Big Oil’s Talent Crisis: High Salaries Are No Longer Enough

Energy companies scramble to attract engineers as young workers fret over climate and job security

Good news from the oil patch: Jobs are plentiful and salaries are soaring.

The bad news is that young people still aren’t interested.

Even as oil-and-gas companies post record profits, the industry is facing a worsening talent drought.

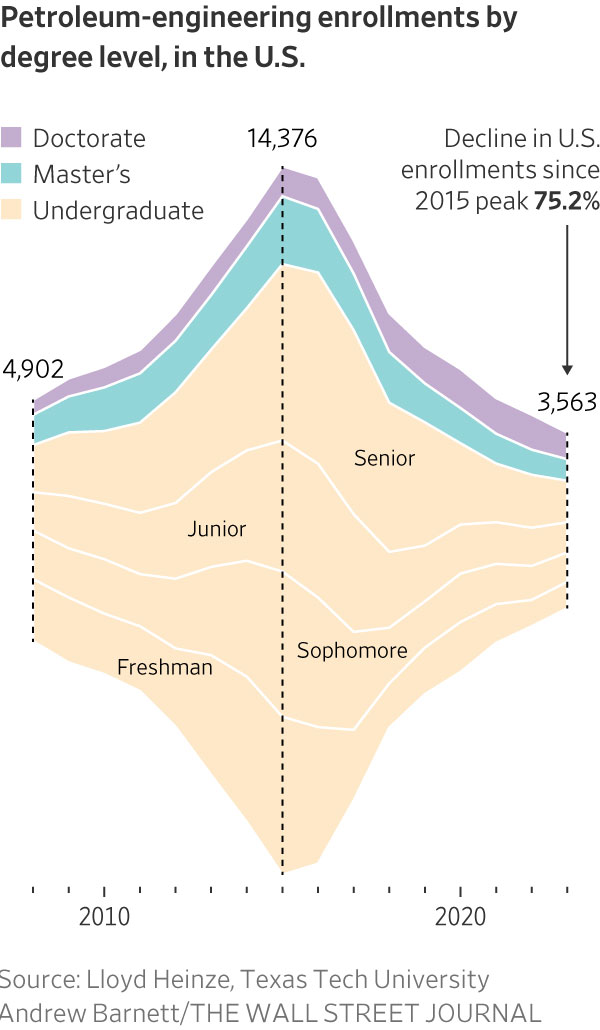

At U.S. colleges, the pool of new entrants for petroleum-engineering programs has shrunk to its smallest size since before the fracking boom began more than a decade ago. European universities, which have historically provided many of the engineers for companies with operations across the Middle East and Asia, are seeing similar trends.

Students and high-skilled young workers are concerned about the industry’s role in climate change, as well as long-term job security given that global economies are transitioning away from fossil fuels to other energy sources, according to executives, analysts and professors.

