How an Ex-Teacher Turned a Tiny Pension Into a Giant-Killer

A bold bet on rising rates lifted a small Massachusetts fund near the top of the performance rankings.

Plymouth County is known for Pilgrims, cranberries—and a top-performing pension fund run by a 65-year-old former schoolteacher.

After a decade of mostly ho-hum performance, the $1.4 billion Plymouth County Retirement Association ranked in the top 10% of U.S. pensions over the past three years. Key to that success was an early—and prescient—bet that interest rates would rise. That buoyed the fund through big chunks of the past two years, when climbing rates hammered both stocks and bonds.

Now markets of all kinds have posted a six-month rally , stocks are hitting records and Plymouth risks falling behind again. But Peter Manning, the fund’s director of investments, is sticking to his guns. The hope that rates will fall soon is misplaced, he said. Another downturn could be coming for Wall Street.

And so, to Manning, the best way to enlarge the pension long term is by avoiding big losses, rather than chasing high returns.

“It ain’t about what you make. It’s about what you keep,” he said.

Beating the big guys

The fund, which manages savings for the county’s firefighters, bus drivers and custodians, delivered average annual net returns of 5.7% in the three years ending Dec. 31. That put it ahead of 92% of pensions nationally. The median U.S. public retirement fund returned 3.7% over the same period, according to Investment Metrics, a portfolio analysis provider.

Plymouth County surpassed bigger peers by slashing exposure to Treasurys and public stocks before they tanked in 2022. The fund then reinvested the money in infrastructure, private equity and inflation-protected debt.

While many other public plans have followed suit , the trades were also unusually quick for pension funds, which often change investments incrementally rather than in bold strokes.

“A lot of our clients made moves on the margin,” said Daniel Dynan, a managing principal at Meketa Investment Group, Plymouth County’s investment consultant. “The difference in Plymouth is the magnitude of the change.”

An unlikely trendsetter

With only 10,500 members, the fund is an unlikely trendsetter. U.S. public pensions guarantee retirement and benefit payments to 34 million members nationally, according to data from the Urban Institute, a nonprofit think tank. Plymouth County, which lies south of Boston, encompasses mostly middle-class suburbs, but also some wealthy enclaves and gritty urban areas. It is split between Democratic and Republican voters.

A decade ago, Plymouth County had only about half of the money it needed to make expected payments for its retirees. An accounting change in 2012 drastically widened shortfalls for most public pensions across the country.

At the same time, the board overseeing the fund, which had spent years relying solely on an outside consultant, was dissatisfied with its investment performance. The approach resembled the classic mix of 60% stocks and 40% bonds popular with ordinary investors.

“We were doing what everyone else was doing, running a 60-40 portfolio and hoping for the best,” said Tom O’Brien, Plymouth County’s treasurer and chairman of the pension board.

From teacher to investor

The county hired Manning to advise the board on investment strategy in 2012. He had never managed a pension fund before.

“I was a schoolteacher [in the 1980s] in a suburb of Boston and one day, after staring at 20 vacuous stares, I had a talk with my Uncle Bill, a currency trader,” Manning said.

He spent two decades trading commodity futures at his uncle’s brokerage in Boston and stocks at brokerages in Chicago. Then he became a financial adviser to wealthy individuals and families at Merrill Lynch on Cape Cod.

The job at Plymouth County involved a small pay cut, but offered the opportunity to run a nine-figure portfolio for public employees. He got a taste of how painful rising rates could be in May 2013, when comments by Fed Chairman Ben Bernanke sent bond prices tumbling in what became known as the “taper tantrum.”

“We lost $20 million in three trading days and it took us 36 months of clipping coupons to make that back,” Manning said. Coupons are the interest payments bondholders receive.

Initially, Manning and O’Brien focused on boosting alternative investments such as private equity and infrastructure, which made up less than 5% of the fund. They were part of a flock of pension funds seeking alternative investments for higher returns .

Plymouth County hired Meketa as a consultant in 2015, and private-equity and infrastructure investments climbed to nearly 15% by 2020, according to fund financial reports. Returns improved.

“They have a level of comfort being different,” said Dynan.

A contrarian call

Markets were on a tear the following year, lifted by the economy’s reopening from the pandemic. But Manning grew concerned in the summer about inflation. While many on Wall Street were calling price increases transitory, he worried inflation would persist, triggering rate increases and declines in stocks and bonds.

“We were going to conferences and being told that inflation was a paper tiger, or ‘this is not your father’s inflation,’” O’Brien said.

Manning consulted Bob Sydow, a high-yield bond fund manager at Mesirow who manages part of the pension’s money. Like Manning, he has worked on Wall Street since the 1980s.

“The money supply grew 43% over 26 months during Covid,” Sydow said. “I called it ‘free-range’ money and I thought it would generate a lot of inflation.”

From October 2021 to February 2022, Plymouth County pension sold about $80 million of its public stocks, or 6% of the fund’s assets, according to an email viewed by The Wall Street Journal. It shifted into real estate and infrastructure as well as short-term and floating-rate debt that is less sensitive to rising rates than traditional bonds, Manning said.

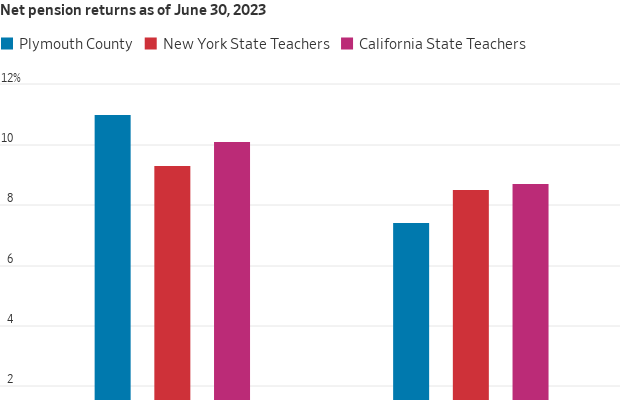

The fund lost 6.5% in 2022 while the median U.S. pension plan lost 14%. That outperformance has helped it stay ahead of other funds, even after it lagged behind the average in 2023.

