Stocks Gain for Second Month in a Row

Dow exits bear market after Fed chief’s comments fuel hopes that the pace of interest-rate increases would slow

The S&P 500 notched a second month of gains but remained on track for its worst year since 2008 after rapidly rising interest rates battered stocks.

The broad U.S. stock index is down about 15% this year even after rallying in October and November. The tech-heavy Nasdaq Composite, whose members tend to be especially sensitive to changing rates, has slumped 27% in 2022.

Stocks have pulled back this year as the Federal Reserve lifts rates in an attempt to tame sky-high inflation. Higher rates give investors more options to earn a return outside the stock market and ding the worth of companies’ future earnings in commonly used valuation models.

“It’s been a pretty one-dimensional year,” said Matt Orton, chief market strategist at Raymond James Investment Management. “The persistence of inflation has dominated everything else.”

Major indexes have pared their losses in recent weeks, boosted by a slowdown in inflation and hopes that the Fed will slow its campaign of rate increases starting in December.

That optimism was bolstered Wednesday when Fed Chairman Jerome Powell indicated in a speech that the central bank is on track to raise interest rates by a half percentage point at its December meeting. That would mark a downshift after a series of four 0.75-point rate rises.

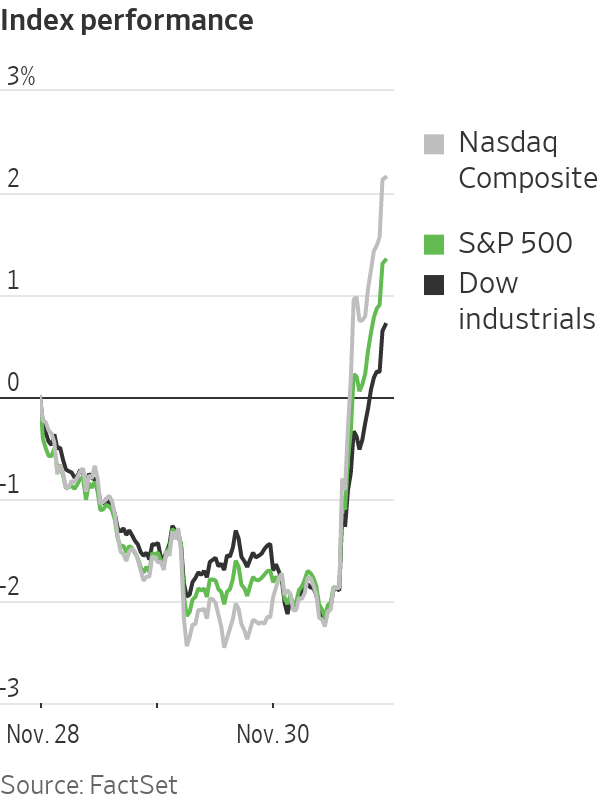

Stocks rallied as Mr. Powell spoke, lifting the S&P 500 3.1% for the day. The Dow Jones Industrial Average rose 2.2%, or about 735 points, in 4 p.m. ET trading, while the Nasdaq Composite jumped 4.4%. The sharp move was enough to put the Dow industrials back in a bull market, defined as a 20% rise from a recent low.

“Today’s speech gives more hope for the possibility of that elusive soft landing,” said Hank Smith, head of investment strategy at Haverford Trust. “From the market’s perspective there’s the chance of a soft landing as opposed to a hard landing that’s a traditional recession.”

Investors will closely watch inflation data due to be published on Dec. 13 for further clues about the path of interest rates.

“Operation catch-up is what this year has been all about and I think it’s over,” said Hani Redha, portfolio manager at PineBridge Investments. “They’ve caught up. They’re in a decent place,” he said of the Fed.

Still, Mr. Redha said Mr. Powell could be seeking to push back at expectations of a looming pivot toward easier monetary policy.

Mr. Redha said stocks are likely to come back under pressure in early 2023. The Fed, he said, will continue to tighten monetary policy through its bondholdings even if it stops raising interest rates, while a recession will hurt earnings.

Money managers also are eying corporate earnings as a potential drag on stocks in the months to come. Analysts are forecasting profits from S&P 500 companies will rise more than 5% next year, according to FactSet. But many investors think those projections are unrealistic.

“Earnings estimates are too high for 2023,” said Niladri Mukherjee, head of CIO portfolio strategy for Merrill and Bank of America Private Bank. “They need to come down.”

Government bond prices have risen since data published Nov. 10 showed inflation slowed in October, sparking hopes the Fed will ease off the brakes.

The yield on 10-year Treasurys declined to 3.699% Wednesday, from 3.746% Tuesday. It is down from more than 4% at the start of the month.

Yields on longer-term U.S. Treasurys have fallen far below those on short-term bonds, a sign investors think the Fed is close to winning its inflation battle—and that the economy is heading toward recession.