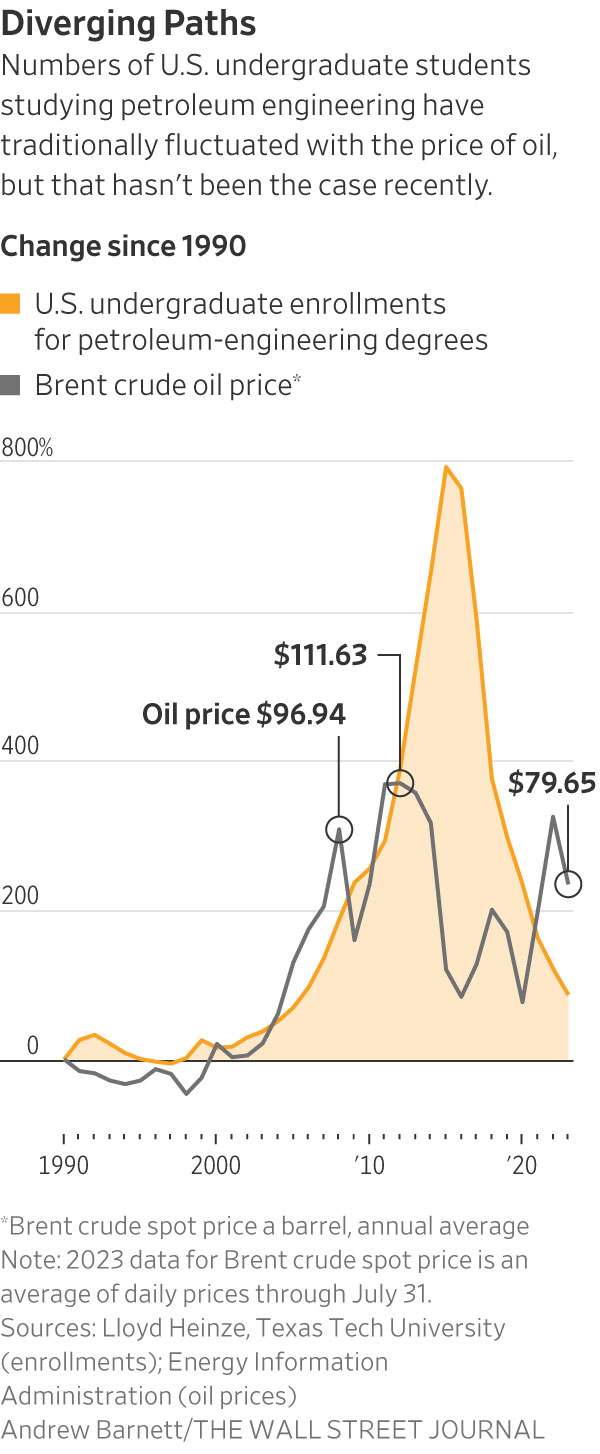

The trend is a stark departure from previous cycles, when the industry’s workforce ebbed and flowed with the rise and fall of oil prices.

Between 2016 and 2021—a period when the Brent crude price nearly doubled—the number of petroleum-engineering graduates more than halved, according to the U.S. Department of Education.

The number of undergraduates pursuing petroleum engineering has dropped 75% since 2014, according to Lloyd Heinze, a Texas Tech University professor.

It is a trend that has continued even as other recent studies have shown that the average graduate earns 40% more than a peer with a computer science degree.

That puts students, including Hayden Gregg, in high demand.

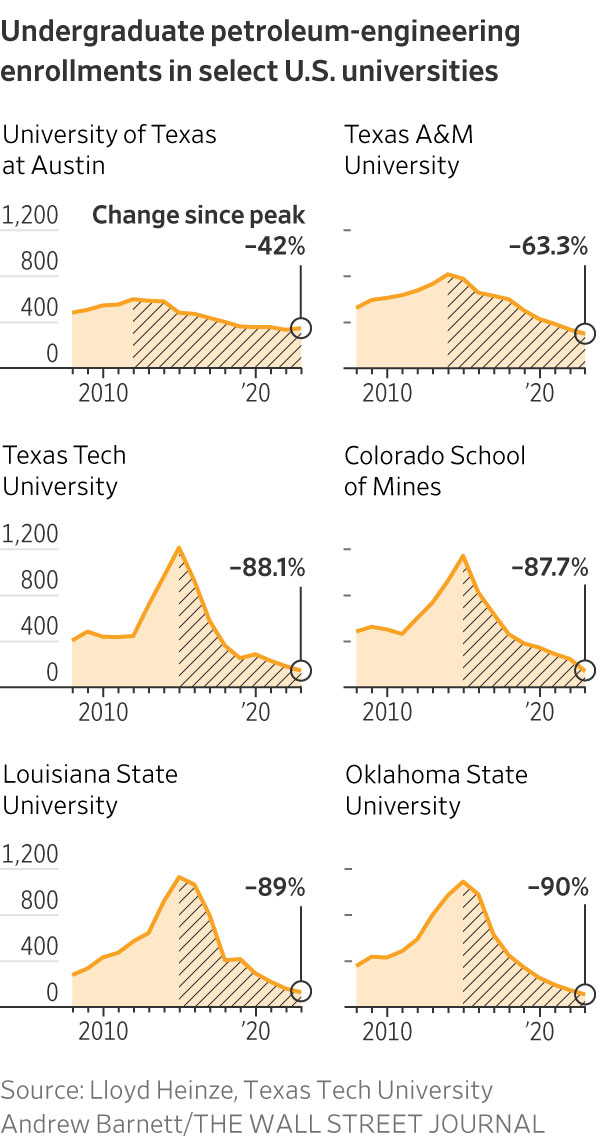

The 21-year-old Kansas City, Mo., native is studying petroleum engineering at Colorado School of Mines. His graduating class of 36 students is down from around 200 in the years before oil prices collapsed in the mid-2010s, according to a college official.

“People are concerned they won’t have a job in 10 to 20 years,” said Gregg.

Encouraged by his roommates and a visit to the oil-and-gas heartland of Texas, he became convinced that the industry offers a range of engineering possibilities as it transitions to a broader mix of energy sources.

