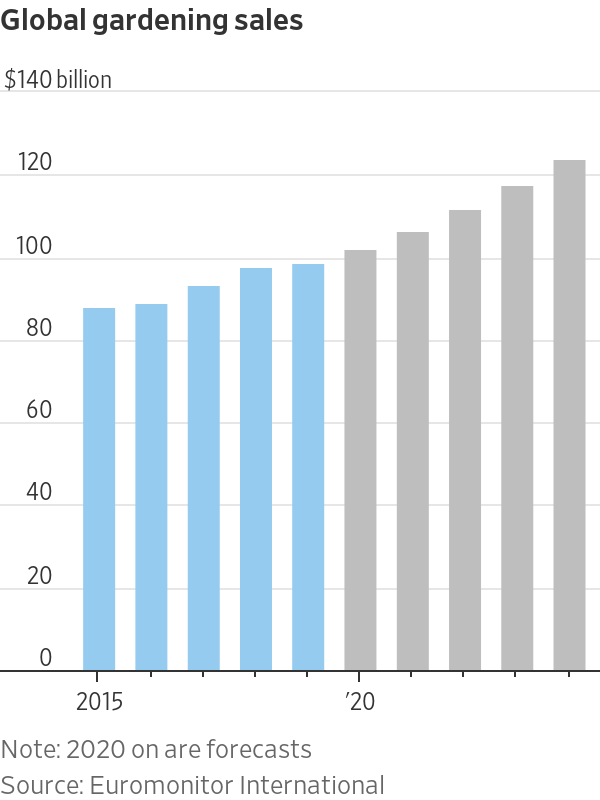

Open Air

Even after the pandemic, people’s desire for outdoor spaces for work, events and recreation will remain strong, Euromonitor says. “Businesses need to create their own outdoor oasis,” the report says. “Adaptation might become more complicated and costly depending on the weather, but open-air structures and heating and illumination systems will pay off due to heightened demand for safe venues and the aesthetic that could continue attracting consumers.”

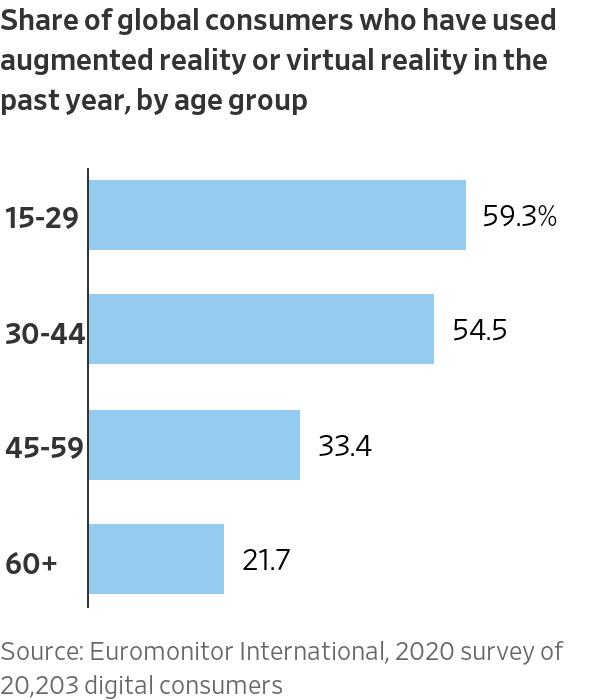

Physical and Digital Worlds

Video calls, connected appliances, smart phones, and technology such as augmented reality have helped consumers stay virtually connected during the pandemic despite being physically separated. Time spent straddling physical and digital worlds is what Euromonitor calls “phygital reality”—a hybrid where consumers seamlessly live, work, shop and play both in person and online. Offering new ways for consumers to combine digital and physical capabilities—say, personal-shopping appointments via video conferencing—will be necessary for businesses to boost sales (and collect data on their customers). Consumers quickly embraced “phygital reality” in the pandemic, but its use will remain long after, Ms Angus says. “Our kids don’t even think about whether something has technology or not, they just expect even a stuffed toy to have interactive technology,” she says. “As those generations become older, it becomes the new normal.”

