These People Quit Higher-Paying Jobs for Better Work-Life Balance. Inflation Is Testing Their Mettle.

Millions of Americans have taken new jobs that earn less than they used to make, either by choice or because of a layoff. Now they are contending with rising prices too.

Many of the millions of people who switched jobs during the pandemic are feeling the bite of inflation especially hard, and for an often overlooked reason—they opted for pay cuts.

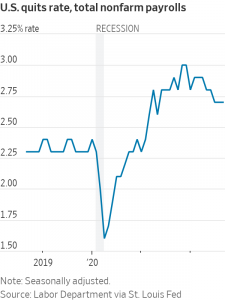

All around, it has been a good time for American workers and their earning power—if not their spending power. Labour shortages have driven up wages, and many in-demand employees have quit jobs for better-paying ones.

Yet a sizeable share of job switchers took pay cuts in the Covid-19 era, according to new research. In a survey of more than 2,300 workers, 32% of those who changed jobs since early 2020 said they made less money as a result.

Many have traded in a higher pay check by choice. While nearly a third of job switchers who now make less money said they had been laid off from their previous jobs, about 25% took a pay cut for better work-life balance, according to Prudential Financial, which commissioned the study. Others said they took a lower-paying job because they wanted to pursue a passion, work remotely or in a new location, or find an employer more aligned with their values.

Rising prices for everything from food and housing to vacations are now testing those decisions, pushing many to tighten budgets already trimmed when they opted for lower-paying jobs. Some job switchers say they are pursuing extra work—even if their original goal was to work less.

Many, including 38-year-old Mae Singerman, say they still have no regrets.

“I sacrificed savings for now to live a more balanced life,” says Ms. Singerman, who left her job as director of operations at a nonprofit last fall for a lower-paying administrator role at another organisation.

She made the decision to find a new job after her appendix burst late one night and she pinged her co-workers from the emergency room to say she was in the hospital but acted as if it were no big deal. “I was obsessed with the job,” she says she realised. “In retrospect, why was I emailing my co-workers at 3 a.m.?”

After her recovery, she took a new job that would let her spend more time with her two young children and help take care of her mother, who has dementia. The catch was it came with a 35% pay cut. Because her husband has a union job with predictable annual raises, Ms. Singerman says the couple didn’t have to make major changes to their lifestyle: She lives in a rent-stabilised apartment, and her youngest is no longer in daycare. But as other expenses have climbed, there have been adjustments, such as no longer contributing to her 401(k). The trade-off has been worth it, she says.

“It’s hard for me to imagine going back to what I had at this point in my life,” she says.

Some who quit jobs for lower-paying positions are now seeking extra work, as are many U.S. workers. In a recent survey of more than 1,000 working adults, 38% said they had looked for a second job and 14% said they planned to.

Nearly two-thirds of respondents said it was harder to pay for living expenses than a year earlier, according to the business-software maker Qualtrics, which conducted the study. Inflation is running near a 40-year high, raising the cost of everyday needs such as car repairs and hair cuts.

Christopher Doran, a 32-year-old in northern New Jersey, makes 20% less than he did as a director of nursing at an assisted-living facility until about a year ago.He says he made the switch to nursing at a hospital after realising that his work affected his relationships with friends and family, and his mental health.

“I was missing events with church, or dinners with friends or family. I had to work holidays, so really, I didn’t have any opportunity to enjoy my life,” he says. “I was burned out.”

Mr. Doran says he is happy with his choice, but he feels the effect on his finances daily. He doesn’t go out as much because of gas prices. “I used to shop healthier,” he adds. “I can’t because it’s so expensive.”

To offset the salary difference and pay off his credit-card debt, Mr. Doran picks up extra shifts at the hospital, which gets him overtime pay. It’s fewer hours and less stress than his old job but still a lot of work, he says.

“I’ve been sacrificing my leisure time to pay the credit cards,” he says. “It’s still kind of taking time I wish I had away.”

For many who have lost jobs, a pay cut was the only option. Kimberly Allen, 38, has changed jobs several times during the pandemic, and her pay has fluctuated with each change. In 2020, she left a nonprofit and took a pay cut for a role in recruiting. A little over a year later, she left that job and almost doubled her salary by taking a contract role with a tech company as a talent sourcer. She was suddenly unemployed when the role ended a few months later.

“I took a leap of faith,” says Ms. Allen, who lives in Schererville, Ind.

Ms. Allen has since found another recruiting job on contract, but it pays 10% less than her last job. Meanwhile, everything from school supplies to sports-team fees and gas spent shuttling everyone back and forth is more expensive than it used to be. Ms. Allen says she and her husband have put a cap on the number of activities their kids can participate in and cut back on entertainment spending.

