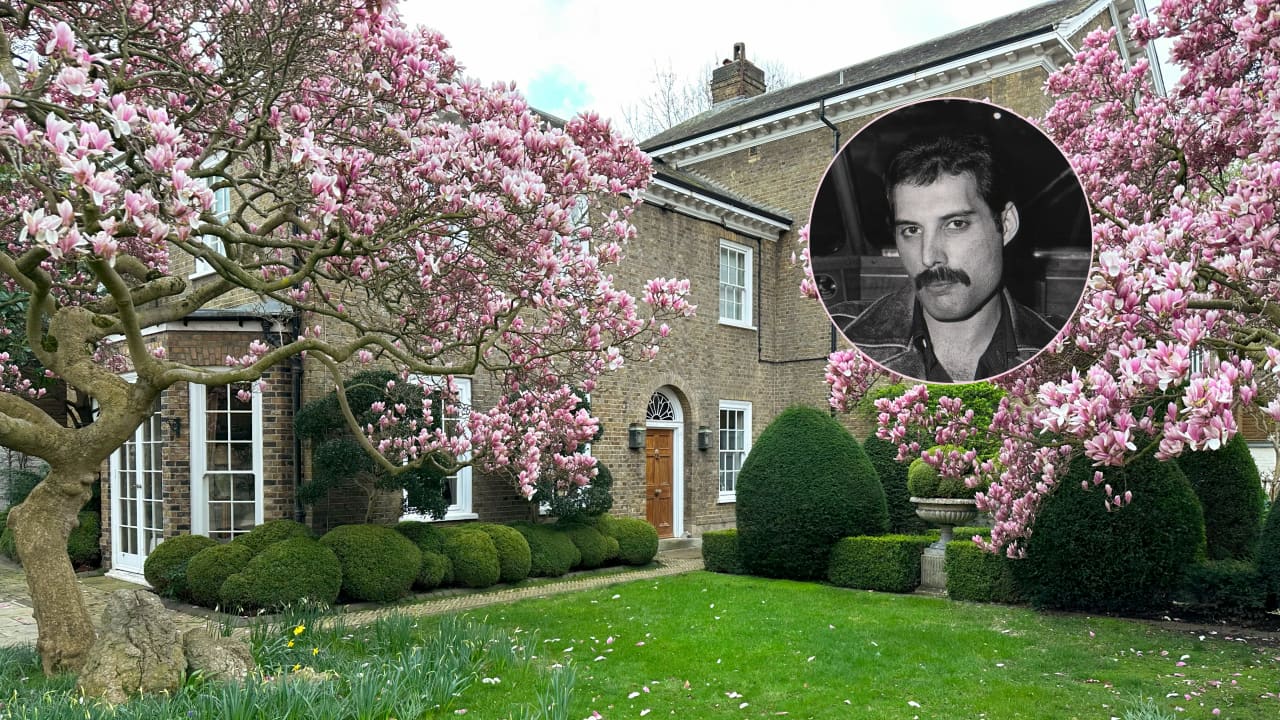

Freddie Mercury’s London Home Selling for the First Time Since He Lived There

Garden Lodge, in the capital’s posh Kensington, was Mercury’s much-loved home from 1980 until his death in 1991

The eclectic London home that Freddie Mercury designed to fit his eccentric lifestyle has hit the market for offers over £30 million (US$38 million).

Garden Lodge, in the capital’s posh Kensington, was Mercury’s much-loved home from 1980—when on a first viewing he decided to buy the property on the spot—until his death in 1991, at which point the Queen frontman’s residence and everything in it was bequeathed to his one-time fianceé and close friend, Mary Austin.

In the 30 years since, Austin has taken “meticulous” care of the home, according to Knight Frank, which listed the walled and private property on Monday.

“This house has been the most glorious memory box, because it has such love and warmth in every room,” Austin, 72, said in a statement. “It has been a joy to live in, and I have many wonderful memories here. Now that it is empty, I’m transported back to the first time we viewed it.”

“Ever since Freddie and I stepped through the fabled green door, it has been a place of peace, a true artist’s house, and now is the time to entrust that sense of peace to the next person,” she said.

Mercury designed the house to be a memorable, inviting place that reflected his personality, case in point, the dining room, which he painted bright yellow—his favourite colour.

It also served as a place to showcase his collection of beautiful objects and art from around the world— much of which was sold at auction last year .

The home’s most “spectacular” space is the double-height drawing room, complete with a wraparound gallery that serves as a library and bar overlooking the room and Mercury’s grand piano, below.

There’s also the Japanese room, a sitting room that leads out to the home’s Japanese-style garden, which Mercury helped to create, complete with magnolia trees, topiary and water features.

The primary bedroom suite, meanwhile, is lined with floor-to-ceiling mirrored doors, behind which Mercury stored his clothes and stage costumes.

“The sale of Garden Lodge presents a once-in-a-lifetime opportunity to own a significant property combined with a piece of cultural history, the beloved home of an icon,” said Paddy Dring, Knight Frank’s global head of prime sales and joint head of its private office.

“Having been carefully preserved with love and respect over the last three decades, we expect that the exceptional provenance of the property will be incredibly alluring to buyers across the world,” he said. “Notwithstanding the legacy of the house, it is very rare that unmodernised homes of this scale, set in such beautiful mature gardens come to market, so it is certainly an exciting prospect for any future purchaser.”

