It’s One of America’s Most Expensive Cities, and Home Buyers Can’t Get Enough

A metro area on California’s central coast ranked No. 1 in the latest WSJ/Realtor.com Emerging Housing Markets Index

It’s an area already popular with the likes of Oprah Winfrey, Ellen DeGeneres, Prince Harry and Meghan Markle.

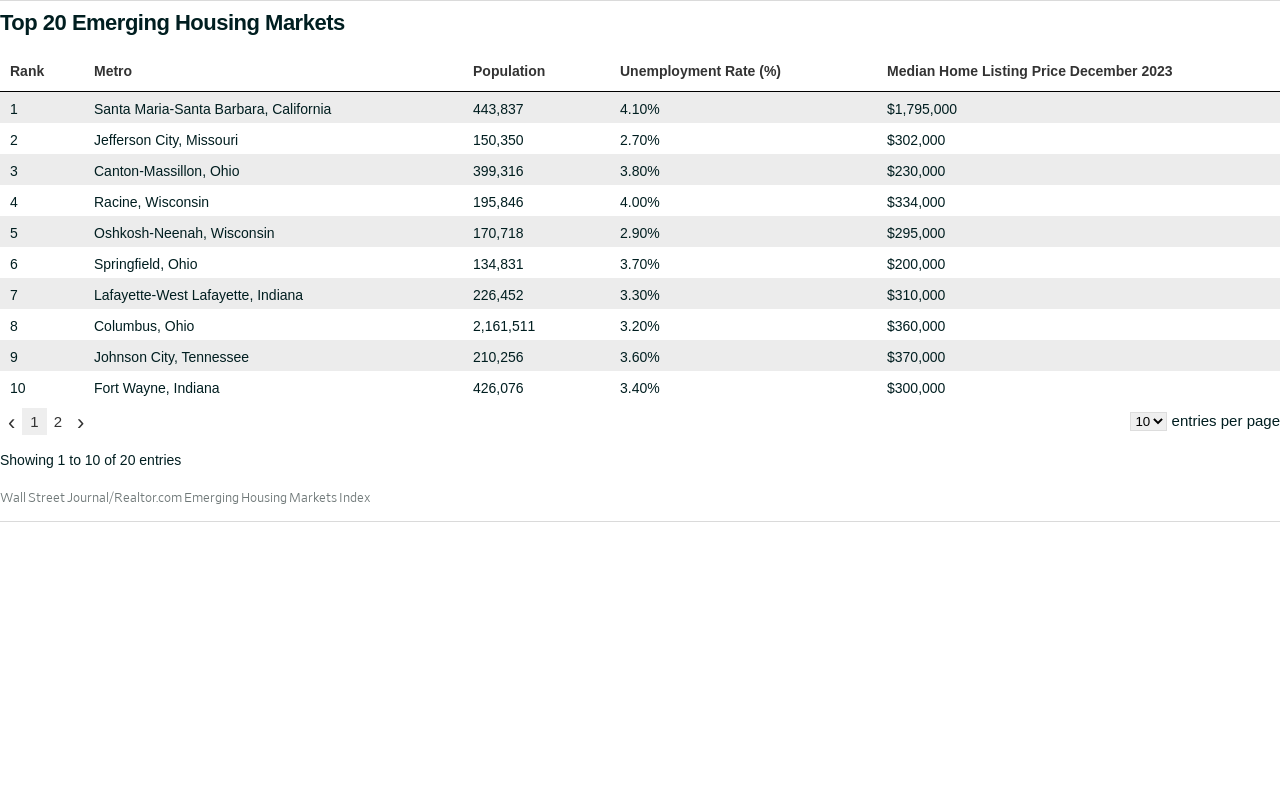

But now the affluent Santa Maria-Santa Barbara metropolitan area on the Central Coast of California nestled between the Santa Ynez Mountains and the Pacific Ocean has ranked as the top housing market in the latest Wall Street Journal/Realtor.com Emerging Housing Markets Index, released Wednesday.

It’s a surprise result for the quarterly index, which has, until now, typically seen more affordable cities rank at the top—Topeka, Kansas, took first place in the prior iteration of the report, released in fall, and Lafayette, Indiana, in the summer ranking.

“Santa Maria-Santa Barbara topping the list serves to highlight the division in today’s housing market,” said Danielle Hale, chief economist at Realtor.com. It’s the one and only West Coast market in the top 20, and, with a median listing price of $1.795 million in December, the highest-priced market by more than $1 million.

The top five cities in the index were rounded out by Jefferson City, Missouri, where the median listing price was $302,000 in December; the Canton-Massillon metro area in Ohio ($230,000); Racine, Wisconsin ($334,000); and the Oshkosh-Neenah metro area in Wisconsin ($295,000).

“Many housing markets cooled off after the pandemic’s run-up in prices and inventory-depleting demand,” Hale explained. “The markets that have continued to chug along, and even gain steam, are either priced low enough that buyers can compete, or priced high enough that the typical affordability constraints are not of concern to the market’s buyers.”

The latter is the scenario that’s playing out in Santa Barbara.

The index analyses key housing market data, as well as economic vitality and lifestyle metrics for the largest 300 metropolitan areas in the country to highlight emerging housing markets that offer a high quality of life and are expected to see future home price appreciation. It identifies markets that those considering a home purchase should add to their shortlist—whether the goal is to live in it or rent.

Santa Barbara “offers perhaps the finest lifestyle in the U.S.,” said local agent Luke Ebbin of The Ebbin Group at Compass. “Three-hundred days of sunshine and warm weather, a relaxed pace of living, proximity to uncrowded beaches, mountain hikes, fine food and wine, and incredible cultural offerings more often found in major metropolitan areas.”