“We’re working on creative low-budget ways to have fun at home for the entire year and probably next year,” she says.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

As Paris makes its final preparations for the Olympic games, its residents are busy with their own—packing their suitcases, confirming their reservations, and getting out of town.

Worried about the hordes of crowds and overall chaos the Olympics could bring, Parisians are fleeing the city in droves and inundating resort cities around the country. Hotels and holiday rentals in some of France’s most popular vacation destinations—from the French Riviera in the south to the beaches of Normandy in the north—say they are expecting massive crowds this year in advance of the Olympics. The games will run from July 26-Aug. 1.

“It’s already a major holiday season for us, and beyond that, we have the Olympics,” says Stéphane Personeni, general manager of the Lily of the Valley hotel in Saint Tropez. “People began booking early this year.”

Personeni’s hotel typically has no issues filling its rooms each summer—by May of each year, the luxury hotel typically finds itself completely booked out for the months of July and August. But this year, the 53-room hotel began filling up for summer reservations in February.

“We told our regular guests that everything—hotels, apartments, villas—are going to be hard to find this summer,” Personeni says. His neighbours around Saint Tropez say they’re similarly booked up.

As of March, the online marketplace Gens de Confiance (“Trusted People”), saw a 50% increase in reservations from Parisians seeking vacation rentals outside the capital during the Olympics.

Already, August is a popular vacation time for the French. With a minimum of five weeks of vacation mandated by law, many decide to take the entire month off, renting out villas in beachside destinations for longer periods.

But beyond the typical August travel, the Olympics are having a real impact, says Bertille Marchal, a spokesperson for Gens de Confiance.

“We’ve seen nearly three times more reservations for the dates of the Olympics than the following two weeks,” Marchal says. “The increase is definitely linked to the Olympic Games.”

Getty Images

According to the site, the most sought-out vacation destinations are Morbihan and Loire-Atlantique, a seaside region in the northwest; le Var, a coastal area within the southeast of France along the Côte d’Azur; and the island of Corsica in the Mediterranean.

Meanwhile, the Olympics haven’t necessarily been a boon to foreign tourism in the country. Many tourists who might have otherwise come to France are avoiding it this year in favour of other European capitals. In Paris, demand for stays at high-end hotels has collapsed, with bookings down 50% in July compared to last year, according to UMIH Prestige, which represents hotels charging at least €800 ($865) a night for rooms.

Earlier this year, high-end restaurants and concierges said the Olympics might even be an opportunity to score a hard-get-seat at the city’s fine dining.

In the Occitanie region in southwest France, the overall number of reservations this summer hasn’t changed much from last year, says Vincent Gare, president of the regional tourism committee there.

“But looking further at the numbers, we do see an increase in the clientele coming from the Paris region,” Gare told Le Figaro, noting that the increase in reservations has fallen directly on the dates of the Olympic games.

Michel Barré, a retiree living in Paris’s Le Marais neighbourhood, is one of those opting for the beach rather than the opening ceremony. In January, he booked a stay in Normandy for two weeks.

“Even though it’s a major European capital, Paris is still a small city—it’s a massive effort to host all of these events,” Barré says. “The Olympics are going to be a mess.”

More than anything, he just wants some calm after an event-filled summer in Paris, which just before the Olympics experienced the drama of a snap election called by Macron.

“It’s been a hectic summer here,” he says.

AFP via Getty Images

Parisians—Barré included—feel that the city, by over-catering to its tourists, is driving out many residents.

Parts of the Seine—usually one of the most popular summertime hangout spots —have been closed off for weeks as the city installs bleachers and Olympics signage. In certain neighbourhoods, residents will need to scan a QR code with police to access their own apartments. And from the Olympics to Sept. 8, Paris is nearly doubling the price of transit tickets from €2.15 to €4 per ride.

The city’s clear willingness to capitalise on its tourists has motivated some residents to do the same. In March, the number of active Airbnb listings in Paris reached an all-time high as hosts rushed to list their apartments. Listings grew 40% from the same time last year, according to the company.

With their regular clients taking off, Parisian restaurants and merchants are complaining that business is down.

“Are there any Parisians left in Paris?” Alaine Fontaine, president of the restaurant industry association, told the radio station Franceinfo on Sunday. “For the last three weeks, there haven’t been any here.”

Still, for all the talk of those leaving, there are plenty who have decided to stick around.

Jay Swanson, an American expat and YouTuber, can’t imagine leaving during the Olympics—he secured his tickets to see ping pong and volleyball last year. He’s also less concerned about the crowds and road closures than others, having just put together a series of videos explaining how to navigate Paris during the games.

“It’s been 100 years since the Games came to Paris; when else will we get a chance to host the world like this?” Swanson says. “So many Parisians are leaving and tourism is down, so not only will it be quiet but the only people left will be here for a party.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.