Now, inflation remains above the Fed’s targets , and analysts’ forecasts for multiple rate cuts this year seem less certain. Plymouth County is keeping its strategy relatively unchanged, betting that rates will remain steady—or even climb.

Many investors are buying back into bonds because yields are at multiyear highs and they expect cuts by the Fed to trigger a rally. Manning takes a different tack. He thinks rates could stay high far longer than the Wall Street consensus, so he is using infrastructure funds to deliver income rather than bonds.

“Why do you have to own bonds at all in 2024?” Manning said. “It’s a legitimate question.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

As Paris makes its final preparations for the Olympic games, its residents are busy with their own—packing their suitcases, confirming their reservations, and getting out of town.

Worried about the hordes of crowds and overall chaos the Olympics could bring, Parisians are fleeing the city in droves and inundating resort cities around the country. Hotels and holiday rentals in some of France’s most popular vacation destinations—from the French Riviera in the south to the beaches of Normandy in the north—say they are expecting massive crowds this year in advance of the Olympics. The games will run from July 26-Aug. 1.

“It’s already a major holiday season for us, and beyond that, we have the Olympics,” says Stéphane Personeni, general manager of the Lily of the Valley hotel in Saint Tropez. “People began booking early this year.”

Personeni’s hotel typically has no issues filling its rooms each summer—by May of each year, the luxury hotel typically finds itself completely booked out for the months of July and August. But this year, the 53-room hotel began filling up for summer reservations in February.

“We told our regular guests that everything—hotels, apartments, villas—are going to be hard to find this summer,” Personeni says. His neighbours around Saint Tropez say they’re similarly booked up.

As of March, the online marketplace Gens de Confiance (“Trusted People”), saw a 50% increase in reservations from Parisians seeking vacation rentals outside the capital during the Olympics.

Already, August is a popular vacation time for the French. With a minimum of five weeks of vacation mandated by law, many decide to take the entire month off, renting out villas in beachside destinations for longer periods.

But beyond the typical August travel, the Olympics are having a real impact, says Bertille Marchal, a spokesperson for Gens de Confiance.

“We’ve seen nearly three times more reservations for the dates of the Olympics than the following two weeks,” Marchal says. “The increase is definitely linked to the Olympic Games.”

Getty Images

According to the site, the most sought-out vacation destinations are Morbihan and Loire-Atlantique, a seaside region in the northwest; le Var, a coastal area within the southeast of France along the Côte d’Azur; and the island of Corsica in the Mediterranean.

Meanwhile, the Olympics haven’t necessarily been a boon to foreign tourism in the country. Many tourists who might have otherwise come to France are avoiding it this year in favour of other European capitals. In Paris, demand for stays at high-end hotels has collapsed, with bookings down 50% in July compared to last year, according to UMIH Prestige, which represents hotels charging at least €800 ($865) a night for rooms.

Earlier this year, high-end restaurants and concierges said the Olympics might even be an opportunity to score a hard-get-seat at the city’s fine dining.

In the Occitanie region in southwest France, the overall number of reservations this summer hasn’t changed much from last year, says Vincent Gare, president of the regional tourism committee there.

“But looking further at the numbers, we do see an increase in the clientele coming from the Paris region,” Gare told Le Figaro, noting that the increase in reservations has fallen directly on the dates of the Olympic games.

Michel Barré, a retiree living in Paris’s Le Marais neighbourhood, is one of those opting for the beach rather than the opening ceremony. In January, he booked a stay in Normandy for two weeks.

“Even though it’s a major European capital, Paris is still a small city—it’s a massive effort to host all of these events,” Barré says. “The Olympics are going to be a mess.”

More than anything, he just wants some calm after an event-filled summer in Paris, which just before the Olympics experienced the drama of a snap election called by Macron.

“It’s been a hectic summer here,” he says.

AFP via Getty Images

Parisians—Barré included—feel that the city, by over-catering to its tourists, is driving out many residents.

Parts of the Seine—usually one of the most popular summertime hangout spots —have been closed off for weeks as the city installs bleachers and Olympics signage. In certain neighbourhoods, residents will need to scan a QR code with police to access their own apartments. And from the Olympics to Sept. 8, Paris is nearly doubling the price of transit tickets from €2.15 to €4 per ride.

The city’s clear willingness to capitalise on its tourists has motivated some residents to do the same. In March, the number of active Airbnb listings in Paris reached an all-time high as hosts rushed to list their apartments. Listings grew 40% from the same time last year, according to the company.

With their regular clients taking off, Parisian restaurants and merchants are complaining that business is down.

“Are there any Parisians left in Paris?” Alaine Fontaine, president of the restaurant industry association, told the radio station Franceinfo on Sunday. “For the last three weeks, there haven’t been any here.”

Still, for all the talk of those leaving, there are plenty who have decided to stick around.

Jay Swanson, an American expat and YouTuber, can’t imagine leaving during the Olympics—he secured his tickets to see ping pong and volleyball last year. He’s also less concerned about the crowds and road closures than others, having just put together a series of videos explaining how to navigate Paris during the games.

“It’s been 100 years since the Games came to Paris; when else will we get a chance to host the world like this?” Swanson says. “So many Parisians are leaving and tourism is down, so not only will it be quiet but the only people left will be here for a party.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.