Europe’s Gas-Guzzling Days Are Fading

In a reality check for natural-gas producers, volatile prices are prompting European homes and factories to go green faster than expected

Last year’s hottest gas market has cooled, and some of the change will stick.

Demand for natural gas in Europe hasn’t bounced back despite lower prices. The region’s TTF benchmark price is down 85% compared with a year ago, when Europe was rushing to fill its gas-storage facilities for winter after Russia cut off supply.

Prices have fallen partly because Europe’s gas storage is already full. It hit a 90% capacity target last week, more than two months ahead of a schedule set last year by the European Union.

But underlying demand is also weak. According to think tank Bruegel’s European natural gas demand tracker, use of gas in the first quarter of this year was 18% lower than the 2019-2021 average, and 19% below in the second quarter. The declines have accelerated from the 12% fall recorded last year.

Weaker economic growth is one reason why gas use hasn’t recovered. Another may be that lower wholesale prices haven’t been passed on to end users yet, according to Ben McWilliams, author of the Bruegel tracker.

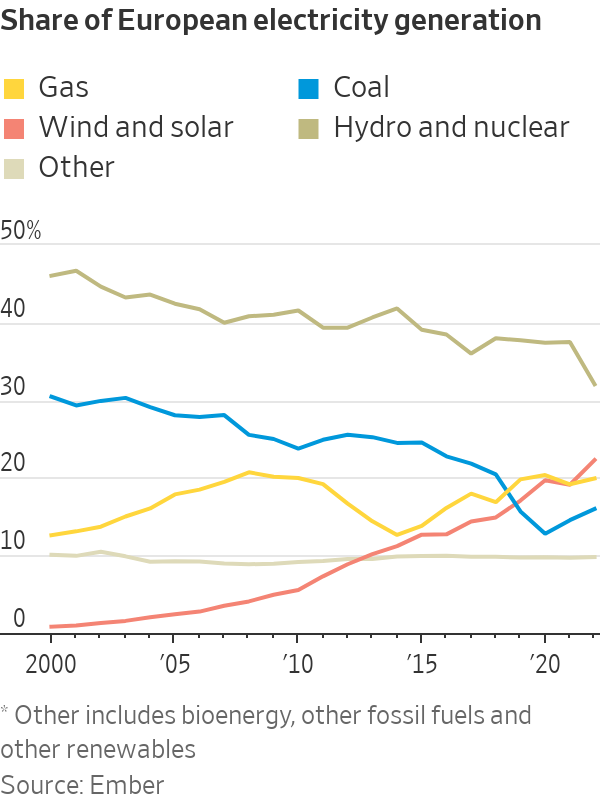

Other factors will be more permanent, notably new technologies. The European Heat Pump Association said sales of heat pumps rose 39% in 2022. They are now installed in 16% of Europe’s residential and commercial buildings, often replacing gas boilers. Heat pumps require electricity, which is often produced using gas, but this too is changing. Installations of new solar capacity rose a record 47% in 2022, and last year was the first time that renewable power generated more of Europe’s electricity than natural gas.

One uncertainty for future gas demand is whether European industries such as chemicals and fertiliser manufacturing will return to normal. The International Energy Agency thinks that up to half of the decline in Europe’s industrial gas demand last year was a result of production shutdowns. Certain companies whose business model traditionally relied on cheap Russian gas moved manufacturing to lower-cost regions such as the U.S., where gas costs roughly a quarter of the European spot price.

European gas prices will be volatile until more global liquefied natural gas supply arrives in 2025. The TTF jumped 5% on Monday because of worries about strikes at an Australian LNG terminal. Companies may be reluctant to restart their European factories until the region’s energy costs are more predictable.

Before the Ukraine war, global demand for natural gas was expected to increase 18% between 2021 and 2030, according to estimates from the Oxford Institute for Energy Studies. This forecast has since been cut to 10%. Lower growth expectations reflect the sharp cutbacks in Europe as well as the U.S. Inflation Reduction Act, which will supercharge America’s shift to renewable energy.

None of this is ideal for the U.S. LNG players who are currently pouring billions of dollars into new production. Based on projects that have already secured funding, and those in the pipeline, U.S. LNG export capacity could double by the end of this decade, according to Wood Mackenzie estimates.

True, Europe needs plenty of LNG over the next few years to replace the shortfall left by Russian pipeline gas. But the faster the region weans itself off gas, the sooner exporters will need to find a new home for at least some of their cargoes.

The expectation is that countries still using a lot of coal in power generation, such as India and Pakistan, will eventually switch to natural gas to cut their carbon emissions—assuming prices come down enough to make that transition affordable. “The window of opportunity for natural gas is tightening all around the world, although coal-reliant markets in Asia provide growth prospects over the medium-term,” says Gergely Molnar, energy analyst at IEA.

Buyers and sellers of natural gas took very different lessons from last year’s record prices, and the fuel’s reputation as a cheap, reliable form of energy took a hit. The pace of change in Europe’s gas market raises the risk of a glut.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Excluding the Covid-19 pandemic period, annual growth was the lowest since 1992

Australia’s commodity-rich economy recorded its weakest growth momentum since the early 1990s in the second quarter, as consumers and businesses continued to feel the impact of high interest rates, with little expectation of a reprieve from the Reserve Bank of Australia in the near term.

The economy grew 0.2% in the second quarter from the first, with annual growth running at 1.0%, the Australian Bureau of Statistics said Wednesday. The results were in line with market expectations.

It was the 11th consecutive quarter of growth, although the economy slowed sharply over the year to June 30, the ABS said.

Excluding the Covid-19 pandemic period, annual growth was the lowest since 1992, the year that included a gradual recovery from a recession in 1991.

The economy remained in a deep per capita recession, with gross domestic product per capita falling 0.4% from the previous quarter, a sixth consecutive quarterly fall, the ABS said.

A big area of weakness in the economy was household spending, which fell 0.2% from the first quarter, detracting 0.1 percentage point from GDP growth.

On a yearly basis, consumption growth came in at just 0.5% in the second quarter, well below the 1.1% figure the RBA had expected, and was broad-based.

The soft growth report comes as the RBA continues to warn that inflation remains stubbornly high, ruling out near-term interest-rate cuts.

RBA Gov. Michele Bullock said last month that near-term rate cuts aren’t being considered.

Money markets have priced in a cut at the end of this year, while most economists expect that the RBA will stand pat until early 2025.

Treasurer Jim Chalmers has warned this week that high interest rates are “smashing the economy.”

Still, with income tax cuts delivered at the start of July, there are some expectations that consumers will be in a better position to spend in the third quarter, reviving the economy to some degree.

“Output has now grown at 0.2% for three consecutive quarters now. That leaves little doubt that the economy is growing well below potential,” said Abhijit Surya, economist at Capital Economics.

“But if activity does continue to disappoint, the RBA could well cut interest rates sooner,” Surya added.

Government spending rose 1.4% over the quarter, due in part to strength in social-benefits programs for health services, the ABS said.

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.