The Office Market Had It Hard in 2023. Next Year Looks Worse.

Office building owners are losing hope that occupancy rates will rebound soon

Office building owners, hammered by falling demand and high interest rates, struggled in 2023. But they mostly managed to stay afloat.

That is going to be a lot harder to do next year.

Many landlords have been able to extend their loans, often by putting in more capital. But a lot of those extensions are now expiring, and owners are losing hope that occupancy rates will rebound soon.

That means many more office landlords will be compelled to pay off their mortgages, sell their properties at a steep discount or hand their buildings over to their creditors.

“In 2024, it’s game time,” said Scott Rechler, chief executive of RXR Realty, a major owner of office buildings in the New York region. “Owners and lenders are going to have to come to terms as to where values are, where debt needs to be and right-sizing capital structures for these buildings to be successful.”

Office demand shows no sign of returning to pre pandemic levels. While the number of full-time remote employees has dwindled, hybrid workplace policies look here to stay. In the fourth quarter, 62% of U.S. businesses allowed employees to work from home some days of the week, up from 51% in the first quarter, according to Scoop Technologies.

Return-to-office rates also stalled for most of 2023. Kastle Systems, which tracks security-card swipes in 10 major U.S. cities, said that average office attendance is about half of its pre pandemic level. Placer.ai, which tracks mobile phone data, puts it in the 60% to 65% range. But it also said the return rate has topped out.

The office market has shown “some monthly fluctuations but little real change in the overall trajectory,” Placer.ai said in a November report.

The U.S. office vacancy rate stands at a record 13.6%, up from 9.4% at the end of 2019, according to data firm CoStar Group. The firm is forecasting it will rise to 15.7% by the end of 2024 and will peak above 17% by the end of 2026.

That vacancy rate is poised to push higher because nearly half of office leases signed before the pandemic haven’t expired, CoStar said. When they do, many of the businesses will likely take less space than they are currently occupying, whether they are renewing or relocating.

Take the case of Chicago law firm Neal Gerber Eisenberg, which signed one of the city’s largest 2023 office leases earlier this fall. The firm, which has grown steadily throughout the pandemic, adopted a policy that requires employees to work from the office at least eight days a month. Neal Gerber leased 90,000 square feet at its new location, down from the 113,000 square feet it will be giving up.

Beyond the longer-term decline in demand, office landlords are still contending with high interest rates. Landlords that have to refinance debt borrowed when rates were at historic lows will face much higher borrowing costs as high vacancy is putting rents and incomes under pressure.

In recent weeks, inflation has been declining and the Federal Reserve is likely to ease interest rates in 2024. That will soften the blow. But landlords still face a financial squeeze, analysts say.

“If you have a mortgage that’s expiring at 3% or 4%, there’s no way you’re refinancing at 3% or 4%,” said Steve Sakwa, an analyst with Evercore ISI. Even though rates have come down, he added, property owners are still looking at rates that could be double their expiring rates to refinance.

Not all the signals are bleak for the office market in 2024. Demand is still strong for the highest quality and best-located space in many markets from tenants willing to pay high rents to encourage employees to return to offices.

Developers have retreated from new construction in the sector, so there’s little competition from new supply. The 30 million square feet in office construction starts in 2023 was the lowest amount since 2010, according to CoStar.

Cities such as San Francisco, New York and Boston are lowering costs and streamlining the process for converting obsolete office buildings into apartments. While this isn’t expected to result in a big decline in vacancy, the actions might bring more activity to business districts, giving a psychological boost to downtown landlords and businesses.

But the steadily rising number of owners who are defaulting on their mortgages because of falling rent rolls looms over the market. The delinquency rate of bank loans and loans converted into commercial mortgage-backed securities currently is over 6% compared with below 1% before the pandemic hit, according to data firm Trepp.

High delinquencies combined with the dismal office outlook already have convinced some owners to hand properties back to lenders or sell for sharply discounted prices.

