The Classic 60-40 Investment Strategy Falls Apart. ‘There’s No Place to Hide.’

A savings mix of stocks and bonds has helped offset losses in previous years—but not this one

For decades, Americans planning for retirement have been advised to invest in a mixture of stocks and bonds.

The idea was simple. When stocks did well, their portfolios did, too. And when stocks had a bad year, bonds usually did better, which helped offset those losses.

It was one of the most basic, dependable ways of investing, used by millions of Americans. This year it stopped working.

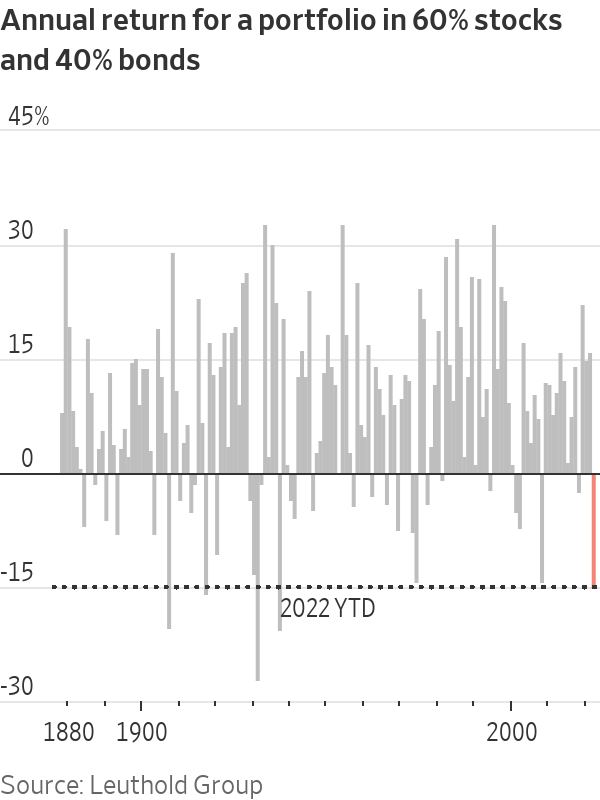

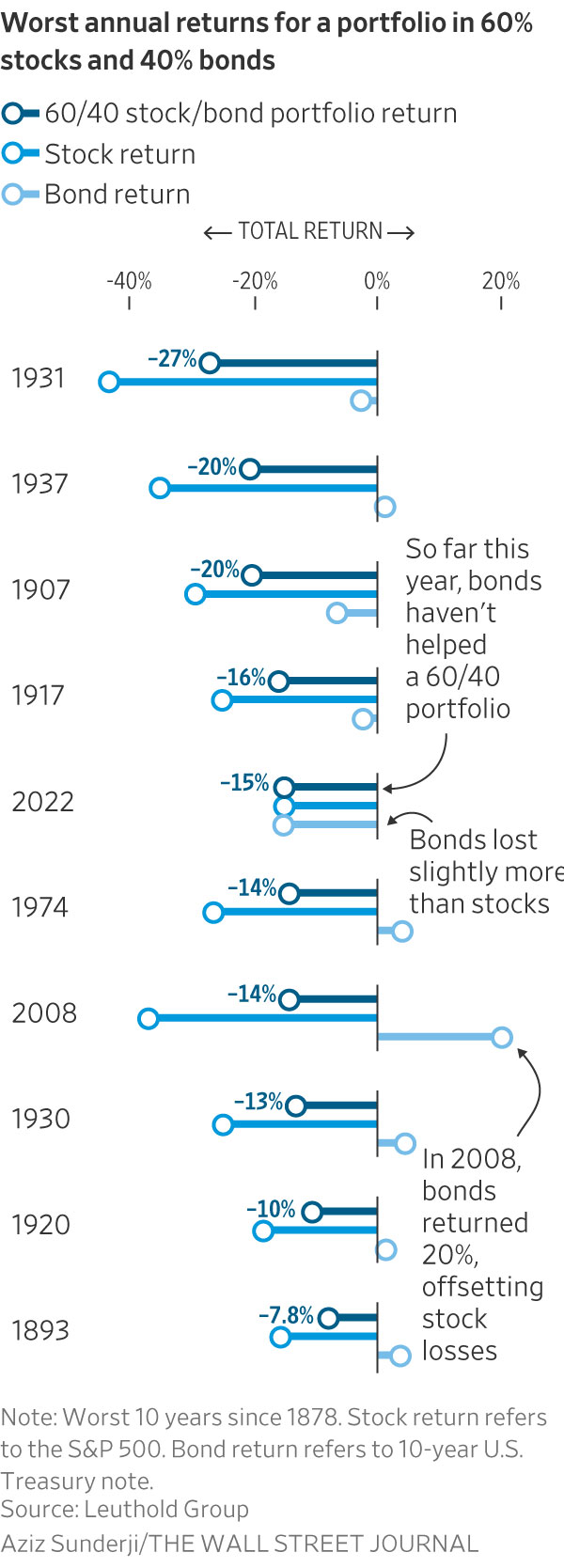

Despite a powerful rally last week after cooler-than-expected inflation data, the S&P 500 is down in 2022 about 15%, including dividends, while bonds are in their first bear market in decades. A portfolio with 60% of its money invested in U.S. stocks and 40% invested in the 10-year U.S. Treasury note has lost 15% this year. That puts the 60-40 investment mix on track for its worst year since 1937, according to an analysis by investment research and asset management firm Leuthold Group.

Many Americans are seeing decades’ worth of savings shrink, week by week. Belt-tightening among millions of households could serve as yet another drag on an economy already suffering from high inflation, a slowing housing market and rapidly rising interest rates.

Eileen Pollock, a 70-year-old retiree living in Baltimore, has seen the value of her portfolio, with a roughly 60-40 mix, dip by hundreds of thousands of dollars. The former legal secretary had amassed more than a million dollars in her retirement accounts. To build her savings, she left New York to live in a less expensive city and skipped vacations for many years.

“A million dollars seems like a great deal of money, but I realised it’s not,” she said. “I saw my money was piece by large piece disappearing.”

Bonds have helped offset the pain of the previous market crises, including the bursting of the dot-com bubble in 2000, the global financial crisis of 2008, and, most recently, the brief but punishing bear market brought about by the Covid-19 pandemic in 2020.

This year, U.S. Treasurys are having what could wind up being their worst year going back to 1801, according to Leuthold, as central banks have swiftly raised interest rates in a bid to quell inflation. The iShares Core U.S. Aggregate Bond exchange-traded fund, which tracks investment-grade bonds, has lost 14% on a total return basis.

The declines weigh especially on baby boomers, who have hit retirement age in worse financial shape than the generation before them and have fewer earning years ahead to recover investment losses.