New Schedules

Staying home more has pushed consumers to be more creative with their time and more deliberate in organizing their daily schedules as they juggle their work, family, and personal lives. So much multitasking means that consumers now expect businesses to offer more flexibility, too. Euromonitor predicts that consumers will demand a 24-hour service culture. “As more and more consumers try to cram more into their day, they’re trying to get time back through services and products that help them do it,” says Ms Angus.

Revenge Spending

Many people are distrusting of leadership and government, and bias and misinformation are feeding a crisis of confidence, Euromonitor says. That’s driving some consumers to rebel by placing their own needs and wants first. Lockdowns world-wide have led some to “revenge shopping,” or splurging, after being homebound for months, as well as seeking out illegal parties and online gambling, Euromonitor says. Affordable luxuries like alcoholic drinks, indulgent packaged food and video games are also on the rise. “Revenge spending is evident among those who can afford it or have saved money from being homebound and not going out,” says Ms Angus. “These consumers are spending on indulgences for themselves or their homes in order to make them feel better.”

Thoughtful Frugality

In contrast to those who want to splurge, another group of shoppers is suffering financial hardships from job losses and economic instability that is forcing thrifty spending behaviour, Ms Angus says. Some consumers will identify with both trends, she says, trading down on some items in order to be able to spend more on others, like affordable luxuries and experiences that boost their physical and mental well-being during this crisis. This “trading down to trade up” is an accelerating trend during the pandemic. “Thrifty yet restless consumers are reviewing and adjusting their spending to support diverse and contradictory needs,” says Ms Angus.

Safety Obsession

Safety is the new wellness movement, according to Euromonitor. Frequent hand-washing and wearing masks have become widely normalized habits, and contactless payments became more common as people shy away from handling unclean cash. “Consumers will be more fearful going forward about any future health concern,” says Ms Angus. “I think we will care a lot about safety for a long time.”

Greater Self-Awareness

The global pandemic forced consumers to reconfigure their lives and test their mental resilience amid health risks, economic hardship and isolation. Now they are reassessing their priorities, identities and work-life balance, Euromonitor says. Targeting these consumers includes offering access to goods and services that promote self-improvement and lifestyle balance. Global sales of educational, hobby-related toys and games, musical instruments, sports equipment and nostalgic comforts like childhood snacks are expected to rise.

Working From Home Evolves

The trend of working from home was already on the rise before the pandemic, but last year’s social-distancing measures made it a reality for many overnight. When the pandemic lifts, many people are expected to continue working from home, at least some of the time, for the long term. This shift affects many aspects of daily life, from technology spending to eating habits to clothing choices. Loss of commutes and office workplaces limit spending on coffee runs, lunch breaks and socializing with colleagues after work. Though workwear and beauty routines have become more casual, food and beverage purchases could become more high-end as people try to create restaurant-quality meals at home, Euromonitor forecasts.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

As Paris makes its final preparations for the Olympic games, its residents are busy with their own—packing their suitcases, confirming their reservations, and getting out of town.

Worried about the hordes of crowds and overall chaos the Olympics could bring, Parisians are fleeing the city in droves and inundating resort cities around the country. Hotels and holiday rentals in some of France’s most popular vacation destinations—from the French Riviera in the south to the beaches of Normandy in the north—say they are expecting massive crowds this year in advance of the Olympics. The games will run from July 26-Aug. 1.

“It’s already a major holiday season for us, and beyond that, we have the Olympics,” says Stéphane Personeni, general manager of the Lily of the Valley hotel in Saint Tropez. “People began booking early this year.”

Personeni’s hotel typically has no issues filling its rooms each summer—by May of each year, the luxury hotel typically finds itself completely booked out for the months of July and August. But this year, the 53-room hotel began filling up for summer reservations in February.

