What Aussies Are Doing To Cope With The Cost-of-living Crisis

Limiting spending, refinancing loans, moving back home with mum and dad and working a side hustle are popular options being adopted today

Mortgage holders are limiting household spending and refinancing their loans, while a rising number of young Australians are moving back home with their parents. These are some of the ways in which people are dealing with today’s cost-of-living crisis, which has been caused by the highest inflation rate in two decades along with rising interest rates and rents, according to research by Finder.

Three in four Australians surveyed in September said they were somewhat or extremely stressed about their financial situation. This includes 84% of mortgage holders, up from 76% in September 2021. Finder says almost $15,000 in extra interest costs have been added to the annual repayments of an average Australian home loan. And that was before the Reserve Bank of Australia raised the official cash rate again this week. The RBA raised rates by 25 basis points to 4.35%. That was the 13th increase since May 2022 and takes the cash rate to its highest level since 2011.

The research cites data from the Australian Bureau of Statistics showing the total monthly value of refinanced home loans peaked at $22 billion in June. Finder says more than 70% of refinancing borrowers were going to a new lender rather than renegotiating with the existing one. However, the savings were fairly small. On average, refinancers went from a variable rate of 5.01% to 4.78%.

Graham Cooke, Finder’s Head of Consumer Research, said “the willingness of homeowners to refinance for even marginal gains underscores the pervasive cost-of-living crisis, reflecting a desperate search for any fiscal relief.” He added that millennial homeowners were struggling the most today. “This could be a sign that they jumped in when rates were at record lows and were unprepared for an environment where rates and repayments increased.”

Finder says young renters are increasingly moving back in with their parents to escape rising rents or to save to buy a home. Unaffordable rents prompted 30% to move back home. A further 30% did so to save money for a home deposit, while 14% said the loss of a job forced a change in living arrangements. Mr Cooke said interest rate rises were actually having a higher impact on renters, given landlords typically pass on higher costs to tenants through rent increases.

Cutting discretionary spending is another method of coping with rising costs. The Finder research shows 45% of Australians have cut back on dining out or ordering home delivery, 32% are shopping around for better prices, 23% have reduced beauty and self-care treatments, and 19% have cancelled a holiday. A small proportion (3%) have moved their child to a different school with lower fees.

Refinancing advice

Mr Cooke said it was important not to rush a refinancing decision. “There is a significant gap in rates offered by different lenders for comparable loan products. The best thing you can do is take the time to review and compare your home loan options to ensure you’re getting the most competitive rate. It’s never too late to find a better home loan deal.”

Advice if you’re moving back home

Mr Cooke said there was no point ‘returning to the nest’ without changing your spending habits. “Prioritising a budget is critical. Start cutting out non-essentials and look for ways you can save money. Working out all your expenses to the smallest detail will give you an idea of how much capacity you have to save.”

Tips for cutting spending

Finder says shopping around can help reduce non-discretionary spending as well. Finder recommends that consumers consider switching energy providers and insurers, and use a high-interest account for savings. RateCity recently reported that nine financial institutions on its panel are now offering savings account interest rates that are above inflation at 5.5% or more.

Take up a side hustle

Finder research also shows 35% of Australians are earning extra income through side hustle jobs like dog walking, mystery shopping, tutoring, freelancing and ride-share driving. Popular non-employed side hustles include recycling cans and bottles, making and selling goods, selling pre-owned goods and renting out a spare room or garage.

Formula 1 may be the world’s most glamorous sport, but for Oscar Piastri, it’s also one of the most lucrative. At just 24, Australia’s highest-paid athlete is earning more than US$40 million a year.

From gorilla encounters in Uganda to a reimagined Okavango retreat, Abercrombie & Kent elevates its African journeys with two spectacular lodge transformations.

