Epic Housing Booms Meet Their Match in Australia, Canada, New Zealand

After multiyear surges for homeowners, property prices are at particular risk

SYDNEY—Australia, New Zealand and Canada are home to three of the biggest property booms in recent history, having survived the global financial crisis, recession and Covid-19 pandemic. They might have finally met their match, however, at the hands of an unprecedented pace of global monetary tightening.

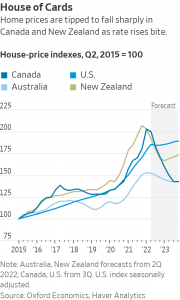

While home prices have been strong around the world for decades, these three stand out. They dodged much of the collapse in prices that hit the U.S. ahead of the global financial crisis, and the booms have gathered even more steam during the pandemic. Since 1990, home prices in Australia, New Zealand and Canada are up 532%, 602% and 331%, respectively, compared with 289% for the U.S., according to one measure from research firm Oxford Economics.

All three, however, are particularly sensitive to monetary tightening. Unlike in the U.S., where people often have long-term, fixed-rate mortgages that are protected against rate increases, many home loans in Australia, New Zealand and Canada are effectively at a floating rate, meaning that mortgage payments go up as rates rise.

“Overall, this is the most worrying housing market outlook since 2007-2008, with markets poised between the prospect of modest declines and much steeper ones,” Oxford Economics wrote in a recent note.

While the firm’s concerns apply globally, it said Australia, New Zealand and Canada were among the markets most at risk for large price declines. It estimates home prices in Canada could fall 30% and New Zealand prices could drop 20%. In Australia, recently released documents show that central bank economists fear house prices could fall by as much as 20%.

The rising rates are expected to hit homeowners fully in those three countries starting next year. Many home loans in these markets have a fixed-rate period for a few years, so mortgages taken out soon after the pandemic have yet to be reset to more-expensive current rates.

“2023 looks ominous,” said Ron Butler, who runs the Canadian mortgage broker Butler Mortgage.

Chris Joye, chief investment officer at Coolabah Capital in Sydney, estimates the city is seeing the biggest monthly falls in house prices since 1983. Using the central bank’s house-price forecasting model, he says if interest rates hit 4.25%, house prices could plummet 40%. Money markets are currently pricing in a peak central bank policy rate above 4%, higher than the current 2.85%.

Australia is “a harbinger of what awaits the rest of the world,” Mr. Joye said. “The Aussie housing market is certain to suffer a record drawdown.”

In New Zealand, around 45% of home loans end their fixed-rate period within 12 months, said Kelvin Davidson, chief property economist at the real-estate data firm CoreLogic. Many economists in New Zealand expect interest rates to peak above 5% after recent inflation numbers were higher than expected. That could push one-year fixed-mortgage rates to 7%, which would be unaffordable for many homeowners and could force them to sell rather than refinance.

In Canada, some housing-market participants are worried about so-called trigger points and trigger rates. While many mortgages have variable rates, Canadian lenders often offer fixed payments to keep things predictable, and allocate more or less of the monthly payment toward interest depending on prevailing rates at the time. If rates keep rising, the fixed payment at some point won’t be enough to cover all the interest, according to the Canadian financial-information website Ratehub.ca.

Eventually, some borrowers might be required to increase their monthly payments, make a lump-sum payment or convert to a less favourable fixed-rate mortgage, according to Ratehub.ca. All of that threatens to add financial strain to households in coming months, given that Canada’s central bank is poised to keep raising rates.

Unlike what happened in the run-up to the financial crisis, large-scale mortgage defaults are improbable this time, according to Oxford Economics. That is partly because many people have amassed savings during the pandemic that will provide a cushion. Unemployment in all three countries is at multi-decade lows. Even if home prices fall some 20% to 30%, that wipes out just a couple of years of gains.

Stress testing of lenders by some central banks suggests house prices would need to fall a long way before threatening financial stability, given that banks have built up large capitalisation buffers since the financial crisis.

New Zealand’s central bank, for example, recently published bank stress testing and concluded the sector is well placed to withstand a stagflation scenario of high inflation and low or negative economic growth. The banks were even able to withstand a scenario in which house prices fall by 47% from the peak in November 2021, and the unemployment rate jumps to 9.3%.

Even if a crisis isn’t in the cards, the outlook for many homeowners is grim. Natalie Bell, 40 years old, who works in school administration, said monthly mortgage payments on her four-bedroom brick home in a Sydney suburb are expected to rise from about 2,500 Australian dollars, the equivalent of $1,600, to A$3,600. Late last year, her family secured a fixed rate of 1.9% for two years, but that will likely bump up to well over 5% in October next year.

Ms. Bell said the family would sell the house if payments got too expensive, but she hopes it doesn’t get to that.

“It’s a bit stressful as we don’t know how much they will keep going up,” Ms. Bell said. “We did take out the mortgage knowing rates would fluctuate, and budgeted for that, but there is always a point where it becomes too much.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Former Google CEO Eric Schmidt is selling his Northern California estate, which was listed Monday for $24.5 million.

Located in Atherton, an extremely affluent town northwest of Palo Alto and about 30 miles south of San Francisco, the 3.36-acre property is made up of three parcels that Schmidt acquired over the years, according to public records and Compass, who has the listing.

Schmidt, 69, and his wife, businesswoman Wendy Schmidt, purchased the main home in 1990 for $2 million, according to public records accessed via PropertyShark. They remodelled the 1969 home in 2007, and at that time, bought a neighbouring parcel of land, allowing an expansion of the main house and the addition of a guest house, according to Compass, who holds the listing. A third parcel was later acquired, on which the Schmidts added an English garden house and landscaped grounds overlooking the Eastern Hills.

“Finding three contiguous parcels in Atherton is rare. Even rarer are those with views of the Eastern hills,” said listing agent Katharine Carroll of the reSolve Group at Compass. “The location of this residence is ultra private, at the back of a cul-de-sac with the main house built into a hillside that provides privacy and very good security.”

Across the estate, there are five bedrooms, five full bathrooms and six half bathrooms.

The 5,265-square-foot main house also offers a number of private outdoor spaces on its upper level, including a large terrace off the primary suite, another large terrace off a secondary bedroom, plus a third smaller terrace and two balconies.

Behind the main house is a patio with a pool and spa. For even more outdoor space, there’s an entertaining pavilion, an open lawn and an outdoor fireplace area near the guest quarters.

The grounds themselves are also a standout feature, with an array of mature plants and specimen trees. The upper portion of the property’s landscaping is designed around an Amdega-designed conservatory, which was imported from the U.K. Around the greenhouse, there is a garden of raised beds and fruit trees, Carroll said.

“From the moment you step onto the grounds, it feels as if you’ve been transported to a private botanical sanctuary,” she said.

Schmidt served as Google’s CEO from 2001 to 2011, and then became the company’s executive chairman until 2015. He could not be reached for comment.

This article first appeared on Mansion Global

Consumers are going to gravitate toward applications powered by the buzzy new technology, analyst Michael Wolf predicts

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.