“What’s shocking investors is there’s no place to hide,” said Peter Mallouk, president and chief executive of wealth-management company Creative Planning in Overland Park, Kan. “Everything on the statement is blood red.”

In 2008—the year the housing market crashed, Lehman Brothers declared bankruptcy and Congress agreed to an unprecedented bailout plan to rescue the financial system—bond prices soared. Investors with 60% of their money in stocks and 40% in bonds would have outperformed investors with all of their money in stocks by 23 percentage points, according to Leuthold.

Investors with a mix of stocks and bonds also came out significantly ahead of those putting all their money in stocks in 1917, the year the U.S. entered World War I; in 1930, during the Great Depression; and in 1974, after a staggering market selloff brought on by a series of crises including surging oil prices, double-digit inflation and Richard Nixon’s resignation over the Watergate scandal.

That final year, the S&P 500 declined 26%, including dividends. But 10-year Treasurys returned 4.1%. That meant a portfolio with 60% of its money in stocks and the remainder in bonds would have ended the year down 14%—a big hit, but still much better than the 26% loss it would have suffered had it been all in stocks.

Investors in a U.S. government bond are virtually certain to be paid their principal back when the bond matures. But before then, the bond’s value can fluctuate wildly—especially in the case of a bond that has many years before maturity. An investor holding a hypothetical older bond with a $100 face value and 1% coupon, or annual interest rate, that matures in seven years would get far less than $100 if she sold that bond today. That’s because the newest seven-year Treasury was recently issued with a coupon of 4%. To compensate for her bond coming with a much smaller coupon, the investor would have to sell at a lower price.

Miss Pollock said she wishes she didn’t have so much money tied up in the markets, but is in too deep to pull out of her investments. She has resigned herself to wait things out—hoping that the market will eventually go back up.

“If I get out of it, I’ll only lock my losses in,” she said. “I’ll just have to hang on to my belief in the American economy.”

Delaine Faris, 60, retired from her job as a project manager in 2019. She had hoped her husband, a technology consultant, could join her in a few years, based on how much their savings mix of 70% stocks and 30% bonds had grown over the previous decade. The couple took a big trip to Europe, then Argentina. They sold their house in Atlanta and moved to an exurb where they planned to settle down.