“We told our regular guests that everything—hotels, apartments, villas—are going to be hard to find this summer,” Personeni says. His neighbours around Saint Tropez say they’re similarly booked up.

As of March, the online marketplace Gens de Confiance (“Trusted People”), saw a 50% increase in reservations from Parisians seeking vacation rentals outside the capital during the Olympics.

Already, August is a popular vacation time for the French. With a minimum of five weeks of vacation mandated by law, many decide to take the entire month off, renting out villas in beachside destinations for longer periods.

But beyond the typical August travel, the Olympics are having a real impact, says Bertille Marchal, a spokesperson for Gens de Confiance.

“We’ve seen nearly three times more reservations for the dates of the Olympics than the following two weeks,” Marchal says. “The increase is definitely linked to the Olympic Games.”

Getty Images

According to the site, the most sought-out vacation destinations are Morbihan and Loire-Atlantique, a seaside region in the northwest; le Var, a coastal area within the southeast of France along the Côte d’Azur; and the island of Corsica in the Mediterranean.

Meanwhile, the Olympics haven’t necessarily been a boon to foreign tourism in the country. Many tourists who might have otherwise come to France are avoiding it this year in favour of other European capitals. In Paris, demand for stays at high-end hotels has collapsed, with bookings down 50% in July compared to last year, according to UMIH Prestige, which represents hotels charging at least €800 ($865) a night for rooms.

Earlier this year, high-end restaurants and concierges said the Olympics might even be an opportunity to score a hard-get-seat at the city’s fine dining.

In the Occitanie region in southwest France, the overall number of reservations this summer hasn’t changed much from last year, says Vincent Gare, president of the regional tourism committee there.

“But looking further at the numbers, we do see an increase in the clientele coming from the Paris region,” Gare told Le Figaro, noting that the increase in reservations has fallen directly on the dates of the Olympic games.

Michel Barré, a retiree living in Paris’s Le Marais neighbourhood, is one of those opting for the beach rather than the opening ceremony. In January, he booked a stay in Normandy for two weeks.

“Even though it’s a major European capital, Paris is still a small city—it’s a massive effort to host all of these events,” Barré says. “The Olympics are going to be a mess.”

More than anything, he just wants some calm after an event-filled summer in Paris, which just before the Olympics experienced the drama of a snap election called by Macron.

“It’s been a hectic summer here,” he says.

AFP via Getty Images

Parisians—Barré included—feel that the city, by over-catering to its tourists, is driving out many residents.

Parts of the Seine—usually one of the most popular summertime hangout spots —have been closed off for weeks as the city installs bleachers and Olympics signage. In certain neighbourhoods, residents will need to scan a QR code with police to access their own apartments. And from the Olympics to Sept. 8, Paris is nearly doubling the price of transit tickets from €2.15 to €4 per ride.

The city’s clear willingness to capitalise on its tourists has motivated some residents to do the same. In March, the number of active Airbnb listings in Paris reached an all-time high as hosts rushed to list their apartments. Listings grew 40% from the same time last year, according to the company.

With their regular clients taking off, Parisian restaurants and merchants are complaining that business is down.

“Are there any Parisians left in Paris?” Alaine Fontaine, president of the restaurant industry association, told the radio station Franceinfo on Sunday. “For the last three weeks, there haven’t been any here.”

Still, for all the talk of those leaving, there are plenty who have decided to stick around.

Jay Swanson, an American expat and YouTuber, can’t imagine leaving during the Olympics—he secured his tickets to see ping pong and volleyball last year. He’s also less concerned about the crowds and road closures than others, having just put together a series of videos explaining how to navigate Paris during the games.

“It’s been 100 years since the Games came to Paris; when else will we get a chance to host the world like this?” Swanson says. “So many Parisians are leaving and tourism is down, so not only will it be quiet but the only people left will be here for a party.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.