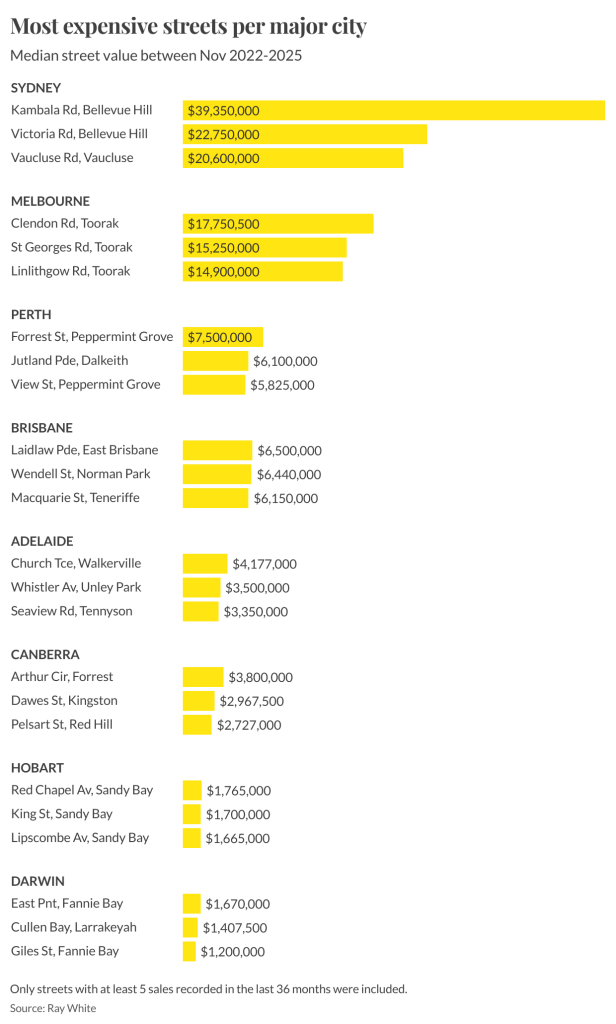

Ray White senior data analyst Atom Go Tian says Sydney’s elite postcodes are pulling further ahead, with Bellevue Hill dominating the nation’s most expensive streets in 2025.

Sydney has cemented its status as the nation’s luxury capital, with Kambala Road in Bellevue Hill being Australia’s most expensive street this year, posting a median house price of $39.35 million.

And, according to Ray White senior data analyst Atom Go Tian, last year’s leader, Wolseley Road, was excluded from this year’s rankings due to limited sales.

“Wolseley Road recorded only three sales this year and was therefore excluded from the rankings, though its $51.5 million median would have otherwise retained the top position,” he says.

Bellevue Hill continues its dominance, accounting for six of the nation’s top 10 streets. Tian says the suburb’s appeal lies in its rare blend of location and lifestyle advantages.

“The suburb’s enduring appeal lies in its rare combination of proximity to both the CBD and multiple beaches, harbour views, and large estate-sized blocks on tree-lined streets.”

Vaucluse remains a powerhouse in its own right. “Vaucluse extends this harbourside premium with even more direct beach access and panoramic water views,” he says.

The gulf between Sydney and the rest of the country remains striking.

According to Tian, “Sydney’s most expensive streets are more than five times more expensive than the leading streets in Perth and Brisbane, and more than 10 times the premium streets in Canberra and Adelaide.”

He attributes this to Sydney’s economic role and geographic constraints, describing it as “Australia’s financial capital and its most internationally connected city.”

Beyond Sydney, each capital city has developed its own luxury hierarchy. Tian highlights Melbourne’s stronghold in Toorak, noting that “Melbourne’s luxury market remains centred around Toorak, led by Clendon Road, St Georges Road and Linlithgow Road.”

Brisbane’s prestige pockets are more dispersed: “Brisbane’s luxury real estate shows a more diverse pattern,” he says, led by Laidlaw Parade at $6.5 million. Perth’s top-end market remains anchored in the Peppermint Grove–Dalkeith corridor, with Forrest Street at $7.5 million.