Falling yields, coupled with easing fears of a steep European downturn, have pulled the dollar down from multiyear highs. The WSJ Dollar Index fell 4.2% this month through Tuesday, putting it on pace for its largest one-month percentage decline since 2010.

Global markets broadly rose Wednesday. Travel, leisure and auto stocks helped push the Stoxx Europe 600 up 0.6%. China’s Shanghai Composite Index added about 0.1%. The Hang Seng rose 2.2%, closing out the biggest one-month advance for the Hong Kong benchmark since 1998.

Oil benchmark Brent crude rose 2.9% to $85.43 a barrel. Traders are awaiting details of the price cap that the U.S. and its allies are due to impose on Russian oil next week. The level of the cap is still under negotiation in the European Union.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

There are Corvette fans for whom the base US$68,300 car is plenty powerful enough. After all, it produces 495 horsepower and can reach 60 miles per hour in 2.9 seconds. But hold on, there’s also the approximately US$115,000 Z06—with 670 horsepower and able to reach 60 in 2.6 seconds. These split seconds are important for busy people—and for marketing claims. And if that’s not enough go power, there’s the even more formidable 900-horsepower ZR1 version of the Corvette, starting around US$150,000. The hybrid E-Ray, at US$104,900, is pretty potent, too.

But if they’re still too slow, fans of American-engineered muscle can consider the exclusive Texas-built Hennessey Venom F5, a limited-edition carbon-fibre hypercar. Ten years ago, the Hennessey became the world’s fastest production car, defeating the Bugatti Veyron Super Sport, with a top speed of 270.49 miles per hour.

That world title is much sought after, and is currently held by the Sweden-built 1,600-horsepower Koenigsegg Jesko Absolut, with a two-way average top speed of 277.8 mph. But Hennessey is still very much a contender. The company is hoping the 1,817-horsepower F5 (with 1,192 pound-feet of torque) can exceed 300 mph on the track this year.

Hennessey photo

Hennessey’s previous Venom GT model (introduced in 2010) was based on the Lotus Exige, with a GM LS-based engine, and was built by partner Delta Motorsport. Spokesman Jon Visscher tells Penta , “The new Venom F5, revealed in 2020, is a 100%bespoke creation—unique to Hennessey and featuring a Hennessey-designed 6.6-litre twin-turbo V8 engine boasting 1,817 horsepower, making it the world’s most powerful combustion-engine production car.” Leaps in performance like this tend to be pricey.

This is a very exclusive automobile, priced around US$2.5 million for the coupe, and US$3 million for the F5 Roadster announced in 2023. Only 30 Roadsters will be built, with a removable carbon-fiber roof. The 24 F5 coupes were spoken for in 2021, but if you really want one you could find a used example—or go topless. In a statement to Penta , company founder and CEO John Hennessey said that while the coupe “is now sold out, a handful of build slots remain for our Roadster and [track-focused] Revolution models.”

Only 24 Revolutions will be built in coupe form, priced at US$2.7 million. There’s also a rarefied roadster version of the Revolution, with just 12 to be built.

Hennessey photo

The Venom F5 coupe weighs only 3,000 pounds, and it’s not surprising that insane speeds are possible when combined with a hand-built motor (nicknamed “Fury”) created with power uppermost. The V8 in the F5, installed in a rear mid-engine configuration, has a custom engine block and lightweight forged aluminium pistons, billet-steel crankshaft, and forged-steel connecting rods. Twin turbochargers are featured. The F5 can reach 62 mph in less than three seconds, but top speed seems to be its claim to fame.

The driver shifts the rear-wheel-drive car via a seven-speed, single-clutch transmission with paddle shifters. The interior is not as spartan or as tight as in many other supercars, and is able to handle very tall people. The butterfly doors lift up for access.

“With 22 customer Venom F5 hypercars already delivered to customers around the world, and a newly expanded engineering team, we’re focusing the Venom F5 on delivering on its potential,” Hennessey says. “Breaking 300 mph in two directions is the goal we aim to achieve toward the end of this year to claim the ‘world’s fastest production car’ title.”

Hennessey says the car and team are ready. “Now the search is on for a runway or public road with a sufficiently long straight to allow our 1,817-horsepower, twin-turbo V8 monster to accelerate beyond 300 mph and return to zero safely.” The very competitive Hennessey said the track-focused Revolution version of the F5 set a fastest production car lap around Texas’ 3.41-mile Circuit of the Americas track in March, going almost seven seconds faster than a McLaren P1.

The Revolution features a roof-mounted central air scoop (to deliver cool air to the engine bay), a full-width rear carbon wing, larger front splitter and rear diffuser, tweaked suspension, and engine cooling. It’s got the same powertrain as the standard cars, but is enhanced to stay planted at otherworldly speeds.

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Consumers are going to gravitate toward applications powered by the buzzy new technology, analyst Michael Wolf predicts