Hong Kong’s Property Market Is a Mess—and the Fed Is Partly to Blame

U.S. rate increases have tamed inflation at home but caused pain elsewhere

Hong Kong’s notoriously expensive property market is often seen as a barometer of the city’s economy. It isn’t looking good.

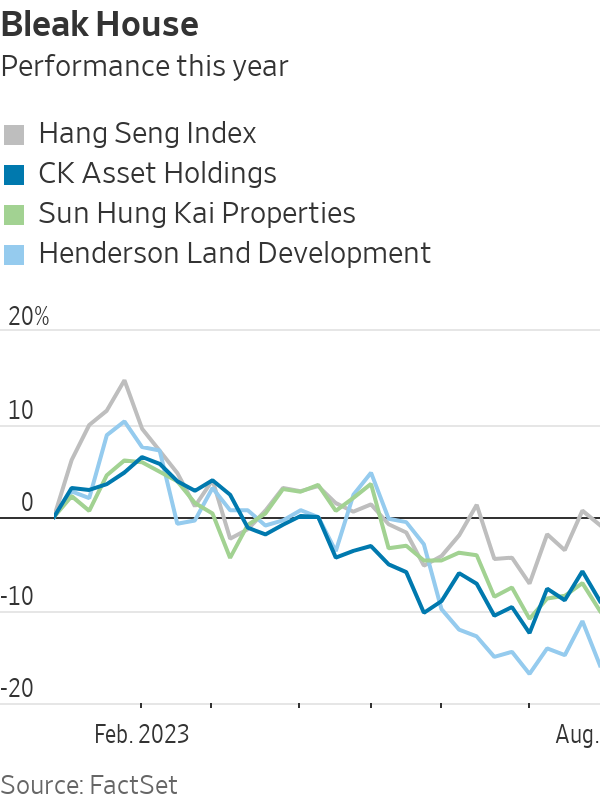

Home prices are down. Office vacancy rates have hit a record high. Commercial real-estate investment has plummeted. The shares of some big developers in the city are trading at a 30-year low to their net asset value, a measure of financial health, according to research by analysts at JPMorgan.

A key reason is high interest rates, which have increased the burden on mortgage-paying home buyers, said Cathie Chung, senior director of research at Jones Lang LaSalle, a real-estate services company. The Hong Kong dollar’s peg to the U.S. dollar forces monetary authorities in the city to track U.S. interest-rate decisions, limiting their ability to stimulate the property sector and the wider economy.

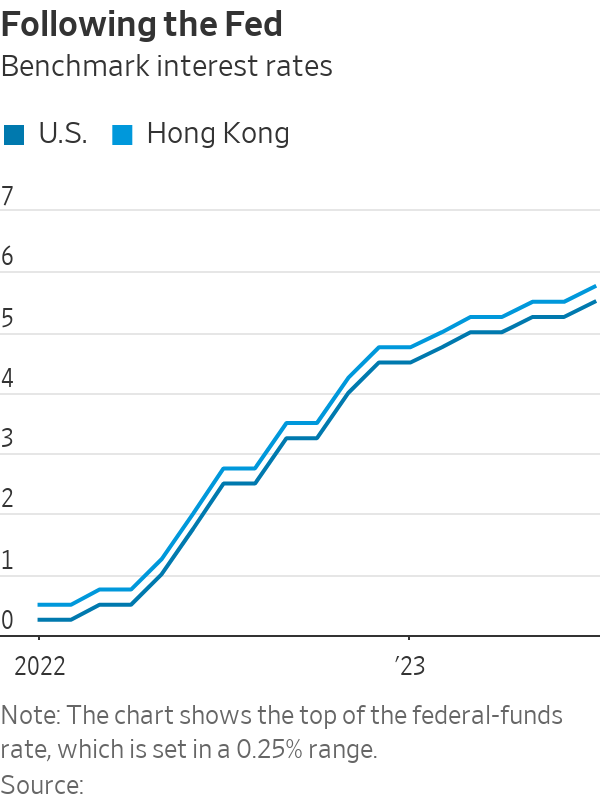

The Federal Reserve has embarked on a historic cycle of interest-rate rises since last March, raising the benchmark federal-funds rate from around zero to 5.25% to 5.50%. The Hong Kong Monetary Authority, the city’s de facto central bank, has followed these hikes, increasing its base rate to 5.75% from 0.75% over the same period.

