Cash-Rich Consumers Could Mean Higher Interest Rates for Longer

Buoyed by pandemic-fueled savings, consumers and businesses are proving less sensitive to tighter credit—complicating the Fed’s job

Washington’s response to the pandemic left household and business finances in unusually strong shape, with higher savings buffers and lower interest expenses. It could also make the Federal Reserve’s job of taming high inflation more difficult.

The U.S. central bank is trying to slow down economic growth to prevent inflation from becoming entrenched. To that end, it has increased rates aggressively this year and is likely to raise them another 0.75 percentage point at a two-day policy meeting that concludes Wednesday. That would bring the benchmark federal-funds rate to a range of 3.75% to 4%.

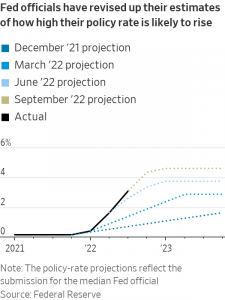

Some officials have argued for slowing the pace of rate rises after this week’s meeting. But the debate over the speed of increases could obscure a more important one around how high rates ultimately rise. In economic projections released at the Fed’s last meeting in mid-September, most officials anticipated their policy rate would reach at least 4.6% by early next year.

But some economists think it will have to go higher than 4.6%, citing in particular reduced sensitivity of spending to higher interest rates.

“The big question will be, given the resilience the economy has had to interest-rate increases so far, whether that will actually be sufficient,” said former Boston Fed President Eric Rosengren. “The risks are they’re going to have to do a bit more than they’re suggesting.”

The Fed combats inflation by slowing the economy through tighter financial conditions—such as higher borrowing costs and lower stock prices—which curb spending, further reducing employment, income and spending. This normally has its greatest effect on sectors of the economy most sensitive to the cost and availability of credit.

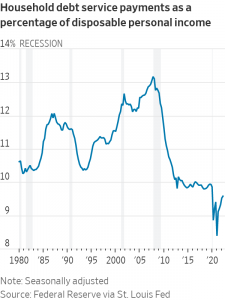

In 2020, however, the government’s wartime-like response to the pandemic—generous fiscal stimulus that showered cash on households and reduced borrowing costs—interrupted the usual recessionary dynamics of rising joblessness that amplifies declines in income and spending. It means private-sector balance sheets are in a historically strong position.

Household, non financial corporate and small-business sectors ran a surplus of total income over total spending equal to 1.1% of gross domestic product in the quarter of April to June, according to economists at Goldman Sachs Group Inc. Using a three-year average, the measure is healthier than on the eve of any U.S. recession since the 1950s.

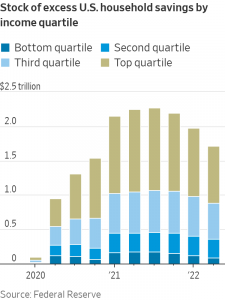

U.S. households still have around $1.7 trillion in savings they accumulated through mid-2021 above and beyond what they would have saved if income and spending had grown in line with the pre pandemic economy, according to estimates by Fed economists. Around $350 billion in excess savings as of June were held by the lower half of the income distribution, or around $5,500 per household on average.

Businesses were also able to lock in lower borrowing costs as interest rates plumbed new lows in 2020 and 2021. Just 3% of junk bonds, or those issued by companies without investment-grade ratings, mature over the next year, and only 8% come due before 2025, according to Goldman Sachs.

State and local governments are also flush with cash, leaving them in a far better position than after the recession of 2007 to 2009.

While the housing market—among the most interest-rate sensitive parts of the economy—is entering a deep downturn, the rest of the economy is so far holding together. Consumer credit-card balances are rising. Earnings reports from companies including United Airlines Holdings Inc., Bank of America Corp., Nestlé SA, Coca-Cola Co. and Netflix Inc. also point to strong consumer demand and pricing increases.

“This is not the earnings season the [Fed] wanted to see,” said Samuel Rines, managing director at Corbu LLC, a market intelligence firm in Houston. “For now, the consumer is too strong for comfort.”

The Commerce Department reported Friday that consumer spending adjusted for inflation rose 0.3% in September from August, a pickup from prior months.

The upshot is that cooling the U.S. economy might require even higher interest rates. The household savings buffer “suggests to me we may have to keep at this for a while,” said Federal Reserve Bank of Kansas City President Esther George in a webinar earlier this month.

Ms. George is among a handful of Fed officials who have argued in favour of slowing down the pace of interest-rate increases. But she also said the central bank’s ultimate rate destination might be higher than anticipated and that the Fed might have to stay at that higher rate longer.

The tight labour market also figures into this calculus. It not only leads to higher wages that might bump up prices, but also could continue to power consumer spending even as households run down savings.

Worker pay and benefits continued to rise at a rapid clip in the third quarter, according to a Labor Department measure released Friday that is closely monitored by the Fed. The employment-cost index, a measure of what employers pay for wages and benefits, showed that wages and benefits for private-sector workers excluding incentive-paid occupations rose 5.6% from a year earlier.

Jason Furman, a Harvard economist who served as a top adviser to former President Obama, thinks it will be harder for the Fed to slow down the economy. He said he sees the fed-funds rate ultimately reaching 5.25% next year, with a significant risk for topping out at an even higher level.