“Even if oil and gas is going away, I can deploy my skills in other engineering fields,” he said.

Jennifer Miskimins, head of the petroleum engineering department at Colorado School of Mines, said Gregg’s graduating class is benefiting from a pickup in oil-industry hiring and many have gotten good internships. “They’re a hot commodity,” she said. “I think this class is going to be sitting pretty.”

Oil-and-gas companies are pouring money into fellowships and other programs designed to cultivate a new generation of talent. Much of the focus is on white-collar careers that tend to attract college graduates, but the trend is broadly true among the industry’s blue-collar workers as well.

A big part of the pitch is that the industry is increasingly dynamic and creative, requiring employees who can run carbon capture, hydrogen and geothermal projects, said Barbara Burger, who served in several leadership roles at Chevron and is now a senior adviser at investment bank Lazard.

Part of the challenge, she said, is that there are more startups and fast-growing companies in those fields that don’t carry the same baggage as the giants that earn most of their profits from fossil fuels.

“There’s competition in a way that probably wasn’t there 15 years ago,” she said.

Burger recently attended an event hosted by Fervo Energy, a startup that uses the shale boom’s horizontal drilling and fracking techniques to develop geothermal wells for electricity generation. Around 60% of Fervo’s employees previously worked at oil-and-gas outfits, the company said.

To attract workers, she said, oil-and-gas companies need to better articulate their energy transition strategies, including efforts to carve out new businesses or curb emissions.

“That’s a hook for employees—current and future,” Burger said. “They want to know there’s a future in the actual companies, the industries and the skill sets they have.”

The talent shortage represents a long-term problem at a moment when energy security—largely dependent on fossil fuels for the foreseeable future—is increasingly a global priority. Since Russia’s invasion of Ukraine last year, Europe has become desperate for new supplies of oil and gas, though countries around the world are trying to keep fuel affordable.

Darian Kane-Stolz said that growing up in New York, she was always concerned with climate change. She taught neighbours how to recycle.

When Kane-Stolz, 25, enrolled at the University of Texas at Austin seven years ago, she felt that joining the petroleum-engineering program was consistent with her desire to have a positive impact on the planet.

Now a BP engineer bringing wells online in the Gulf of Mexico, she said the attitude toward the industry has drastically shifted within her cohort. Before she goes out with friends, she sometimes prepares talking points in case someone attacks the industry.

“There’s definitely a negative perception out there,” said Kane-Stolz.

BP this year launched a new $4 million fellowship program with U.S. universities to provide students with exposure to the energy industry. It also said last year that it planned to double the size of its apprenticeship program to 2,000 people this decade.

“To achieve our goal of reimagining energy, we need the brightest talent,” said a BP spokesperson.

Meanwhile, Kane-Stolz’s alma mater, the University of Texas, is working on adding a new master’s degree without the word “petroleum” to capture a broader group of students who still want to work in energy-related engineering, said Jon E. Olson, the department chair of petroleum and geoscience at UT.

Other universities are ending their petroleum engineering degrees or rebranding them. Imperial College London—formerly housing the Royal School of Mines—shut its program last year and replaced it with one in geo-energy with machine learning and data science.

Analysts and company officials say a steady flow of talent is critical to company efforts to build out infrastructure needed to curb emissions and develop clean-energy and low-carbon businesses.

“One of the scarcest resources at the moment seems to be people,” said Aslak Hellestø, a business adviser for Northern Lights, a carbon capture and storage project off the coast of Norway operated by European energy companies Equinor, Shell and TotalEnergies.

“This is groundbreaking technology and we cannot afford to try and fail,” he said. “We need young people with new ideas and bright minds to make it right the first time.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

A divide has opened in the tech job market between those with artificial-intelligence skills and everyone else.

A 30-metre masterpiece unveiled in Monaco brings Lamborghini’s supercar drama to the high seas, powered by 7,600 horsepower and unmistakable Italian design.

Ready to level up your cellar? Here, LANGTONS Head of Auctions, Michael Anderson, selects the bottles to chase from Bordeaux 2022.

There are Bordeaux drops and then there are Bordeaux moments. This is the latter. The 2022 vintage has arrived through LANGTONS with depth across communes and enough quality to satisfy both the curious and the die-hard.

Here is your guide to what deserves a place in the cellar, and in years to come, your dining table.