Mercury, born Farrokh Bulsara, formed Queen, one of the best-selling bands of all time, in 1970. Diagnosed with AIDS in 1987, Mercury died from complications from the disease at the age of 45, the day after publicly announcing his diagnosis.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

If you’re looking to secure a home loan, you might want to consider these expert tips…

No matter whether you’re a first home buyer or a seasoned investor, entering the property market right now, in whatever capacity, is a tricky task thanks to high interest rates and a super competitive market across the board.

With Google searches like ‘how much deposit do I need to buy a house’ and ‘how to get a home loan’ currently trending, there’s one question potential buyers should be asking, as well: ‘what are the things to stop doing before applying for a home loan’.

Barbara Giamalis, a mortgage broker at Tiimely Home, has over 25 years of experience on the matter, and says there are certainly some factors to consider when applying for a home loan that can better your chances of success.

“There’s no right or wrong time to purchase a home; it all depends on every person’s financial situation, but you must ensure you’re comfortable paying back the loan based on your personal financial circumstances,” said Ms Giamalis.

“The number one question I’m asked is, ‘how much can I borrow?’, but there’s a huge difference between what people can borrow now in comparison to rates. By enacting some of these small tips below, it might just be the difference between getting approved or denied for a home loan.”

Below, Ms Giamalis lists five things you should consider stopping if you’re planning to apply for a home loan. And with predications of lower interest rates coming into play this year, there’s never been a better time to get on top of the home loan race.

—

1. Consider cancelling your credit card

This is a simple one. Typically, if you’re looking to borrow more money for a higher loan, it’s wise to close any credit card accounts you have open. Contrary to popular opinion, you definitely don’t need a credit card to build your credit score to get a home loan.

“If you’ve got credit cards, try and pay them off and cancel them before applying for a loan because it gives you greater borrowing power,” said Ms Giamalis.

“You don’t need a good credit score through a credit card to get approved for a home loan as your credit rating is what it is. If you’re a first-time borrower and never had a loan, your rating won’t be great, it might be around 700, but it’s better than having 800 with two credit cards.”

Typically, a credit card rating is calculated from your credit report, which is essentially a history of your credit card actions. It’s calculated based off your line of credit (the amount you have borrowed), your credit application history, and whether you have paid your debts in time. Your score will be highlighted between zero to 1,200; the higher the score, the better your odds are of getting a loan. The lower your score, riskier you present to potential lenders.

2. Stop using ‘Buy Now, Pay Later’ schemes

We’ve all been there. ‘Buy Now, Pay Later’ services present as extremely attractive payment alternatives when shopping online. But therein lies the danger; such services rely on its customers not making repayments in time.

And if you’re considering applying for a home loan, it’s wise to avoid using such services all together.

“If an applicant opts to pay off purchases in increments, even interest-free payments, this could signal to some lenders that the applicant may not be financially stable,” said Ms Giamalis.

“Most lenders will look at the living expenses of an applicant. If an applicant is using ‘buy now, pay later’ services more than what they have in their savings, this could be a red flag and lenders could question whether they can afford a loan.”

Services like Afterpay also have the right to report any missed payments on your credit history, which could definitely have a negative impact to your credit score.

3. Don’t put off saving for future mortgage repayments

Before applying for a home loan, a good indication of whether you would be able to afford the monthly repayments on your mortgage is demonstrating the ability to save the amount. This, along with saving for your ten or 20 percent deposit, will put you in good stead for your home loan preparation, and will show lenders that you’re disciplined when it comes to finances.

“One of the best tips for young people, and one they can start doing now, is to start saving for their monthly mortgage payment before applying for a home loan as it shows dedication,” said Ms Giamalis.

Ms Giamalis adds that having a three-month saving history is a great way to prove this to potential lenders.

Here are some friendly financial tools to assist you along the way.

4. Stop gambling and making cash withdrawals

According to Gambling Statistics Australia, 6.8 million Australians participate in some form of gambling each year. This could include activities like buying a ticket in the lottery right through to using gambling apps and visiting casinos. This can present as an obvious red flag to lenders, who will take this into account when deciding to service a home loan application or not.

Another factor to consider is cash withdrawals. If you’re someone who is making regular ATM cash withdrawals per week or per month, this can be a problem as the potential lender can’t track where this money is going. Experts suggest it’s better to have purchases that are traceable.

“Large one-off purchases such as a couch, a new hot water service or a motor vehicle, won’t be taken into an applicant’s living expenses as it’s a one-off meaning the banks will look at that as a discretionary cost,” added Ms Giamalis.

5. Don’t hold onto student debt

One of the key considerations your mortgage broker or financial professional will consider in the home loan application process is paying out any debts you may have outstanding, such as your higher education debt.

It might seem obvious that paying off a HECS debt will strengthen your chances of obtaining a home loan, however, Ms Giamalis says many people often don’t factor in these debts.

“The Higher Education Loan Program (HELP) impacts your borrowing power. HELP debt is a liability that you need to declare in the home loan application process,” said Ms Giamalis.

“The impact of HECS on your ability to get a home loan may vary depending on your income level and the amount of your HECS debt. Seeking financial advice before deciding to pay off your debt is crucial.”

Many are not in the position to pay off their student loans immediately, so this point comes as an additional should you be in the position to do so. This also applies even in light of the Federal Government’s proposal to wipe a reported $3 billion in debt from three million Australians who have HECS debts through indexation changes, essentially capping indexation rate for loans. The proposal is designed to lend a hand in helping young tertiary educated Australians pay off their student loans.

—

Consumers are going to gravitate toward applications powered by the buzzy new technology, analyst Michael Wolf predicts

This stylish family home combines a classic palette and finishes with a flexible floorplan