In Stamford, Conn., the owner of One Stamford Forum, a 500,000-square-foot building whose tenants include troubled Purdue Pharma, this fall gave the building back to its creditors, according to Trepp. In San Francisco, buyers have purchased office buildings like 60 Spear Street and 350 California Street for fractions of what they were worth before the pandemic.

Trepp is projecting that the office delinquency rate could be over 8% by the second half of next year. As more landlords default, the new owners that replace them—buying in at greatly reduced prices—will likely put more pressure on the market because they’ll be able to charge lower rents and still make a profit.

“What could be catastrophic is if you start seeing corporate profit pressures leading to continued or accelerated pace of office downsizing,” said Stephen Buschbom, Trepp’s research director.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Birthrates are falling fast across countries, with economic, social and geopolitical consequences

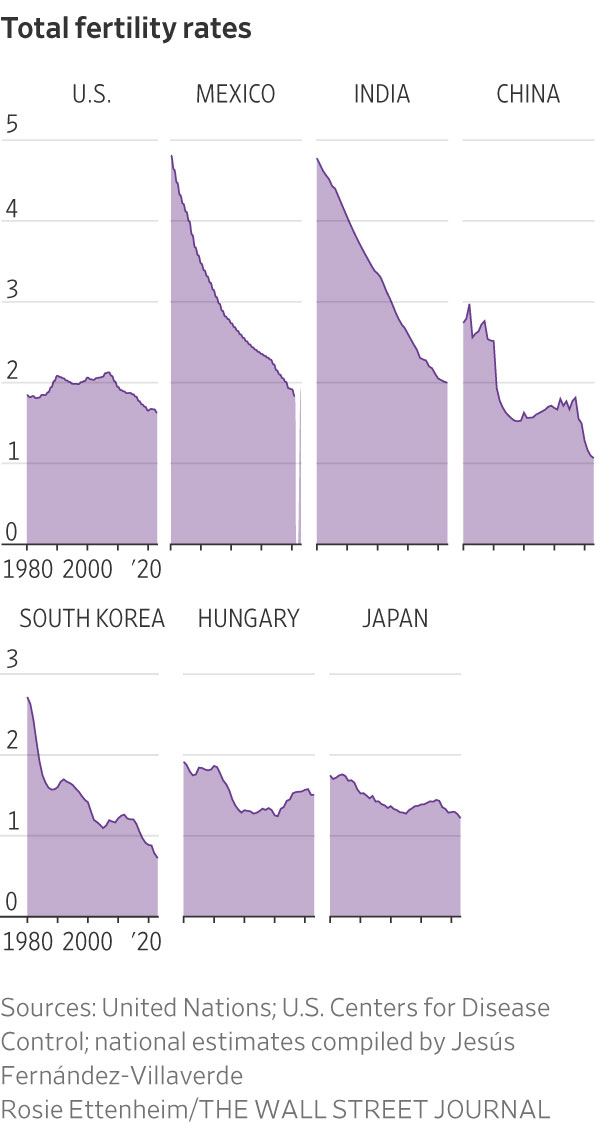

The world is at a startling demographic milestone. Sometime soon, the global fertility rate will drop below the point needed to keep population constant. It may have already happened.

Fertility is falling almost everywhere, for women across all levels of income, education and labor-force participation. The falling birthrates come with huge implications for the way people live, how economies grow and the standings of the world’s superpowers.

In high-income nations, fertility fell below replacement in the 1970s, and took a leg down during the pandemic. It’s dropping in developing countries, too. India surpassed China as the most populous country last year, yet its fertility is now below replacement.

“The demographic winter is coming,” said Jesús Fernández-Villaverde, an economist specialising in demographics at the University of Pennsylvania.

Many government leaders see this as a matter of national urgency. They worry about shrinking workforces , slowing economic growth and underfunded pensions; and the vitality of a society with ever-fewer children. Smaller populations come with diminished global clout, raising questions in the U.S., China and Russia about their long-term standings as superpowers.