“I saved and invested responsibly and made plans,” Ms. Faris said.

Earlier this year, she strongly considered returning to work to supplement their savings. Layoffs in the technology industry have added to the couple’s worries.

She considers herself and her husband fortunate that they still have a home, his job, their health and their savings, but the past year has been a “big gut check,” she said. “Millions of us said, ‘We’re going to retire early, yay,’ and now we’re thinking, ‘Wait a second, what the heck happened?’ ”

Roughly 51% of retirees are living on less than half of their preretirement annual income, according to Goldman Sachs Asset Management, which this summer conducted a survey of retired Americans between the ages of 50 and 75. Nearly half of respondents retired early because of reasons outside their control, including poor health, losing their jobs and needing to take care of family members. Only 7% of survey respondents said they left the workforce because they had managed to save up enough money for retirement.

Most Americans said they would prefer to rely on guaranteed sources of income, like Social Security, to fund their retirement—not returns from volatile markets. But only 55% of retirees are able to do so, the firm found.

Susan Hodges, 66, and her wife decided to pull all their money out of the markets in May. “We can only take so much anxiety,” she said.

The couple, based in Rio Rancho, N.M., have since put some money back into stocks, but remained cautious, keeping roughly 10% of their overall retirement funds in the market. The couple has also become extra judicious about where and how they spend their money, cutting back on dining out and discussing online purchases with each other before pulling the trigger.

Market returns have grown increasingly important for U.S. households trying to prepare for retirement. In 1983, 88% of workers with an employer-provided retirement plan had coverage that included a defined-benefit pension, which provides payments for life, according to a report from the Center for Retirement Research at Boston College using data from the Federal Reserve.

In the following decades, traditional pensions were replaced by 401(k)-style retirement plans. By 2019, 73% of workers with an employer plan had only defined-contribution coverage, in which the amount of money available in retirement depends on how much workers and employers put into the plan and how that money is invested.

An October survey from the American Association of Individual Investors found that respondents had about 62% of their portfolios in stocks, 14% in bonds and 25% in cash. That stock allocation matched the average in data going back to 1987, while investors were keeping a bit less in bonds and more in cash than the long-term norm.

Defined-contribution retirement plans have leaned into stocks. In the 401(k)s of workers still employed by their retirement plans’ sponsor, 68% of participants’ assets were invested in equity securities, including the stock portions of funds, at the end of 2019, while 29% of assets were in fixed-income securities, according to a report earlier this year from the Employee Benefit Research Institute and the Investment Company Institute.

No one knows when the typical stock-and-bond portfolio will start working again, but the economic outlook is darkening. Economists surveyed by The Wall Street Journal expect the U.S. to enter a recession within the next 12 months as slowing growth forces employers to pull back on hiring.

Unlike during the dot-com crash, the financial crisis and the early days of the pandemic, the Fed appears unlikely to swoop to the markets’ rescue by loosening monetary conditions. Fed Chairman Jerome Powell has emphasised the need to keep raising interest rates to bring down inflation, even if it results in some economic pain.

Many financial advisers caution against abandoning the stock-and-bond approach after just one year of unusually bad returns. They point to charts tracking the S&P 500’s upward climb over the decades and note that throughout history, investors who bought at the end of the worst selloffs have been richly rewarded. Someone who entered the U.S. stock market during the depths of the financial crisis in 2009 would have received a return of roughly 361% over the following 11 years—enjoying stocks’ longest-ever stretch of gains.

For now, some advisers are reminding clients of the importance of staying diversified, such as by holding commodities like oil and precious metals along with stocks and bonds, or of holding enough cash to cover coming bills.

Eric Walters, a financial adviser based in Greenwood Village, Colo., said his clients have seemed notably sober as of late.

“Often we will start meetings and they will nervously ask, ‘Are we OK?’ ” he said. “I think they’re referring to the country and the economy and the stock market, and they’re also referring to themselves personally: Are we OK financially?”

Johnathan Bowden, a 64-year-old in Conroe, Texas, is no stranger to investing. He has read financial news for decades, tunes into webinars hosted by Morgan Stanley’s E*Trade platform and trades options on the side.

After retiring in June 2021, he began worrying the stock market’s supercharged run wouldn’t last. His fears were confirmed this year.

Rather than allowing himself to obsess over how badly the markets were doing, Mr. Bowden returned to his former job as a procurement manager. He works part-time—just enough to give himself a financial cushion, and to occupy himself during the week.