However, with that median listing price of $1.79 million—more than four times the national median—the price tag attached to the idyllic locale is well out of range for many would-be buyers.

“Though Santa Barbara is among the highest-priced large housing markets in the U.S., buyers in the area have seen similar trends to buyers in other more affordable markets,” Hale said. “For-sale inventory fell rapidly during the early days of the pandemic, and has not recovered much as demand waned in the area and homeowners chose not to sell.”

As a result, “buyers hoping to snag a median-priced home are facing more competition, which has driven prices higher,” she said.

In December, 71% of homes on the market in the metro were priced at $1 million or higher, up from the same time in 2019, when the metric stood at 62%.

“Buyers who have been eager to purchase here and have been on the sidelines due to low inventory and high interest rates are entering the market as rates decline and more inventory becomes available,” Ebbin said. That “low inventory and high demand are keeping prices elevated.”

It should come as no surprise then that Santa Barbara boasts an affluent population who “are drawn to the area’s lifestyle, amenities and upscale housing options,” said Santa Barbara-based agent Jason Streatfeild of Douglas Elliman.

Santa Barbara has “long been a popular destination for retirees, especially those seeking a mild climate, beautiful scenery and a relaxed coastal lifestyle,” Streatfeild said, noting that many migrate from colder regions of the country, as well as from other parts of California.

Not only charmed by the balmy wealth, individuals from far and wide are equally wooed to the area by its thriving entrepreneurial community, and Santa Barbara’s “robust job market, including opportunities in technology, healthcare, finance and education, attracts professionals from various parts of the country,” Streatfeild said. “Some may relocate from major metropolitan areas like Los Angeles, San Francisco or New York in search of a more balanced and less crowded lifestyle.”

Indeed, out-of-towners appear to be driving demand in the coastal enclave, according to search data from Realtor.com. More than three-quarters (79.5%) of views to Santa Barbara home listings on the site came from outside of the metro in the fourth quarter, with a notable amount of attention coming from the Los Angeles (32.8%) area, according to the index. House hunters from Silicon Valley, Atlanta and New York City were also shopping in the area, according to Realtor.com data.

Meanwhile, Prince Harry and Megan Markle are prime examples that “Santa Barbara’s appeal extends beyond U.S. borders,” Streatfeild said.

The University of California, Santa Barbara, also attracts a global cohort—along with plenty of domestic new residents—who move to the area to pursue higher education.

The Santa Barbara metro area “attracted a sizeable 3.3% of its listing viewership from shoppers outside of the U.S.,” Hale said in the report. “Suggesting that international demand is applying pressure to already high prices.”

For comparison, “the average international viewership share across the 300 ranked markets was less than half (1.4%) the viewership share in Santa Barbara,” she added.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Companies are leasing premium office space to entice workers back, but employees in one major capital are holding out

The post-COVID return to CBD offices continues across Australia, with the average office occupancy rate climbing to 76 percent of pre-pandemic levels in the first quarter of 2024, according to new CBRE figures. Workers are gradually responding to their employers’ requests to attend their offices more regularly to enable greater collaboration with workmates. The occupancy rate has risen from 70 percent in the December quarter and 67 percent 12 months ago.

Occupancy rates improved across all capital cities during the March quarter, with Perth and Adelaide maintaining the strongest rates of 93 percent and 88 percent respectively. CBRE analysis suggests shorter commuting times and less structured working-from-home arrangements in these cities have contributed to higher rates of return. Brisbane’s occupancy rate is 86 percent of pre-COVID levels, weighed down by a slower return within the public sector, which represents 35 percent of the city’s office space. This same trend is being seen in Canberra, where the occupancy rate is just 66 percent.

In Sydney, the occupancy rate has risen to 77 percent, largely due to major banks and professional services firms pushing for more staff to return to the office this year. There has been a significant increase in workers returning to offices in Melbourne, with the occupancy rate up from 57 percent last quarter to 62 percent now. However, this is still the lowest attendance rate in the capital cities.

Businesses are increasingly pushing workers to return to the office because they are concerned working from home over multiple years will have a negative long-term impact on company-wide productivity. Part of the problem is new employees not having regular access to senior staff so they can learn and work more effectively and productively. CBRE says lower levels of collaboration and interaction reduce innovation, which is a particular concern for technology firms. They were quick to embrace remote working during COVID, but are now seeing dampened creativity among staff.

Tuesday is the peak day for attendance at CBD offices and Friday is the lowest day. Two-thirds of organisations that have moved their corporate headquarters since COVID have chosen to upgrade to premium office buildings, according to CBRE’s research. Premium blocks typically feature retail, restaurants, and recreational amenities on the ground floor, and command a higher rent. Companies are deciding it’s worth the cost to entice workers backand keep them feeling happy and engaged.

Jenny Liu, Director of Workplace Consulting at CBRE, said a vibrant workplace experience is essential.

“A workplace experience isn’t just environment, cool furniture and tech anymore,” she said. “It’s the culture, ways of working, leadership, and how vibrancy is created.”

Some companies are using apps that inform staff who will be in the office tomorrow. CBRE Research Manager Thomas Biglands said:

“It’s important that you achieve a critical mass of visitation so that employees come in and feel as though the office is vibrant and full,” he said.

Some firms are linking salary and promotions to office attendance to reward those workers providing higher contributions to corporate culture and mentoring younger staff.

The rate of return to offices in Australia is much higher than in the United States, where occupancy rates have remained at about 50 percent over the past year. CBRE analysis suggests this may be due to better public transport, shorter commutes and lower inner-city crime rates in Australia.

Consumers are going to gravitate toward applications powered by the buzzy new technology, analyst Michael Wolf predicts

This stylish family home combines a classic palette and finishes with a flexible floorplan