Steven Blitz, chief U.S. economist at research firm TS Lombard, thinks the central bank’s policy rate will rise to 5.5%. “A recession is coming in 2023, but there is more work for the Fed to do to create one,” he said.

The silver lining might be that stronger private-sector balance sheets cushion the extent of any slump in the U.S. The danger is that higher interest rates or a stronger dollar make trouble in corners of a global financial system that had come to expect low interest rates to persist.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

As Paris makes its final preparations for the Olympic games, its residents are busy with their own—packing their suitcases, confirming their reservations, and getting out of town.

Worried about the hordes of crowds and overall chaos the Olympics could bring, Parisians are fleeing the city in droves and inundating resort cities around the country. Hotels and holiday rentals in some of France’s most popular vacation destinations—from the French Riviera in the south to the beaches of Normandy in the north—say they are expecting massive crowds this year in advance of the Olympics. The games will run from July 26-Aug. 1.

“It’s already a major holiday season for us, and beyond that, we have the Olympics,” says Stéphane Personeni, general manager of the Lily of the Valley hotel in Saint Tropez. “People began booking early this year.”

Personeni’s hotel typically has no issues filling its rooms each summer—by May of each year, the luxury hotel typically finds itself completely booked out for the months of July and August. But this year, the 53-room hotel began filling up for summer reservations in February.

“We told our regular guests that everything—hotels, apartments, villas—are going to be hard to find this summer,” Personeni says. His neighbours around Saint Tropez say they’re similarly booked up.

As of March, the online marketplace Gens de Confiance (“Trusted People”), saw a 50% increase in reservations from Parisians seeking vacation rentals outside the capital during the Olympics.

Already, August is a popular vacation time for the French. With a minimum of five weeks of vacation mandated by law, many decide to take the entire month off, renting out villas in beachside destinations for longer periods.

But beyond the typical August travel, the Olympics are having a real impact, says Bertille Marchal, a spokesperson for Gens de Confiance.

“We’ve seen nearly three times more reservations for the dates of the Olympics than the following two weeks,” Marchal says. “The increase is definitely linked to the Olympic Games.”

Getty Images

According to the site, the most sought-out vacation destinations are Morbihan and Loire-Atlantique, a seaside region in the northwest; le Var, a coastal area within the southeast of France along the Côte d’Azur; and the island of Corsica in the Mediterranean.

Meanwhile, the Olympics haven’t necessarily been a boon to foreign tourism in the country. Many tourists who might have otherwise come to France are avoiding it this year in favour of other European capitals. In Paris, demand for stays at high-end hotels has collapsed, with bookings down 50% in July compared to last year, according to UMIH Prestige, which represents hotels charging at least €800 ($865) a night for rooms.

Earlier this year, high-end restaurants and concierges said the Olympics might even be an opportunity to score a hard-get-seat at the city’s fine dining.

In the Occitanie region in southwest France, the overall number of reservations this summer hasn’t changed much from last year, says Vincent Gare, president of the regional tourism committee there.

“But looking further at the numbers, we do see an increase in the clientele coming from the Paris region,” Gare told Le Figaro, noting that the increase in reservations has fallen directly on the dates of the Olympic games.

Michel Barré, a retiree living in Paris’s Le Marais neighbourhood, is one of those opting for the beach rather than the opening ceremony. In January, he booked a stay in Normandy for two weeks.

“Even though it’s a major European capital, Paris is still a small city—it’s a massive effort to host all of these events,” Barré says. “The Olympics are going to be a mess.”

More than anything, he just wants some calm after an event-filled summer in Paris, which just before the Olympics experienced the drama of a snap election called by Macron.

“It’s been a hectic summer here,” he says.

AFP via Getty Images

Parisians—Barré included—feel that the city, by over-catering to its tourists, is driving out many residents.

Parts of the Seine—usually one of the most popular summertime hangout spots —have been closed off for weeks as the city installs bleachers and Olympics signage. In certain neighbourhoods, residents will need to scan a QR code with police to access their own apartments. And from the Olympics to Sept. 8, Paris is nearly doubling the price of transit tickets from €2.15 to €4 per ride.

The city’s clear willingness to capitalise on its tourists has motivated some residents to do the same. In March, the number of active Airbnb listings in Paris reached an all-time high as hosts rushed to list their apartments. Listings grew 40% from the same time last year, according to the company.

With their regular clients taking off, Parisian restaurants and merchants are complaining that business is down.

“Are there any Parisians left in Paris?” Alaine Fontaine, president of the restaurant industry association, told the radio station Franceinfo on Sunday. “For the last three weeks, there haven’t been any here.”

Still, for all the talk of those leaving, there are plenty who have decided to stick around.

Jay Swanson, an American expat and YouTuber, can’t imagine leaving during the Olympics—he secured his tickets to see ping pong and volleyball last year. He’s also less concerned about the crowds and road closures than others, having just put together a series of videos explaining how to navigate Paris during the games.

“It’s been 100 years since the Games came to Paris; when else will we get a chance to host the world like this?” Swanson says. “So many Parisians are leaving and tourism is down, so not only will it be quiet but the only people left will be here for a party.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.