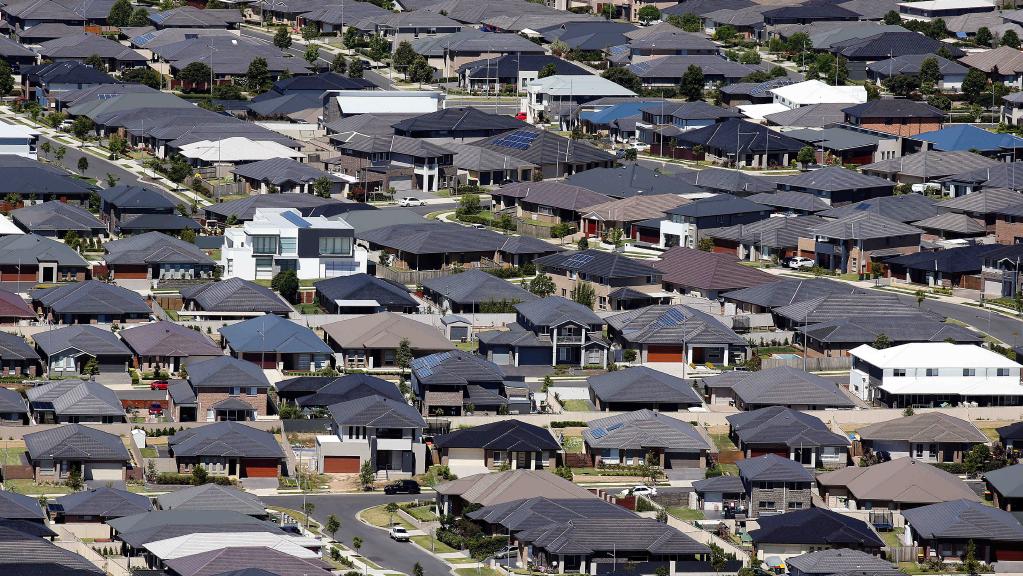

Fewer properties but consistent clearance rates point to a busy weekend

There’s plenty of activity for motivated buyers on the Australian east coast

The number of auctions scheduled across Australia has fallen week-on-week, new figures show.

Data from CoreLogic shows that the number of properties across the combined capitals is down -7.7 percent for the first weekend in August, with a total of 1,821 expected to go under the hammer. However, figures are still a significant improvement on last year, up 23.8 percent on the same week in 2022 when 1,471 auctions took place and the clearance rate was just 56.6 percent.

Melbourne has experienced the biggest fall, with a -9.0 percent decrease on last week. However, the eastern capital will still see the most properties go to market, with 792 homes scheduled compared with 748 homes in Sydney. The difference is that Sydney figures have remained steady, with just one less home up for sale this week compared with the previous week. Auction figures in both cities are considerably higher than this time last year with data showing an increase of more than 25 percent.

In the smaller capitals, it’s a mixed bag. Brisbane is experiencing its quietest week since Easter with 86 homes scheduled, a significant drop from the previous week when 173 homes went to auction while Adelaide has 105 homes set to go to market (nine less than last week). However, the nation’s capital is set for a busy weekend, with 81 homes scheduled in Canberra – the highest number of homes in nine weeks.

Figures in Perth are typically lower, with just seven auctions scheduled. It’s a similar story in tightly held Tasmania, with just two properties going to market this weekend.

Clearance rates from last week continue to show a steady winter auction market, the 64.9 percent of properties put to market resulting in a sale. This time last year, the clearance rate was just 54 percent.

A divide has opened in the tech job market between those with artificial-intelligence skills and everyone else.

A 30-metre masterpiece unveiled in Monaco brings Lamborghini’s supercar drama to the high seas, powered by 7,600 horsepower and unmistakable Italian design.

The house, with a pool, a wine cellar and cinema, is in Estoril’s gated Quinto Patino community.

If you’re looking to run into Cristiano Ronaldo, this six-bedroom villa near the coastal Portuguese town of Cascais, where the footballer lives, might up your chances.

The detached home, which came to market earlier this month asking €10 million (US$11.79 million), is within the gated Quinta Patino community in the town’s Estoril suburb, and comes with a private green-tiled pool, its own wine cellar and cinema, as well as a moody six-car show garage.

The eclectic house comes with a little French flair, including a grey mansard roof, as well as arched windows and a cream-stucco facade.

The interiors showcase a mix of modern floor-to-ceiling windows as well as more old-school elegance, including black-and-white checkered flooring, extensive crown moldings, a wood-paneled library and classic columns in between arched windows.

There are six bedrooms across 7,000 square feet, as well as a wine cellar, game room, a pergola and easy transitions between the indoors and outdoors.

“This residence was created for the way people truly want to live, with light-filled spaces that flow naturally from the kitchen and dining areas out to the garden and pool,” said listing agent Yared Hagos of Nest Seekers International via email.

Cascais is located in the Portuguese Riviera, roughly 30 minutes from Lisbon, and features sandy beaches, resorts and other visitor attractions.

“This property represents the best of both worlds, complete privacy in one of Portugal’s most prestigious gated communities, and yet you’re just minutes from the beach, the golf courses, and Lisbon’s cultural scene,” Hagos wrote.

Cascais is also one of many Portuguese cities to have benefited from the popularity of the country’s real estate among foreign investors, particularly its high-end homes , according to Hagos. Mansion Global could not determine the identity of the seller.

“With six consecutive months of rising buyer demand and price growth now exceeding 15% annually, prime areas like Lisbon, Cascais and the Algarve are seeing international buyers compete for an increasingly scarce supply of high-end homes,” he said.

The Portuguese Riviera also has seen an influx of celebrities in recent years, including most notably, soccer legend Cristiano Ronaldo, Mansion Global previously reported.

Micro-needling promises glow and firmness, but timing can make all the difference.

Australia’s market is on the move again, and not always where you’d expect. We’ve found the surprise suburbs where prices are climbing fastest.