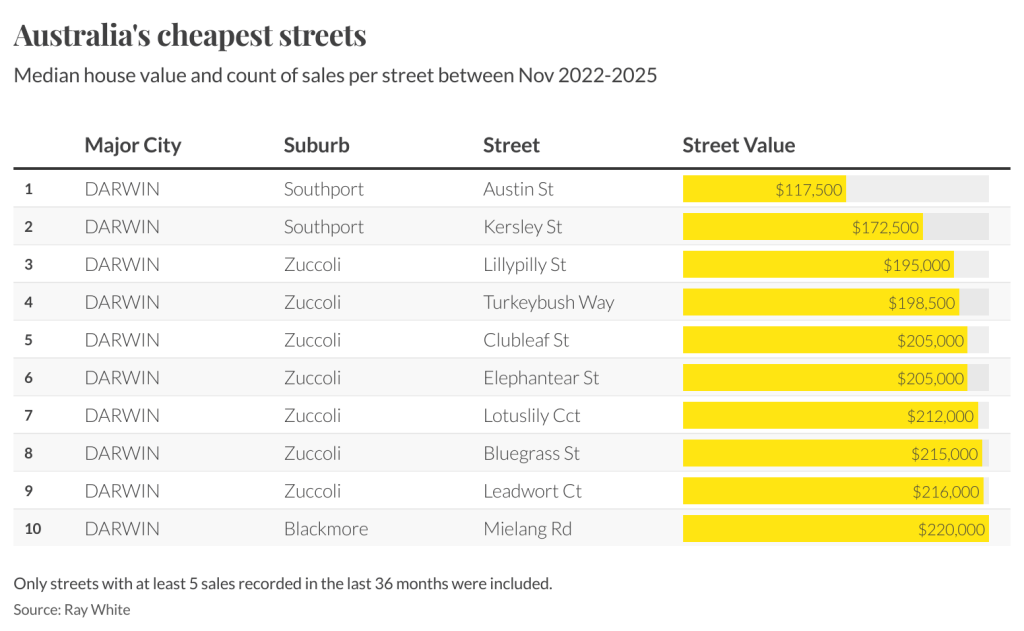

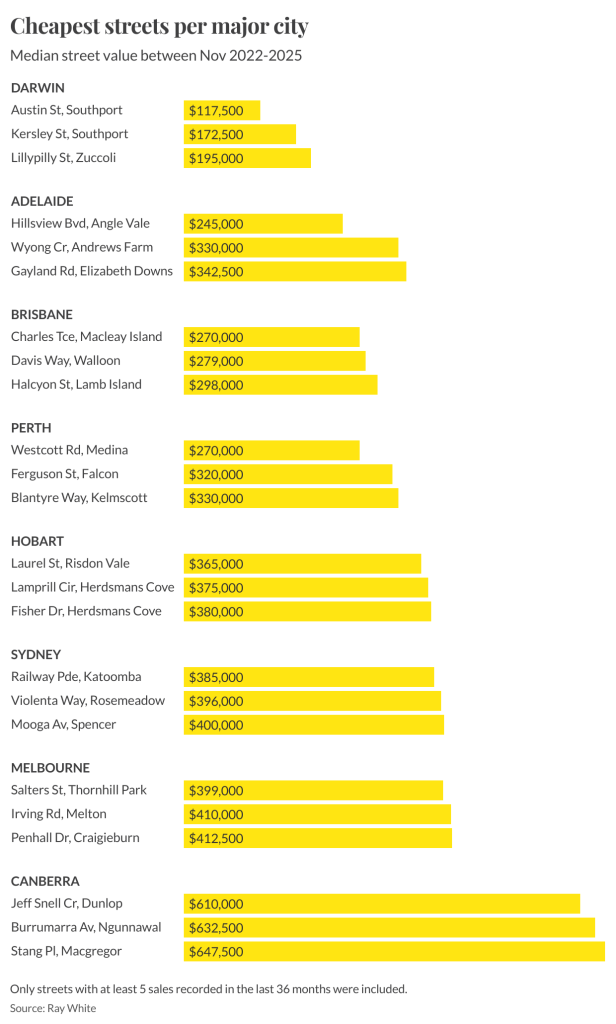

He also points to the stark contrast at the lower end of the spectrum. “Darwin presents a mirror image, hosting all 10 of the country’s cheapest streets,” Tian says. Austin Street in Southport sits at just $117,500.

The national spread reaches its extreme in New South Wales. “Sydney emerges as the most polarised market, spanning an extraordinary range from Railway Parade in Katoomba at $385,000 to Kambala Road’s $39.35 million,” Tian says.

Methodology: Tian’s analysis examines residential house sales between November 2022 and November 2025, with only streets recording at least five sales included. Several streets with higher medians, including Black Street, Queens Avenue and Clairvaux Road in Vaucluse, were excluded because they did not meet the sales threshold.

From office parties to NYE fireworks, here are the bottles that deserve pride of place in the ice bucket this season.

An opulent Ryde home, packed with cinema, pool, sauna and more, is hitting the auction block with a $1 reserve.