The full impact of higher interest rates in the city still hasn’t been felt, said Asif Ghafoor, chief executive of online real-estate marketplace Spacious. Asking prices of residential properties listed on the platform have fallen 5% since the start of the year. Sales prices tend to follow suit, and are likely to fall 5% to 10% in the next six months, he said.

To prop up the market, the HKMA relaxed mortgage rules in early July for the first time since 2009, allowing home buyers to pay less upfront and borrow more for some properties if they plan to live in them. But those working in the sector think the pain is far from over.

“We expect that the recovery will be slow and long,” said Chung at Jones Lang LaSalle.

The slump in the property market has hurt the share prices of developers, a major source of wealth for some of the city’s richest families. CK Asset Holdings, Henderson Land Development, Sun Hung Kai Properties and New World Development—all still partly owned by the families of the founders—are performing much worse than the wider stock market this year. New World and Henderson Land have lost more than 15% this year, according to FactSet data.

Hong Kong is one of the world’s leading financial centres and is seen by many foreign businesses as a gateway to mainland China. It is now being hit by a slowdown in investment-banking activity—with several large banks cutting staff this year—and the shaky recovery of China’s economy, which has undermined confidence among businesses and potential home buyers in Hong Kong.

The overall vacancy rate for offices reached a record high of 15.7% in the first half of this year, compared with an average of under 5% in 2018, according to figures by CBRE. In the central business district, there was almost eight times as much empty office space as in 2018, when the area had a vacancy rate of just 1.3%.

The equivalent of $603 million was invested in commercial real estate between April and June, according to CBRE data, just a third of the first-quarter tally and the lowest quarterly figure since the end of 2008, when the global financial crisis caused a huge drop in confidence.

Hong Kong’s border with mainland China was reopened earlier this year, but companies from the mainland haven’t grabbed office space in the numbers many had hoped, said Ada Fung, head of office services at CBRE Hong Kong. Flexible working arrangements and geopolitical tensions that have made many companies pause expansion plans are also crimping demand, she said.

The drop in demand is being exacerbated by a supply glut. Developers bought land and started constructing a number of new buildings before 2019, when widespread protests rocked the city and only ended with the passing of a strict national-security law. Demand for commercial property after that was soon undermined by the spread of Covid-19.

This shift in supply and demand is finally giving potential renters the upper hand, said Fung. “It could be a healthy reset,” she said.

There are some reasons for optimism. Retail businesses have increased their demand for commercial property after the reopening of the border with China, which has brought in tourists looking to spend on luxury goods. There is also hope that a recent rise in residential rents could help home prices.

After an exodus of professionals and other residents in recent years, people have started to move to the city, including foreign students and those coming to Hong Kong through government talent schemes designed to reverse a brain drain. That is helping rents pick up after hitting a bottom in the first quarter, and could lead to more demand for properties as investments, said Cusson Leung, head of property research in Hong Kong at JPMorgan.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

It pays to do logistical research before taking this leap of faith for your travels

Would you let a stranger vacation in your home if you got free lodging in return?

A free stay in someone else’s home, long a budget-friendly way to travel, has become more appealing as costs rise and travelers seek out local vibes.

Home-swapping platform People Like Us has more than 10,300 homes listed on its site. Chief Executive Drew Seitam says, by the end of June, members had completed or arranged for 30% more swaps than in all of 2023. Another platform, HomeExchange, has more than 175,000 members, a number it says has grown 17% this year.

Home-swap platforms like these charge annual membership fees north of $100. Swaps also happen more informally in Facebook groups and between friends. Travellers can do a simultaneous swap, where they travel during the same dates, but can also plan to host each other at different times.

While home exchanges can save travellers thousands on lodging, they aren’t for everyone. Home swappers give the following tips to consider before listing your home.

Get a read on the situation

The person you are swapping with shouldn’t feel like a stranger by the time you arrive, home exchangers say.