Some demographers think the world’s population could start shrinking within four decades—one of the few times it’s happened in history.

Donald Trump , this year’s presumptive Republican presidential nominee, has called collapsing fertility a bigger threat to Western civilization than Russia. A year ago Japanese Prime Minister Fumio Kishida declared that the collapse of the country’s birthrate left it “standing on the verge of whether we can continue to function as a society.” Italian Prime Minister Giorgia Meloni has prioritized raising the country’s “demographic GDP.”

Governments have rolled out programs to stop the decline—but so far they’ve barely made a dent.

Demographic surprise

In 2017, when the global fertility rate—a snapshot of how many babies a woman is expected to have over her lifetime—was 2.5, the United Nations thought it would slip to 2.4 in the late 2020s. Yet by 2021, the U.N. concluded, it was already down to 2.3—close to what demographers consider the global replacement rate of about 2.2. The replacement rate, which keeps population stable over time, is 2.1 in rich countries, and slightly higher in developing countries, where fewer girls than boys are born and more mothers die during their childbearing years.

While the U.N. has yet to publish estimated fertility rates for 2022 and 2023, Fernández-Villaverde has produced his own estimate by supplementing U.N. projections with actual data for those years covering roughly half the world’s population. He has found that national birth registries are typically reporting births 10% to 20% below what the U.N. projected.

China reported 9 million births last year , 16% less than projected in the U.N.’s central scenario. In the U.S., 3.59 million babies were born last year, 4% less than the U.N. projected. In other countries, the undershoot is even larger: Egypt reported 17% fewer births last year. In 2022, Kenya reported 18% fewer.

Fernández-Villaverde estimates global fertility fell to between 2.1 and 2.2 last year, which he said would be below global replacement for the first time in human history. Dean Spears, a population economist at the University of Texas at Austin, said while the data isn’t good enough to know precisely when or if fertility has fallen below replacement, “we have enough evidence to be quite confident about…the crossing point not being far off.”

In 2017 the U.N. projected world population, then 7.6 billion, would keep climbing to 11.2 billion in 2100. By 2022 it had lowered and brought forward the peak to 10.4 billion in the 2080s. That, too, is likely out of date. The Institute for Health Metrics and Evaluation at the University of Washington now thinks it will peak around 9.5 billion in 2061 then start declining.

In the U.S., a short-lived pandemic baby boomlet has reversed. The total fertility rate fell to 1.62 last year, according to provisional government figures, the lowest on record .

Had fertility stayed near 2.1, where it stood in 2007, the U.S. would have welcomed an estimated 10.6 million more babies since, according to Kenneth Johnson, senior demographer at the University of New Hampshire.

In 2017, when the fertility rate was 1.8, the Census Bureau projected it would converge over the long run to 2.0. It has since revised that down to 1.5. “It has snuck up on us,” said Melissa Kearney, an economist at the University of Maryland specialising in demographics.

A second demographic transition?

Historians refer to the decline in fertility that began in the 18th century in industrialising countries as the demographic transition. As lifespans lengthened and more children survived to adulthood, the impetus for bearing more children declined. As women became better educated and joined the workforce, they delayed marriage and childbirth, resulting in fewer children.

Now, said Spears, “the big-picture fact is that birthrates are low or are falling in many diverse societies and economies.”

Some demographers see this as part of a “second demographic transition,” a society-wide reorientation toward individualism that puts less emphasis on marriage and parenthood, and makes fewer or no children more acceptable.

In the U.S., some thought at first that women were simply delaying childbirth because of lingering economic uncertainty from the 2008 financial crisis.

In research published in 2021 , the University of Maryland’s Kearney and two co-authors looked for possible explanations for the continued drop. They found that state-level differences in parental abortion notification laws, unemployment, Medicaid availability, housing costs, contraceptive usage, religiosity, child-care costs and student debt could explain almost none of the decline. “We suspect that this shift reflects broad societal changes that are hard to measure or quantify,” they conclude.