“I spent 40 years making this money,” Mr. Bowden said. “I don’t want to blow it.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

The marketplace has spoken and, at least for now, it’s showing preference for hybrids and plug-in hybrids (PHEVs) over battery electrics. That makes Toyota’s foot dragging on EVs (and full speed ahead on hybrids) look fairly wise, though the timeline along a bumpy road still gets us to full electrification by 2035.

Italian supercar producer Lamborghini, in business since 1963, is also proceeding, incrementally, toward battery power. In an interview, Federico Foschini , Lamborghini’s chief global marketing and sales officer, talked about the new Urus SE plug-in hybrid the company showed at its lounge in New York on Monday.

Lamborghini

The Urus SE SUV will sell for US$258,000 in the U.S. (the company’s biggest market) when it goes on sale internationally in the first quarter of 2025, Foschini says.

“We’re using the contribution from the electric motor and battery to not only lower emissions but also to boost performance,” he says. “Next year, all three of our models [the others are the Revuelto, a PHEV from launch, and the continuation of the Huracán] will be available as PHEVs.”

The Euro-spec Urus SE will have a stated 37 miles of electric-only range, thanks to a 192-horsepower electric motor and a 25.9-kilowatt-hour battery, but that distance will probably be less in stricter U.S. federal testing. In electric mode, the SE can reach 81 miles per hour. With the 4-litre 620-horsepower twin-turbo V8 engine engaged, the picture is quite different. With 789 horsepower and 701 pound-feet of torque on tap, the SE—as big as it is—can reach 62 mph in 3.4 seconds and attain 193 mph. It’s marginally faster than the Urus S, but also slightly under the cutting-edge Urus Performante model. Lamborghini says the SE reduces emissions by 80% compared to a standard Urus.

Lamborghini’s Urus plans are a little complicated. The company’s order books are full through 2025, but after that it plans to ditch the S and Performante models and produce only the SE. That’s only for a year, however, because the all-electric Urus should arrive by 2029.

Lamborghini

Thanks to the electric motor, the Urus SE offers all-wheel drive. The motor is situated inside the eight-speed automatic transmission, and it acts as a booster for the V8 but it can also drive the wheels on its own. The electric torque-vectoring system distributes power to the wheels that need it for improved cornering. The Urus SE has six driving modes, with variations that give a total of 11 performance options. There are carbon ceramic brakes front and rear.

To distinguish it, the Urus SE gets a new “floating” hood design and a new grille, headlights with matrix LED technology and a new lighting signature, and a redesigned bumper. There are more than 100 bodywork styling options, and 47 interior color combinations, with four embroidery types. The rear liftgate has also been restyled, with lights that connect the tail light clusters. The rear diffuser was redesigned to give 35% more downforce (compared to the Urus S) and keep the car on the road.

The Urus represents about 60% of U.S. Lamborghini sales, Foschini says, and in the early years 80% of buyers were new to the brand. Now it’s down to 70%because, as Foschini says, some happy Urus owners have upgraded to the Performante model. Lamborghini sold 3,000 cars last year in the U.S., where it has 44 dealers. Global sales were 10,112, the first time the marque went into five figures.

The average Urus buyer is 45 years old, though it’s 10 years younger in China and 10 years older in Japan. Only 10% are women, though that percentage is increasing.

“The customer base is widening, thanks to the broad appeal of the Urus—it’s a very usable car,” Foschini says. “The new buyers are successful in business, appreciate the technology, the performance, the unconventional design, and the fun-to-drive nature of the Urus.”

Maserati has two SUVs in its lineup, the Levante and the smaller Grecale. But Foschini says Lamborghini has no such plans. “A smaller SUV is not consistent with the positioning of our brand,” he says. “It’s not what we need in our portfolio now.”

It’s unclear exactly when Lamborghini will become an all-battery-electric brand. Foschini says that the Italian automaker is working with Volkswagen Group partner Porsche on e-fuel, synthetic and renewably made gasoline that could presumably extend the brand’s internal-combustion identity. But now, e-fuel is very expensive to make as it relies on wind power and captured carbon dioxide.

During Monterey Car Week in 2023, Lamborghini showed the Lanzador , a 2+2 electric concept car with high ground clearance that is headed for production. “This is the right electric vehicle for us,” Foschini says. “And the production version will look better than the concept.” The Lanzador, Lamborghini’s fourth model, should arrive in 2028.

Consumers are going to gravitate toward applications powered by the buzzy new technology, analyst Michael Wolf predicts

This stylish family home combines a classic palette and finishes with a flexible floorplan