1. Château Carbonnieux Blanc 2022, Graves, $110

The story of the legendary white of Château Carbonnieux Blanc (Graves, $110) stretches back to the 18th century when, thanks to its crystal clarity, it was introduced to the Sultan of Constantinople’s palace disguised as ‘mineral water from Carbonnieux. Today, the wine retains that luminous freshness in youth but develops dried and candied fruit characters with maturity, making it one of the most versatile whites in the region. This is a wine that can be drunk now through to 2029, so not a long termer.

2. Château Figeac 2022, St-Émilion, $850

If Carbonnieux speaks of crystalline youth, Château Figeac (St-Émilion, $850) speaks of longevity. Few estates can match its claim to 2000 years of continuous occupation, and the 2022 vintage bears that gravitas. Deeply garnet in colour, Cabernet Sauvignon shines here with notes of blackcurrant, blueberry, lilac, tobacco and bay leaf. On the palate, the wine is elegant and mineral, yet vibrantly alive. It’s a stunning effort that will reward those with patience – I’d suggest drinking from 2034–2060. It’s a great investment wine given Figeac’s ascent, too.

3. Château Gazin 2022, Pomerol, $235

In Pomerol, the quiet achiever is Château Gazin ($235), whose neighbours happen to be Petrus and L’Evangile. The 2022 shows deep crimson colour, with aromas of violet, musky plum, roasted chestnut and mocha. Classically proportioned, it offers a palate of ripe black fruits, chalky tannins and mid-palate depth that places it among the appellation’s most compelling releases. This wine sees its best drinking between 2029 and 2040.

4. Château Palmer 2022, Margaux, $1,050

Further south in Margaux, Château Palmer ($1,050) continues its reputation as a ‘Super Second’, officially ranked a Third Growth but revered as the equal of the First Growths. The 2022 is abundant in blackberry jam, chocolate, lavender and smoke, a wine of sheer extract and richness with remarkable intensity. It is best from 2035 and should be showing nicely to 2065. It’s a wine nipping at the heels of the Firsts and a wonderful investment opportunity.”

5. Château Haut-Bailly 2022, Pessac-Léognan, $415

Another of Bordeaux’s historic properties, Château Haut-Bailly (Pessac-Léognan, $415), dates to the mid-15th century. Its 2022 vintage shows blackcurrant pastille, violet and graphite, with a refreshing yet dense palate that finishes chalky and minerally. It is incredibly elegant now, so try from 2030–2045 with ease. A wine worth buying 6–12 bottles of to watch this ‘value’ Bordeaux evolve in the cellar over time.

6. Château Pontet-Canet 2022, Pauillac, $330

The Pauillac commune offers two contrasting but equally celebrated estates. Château Pontet-Canet ($330), founded in 1725, is full-bodied and packed with ripe black fruits supported by finely integrated tannins. The wine is remarkably compelling now, but best after 2029 through to 2045. It’s also a hit in the secondary market amongst speculators.

7. Château Lafite-Rothschild 2022, Pauillac, $1,950

Then there is Château Lafite-Rothschild (Pauillac, $1,950), perhaps the most recognised name in the Médoc. The 2022 vintage has immense grip and presence, offering loganberry, blueberry, wet stones, and forest floor. For me, this is one of the definitive wines of the vintage. It’s one of the world’s most collected and cellared wines. Best from 2034–2070+ and is a triumph.

8. Château Montrose 2022, St-Estèphe, $595

North in St-Estèphe, Château Montrose ($595) demonstrates why this Second Growth is often regarded as a rival to the First Growths. Ample blackberry, cassis and briary fruits meet velvety tannins and cedar, creating a wine of both richness and precision. The wine is fine, aromatic and worth the investment. Most joy to be extracted from 2033 onwards with a 25-year satisfaction window.

9. Château Suduiraut 2022, Sauternes, $99

The sweet wines of Bordeaux complete the spectrum. Château Suduiraut (Sauternes, $99), a neighbour to d’Yquem, delivers a 2022 that is full of marmalade, saffron, lime and orange zest. Its sweetness is cut with a lifted bitterness that lends focus. This wine is showing beautifully now and best from 2028–2035+.

10. Château Cos d’Estournel 2022, St-Estèphe, $690

Finally, another St-Estèphe giant, Château Cos d’Estournel ($690), speaks with intensity and power. A blend dominated by Cabernet Sauvignon and Merlot, the 2022 is tannic, commanding and built for the long haul like every vintage of Cos.

By improving sluggish performance or replacing a broken screen, you can make your old iPhone feel new agai

An opulent Ryde home, packed with cinema, pool, sauna and more, is hitting the auction block with a $1 reserve.