Kearney said while raising children is no more expensive than before, parents’ preferences and perceived constraints have changed: “If people have a preference for spending time building a career, on leisure, relationships outside the home, that’s more likely to come in conflict with childbearing.”

Meanwhile, time-use data show that mothers and fathers, especially those that are highly educated, spend more time with their children than in the past. “The intensity of parenting is a constraint,” Kearney said.

Erica Pittman, a 45-year-old business banker in Raleigh, N.C., said she and her husband opted to have only one child because of demands on their time, including caring for her mother, who died last year after a long battle with multiple sclerosis. Their 8-year-old son is able to participate in theatre workshops, soccer and summer camps because the couple, with a combined income of about $225,000 a year, has more time and money.

“I feel like a better mom,” Pittman said. “I feel like I can go to work—because I have a fairly demanding job—but I can also make time to volunteer at his school, be the chaperone for the field trip and do those kinds of things, because I only have one to coordinate with my schedule.”

Pittman said she only questions their decision when her son says he wishes he had a sibling to play with. In response, she and her husband, a middle-school history teacher, pick vacation destinations with a kids’ club, such as a Disney cruise, so her son can play with others his age.

‘Plugged into the global culture’

Fertility is below replacement in India even though the country is still poor and many women don’t work —factors that usually sustain fertility.

Urbanisation and the internet have given even women in traditional male-dominated villages a glimpse of societies where fewer children and a higher quality of life are the norm. “People are plugged into the global culture,” said Richard Jackson, president of the Global Aging Institute, a nonprofit research and education group.

Mae Mariyam Thomas, 38, who lives in Mumbai and runs an audio production company, said she’s opted against having children because she never felt the tug of motherhood. She sees peers struggling to meet the right person, getting married later and, in some instances, divorcing before they have kids. At least three of her friends have frozen their eggs, she said.

“I think now we live in a really different world, so I think for anyone in the world it’s tough to find a partner,” she said.

Sub-Saharan Africa once appeared resistant to the global slide in fertility, but that too is changing. The share of all women of reproductive age using modern contraception grew from 17% in 2012 to 23% in 2022, according to Family Planning 2030, an international organisation.

Jose Rimon, a professor of public health at Johns Hopkins University, credits that to a push by national leaders in Africa which, he predicted, would drive fertility down faster than the U.N. projects.

Once a low fertility cycle kicks in, it effectively resets a society’s norms and is thus hard to break, said Jackson. “The fewer children you see your colleagues and peers and neighbours having, it changes the whole social climate,” he said.

Danielle Vermeer grew up third in a family of four children on Chicago’s North Side, where her neighbourhood was filled with Catholics of Italian, Irish and Polish descent and half her close friends had as many siblings as her or more. Her Italian-American father was one of four children who produced 14 grandchildren. Now her parents have five grandchildren, including Vermeer’s two children, ages 4 and 7.

The 35-year-old, who is the co-founder of a fashion thrifting app, said that before setting out to have children, she consulted dozens of other couples and her Catholic church and read at least eight books on the subject, including one by Pope Paul VI. She and her husband settled on two as the right number.

“The act of bringing a child into this world is an incredible responsibility,” she said.

New policies

Governments have tried to reverse the fall in fertility with pro natalist policies.

Perhaps no country has been trying longer than Japan. After fertility fell to 1.5 in the early 1990s, the government rolled out a succession of plans that included parental leave and subsidised child care. Fertility kept falling.

In 2005, Kuniko Inoguchi was appointed the country’s first minister responsible for gender equality and birthrate. The main obstacle, she declared, was money: People couldn’t afford to get married or have children. Japan made hospital maternity care free and introduced a stipend paid upon birth of the child.

Japan’s fertility rate climbed from 1.26 in 2005 to 1.45 in 2015. But then it started declining again, and in 2022 was back to 1.26.