Barbara Osterwisch , 66 years old, and her husband, both retirees, have swapped their home in Houston and their cabin in Texas’ Hill Country for stays in the Netherlands, France, Canada, Austria and California. They video chat with potential matches to establish rapport, and to give tours of their homes. Many exchangers begin planning their swaps months, if not years, in advance. This gives ample time for getting to know one another, Osterwisch says.

Apprehensive travellers should consider a swap within a few hours’ drive as a trial run, rather than jumping into an exchange in another country, she says.

Home swaps aren’t for tourists who like everything just so, travelers say. Unlike a short-term rental, home swaps are more likely to be people’s primary residences. People leave clothes in the closets, tools in the garage and photos on the walls. Living in someone’s home is part of the charm, but it isn’t the same as staying in a hotel with a front desk and staff to fix issues that arise.

Using a platform can ensure some safety and quality guarantees, swappers say. Some companies, such as Kindred, a members-only platform, offer 24/7 text support for problems.

Osterwisch says she and her husband have stayed in touch with the families they swapped with and now have connections all over the world.

Check your insurance policy

Some travelers use membership-based services to provide supplemental insurance or support if things go wrong.

Oleg Pynda is a 31-year-old New York City tech worker who has swapped with travellers from France. He says, based on his experience, U.S. travellers tend to worry more about strangers staying in their homes and damaging their belongings. Most of the initial messages he gets from U.S.-based travellers emphasise their trustworthiness, while European travelers focus on the quality of the home they are offering to exchange.

Pynda says he is comfortable with people staying in his apartment for a short time, so he doesn’t feel compelled to sign up for services that provide extra insurance for members. The people he swaps with end up becoming familiar to him and don’t feel like complete strangers.

He says his lease prohibits situations with a monetary exchange, such as a short-term rental or sublet, but not home exchanges.

Homeowners and renters-insurance policies might limit the number of days a guest can stay in your home during a swap, says Janet Ruiz of the Insurance Information Institute. They might also limit compensation for damage done to hosts’ and visitors’ possessions while people are in your home.

“People don’t want to tell their insurance agents what they are doing,” she says. Having a conversation with the agent before anything happens can help you make informed choices about coverage, she adds, including whether to buy a supplemental policy for vacation-rental coverage.

Travelers should also ensure the home they are staying in has coverage. And renters ought to check their leases before entering into a swap.

Some swappers let travellers borrow their cars. Ruiz recommends first asking the person you’re exchanging with about their driver’s licenses and insurance coverage.

Shawn and Bill Personke , from Michigan, had a potential swap fall through because the other family wanted to use their car. They had promised it to someone else while they were away.

Some travelers say they lock valuables in one room of the house or put them in the trunks of their cars and take the keys with them. Problems can arise, but none of the travellers interviewed had any horror stories to share.

“My only regret regarding home exchanging is not figuring it out sooner,” Osterwisch says.

Travel somewhere new

Marina Wanders , a photographer, lives in a suburb of Austin, Texas. She floated the idea of a summer house swap in a Facebook group. A Dallas woman, whose home has a backyard swimming pool and a shower with a chandelier in it, responded and said she was game. Wanders says Dallas isn’t her ideal vacation destination, but as a 29-year-old single mom of two, she looks for affordable travel alternatives.

“I’m like a middle-class American single mom and make enough to pay my bills and buy $40 shampoo, but I do not have a chandelier in my shower,” Wanders says.

She decided to go for the swap because she can give her sons a memorable vacation in a beautiful home while saving thousands on lodging. The Dallas family will stay in her home during the same dates.

Travelers with flexible dates and locations will have more options. The Personkes once scored a swap in Angers, France, on their preferred dates.

People who live in major cities have more luck requesting specific dates because their locations are in demand, but travelers like the Personkes, who live in a small city outside of Detroit, often need to work harder marketing their homes and communities. The Personkes’ swappers have experienced their town’s local parade and nearby nature trails.

The retirees have swapped as part of People Like Us and HomeLink. They also use the People Like Us Facebook group to speak with other travellers, get advice and suss out exchanges.

They say they love living like locals, getting baguettes from vending machines in remote French towns and joining neighbours for dinner.

“Sometimes we are the first Americans people are ever going to meet, and I want to make a good impression,” Shawn says.

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.