This year, Prime Minister Fumio Kishida rolled out yet another program to increase births that extends monthly allowances to all children under 18 regardless of income, free college for families with three children, and fully paid parental leave.

Inoguchi, now a member of parliament’s upper house, said the constraint on would-be parents is no longer money, but time. She has pressed the government and businesses to adopt a four-day workweek. She said, “If you’re a government official or manager of a big corporation, you should not worry over questions of salary now, but that in 20 years time you will have no customers, no clients, no applicants to the Self-Defense Forces.”

Hungarian Prime Minister Viktor Orban has pushed one of Europe’s most ambitious natality agendas. Last year he expanded tax benefits for mothers so that women under the age of 30 who have a child are exempt from paying personal income tax for life. That’s on top of housing and child-care subsidies as well as generous maternity leaves.

Hungary’s fertility rate, though still well below replacement, has risen since 2010. But the Vienna Institute of Demography attributed this primarily to women delaying childbirth because of a debt crisis that hit around 2010. Adjusted for that, fertility has risen only slightly, it concluded.

In the U.S., while state and federal legislators have pushed to expand child-care subsidies and parental leave, they have generally not set a higher birthrate as an explicit goal. Some Republicans, though, are leaning in that direction. Last year, Trump said he backed paying out “baby bonuses” to prop up U.S. births, and GOP Arizona Senate candidate Kari Lake recently endorsed the idea.

Republican Sen. J.D. Vance of Ohio said falling fertility matters beyond the economic pressures of a smaller labor force and unfunded Social Security. “Do you live in communities where there are smiling happy children, or where people are just ageing?” he said in an interview. Lack of siblings and cousins, he said, contributes to children’s social isolation.

He’s studied potential solutions, in particular Hungary’s approach, but hasn’t seen proof of anything that works over the long term.

The Institute for Health Metrics and Evaluation found little evidence that pronatalist policies lead to sustained rebounds in fertility. A woman may get pregnant sooner to capture a baby bonus, researchers say, but likely won’t have more kids over the course of her lifetime.

Economic pressure

With no reversal in birthrates in sight, the attendant economic pressures are intensifying. Since the pandemic, labor shortages have become endemic throughout developed countries. That will only worsen in coming years as the postcrisis fall in birthrates yields an ever-shrinking inflow of young workers, placing more strain on healthcare and retirement systems.

Neil Howe , a demographer at Hedgeye Risk Management, has pointed to a recent World Bank report suggesting that worsening demographics could make this a second consecutive “lost decade” for global economic growth.

The usual prescription in advanced countries is more immigration, but that has two problems. As more countries confront stagnant population, immigration between them is a zero-sum game. Historically, host countries have sought skilled migrants who enter through formal, legal channels, but recent inflows have been predominantly unskilled migrants often entering illegally and claiming asylum.

High levels of immigration have also historically aroused political resistance, often over concerns about cultural and demographic change. A shrinking native-born population is likely to intensify such concerns. Many of the leaders keenest to raise birthrates are most resistant to immigration.

As birthrates fall, more regions and communities experience depopulation, with consequences ranging from closed schools to stagnant property values. Less selective colleges will soon struggle to fill classrooms because of the plunge in birthrates that began in 2007, said Fernández-Villaverde. Vance said rural hospitals can’t stay open because of the falling local population.

An economy with fewer children will struggle to finance pensions and healthcare for growing ranks of elderly. South Korea’s national pension fund, one of the world’s largest, is on track to be depleted by 2055. A special legislative committee recently presented several possible pension reforms, but there’s only a short window to act before the next presidential election campaign heats up.

There’s been little public pressure to act, said Sok Chul Hong, an economist at Seoul National University. “The elderly are not very interested in pension reform, and the youth are apathetic towards politics,” he said. “It is truly an ironic situation.”

Consumers are going to gravitate toward applications powered by the buzzy new technology, analyst Michael Wolf predicts

This stylish family home combines a classic palette and finishes with a flexible floorplan